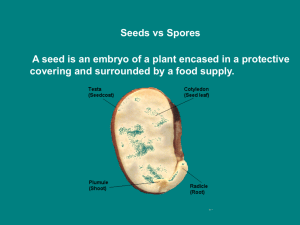

Seed

advertisement

Seeds Ltd. Business Plan For A New and Improved Seed Cleaning Plant Nav Khinda, Sean McAlpine and Noor Syed April 05, 2007 Contents of the Plan Introduction Background Current Situation Goals Key Questions Operational Plan Marketing Plan Financial Plan Introduction Seeds is an on-farm cleaning and packaging plant in Sask. •Cereals, pulses and oil seeds are cleaned and quality tested to broker’s specification •Four machines clean and sort the seeds according to color, size, shape and density. •Six employees size and color comparison of beans Color, Weight and Size Variations in Seeds Variety of pulses black mustard coriander soya beans oats Pinto beans green lentils Golden flax fenugreek green split peas dried peas wheat germ hemp wheat grain Assorted beans Background began seed cleaning operation in 1985 Authorized for pedigree and certified for organic seed cleaning Seeds Ltd. became incorporated in 1997 Current Situation Seed variety Unmet Requirements Comments Chickpeas, Lentils, Peas and Beans Not able to process fragile crops Flax Unable to meet 99.99% purity Not able to remove cereals Gluten is allergen, 100% wheat free Unable to meet 99.9% purity Unable to remove splits and wheat Wheat is an allergen Small Lentils Mustard Coriander Current Situation Seeds Ltd. Business Plan New equipment will further improve capability to clean seeds to customer specifications Increase the plant capacity Goals of New Plant Reach sales of $1 M Continue superior quality service ORGANIZATIONAL CHART President Administrative Asst. Plant Operator Plant Assistants Warehouse Technologist Warehouse Technologist 3rd technologist Plan View of Operations Long Term Storage Warehouse Future Development Area Screenings Shipping Processing Raw Material Storage Receiving Bulk Shipping Screenings Burning Area WORK FLOW PLAN 1. 2. RECEIVING CLEANING 3. PACKAGING Packaging HACCP and ISO •Seeds Ltd. meets HACCP inspection regulations •Currently no certification for seed cleaning plants exists •Voluntary compliance and free inspection is available •New plant is designed with improvements in critical control points •According to customers specifications lab tests are outsourced Canadian Food Inspection Agency Marketing Questions •Organic industry expanding? •Who are the current competitors? •Unique services? •Supply a niche market successfully? •Buying and selling direct •Will HACCP be a factor in the future? •Should a quality control lab be part of the QC system? In-house? The Four P’s 1. Products and Services - cleaning, storage and packaging of various seeds - high quality of service 2. Pricing - cost plus; time required for processing - below or in par with others 3. Promotion - develop relations with existing and new brokers STP Segmentation Targeting Geographical location Broker specifications Continue to focus on organic market Positioning Consistent high quality std. Approachable, professional and dependable SWOT Analysis •Strengths •knowledge & experience •solid reputation •economy of scope •Weaknesses •location (rail) •company size •Opportunities •emerging trend of higher quality standards •growth in organic industry •Threats •power of buyers •environment •large competitors •demand Marketing Strategies Sales and Profit Objectives Channels of Distribution Cost plus We recommend a market value approach Select Markets/Products/Service Mix Customers arrange for delivery and pickup Pricing Policy $1 million in sales Organic, Export, High purity demands Selling and Advertising Minimal effort $10,000 per year in trade shows Debt and Equity Breakdown of funding for BirdSeeds Ltd. Finance Source Owner Equity Venture Capital Long Term Debt Total Financing Cdn $ $ 598,300 $ 1,015,872 $ 356,928 $ 1,971,100 Financial Analysis and Overall Financial Performance Summary of the Financial Situation (Base case scenario) Year 2008 2009 2013 2017 $1,030,857 $1,149,312 $1,253,838 $1,367,870 COGS $809,634 $913,426 $727,290 $709,740 Gross Profit $221,223 $235,885 $526,548 $658,131 $72,685 $72,554 $71,326 $68,607 $148,538 $163,331 $455,221 $589,524 Income Tax $14,854 $16,333 $59,327 $106,333 Net Income $133,684 $146,998 $395,894 $483,190 Net Cash Flow to Equity $369,912 $483,930 $497,037 $504,836 Net Present Value (NPV) $287,909 Sales Expenses Net Income Before Taxes IRR 25.11% Risk Analysis Variable Level of Importance (1, 2, 3) Capacity 1 Cleaning Price 1 Grade Changes 2 Number of Employees 2 Wage rates 2 Seed Price 2 Interest rate 2 Inflation rate 2 Tax rate 3 Key for the table. 1. Critical for success and feasibility 2. Important for financial performance 3. Minor importance, but has damaging effect on financial performance. Scenario Analyses Variable Capacity % Capacity Grade Changes Packaging Price $ NPV $ IRR Base Case Worst Case Best Case 100% 27.8 80% 24.2 100% 27.8 1 3 0 38.86 36.91 $ 40.80 287,909 $(1,027,617) $ 855,391 25% $ -6% 35% Break even Analysis IRR Cash Flow Net Income 20000 15000 10000 5000 Year 17 20 16 20 15 20 14 20 13 20 12 20 11 20 10 20 09 20 08 0 20 Annual Tonnage/t 25000 Break even Analysis IRR Cash Flow Net Income $20.00 $15.00 $10.00 $5.00 Year 17 20 16 20 15 20 14 20 13 20 12 20 11 20 10 20 09 20 08 $- 20 Average Cleaning Price/$/t $25.00 Summary Volume is key Marketing will play an important role Viable Business Plan Interactive Session Thank You