Hedging

advertisement

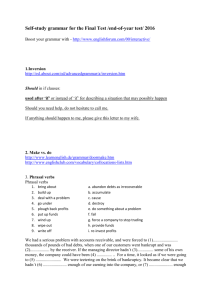

Agribusiness Library Lesson 060063: Hedging 1 Objectives 1. Describe the hedging process, and examine the advantages and disadvantages of hedging. 2. Distinguish between short and long hedges, and calculate short and long hedging examples. 3. Explain the rules to make educated hedging decisions. 2 Terms hedging long hedge maintenance margin margin money perfect hedge short hedge 3 What is hedging the process? What are the advantages and disadvantages of hedging? The hedging process and its pros and cons A. Hedging is the process of shifting price risks in the cash market to the futures market by simultaneously holding opposite positions in the cash and futures market. It is a risk management option. The hedging process allows a producer to protect himself or herself from prices that turn against his or her current position on a futures contract. The beneficial use of a hedge is determined by the basis. 4 What is hedging the process? What are the advantages and disadvantages of hedging? A. To hedge, the customer must do several things. 1. The customer must contact a broker. 2. After a broker has been selected, the customer must sign an agreement and deposit sufficient funds to guarantee performance on the contract. a. The money put down to guarantee performance is called margin money. b. A typical margin is about 10 percent of the value of the commodity being traded. 5 What is hedging the process? What are the advantages and disadvantages of hedging? A. To hedge, the customer must do several things. 3. Once these actions are completed, the final act is to instruct the broker as to the trades to transact. 4. Some other initial costs may be involved. a. The broker may require the customer to put down more than the margin amount. 6 What is hedging the process? What are the advantages and disadvantages of hedging? 4. Some other initial costs may be involved. (cont’d) b. He or she may also have to pay for maintenance margin money. Maintenance margin money is asked for if the market moves adversely and is in the amount below which the total value of the contracts must not be allowed to fall. All of these amounts are collected to ensure that traders do not fall short of their obligations. 7 What is hedging the process? What are the advantages and disadvantages of hedging? B. The advantages of hedging 1. It is a risk management tool used by long-term traders and investors. 2. It can be used to lock in a profit. 3. It assists traders during poor market periods. 4. It is protection against commodity price changes, inflation, currency exchange rate changes, and interest rate changes. 8 What is hedging the process? What are the advantages and disadvantages of hedging? B. The advantages of hedging (cont’d) 5. It saves time by requiring less maintenance on portfolio/files due to daily market volatility. 6. It allows traders to practice complex options trading approaches to maximize returns. 9 What is hedging the process? What are the advantages and disadvantages of hedging? C. The disadvantages of hedging 1. The cost of hedging can minimize overall profits. 2. Reducing the risk can reduce profits. 3. It is a difficult strategy to understand and is not commonly used by the short-term trader. 4. When markets are moving positive, hedging proposes little benefits. 5. It requires an increase in account balances. 6. It requires excellent trading skills and experience. 10 What is the difference between short and long hedges? How can hedges be calculated? Short and long hedges and their calculations A. To test a proper hedge, it is necessary to go over these general rules: 1. The investor must hold opposite initial cash and futures positions, which are made by buying or selling in either market. 2. The final cash and initial futures must match. 11 What is the difference between short and long hedges? How can hedges be calculated? A. To test a proper hedge, it is necessary to go over these general rules: 3. If the cash price is declining, it is necessary to enter a short hedge. If the cash price is increasing, a long hedge should be entered. (It is essential to use two or more rules to determine if the hedge was properly placed.) 12 What is the difference between short and long hedges? How can hedges be calculated? B. A short hedge is simply what is being done if futures are being sold. 1. A short hedge protects the seller of a commodity against falling prices. 2. Example a. It is May, and the local forward cash price for September corn is $2.40, while the September futures price is $2.75. The basis is 35 cents under ($2.40 to $2.75). 13 What is the difference between short and long hedges? How can hedges be calculated? B. A short hedge 2. Example (cont’d) b. The broker sells September corn futures at $2.75. c. The prices fall. The cash price has fallen to $2.10; the futures price has fallen to $2.45; and the basis is still at 35 cents under. d. The broker buys back the futures contract at $2.45, receiving a gain of 30 cents per bushel ($2.75 to $2.45). 14 What is the difference between short and long hedges? How can hedges be calculated? B. A short hedge 2. Example (cont’d) e. Then the corn is sold in the cash market at $2.10. Therefore, the total price received is the cash price of $2.10 plus the 30 cent futures gain ($2.40), which is the same as if the broker would have accepted the forward contract price of $2.40 in May. In this example, you will see a perfect hedge. A perfect hedge occurs if the basis remains the same during the transaction. 15 What is the difference between short and long hedges? How can hedges be calculated? C. A long hedge is the term used for buying futures. 1. A long hedge protects the buyer of a commodity against rising prices. 2. Example: It is November. According to the planning records, Farmer Smith is going to need more corn for grinding sow feed in May. The May futures price is $2.50; the local forward cash price for May is $2.42; and the basis is at 8 cents below. 16 What is the difference between short and long hedges? How can hedges be calculated? C. A long hedge (cont’d) 3. Farmer Smith decides to buy a May futures contract at $2.50. 4. In May, Farmer Smith sells back the futures contract and purchases the corn in the local cash market. 5. The prices increase. The cash price is at $2.52; the futures price is up to $2.60; and the basis is still at 8 cents below. When the cash price increases, the net price that was paid is protected because of the hedging practice used. 17 18 19 How are educated decisions made when using the hedging process? Unfortunately, there is not a set of rules to follow to consistently be successful with hedging. All markets are able to change at any time because of weather, the prices of related products, the current value of uses for the commodity, and many other factors. To be more successful, some things can be done. 20 How are educated decisions made when using the hedging process? A. It is important to always keep the size of the futures position no larger than the size of the grain position with which the person is involved. This will help the investor offset the position more equally. B. It is important to keep the futures position the opposite of the cash position. If a person is buying a commodity, he or she should buy the futures. If a person is growing a crop or selling, then he or she should sell the futures. 21 How are educated decisions made when using the hedging process? C. A person should close his or her cash and futures positions at the same time. 1. After harvest, when the person sells his or her product, he or she must buy back the futures contract. 2. If a person is buying a commodity from someone else, then he or she should sell the futures contract. 22 How are educated decisions made when using the hedging process? C. A person should close (cont’d) 3. There are some occasions when a person should stay in his or her futures position after closing a cash transaction. It is called speculating, which is trading futures or options contracts with the intention of making a profit. When a person speculates, he or she does not own or control the actual cash commodity. 23 How are educated decisions made when using the hedging process? D. It is essential to have a knowledgeable and reputable broker. If the broker is good, he or she can help an individual make intelligent hedging decisions. 24 Review • What are the advantages and disadvantages of hedging? • What protects the seller of a commodity against falling prices? • What protects the buyer of a commodity against rising prices? • What factors affect successful hedging? 25