FridayFebruary28thMeeting - Sites at Lafayette

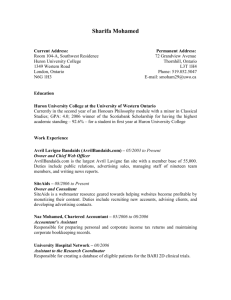

advertisement

Friday February 28th, 2014 Lafayette College Investment Club Meeting Agenda • 1) Announcements • BAT (Bloomberg) Rescheduled • Market Madness • Mentor Program • 2) Market Update • 3) Huron –Ticker HURN (BUY) BAT TEST • Bloomberg Aptitude Test (BAT) • April 5th at 10:00am • Location is TBD • Information to follow on Registration in March • The BAT aids employers in identifying and screening students who wish to pursue a career in business and finance. • Regardless of background will not inhibit you Market Madness 2014 Lafayette College Investment Club How to Market Madness • 1. make a MarketWatch account -http://www.marketwatch.com/ • 2. Hit the “games” tab • 3. Hit the “find games” tab • 4. type “Lafayette Leopards” –then click the name and it will enter you in, the password Game Info • Game name- Lafayette Leopards • Password: lafpards • Start date- March 3rd • End date- March 31st • Budget: $100,000.00 PRIZES • First Prize - $ • Second Prize- Steak Knives • Third Prize – You’re fired • We are currently in discussion what the total $ amount for prizes will be. • Update next week on final prizes Mentor Program • Connect Students and Teach them fundamental analysis and technical analysis of a range of asset classes. • Gain a basic understand of markets and narrow focus into the goals of the Investment Clubs Portfolio) • It works both ways (The Mentor can learn from youth an unbiased perspective with minor market knowledge asks questions that often may be overlooked) • THIS IS NOT A CLASS (this is entirely student run ) • We want to emphasize this is a student initiative and will be informal and interactive. Example of Mentor Session • Lunch Meetings and Potentially Evening Dinners • We will provide you with a company (single stock) you will do prior research and come in with questions. • We will walk you through how we analyze companies and why or why not the company will fit the vision of our portfolio. • The success of this program is in the hands of you. • The greatest piece of feedback I received from the handout on recommendations for the club was the feeling of inadequate fundamental skills. • Here's your chance Board Meetings • Mondays 12:15 PM Simon Lobby • If you have an idea please come with some sort of substance as to what the idea is. • Rough outline it doesn’t have to be comprehensive but an outline is necessary. • If you have questions please don’t hesitate to contact me Simont@lafayette.edu • Sign in sheets up front for mentor program email chain, general club news chain, and board meeting chain (for those interested in running at the end of the semester) Market Update By: Jason Shavel and Andrew Faett Recap of Key Financial News in Markets S&P 500 • Index hits record high – 9.13 points on the week • Federal Reserve Chair Janet Yellen blamed recent weakness on weather. • Testifying before the Senate Banking Committee, Yellen also said the Fed would watch carefully to make sure weather was indeed behind the recent weakness. • Still maintained dovish outlook – stating positive data would have to come for tapering to speed up. • 1,848.36 points has been a resistance point • For the year, the S&P 500 index is now up 0.3 percent Treasury • Following S&P Treasury sells $35B in 5yr Notes • 3rd Note Auction of the week pulling in $109B • Treasury 10-year note yields touched the lowest level in almost three weeks • Ten-year yields fell three basis points, or 0.03 percentage point, to 2.64 • The Bloomberg U.S. Treasury Bond Index, which was on track for a monthly decline until this week’s surge, has gained 0.2 percent in February. Pfizer • 85,000 person study • Prevnar-13 Vaccine (pneumonia immunization trial for adults aged 65 or more were successful). • Physicians and providers showing interest • Stock rose 2% following the news, almost up 10% on the month. Microsoft • Emerging competitor in Health Care Tech Market • Matching of Windows and Health Tech software could swing more attention back to Microsoft • Return of Bill Gates • The return of Steve Jobs to Apple and Howard Schultz to Starbucks are some of the best examples of companies that were reinvigorated with the founders • He is not returning as the CEO, acting as a consultant. • Stock trades at relatively attractive multiples to comps Markets • Dow- +74.24 (.46%) • FTSE- +11.12 (.16%) • Nikkei 225- -21.59 (.14%) • Gold- $1,331.80 (-.01%) • News to watch today: • The second estimate of Q4 GDP will be released at 8:30 ET • Chicago PMI for February will cross the wires at 9:45 ET. • The final reading of the Michigan Sentiment survey for February will be reported at 9:55 ET • Pending Home Sales report for January will be released at 10:00 ET. Huron Consulting Group (HURN) 175 Shares @ $66.72 Background • Headquarters in Chicago, Illinois • Provides services in 4 broad segments: • • • • Healthcare Financial Services Legal Education and Life Sciences Thesis • Clients face a changing marketplace • 20-40% cost cutting across all hospitals • Huron Financial has backlog of clients for 2014 • Rely on consulting firms to help them adapt • Ability to deliver exceptional value Revenue • $720 million in 2013 (15% growth) • Anticipate $765 - $795 million for 2014 (6-10%) • Revenue guidance conservatively estimated Competitive Advantage • Drive revenue through: • 1) Billable hours 2) Rate per hour • Earned unexpected healthcare fees due to value provided for client • Fees increased across all 4 segments • Demonstrates ability to deliver results Executive Compensation • Board Members have “skin in the game” • All own stock options in the company • CEO James Roth has nearly $12 million • Aligns board and shareholder interest Valuation • P/E ratio = 22.91 • Industry Average = 23.17 • Key Competitors: ACN = 17.73 / NCI = 16.72 • P/S ratio = 2 • Industry Average = .79 • ACN = 1.85 • NCI = 1.15 • Beta = .99 Company Headlines • Introduced share repurchase program – up to $50 million for 2014 • Demonstrates confidence in company outlook • Acquired Blue Stone International and Frankel Consulting in 2013 • Further penetrate Life Sciences and IT market • Paid off nearly 34% of debt in 2013 • Have $58 million in cash still on Balance Sheet Word on the Street • Most Analysts have “buy” or “strong buy” • Average target price of $75 • Upgraded following Q4 Earnings Call • Beat Estimates by $.02 Risks • Valuations are on the high side • Indicates stock could be a bit overvalued • 52 week increase of 72.6% • Market may have priced in growth in Healthcare • Consulting is a client demand driven business • Reliant on client need to generate revenue Conclusion • Huron operates in volatile industries • Generate high fees due to value provided • Huron Financial enjoyed 36% revenue growth • Expected to continue due to client backlog • Investment Club penetrates new market • Hedge risk against other investments: • Pfizer, Gilead Sciences, Goldman, J.P. Morgan

![PW Heavy Equipment Operator [Read More]](http://s3.studylib.net/store/data/006999445_1-8417856b741c62f00336b7e979d86f7e-300x300.png)