mod5

advertisement

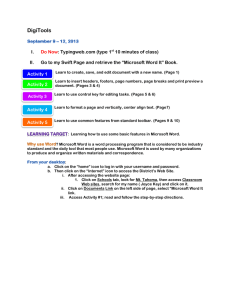

Information Goods and Policy (Antitrust) • Winner-takes-all nature of these goods implies very large market shares. It is efficient to have a standard. • Competition may take a different form: competition to be the next generation standard. • Is there a role for these theories in antitrust? Are consumers in danger? • Owners of Standards need to coordinate consumers and partners to achieve the best result. Could this coordination appear ‘anti-competitive’? 1 Recent Controversies • AOL/Time Warner Merger in Europe • Instant messaging controversy • EU investigation of online music services. • Microsoft case 2 Economic Concepts • • • • Bundling or tying. Locking-in monopoly. Market Foreclosure. Predatory Pricing 3 Tie-In sales. • • • • Generally considered to be an ‘extension of monopoly’ by courts. In other words, courts believed it was an attempt to use one monopoly to create a second. Tie-In sales are poorly understood by courts, imperfectly understood by most economists. Frequently, tying good is sold very cheaply, while tied good is very expensive. Famous cases: IBM and computer cards, Xerox and toner, Canning machines and tin plate. Two monopolies are not better than one if products are used together (in fixed proportions). 4 Tie In Sale when products used together PP MC=AC pairs of shoes 2PL PP-PL MC=AC left or right shoes PR=PL MR Q1 D pairs of shoes Q 5 Market Foreclosure • • • Even if goods are used in fixed proportions, it might be possible to increase profits if there is another group of consumers that uses one of these goods and if there are economies of scale in production. By ‘taking over’ second market you get a new set of customers who didn’t buy your first good. Somewhat farfetched set of conditions required. 6 Predatory Pricing • • • • • Current court-created definition (known as Areeda-Turner rule) : price below average variable cost. Also requires that there be a serious likelihood of driving prey out of business and of recouping losses. Likely to lose money for the predator, and unlikely to remove the prey. Can only succeed if prey is removed. Few real world examples. Standard Oil cases are largely fictional. 7 Predatory Pricing P AC S MC AVC p3 p2 p1 AFC Q 8 AOL-Time Warner Merger • AOL: largest online service, Internet service provider. With 30 million users • Time-Warner: largest media company with movies, television and cable systems. • Was it a merger of complements or substitutes? • What were the potential problems according to antitrust authorities (lock-in)? 9 Instant Messaging • Network effects are very strong here. • AOL has largest network by far • Microsoft, Yahoo and others trying to play catch-up. • AOL has consciously prevented others from making their services ‘compatible’ with AOL’s, depriving others of network effects. • Should government intervene? Came up during AOL/TW merger. 10 Online Music Services • Currently, only 5 major record labels, but lots of retailers. • Antitrust concerns seems to be that the 5 labels will use only a small number of Internet sites to sell digital music and possibly collude. • Consumers need to make sure that current retailers don’t try to stop digital downloads that might put them out of business. • Online services tend to limit ‘burning’ meaning that they are more likely to represent new revenues and not substitutes for CD sales. 11 Microsoft Case • Background – Microsoft ‘sells’ DOS to IBM for use on PCs. IBM allows Microsoft to sell MSDOS to third party computer manufacturers. – PCs quickly eclipse Apple as leading computer platform. – Microsoft and IBM ‘jointly’ begin work on graphical interface (OS/2) which has very ambitious specifications and is not based on DOS. IBM’s attempt to recapture PC market by having special version that only runs on its PCs. – Microsoft develops Windows as a temporary graphical interface that runs on top of DOS. Tells IBM that it doesn’t compete with OS/2. 12 Microsoft Case • Background: – Windows 1.0 and 2.0 are flops, but Windows 3.0 takes off in 1990. – PC manufacturers quickly adopt Windows on the machines they sell. Windows is much cheaper than OS/2. – Microsoft and IBM have a falling out and IBM takes over OS/2 development. – Microsoft develops Windows NT as a more advanced OS to compete with high end workstations such as Sun. Since Microsoft now dominates PCs, workstations are a new market opportunity. 13 Microsoft Case Background (cont) • Background – Government investigates large market share of DOS. FTC tie vote, and then Justice Department investigation. – Government and Microsoft reach consent agreement over Microsoft’s pricing tactics. – 4 anonymous firms hire law firm (Gary Reback) to lobby for government examination of Microsoft’s tactics. – Justice begins new investigation about Microsoft’s inclusion of MSN with each version of Windows. AOL claims it can not compete and that Microsoft was trying to leverage its ownership of Windows to dominate online services. AOL’s continued growth, however, destroy the credibility of the claim. 14 Microsoft Case Background (cont) • Background – Justice then investigates Microsoft’s inclusion of Internet browser (Explorer) with each copy of Windows. Claims it is a violation of consent decree. – Judge Jackson hears this case and orders an injunction forcing Microsoft to sell to computer manufacturers a version of Windows without the browser. – Microsoft slaps judge in face by selling a version of Windows without the browser, but which also doesn’t operate. – On appeal, Judge Jackson’s injunction is overturned. Then Justice bring forward, along with 19 states, a new antitrust case based on the browser. 15 Microsoft Case • Government’s theory: – Microsoft has a monopoly in its Windows OS. To strengthen claim they argue that the proper market definition is Intel based PCs. – This monopoly is protected by network effects, referred to as the “application barrier to entry”. – Netscape browser, along with Java language, are a threat to Windows since they allow programmers to write programs that will run on any OS, removing the great appeal of Windows, its large installed base. – Microsoft engaged in illegal acts to protect its monopoly. It foreclosed the market for Netscape's browser by tying Internet Explorer to the OS. 16 Microsoft Case • Problems with Government’s theory: – Government’s view of network effects suffers from the fact that there is no empirical support for the lock-in claim. Software market examination earlier showed this (Microsoft presented similar evidence after seeing galleys of the book). – It isn’t clear that Netscape/Java is a substitute for Windows, and if it were it isn’t clear that its market share wasn’t big enough. – Showing consumer harm has become more important in antitrust in recent decades, and government has had a hard time demonstrating how consumers were hurt. – The following charts illustrate Microsoft’s impacts on consumers, at least with regard to price. 17 Impact on Consumers Fig. 1: Word Processor & Spreadsheet Prices $250 $200 $150 $100 Average Word Processor Price Average Spreadsheet price $50 Source: S. Liebowitz and S. Margolis,: Winners, Losers and Microsoft: Competition and Antitrust in High Technology, 1999, Independent Institute $0 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 18 Impact on Consumers Figure 3: Normalized Price Changes $140 $120 $100 $80 $60 $40 Non-Microsoft Markets Markets Where Microsoft Competes $20 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 19 1998 Impact on Consumers • What did government say about consumer harm? – Three claimed instances: • Wasted space on hard drive for Internet explorer for those people wishing to use Netscape. • Wasted time putting Netscape on computer instead of having OEM do it. • Lost innovation from Microsoft smothering everyone else. – This last claim is obviously the most important, but it is impossible to either prove or disprove. In general there is no evidence that monopolists are less inventive than others. And the fact that Microsoft has 120,000 developers indicates that they do not destroy all the good ideas. 20 Foreclosing Netscape • Government claimed that Microsoft prevented Netscape from being able to get its product into consumer’s hands. – Contracts with OEMs (computer manufacturers). – Contracts with ISPs (Internet service providers such as AOL). – Contracts with ISVs (independent software vendors such as Quicken). • Why did Internet Explorer gain market share? – Government says for the reasons given above. – Microsoft says that it gained market share because it was a better product. • Here is some evidence. 21 Fig 9.23: Browser Wins 8 Int Explorer Netscape Other 7 6 5 4 3 2 1 0 95-1 95-2 96-1 96-2 97-1 97-2 22 Fig 9.24: Browser Shares 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Netscape Internet Explorer Jan-96 Jul-96 Jan-97 Jul-97 Jan-98 Jul-98 23 Court’s Findings • Microsoft was a monopoly. Upheld by Appeals Court • District court accepted government’s case almost in its entirety. Appeals Court threw out one charge, sent another back with tough conditions, and accepted one charge. • District Court didn’t hold hearings on remedy to break Microsoft into two. That was thrown out by the Appeals Court with a new remedy phase required. • Judge gave interviews during the case. The Appeals Court was outraged and removed him from case. • Department of Justice (and 9 states) then settled with Microsoft but 9 other states have continued to pursue a more stringent remedy. 24 What was the first ‘Remedy’ – Two companies, one selling applications, the other selling operating systems. – They would not be able to trade with one another. – The application company would have gotten all software except operating systems [Windows, Windows NT (2000), Windows CE]. Everything else would go to the application company. • This initial ‘remedy’ was thrown out by Appeals Court. 25 What was the logic, if any? • What would it have accomplished? • Would Microsoft Office be a substitute for Windows? Seems unlikely. • The restriction on interaction, in combination with the application company getting almost all products, would have made innovations in the operating system much more difficult. • Server software, voice recognition, developer tools all belonged with the operating system company. Operating system would have been much weaker without them. For example, we get inefficient result if best voice recognition was made by Microsoft. • This shows the danger of antitrust based on poorly articulated and understood theories. 26