chapter 10 & 11 quiz review solutions

advertisement

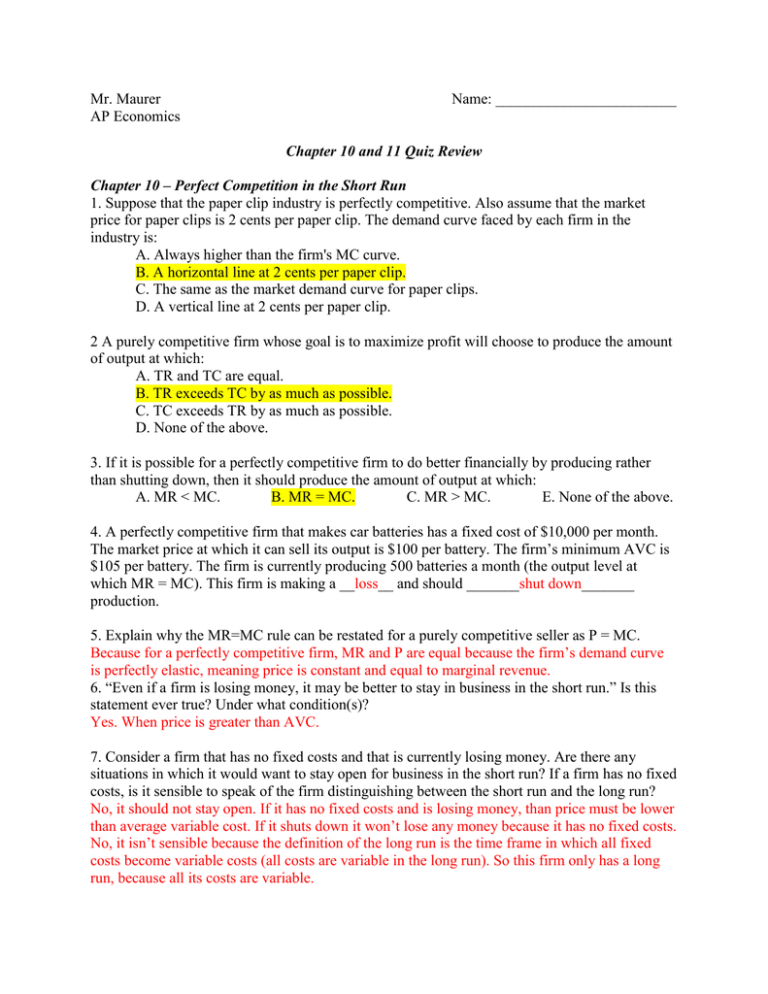

Mr. Maurer AP Economics Name: ________________________ Chapter 10 and 11 Quiz Review Chapter 10 – Perfect Competition in the Short Run 1. Suppose that the paper clip industry is perfectly competitive. Also assume that the market price for paper clips is 2 cents per paper clip. The demand curve faced by each firm in the industry is: A. Always higher than the firm's MC curve. B. A horizontal line at 2 cents per paper clip. C. The same as the market demand curve for paper clips. D. A vertical line at 2 cents per paper clip. 2 A purely competitive firm whose goal is to maximize profit will choose to produce the amount of output at which: A. TR and TC are equal. B. TR exceeds TC by as much as possible. C. TC exceeds TR by as much as possible. D. None of the above. 3. If it is possible for a perfectly competitive firm to do better financially by producing rather than shutting down, then it should produce the amount of output at which: A. MR < MC. B. MR = MC. C. MR > MC. E. None of the above. 4. A perfectly competitive firm that makes car batteries has a fixed cost of $10,000 per month. The market price at which it can sell its output is $100 per battery. The firm’s minimum AVC is $105 per battery. The firm is currently producing 500 batteries a month (the output level at which MR = MC). This firm is making a __loss__ and should _______shut down_______ production. 5. Explain why the MR=MC rule can be restated for a purely competitive seller as P = MC. Because for a perfectly competitive firm, MR and P are equal because the firm’s demand curve is perfectly elastic, meaning price is constant and equal to marginal revenue. 6. “Even if a firm is losing money, it may be better to stay in business in the short run.” Is this statement ever true? Under what condition(s)? Yes. When price is greater than AVC. 7. Consider a firm that has no fixed costs and that is currently losing money. Are there any situations in which it would want to stay open for business in the short run? If a firm has no fixed costs, is it sensible to speak of the firm distinguishing between the short run and the long run? No, it should not stay open. If it has no fixed costs and is losing money, than price must be lower than average variable cost. If it shuts down it won’t lose any money because it has no fixed costs. No, it isn’t sensible because the definition of the long run is the time frame in which all fixed costs become variable costs (all costs are variable in the long run). So this firm only has a long run, because all its costs are variable. Chapter 11 – Perfect Competition in the Long Run 1. Explain why there are no long-run profits or losses in a perfectly competitive industry. Because of the entry or exit of firms. If there are profits, new firms will enter the industry in the long run, increasing supply and decreasing price until price = ATC (normal profit). If there are losses, existing firms will leave the industry, decreasing supply until price = ATC. 2. Why will price equal minimum ATC in the long run in a perfectly competitive industry? Because that is the point where each firm makes a normal profit. See explanation to #1 above. 3. Suppose that as the output of mobile phones increases, the cost of touch screens and other component parts decreases. If the mobile phone industry features pure competition, we would expect the long-run supply curve for mobile phones to be: A. Downward sloping. B. Upward sloping. C. Horizontal. D. U-shaped. 4. In pure competition, which of the following are true in the long run? I. Individual firms have the freedom to enter or exit the industry. II. Individual firms have control over the market price of their product. III. Individual firms’ output decisions are based on their costs and the market price. IV. Individual firms’ profits attract entry, while losses prompt exit. A. I only B. II only D. I, III, and IV only C. I, II, and IV only E. I, II, III, and IV 5. If the market price for a perfectly competitive industry yields economic losses in the short run, existing firms in the industry will exit. The result will be that A. the industry supply curve will shift leftward, the quantity demanded will decrease and the market price in the long run will increase. B. the industry supply curve will shift leftward, demand will decrease, and the market price in the long run will decrease. C. the industry supply curve will shift leftward and the market price in the long run will not change. D. the quantity supplied will decrease and the market price in the long run will increase. E. demand and supply will both decrease and the market price in the long run will not change. 6. The long-run supply curve for a constant-cost industry is A. upward-sloping because changes in output affect resource prices B. upward-sloping because changes in output affect per-unit resource costs C. upward-sloping because firms will produce and sell more only if market price increases D. horizontal because industry expansion and contraction will not affect resource costs E. horizontal because industry expansion and contraction will affect resource costs 7. In a competitive, constant-cost industry, the industry long-run supply curve is A. elastic but not perfectly elastic B. inelastic but not perfectly inelastic C. perfectly elastic D. perfectly inelastic E. unit elastic 8. Assuming a competitive, increasing-cost industry, an increase in market demand in the long run will result in Market Price Resource Prices Average Total Costs A. Constant Increase Increase B. Increase Increase Constant C. Increase Increase Increase D. Decrease Decrease Decrease E. Uncertain Increase Increase 9. At what level of production is allocative efficiency achieved? P = MC 10. Which of the following is true of perfectly competitive industries? I. These industries will be productively efficient. II. These industries will generate optimal allocative efficiency. III. Because marginal cost equals marginal revenue at the minimum of average total cost, some economic inefficiency occurs. IV. These firms will compete in markets that maximize producer and consumer surpluses. A. I only B. III only E. I, II, III, and IV C. II and IV only D. I, II, and IV only 11. If a perfectly competitive firm finds that its marginal revenue is less than its marginal cost. What should it do to maximize profit? Explain. Cut back production (reduce quantity). If MR<MC then they must be past the point where MR = MC and they need to reduce quantity to get back to that point. 12. The long-run supply curve pictured at left represents an industry in which A. expansion and contraction will not affect resource prices B. expansion will increase resource prices C. expansion will decrease resource prices D. contraction will increase resource prices E. expansion will increase resource prices but contraction will not impact resource prices 13. Given the graph at left, a contraction in the industry would I. help the industry and the firms II. decrease costs per unit for the industry and the firms III. increase costs per unit for the industry and the firms A. I only B. III only C. I and II only D. I and III only E. I, II, and III 14. If consumer demand for the product in a perfectly competitive industry increases, what will be the effect on an individual firm’s price and output in the short run? In the long-run? In the short run, price and output will both increase. In the long run both price and output for the individual firm will return to where they were at long-run equilibrium. 15. If consumer demand for the product in a perfectly competitive industry increases, what will be the effect on the entire industry’s price and output in the short run? In the long-run? In the short-run the industry price and output will both increase. In the long-run output will increase, but price will remain constant. 16. Assume that a perfectly competitive firm finds that its property tax (a lump-sum cost) increases. In the short run, how will this affect the firm’s marginal cost curve and profitmaximizing quantity? Explain. This will not affect the marginal cost curve or the profit-maximizing quantity. A lump-sum cost is a fixed cost. Changes in fixed costs do not affect marginal cost. The profit-maximizing quantity is dependent on marginal cost, so it won’t change if only fixed costs change.