The Small Business and Family Enterprise Ombudsman

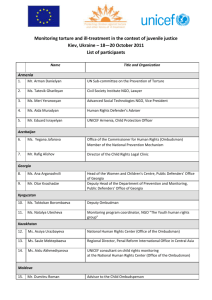

advertisement