BENEFITS AND SERVICES

advertisement

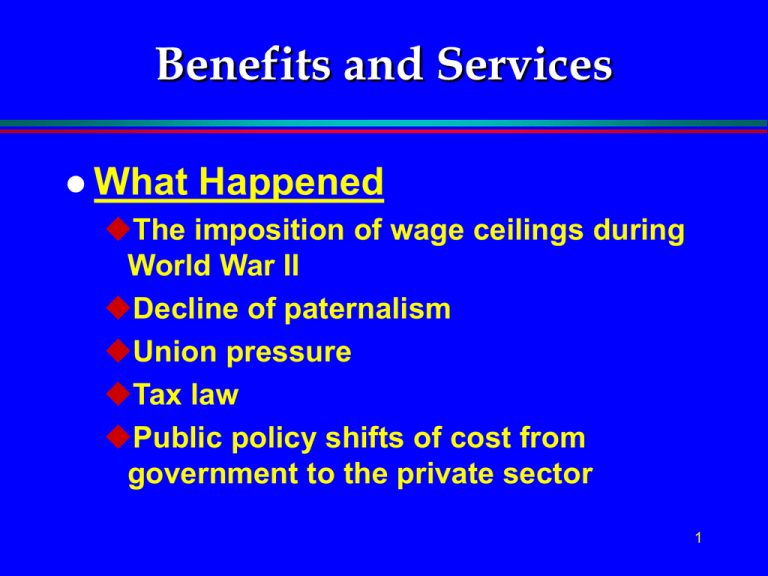

Benefits and Services What Happened The imposition of wage ceilings during World War II Decline of paternalism Union pressure Tax law Public policy shifts of cost from government to the private sector 1 Benefits and Services Once upon a time "fringe benefits" were of marginal importance. In 1929 benefits were approximately 3 percent of wages and salaries. By 1991 benefits had risen to be 38.2 percent of wages and salaries. Between these two periods wages and salaries rose by a factor of 55 while benefits increased by a factor of 716. 2 Benefits And Services What Do Employers Expect? Improved productivity Increased job satisfaction Improved quality Reduction in turn-over and absenteeism Enhanced sense of security 3 Benefits and Services Benefits and services become complicated very quickly because of the number of available components, the variety of optional features within a component, and their legal and financial interactions. 4 Benefits and Services Employee Benefits Those compensation components made available to employees that provide: Protection in case of health and accident-related problems, and Income at some future date or occasion. 5 Employee Services Compensation components that contribute to the welfare of the employee by filling some kind of demand. Total employee benefits as a percent of payroll 39.2 Legally required payments 8.9 Retirement and savings 6.0 6 Employee Services Life and death insurance 0.5 Medical benefits 10.4 Paid rest periods 2.2 Pay for time not worked 10.4 Miscellaneous benefits 0.9 7 Benefits Planning And Design Criteria Minimum age and length of service. Employee contributions an vesting schedule for pension plan. Coinsurance, deductible, ceiling requirements, and dual coverage for medical insurance. Options to be included in the medical plan. What employees will be covered, and what about retirees and dependents. 8 Critical Issues In Benefit Planning Current and future role of governmentmandated benefits. Employee demographics and employee preferences. Possible use of self-funding and thirdparty administrator. Employer ability to pay and employee contributions. Monitoring and auditing programs. 9 Benefits Communication Benefits became viewed as entitlement and employers were loosing the motivational value of their programs. The response was the development of sophisticated communication programs to inform employees of how much they were receiving through their benefits programs. 10 Basic Benefits Communication New employees receive oral and visual presentations of the benefit program, and an Annual benefit statement that provides a description of the employee's benefit account. 11 Basic Benefits Communication The employee has access to inhouse benefit consultant services. Ad-hoc employee meetings to cover new benefits, changes, and critical issues. On-going communication of benefit info. 12 Employee Benefits Employee Benefits Can Be Classified As: Disability Income Continuation Loss-of-Job Income Continuation Deferred Income Spouse or Family Income Continuation Health and Accident Protection Property and Liability Protection Perquisites 13 Disability Income Short-Term Disability L-T Disability Worker's Compensation Sick Leave Non-Occupational Disability Travel Accident Insurance Supplemental Disability Insurance 14 Disability Income Accidental Death And Dismemberment Retirement Plans T-P Disability Social Security 15 Loss-Of-Job Income Unemployment Insurance (Ui) Supplemental Unemployment Benefit Insurance (Sub) Guaranteed Annual Income (Gai) Guaranteed Income Stream (Gis) Severance Pay Job Contract 16 Deferred Income Social Security Qualified Retirement Plan Pension / Profit Sharing / Stock Bonus Simplified Employee Pension Plans (Sep) 17 Deferred Income Keogh Plans Supplemental Executive Retirement Plans Supplemental and Executive Group Life Insurance Plans 18 Spouse and Family Income Protection Life Insurance Retirement Plans Social Security Workers Comp Tax-Sheltered Annuity AD & D Travel Accident Insurance Health Care Coverage 19 Health and Accident Protection Basic Medical, Hospital, and Surgical Major Medical Dental Visual Comprehensive Physical Hearing Aid In-House Medical Services HMO's PPO's Social Security (Medicare) Post-Retirement Medical Workers' Comp 20 Property and Liability Protection Group Auto / Home / Legal Group Umbrella Liability Employee Liability Fidelity Bond Insurance 21 Employee Services Pay For Time Not Worked Holidays / Vacations / Jury Duty / Sick Leave Election Official / Witness In Court Military Duty / Funeral Leave / Marriage Leave 22 Employee Services Illness In Family / Paternity Leave / Wellness Leave / Time Off To Vote / Give Blood Grievance And Contract Negotiations Lunch, Rest, And Wash-up Periods 23 Time Off From Work Without Pay The family and medical leave act passed in 1993 granted up to 12 weeks of unpaid leave for a variety of purposes, including a worker's own illness or that of a spouse or a parent. 24 Income Equivalent Payments and Reimbursements Elderly Care Parking Counseling (Legal, Financial, Psychiatric) Subsidized Food Service Travel Expenses Education Subsidies Relocation Expense Child Adoption Emergency Loans Child Care Credit Union Charitable Contributions 25 Costing Benefits Costing is an essential prerequisite to any worthwhile benefits communication program. Four methods are available for costing benefits and services: Annual cost of benefits and services for all employees. Cost per employee per year. Percentage of payroll Cents per hour 26 Flexible Compensation / Benefits (Cafeteria Plans) Originally the flexible compensation / benefits plan was designed to enable senior executives, top professionals, and managers to choose individually many of their benefits and services. 27 Flexible Compensation / Benefits (CafeteriaPlans) However, organizations are looking to the flex plans today as an opportunity to: Contain the cost of benefits Satisfy employee preference Provide choice 28 Flexible Compensation / Benefits Flex plans are designed to accomplish four goals that are considered fundamental to the development of a successful program. It increases or improves: Appreciation of the interest and desire of the employer to improve the quality of life of each employee. 29 Flexible Compensation / Benefits Loyalty and Motivation. Understanding of Value of Each Benefit. Understanding Of Value Of Total Program 30 Establishing A Flex Plan Three Major Groups Must Participate In the Design of a Flex Plan: Senior Management for setting objectives and determining policy. GOALS 31 Establishing A Flex Plan Compensation and human resource specialists for guiding the development of and assisting in the construction of a program that meets organizational objectives and demands of the employees. Employees for providing initial inputs about what should be included in a benefits program. 32 Employee Spending Accounts This is a tax-free reimbursement account designed to moderate or possibly reduce the rising cost of benefits for the employee while at the same time giving the employer greater control over the benefit expenditures. 33 Employee Spending Accounts Employee are allowed to convert a portion of taxable wages or salaries into nontaxable dollars to be used to pay for specific benefits. 34 Employee Spending Accounts While reducing their taxable income, they can use the funds to pay for: Uncovered medical expenses. Premiums for health, life, and disability insurance. Dependent care assistance. Legal services. Personal financial planning. 35 Benefits in the 90's EAP’s Adoption Expenses Child Care Assistance Paternity Leave Long-Term Care Flex Hours Work-At-Home 36