Accounting Recording Process: Equation & Statements

advertisement

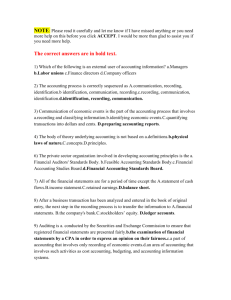

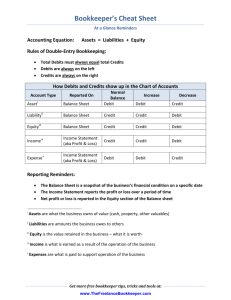

Prepared by Coby Harmon University of California, Santa Barbara Westmont College 2-1 2 The Recording Process Learning Objectives After studying this chapter, you should be able to: 1. State the accounting equation, and define its components. 2-2 2. Analyze the effects of business transactions on the accounting equation. 3. Understand the four financial statements and how they are prepared. 4. Explain what an account is and how it helps in the recording process. 5. Define debits and credits and explain their use in recording business transactions. 6. Identify the basic steps in the recording process. 7. Explain what a journal is and how it helps in the recording process. 8. Explain what a ledger is and how it helps in the recording process. 9. Explain what posting is and how it helps in the recording process. 10. Prepare a trial balance and explain its purposes. Preview of Unit 2 2-3 The Basic Accounting Equation Assets = Liabilities + Owner’s Equity Provides the underlying framework for recording and summarizing economic events. Assets are claimed by either creditors or owners. Claims of creditors must be paid before ownership claims. 2-4 LO 6 State the accounting equation, and define its components. The Basic Accounting Equation Assets Resources a business owns. Provide future services or benefits. Cash, Supplies, Equipment, etc. Assets 2-5 = Liabilities + Owner’s Equity LO 6 State the accounting equation, and define its components. The Basic Accounting Equation Liabilities Claims against assets (debts and obligations). Creditors - party to whom money is owed. Accounts payable, Notes payable, etc. Assets 2-6 = Liabilities + Owner’s Equity LO 6 State the accounting equation, and define its components. The Basic Accounting Equation Owner’s Equity Ownership claim on total assets. Referred to as residual equity. Investment by owners and revenues (+) Drawings and expenses (-). Assets 2-7 = Liabilities + Owner’s Equity LO 6 State the accounting equation, and define its components. Owner’s Equity Illustration 1-6 Increases in Owner’s Equity Investments by owner are the assets the owner puts into the business. Revenues result from business activities entered into for the purpose of earning income. Common sources of revenue are: sales, fees, services, commissions, interest, dividends, royalties, and rent. 2-8 LO 6 State the accounting equation, and define its components. Owner’s Equity Illustration 1-6 Decreases in Owner’s Equity Drawings An owner may withdraw cash or other assets for personal use. Expenses are the cost of assets consumed or services used in the process of earning revenue. Common expenses are: salaries expense, rent expense, utilities expense, tax expense, etc. 2-9 LO 6 State the accounting equation, and define its components. Using the Accounting Equation Transactions are a business’s economic events recorded by accountants. 2-10 May be external or internal. Not all activities represent transactions. Each transaction has a dual effect on the accounting equation. LO 7 Analyze the effects of business transactions on the accounting equation. Using the Accounting Equation Illustration: Are the following events recorded in the accounting records? Discuss Purchase guided trip Event Pay rent computer options with customer Criterion Is the financial position (assets, liabilities, or owner’s equity) of the company changed? Record/ Don’t Record 2-11 LO 7 Analyze the effects of business transactions on the accounting equation. Transaction Analysis Transaction (1): Ray Neal decides to open a computer programming service which he names Softbyte. On September 1, 2014, Ray Neal invests $15,000 cash in the business. 2-12 LO 7 Transaction Analysis Transaction (2): Purchase of Equipment for Cash. Softbyte purchases computer equipment for $7,000 cash. 2-13 LO 7 Transaction Analysis Transaction (3): Softbyte purchases for $1,600 from Acme Supply Company computer paper and other supplies expected to last several months. The purchase is made on account. 2-14 LO 7 Transaction Analysis Transaction (4): Softbyte receives $1,200 cash from customers for programming services it has provided. 2-15 LO 7 Transaction Analysis Transaction (5): Softbyte receives a bill for $250 from the Daily News for advertising but postpones payment until a later date. 2-16 LO 7 Transaction Analysis Transaction (6): Softbyte provides $3,500 of programming services for customers. The company receives cash of $1,500 from customers, and it bills the balance of $2,000 on account. 2-17 LO 7 Transaction Analysis Transaction (7): Softbyte pays the following expenses in cash for September: store rent $600, salaries of employees $900, and utilities $200. 2-18 LO 7 Transaction Analysis Transaction (8): Softbyte pays its $250 Daily News bill in cash. 2-19 LO 7 Transaction Analysis Transaction (9): Softbyte receives $600 in cash from customers who had been billed for services [in Transaction (6)]. 2-20 LO 7 Transaction Analysis Transaction (10): Ray Neal withdraws $1,300 in cash from the business for his personal use. Illustration 1-8 Tabular summary of Softbyte transactions 2-21 LO 7 Financial Statements Companies prepare four financial statements : Income Statement 2-22 Owner’s Equity Statement Balance Sheet Statement of Cash Flows LO 8 Understand the four financial statements and how they are prepared. Financial Statements Net income is needed to determine the ending balance in owner’s equity. Illustration 1-9 Financial statements and their interrelationships 2-23 LO 8 Financial Statements The ending balance in owner’s equity is needed in preparing the balance sheet Illustration 1-9 2-24 LO 8 Financial Statements The balance sheet and income statement are needed to prepare statement of cash flows. Illustration 1-9 2-25 LO 8 Financial Statements Income Statement 2-26 Reports the revenues and expenses for a specific period of time. Lists revenues first, followed by expenses. Shows net income (or net loss). LO 8 Understand the four financial statements and how they are prepared. Financial Statements Owner’s Equity Statement 2-27 Reports the changes in owner’s equity for a specific period of time. The time period is the same as that covered by the income statement. LO 8 Understand the four financial statements and how they are prepared. Financial Statements Balance Sheet 2-28 Reports the assets, liabilities, and owner’s equity at a specific date. Lists assets at the top, followed by liabilities and owner’s equity. Total assets must equal total liabilities and owner’s equity. Is a snapshot of the company’s financial condition at a specific moment in time (usually the month-end or yearend). LO 8 Understand the four financial statements and how they are prepared. Financial Statements Statement of Cash Flows Information for a specific period of time. Answers the following: 1. Where did cash come from? 2. What was cash used for? 3. What was the change in the cash balance? 2-29 LO 8 Understand the four financial statements and how they are prepared. The Account Record of increases and decreases in a specific asset, liability, equity, revenue, or expense item. Debit = “Left” Credit = “Right” Account An account can be illustrated in a Taccount form. 2-30 Account Name Debit / Dr. Credit / Cr. LO 1 Explain what an account is and how it helps in the recording process. The Account Debits and Credits Double-entry system ► Each transaction must affect two or more accounts to keep the basic accounting equation in balance. ► Recording done by debiting at least one account and crediting another. ► 2-31 DEBITS must equal CREDITS. LO 2 Define debits and credits and explain their use in recording business transactions. Debits and Credits If Debit amounts are greater than Credit amounts, the account will have a debit balance. Account Name Debit / Dr. Credit / Cr. Transaction #1 $10,000 $3,000 Transaction #3 8,000 Balance 2-32 Transaction #2 $15,000 LO 2 Define debits and credits and explain their use in recording business transactions. Debits and Credits If Debit amounts are less than Credit amounts, the account will have a credit balance. Account Name Transaction #1 Balance 2-33 Debit / Dr. Credit / Cr. $10,000 $3,000 Transaction #2 8,000 Transaction #3 $1,000 LO 2 Define debits and credits and explain their use in recording business transactions. Debits and Credits Assets Debit / Dr. Assets - Debits should exceed credits. Liabilities – Credits should exceed debits. Normal balance is on the increase side. Credit / Cr. Normal Balance Chapter 3-23 Liabilities Debit / Dr. Credit / Cr. Normal Balance Chapter 3-24 2-34 LO 2 Define debits and credits and explain their use in recording business transactions. Debits and Credits Owner’s Equity Owner’s investments and revenues increase owner’s equity (credit). Owner’s drawings and expenses decrease owner’s equity (debit). Credit / Cr. Debit / Dr. Normal Balance Chapter 3-25 Owner’s Capital Debit / Dr. Chapter 3-25 2-35 Owner’s Drawing Credit / Cr. Debit / Dr. Normal Balance Normal Balance Credit / Cr. Helpful Hint Because revenues increase owner’s equity, a revenue account has the same debit/credit rules as the Owner’s Capital account. Expenses have the opposite effect. Chapter 3-23 LO 2 Debits and Credits Revenue Debit / Dr. The purpose of earning revenues is to benefit the owner(s). The effect of debits and credits on revenue accounts is the same as their effect on Owner’s Capital. Expenses have the opposite effect: expenses decrease owner’s equity. Credit / Cr. Normal Balance Chapter 3-26 Expense Debit / Dr. Credit / Cr. Normal Balance Chapter 3-27 2-36 LO 2 Define debits and credits and explain their use in recording business transactions. Debits/Credits Rules Liabilities Normal Balance Debit Assets Credit / Cr. Normal Balance Chapter 3-24 Owner’s Equity Credit / Cr. Debit / Dr. Debit / Dr. Normal Balance Credit Debit / Dr. Credit / Cr. Normal Balance Normal Balance Chapter 3-23 Expense Debit / Dr. Chapter 3-25 Revenue Credit / Cr. Debit / Dr. Normal Balance Chapter 3-27 2-37 Credit / Cr. Normal Balance Chapter 3-26 LO 2 Debits/Credits Rules Balance Sheet Asset = Liability + Equity Income Statement Revenue - Expense Debit Credit 2-38 LO 2 Define debits and credits and explain their use in recording business transactions. Summary of Debits/Credits Rules Relationship among the assets, liabilities and owner’s equity of a business: Illustration 2-11 Basic Equation Assets = Liabilities + Owner’s Equity Expanded Basic Equation The equation must be in balance after every transaction. For every Debit there must be a Credit. 2-39 LO 2 Define debits and credits and explain their use in recording business transactions. Steps in the Recording Process Illustration 2-12 Analyze each transaction Enter transaction in a journal Transfer journal information to ledger accounts Business documents, such as a sales slip, a check, a bill, or a cash register tape, provide evidence of the transaction. 2-40 LO 3 Identify the basic steps in the recording process. Steps in the Recording Process The Journal Book of original entry. Transactions recorded in chronological order. Contributions to the recording process: 1. Discloses the complete effects of a transaction. 2. Provides a chronological record of transactions. 3. Helps to prevent or locate errors because the debit and credit amounts can be easily compared. 2-41 LO 4 Explain what a journal is and how it helps in the recording process. Steps in the Recording Process Journalizing - Entering transaction data in the journal. Illustration: On September 1, Ray Neal invested $15,000 cash in the business, and Softbyte purchased computer equipment for $7,000 cash. Illustration 2-13 General Journal Date Account Title Sept. 1 Cash Ref. Debit 15,000 Owner’s Capital Equipment Cash 2-42 Credit 15,000 7,000 7,000 LO 4 Explain what a journal is and how it helps in the recording process. Steps in the Recording Process Simple and Compound Entries Illustration: On July 1, Butler Company purchases a delivery truck costing $14,000. It pays $8,000 cash now and agrees to pay the remaining $6,000 on account. Illustration 2-14 General Journal Date July 1 2-43 Account Title Equipment Ref. Debit Credit 14,000 Cash 8,000 Accounts payable 6,000 LO 4 Explain what a journal is and how it helps in the recording process. Steps in the Recording Process The Ledger General Ledger contains the entire group of accounts maintained by a company. Illustration 2-15 2-44 LO 5 Explain what a ledger is and how it helps in the recording process. Steps in the Recording Process Standard Form of Account Illustration 2-16 2-45 LO 5 Explain what a ledger is and how it helps in the recording process. Steps Posting – process of transferring amounts from the journal to the ledger accounts. Illustration 2-17 2-46 LO 6 Explain what posting is and how it helps in the recording process. Chart of Accounts Accounts and account numbers arranged in sequence in which they are presented in the financial statements. Illustration 2-18 2-47 LO 6 Explain what posting is and how it helps in the recording process. The Recording Process Illustrated Follow these steps: 1. Determine what type of account is involved. 2. Determine what items increased or decreased and by how much. 3. Translate the increases and decreases into debits and credits. Illustration 2-19 2-48 LO 6 The Recording Process Illustrated Illustration 2-20 2-49 LO 6 The Recording Process Illustrated Illustration 2-21 2-50 LO 6 The Recording Process Illustrated Illustration 2-22 2-51 LO 6 The Recording Process Illustrated Illustration 2-23 2-52 LO 6 The Recording Process Illustrated Illustration 2-24 2-53 LO 6 The Recording Process Illustrated Illustration 2-25 2-54 LO 6 The Recording Process Illustrated Illustration 2-26 2-55 LO 6 The Recording Process Illustrated Illustration 2-27 2-56 LO 6 The Recording Process Illustrated Illustration 2-28 2-57 LO 6 Summary of Journalizing and Posting Illustration 2-29 2-58 LO 6 2-59 Illustration 2-30 LO 6 Trial Balance Illustration 2-31 2-60 LO 7 Prepare a trial balance and explain its purposes. Trial Balance Limitations of a Trial Balance The trial balance may balance even when 1. a transaction is not journalized, 2. a correct journal entry is not posted, 3. a journal entry is posted twice, 4. incorrect accounts are used in journalizing or posting, or 5. offsetting errors are made in recording the amount of a transaction. 2-61 LO 7 Prepare a trial balance and explain its purposes.

0

0

advertisement

Related documents

Download

advertisement

Add this document to collection(s)

You can add this document to your study collection(s)

Sign in Available only to authorized usersAdd this document to saved

You can add this document to your saved list

Sign in Available only to authorized users