MACROECONOMICS

advertisement

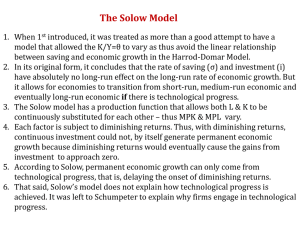

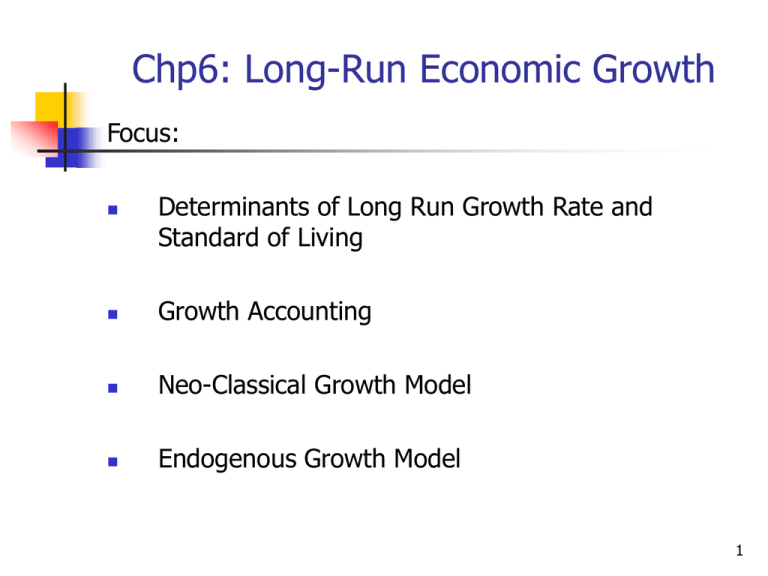

Chp6: Long-Run Economic Growth Focus: Determinants of Long Run Growth Rate and Standard of Living Growth Accounting Neo-Classical Growth Model Endogenous Growth Model 1 Growth Accounting Growth Accounting: Decomposition of growth in output in terms of its sources. Growth Accounting Equation relates output growth to growths in inputs including technical change. If Y = AF(K,N), then growth accounting equation is given by (∆Y/Y) = (∆A/A) +ά_K (∆K/K) + ά_N (∆N/N) 2 ά_K = the Elasticity of Production Function with respect to Capital (K) ά_N = the Elasticity of Production Function with respect to Labor (N) Alternatively, we have (∆A/A) = (∆Y/Y) - ά_K (∆K/K) - ά_N (∆N/N) 3 Neo-Classical (Solow) Growth Model The model relates long run per-capita consumption and growth rate in output to saving rate, population growth rate, and technical progress. Assumptions: 1) 2) 3) 4) Constant returns to scale Diminishing Marginal Productivity of Capital Rate of saving (s) , population growth rate (n), depreciation rate (d) are fixed. No technical progress (Temporary Assumption) 4 Some Notations: Upper case letters denote aggregate variables and the lower case letters denote corresponding per-worker variables. y=(Y/N)= (AF(K,N)/N); k = (K/N); c = (C/N) etc. Constant Returns to Scale implies y= (AF(K,N)/N) = AF(K/N, N/N)= AF(k,1) = Af(k) 5 Steady State: A steady state is a situation in which y, k and c (per-worker variables) are constant over time. It is an equilibrium situation in the sense that once an economy reaches this state it has tendency to continue in the same state. Solow Model predicts that an economy ultimately reaches the steady state. This steady state is given by the condition: sf(k) = (n+d )k 6 Let k*>0 be the steady state per-worker capital stock. Then, this steady state is also stable in the sense that if for (temporary) reason the economy moves away from steady state it has tendency to come back to the original steady state. In the steady state per worker variables (c, k, y) are constant, but aggregate variables (C,K,Y) are growing at the rate of population growth (n). The level of capital stock that maximizes the steady state per-worker consumption (c) is called the Golden Rule level of capital stock. 7 Implications of the Model: Case 1: No Technical Progress: 1) 2) Per-Worker Consumption (c) in the long run depends on s, n, and d. There will be no growth in c in the long run. Ultimately, an economy will grow (growth in Y, C,K) at the rate of population growth (n). Case 2: Technical Progress: 1) Per-Worker Consumption (c) in the long run will grow at the rate of technical progress. 8 Endogenous Growth Theory These models emphasize the role of Human Capital (knowledge, skills, and training of workers). Assumptions: 1) No population growth rate 2) Constant Marginal Productivity of Capital. Aggregate Production Function: Y = AK 9 The long run growth rate of output is given by the condition that ∆Y/Y = sA – d Implication: Higher saving rate (s) implies higher long run growth rate of output unlike Solow model in which with no population growth, the growth rate of output is zero. 10