Chapter 4

advertisement

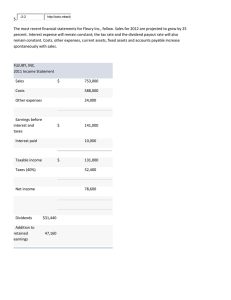

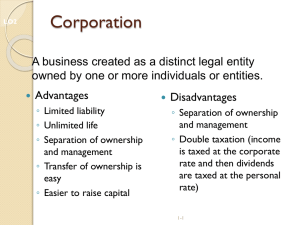

Corporation LO2 A business created as a distinct legal entity owned by one or more individuals or entities. Advantages ◦ Limited liability ◦ Unlimited life ◦ Separation of ownership and management ◦ Transfer of ownership is easy ◦ Easier to raise capital Disadvantages ◦ Separation of ownership and management ◦ Double taxation (income is taxed at the corporate rate and then dividends are taxed at the personal rate) 1-1 LO1 Financial Manager Financial managers try to answer some or all of these questions The top financial manager within a firm is usually the Chief Financial Officer (CFO) ◦ Treasurer – oversees cash management, capital expenditures and financial planning ◦ Controller – oversees taxes, cost accounting, financial accounting and data processing 1-2 LO1 Financial Management Decisions Capital budgeting ◦ What long-term investments or projects should the business take on? Capital structure ◦ How should we pay for our assets? ◦ Should we use debt or equity? Working capital management ◦ How do we manage the day-to-day finances of the firm? 1-3 LO5 Cash Flows to and from the Firm 1-4 Chapter 4 LONG-TERM FINANCIAL PLANNING AND CORPORATE GROWTH 5 Chapter 4 Outline 1. 2. 3. 4. 5. What is financial planning Financial planning models The percentage of sales approach External financing and growth Caveats in financial planning 6 What is Financial Planning? Financial planning formulates the way financial goals are to be achieved Financial plan – a statement of what is to be done in the future What is the goal of financial management? 7 Short vs. Long-term Financial Planning Short-term planning – analysis of decisions that affect current assets and current liabilities: o o Cash and liquidity management Credit and inventory management Long-term planning – focuses on the “big picture”: o o o Capital budgeting Dividend policy Financial structure 8 Dimensions of Financial Planning 1. 2. 3. Financial horizon – the long-range time period the financial planning process focuses on, usually the next 2-5 years Aggregation – process by which smaller investment proposals of each of a firm’s operational units are added up and treated as one big unit Alternative set of assumptions about important variables (scenario analysis) 9 Aims of Financial Planning (1) 1. 2. 3. Examining interactions – make explicit the linkages between investment proposals for the different operating activities of the firm and financing choices available to the firm Exploring options – develop, analyze and compare many different scenarios in a consistent way Avoiding surprises – identify what may happen to the firm if different events take place 10 Aims of Financial Planning (2) 4. Ensuring feasibility and internal consistency – are the company’s goals compatible? 5. Communication with investors and lenders 11 Financial Planning Model: Elements (1) 1. 2. 3. Sales forecast – given as a growth rate in sales Pro forma statements – a financial plan has a forecasted balance sheet, an income statement, and a statement of cash flows Asset requirements – firms’ total capital budget consists of changes in total fixed assets and net working capital 12 Financial Planning Model: Elements (2) 4. 5. 6. Financial requirements – how to raise the capital; dividend policy and debt policy Cash surplus or shortfall (“plug”) – the designated source of external financing needed to deal with any shortfall in financing and to bring the balance sheet into balance Economic assumptions – level of interest rates, the firm’s tax rate and sales forecast 13 Simple Financial Planning Model All variables are tied to sales and this relationship is optimal The growth in assets requires the management to decide how to finance the growth (debt vs. equity) o o Dividend policy Financing policy 14 Simple Financial Planning Model: example (1) COMPUTERFIELD CORPORATION Financial Statements Income statement Sales $1,000 Costs 800 Net Income $200 Balance sheet Assets Total $500 $500 Debt $250 Equity 250 Total $500 15 (2) If sales increase by 20% - income statement Pro forma income statement Sales Costs Net Income 16 (3) If sales increase by 20% - balance sheet Pro forma balance sheet (debt as the plug variable) Assets Debt Equity Total Total Pro forma balance sheet (dividends as the plug variable) Assets Debt Equity Total Total 17 The Percentage of Sales Approach A financial planning method in which accounts are projected depending on a firm’s predicted sales level Not all of the items vary directly with sales 18 Percentage of sales approach: example (1) ROSENGARTEN CORPORATION Initial income statement Sales $1,000 Costs 800(80%) Taxable Income $200 Taxes 68 Net Income $132(13.2%) Addition to retained earnings $88 Dividends $44 19 (2) Dividend payout ratio = Cash dividends/Net income = $ 44/$132 *100= 331/3% Retention ratio (plowback ratio) = Retained earnings/Net income = $88/$132*100 = 662/3% or retention ratio = 1- dividend payout ratio = 1-0.333 = 0.667 20 (3) Pro forma income statement (25% sales increase) Sales $1,250 Costs 1000(80%) Taxable income $250 Taxes 85 Net income $165(13.2%) Projected addition to retained earnings = Projected dividends paid to shareholders = Net income = 21 (4) ROSENGARTEN CORPORATION Balance sheet Liabilities and Owner's Assets Equity Current assets Current liabilities Cash $160 (16%) A/P $300(30%) A/R 440 (44%) Notes payable 100n/a Inventory 600 (60%) Total $400n/a Total $1,200 (120%) Long-term debt $800n/a Fixed assets Owner's equity Net plant and Common stock $800n/a Retained equipment $1,800 (180%) earnings 1,000n/a Total $1,800n/a Total liabilities and shareholder's Total assets $3,000 (300%) equity $3,000n/a 22 (5) ROSENGARTEN CORPORATION Pro forma balance sheet after 25% sales increase ($) (Δ,$) ($) Assets Current assets Cash A/R Inventory Total Liabilities and Owner's Equity $200 $40 550 750 $1,500 110 150 $300 Fixed assets Net plant and equipment Total assets (Δ,$) $2,250 $450 $3,750 $750 Current liabilites A/P $375 $75 Notes payable Total 100 $475 0 $75 Long-term debt Owner's equity $800 $0 $800 1,100 $1,910 $0 110 $110 $3,185 $185 Common stock Retained earnings Total Total liabilities and shareholder's equity External financing needed $565 23 External Financing External financing needed (EFN) = the amount of financing required to balance both sides of the balance sheet For Rosengarten Corporation: Assets-(Liability + Equity) = $3,750 – $3,185 = $565 In order to have a 25% increase in sales the corporation has to raise $565 in new financing Possible sources of financing : - short-term borrowing - long-term borrowing - new equity 24 Capital Intensity Ratio A firm’s total assets divided by its sales The amount of assets needed to generate $1 sales 25 EFN and Capacity Usage Suppose Rosengarten is operating at 80% capacity: 1. What would be sales at full capacity? 2. What is the capital intensity ratio at full capacity? 3. What is EFN? 26 Answers: Conclusion: excess capacity reduces the need for external financing and capital intensity ratio 27 EFN and Growth Increase in total assets is financed internally and externally Increase in total assets = assets (A) × sales growth (g) Internal financing = Addition to retained earnings = Projected net income × retention ratio (R) = Profit margin (p) × projected sales[S×(1+g)] × retention ratio or EFN = A×g – p×S×R×(1+g) or Internal growth rate = ROA×R/(1-ROA×R) 28 Financial Policy and Growth A firm may not wish to sell any new equity Debt capacity = the ability to borrow to increase firm value If a firm borrows to its debt capacity sustainable growth rate can be achieved g* = ROE×R/(1-ROE×R) 29 Internal vs. Sustainable Growth Rates Internal growth rate – the maximum growth rate a firm can maintain with only internal financing Sustainable growth rate – the maximum growth rate a firm can achieve with no external equity financing 30 From intro finance course… Using Du Pont Analysis Net income Net income Sales ROA PM TAT Assets Sales Assets Net income Sales Assets ROE PM TAT EM Sales Assets Equity ROE ROA EM ROA (1 D ) E 31 Determinants of Growth g* = [p (S/A) (1+D/E)×R]/[1-p(S/A)(1+D/E)×R] 1. Profit margin 2. Dividend policy 3. Financial policy 4. Total asset turnover 32 Caveats of Financial Planning Models Rely on accounting relationships Need to be modified over time Objectivity of financial plans 33