Revenue Integrity - HFMA Metropolitan New York Chapter

advertisement

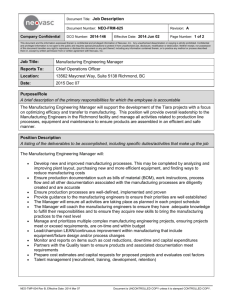

Welcome Emily Casto Linda Corley, MBA, CPC Territory Sales Manager New York State Corporate Compliance Officer Revenue Cycle Solutions Craneware, Inc. Dell Services e.casto@craneware.com Linda_Corley@dell.com NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.1 Developing Sound Controls Managing the Shift from Revenue Cycle to Revenue Integrity Practices NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. Today’s Agenda Importance of Continued Focus on the Revenue Cycle Transitioning from Revenue Cycle to Revenue Integrity Significance of the Chargemaster Identifying where Problems start Strategies for Revenue Integrity Questions & Answers NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.3 Why Focus on the Revenue Cycle? Increase in Bad Debt due to Revenue Leakage Increase in Compliance Risk Increase in Non-payment NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.4 What is Revenue Leakage? Revenue leakage – the gap between the amount of revenue providers are entitled to and the amount of reimbursement eventually received – is missed or “lost” revenue. NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.5 Increase in Bad Debt 1 40% of what hospitals bill is collected 2 $31.2 billion in uncompensated care 17% growth in uncompensated care with no increase in 3 reimbursement at EMH Regional Healthcare System in Ohio 4 25% of Americans have trouble paying for medical care 5 80% of payments uncollected at any given time 1. Healthcare Financial Management: Trends in Hospital Uncollectible Revenues (February 2008) 2. Healthcare Financial Management Association Report: Getting Rid of Bad Debt Blues (April 2008) 3. Healthcare Finance News: Ohio Hospital System Addresses Bad Debt by Identifying Patients, Resources (January 30, 2008) 4. USA TODAY: Report: Even the Insured Have Trouble Paying Bills (October 25, 2007) 5. The Advisory Board Company, Financial Leadership Council: "Cultivating the Self-Pay Discipline" (2007) NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.6 Increase in Compliance Risk $76.5 million owed to Medicaid from a New York hospital because of 1 overbilling 42% of improper payments identified by Recovery Audit Contractors 2 are attributed to improper coding 38 states had either proposed or passed legislation related to pricing 3 transparency as of September 2007 $2.2 billion expected recoveries from fraud investigations and audits by the OIG in the first-half FY 2008 4 1. Medicaid Fraud Control Units: 2005 Annual Report 2. HealthLeaders: When the Auditor Comes Calling: Surviving an Audit (June 2008) 3. Healthcare Financial Management: Is Your Strategic Pricing Strategy Based on Fact or Myth? (May 2008) 4. Office of Inspector General: OIG Reports More Than $2 Billion in Recoveries From Fighting Fraud, Waste, and Abuse for First-Half FY 2008 (June 12, 2008) NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.7 Increase in Non-Payment through Errors A $300-million hospital can easily lose $3 million to chargemaster and charge capture errors 1 2 90% of claim denials are preventable 67% of denials are recoverable 3 14% of claims submitted are denied One out of every seven claims has to be resubmitted, appealed or written off 1. Healthcare Financial Management: Are You Speeding Toward Revenue Loss? (December 2004) 2. American Medical News: Stake Your Claim: How to fight for fair reimbursement (June 21, 2004) 3. Healthcare Financial Management: Improving Cash Flow with Better Charge Capture and Denial Management (October 2005) NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.8 Increase in Non-Payment due to Errors 1 According to a study of 1 million hospitals’ claims: 56% of claims contained coding errors • 86% of the errors were HCPCS based o 79% of the HCPCS errors were chargemaster related 27% of claims contained billing errors 17% of claims contained charging errors $75 to $125 per claim is the cost associated with managing a denial or reworking a claim 1. Healthcare Financial Management Association: Outpatient PPS Can Undermine Effective Revenue Cycle Management (July 30, 2004 NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.9 The Case for Revenue Integrity Revenue Integrity (rev-uh-noo in-teg-ri-ty) -noun The achievement of operational efficiency, compliance and ligament reimbursement – can be achieved only with the proper processes, tools, and related expertise. NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.10 Symptoms of a Significant Revenue Cycle Problem High dollars written-off due to lack of medical necessity Low percentage of: • Medicare APC and other payors’ reimbursement of charges • Claims that transmit electronically without biller intervention High Percentage of : • “Return-to-provider” (RTP) Claims • Rework Claims Multiple rejections for “duplicate claims” Not enough staff to keep up with collections follow-up High or growing days in A/R Cash flow problems NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.11 How to Stop Revenue Leakage and begin the Shift to Revenue Integrity “What is the most important tool to ensure optimum and compliant reimbursement?” THE CHARGEMASTER NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.12 Start in the Middle The Chargemaster is the database responsible for translating care into billable and payable services NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.13 Significance of the Chargemaster The Charge Description Master, CDM or Chargemaster is the vehicle through which an organization describes all of its services-both internal and to the outside world Basis for measuring • Revenue Performance • Costs • Productivity NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.14 Significance of the Chargemaster The Chargemaster is your “Friend” to charging and billing accurately or “Foe” when it creates careless patterns of behavior NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.15 Significance of the Chargemaster When does CDM Maintenance cause Lost Charges? HFMA Insta Poll March 2009 NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.16 Significance of the Chargemaster Considering the basis of payment, approximately how much of your revenue is charge based? Greater than 50% 13% 24% 25-50% 21% 5-25% 43% <5% NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.17 Imbed Essential Controls into CDM Maintenance Process The CDM has a pervasive effect on the charge capture process Internal controls are most effective when closest to transactions A control point is located anywhere a process can break down Internal controls assure that you either prevent or detect errors The importance of a control point depends on probability, frequency and materiality of error What are the controls most important in CDM management? NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.18 Essential CDM Controls needed to Shift to Revenue Integrity Control Risk Materiality Control Point 1. CDM not updatedfor changes to coding rules Impacts 100% of transactions using incorrect code Continuous audit of CDM prioritizes records by significance of issue 2. CDM missing services Clinical transaction is never billed Constant comparison to Best Practice compare & Identification of linked services NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.19 Essential CDM Controls needed to Shift to Revenue Integrity Control Risk 3. Medication units of service incorrect Materiality Impacts 100% of transactions using incorrect dosage Control Point Comparison of description and CPT Intent of service to identify incorrect unit of service 4. Pharmacy acquisition costs do not reconcile with revenue 100% of transactions tied to billable supplies Compare Pharmacy purchase history against CDM NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.20 Essential CDM Controls needed to Shift to Revenue Integrity Control Risk 5. Clerical data entry error to CDM table Materiality Impacts 100% of transactions using incorrect code Control Point Automated checking of key data elements by comparing to external sources 6. Delay creating new charge codes Clinical transaction is never billed or can’t be delivered Electronic change request form with automated escalation NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.21 Essential CDM Controls needed to Shift to Revenue Integrity Control Risk Materiality Control Point 7. Clinical department’s inappropriate use of charge due to absence of education Varies from random error to 100% of transactions Automated way to notify department managers of information specific to clinical department 8. Clinical department disengaged from CDM Risk increases with staff turn-over Provide department read only access to the CDM NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.22 Essential CDM Controls needed to Shift to Revenue Integrity Control Risk 9. Order entry system doesn’t reflect CDM edits Materiality Impacts 100% of transactions using incorrect code Control Point Implement workflow that includes e-mail acknowledgement & sign off NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.23 Essential CDM Controls needed to Shift to Revenue Integrity Control Risk Materiality Control Point 10. Poor documentation results in loss of knowledge Reliance on individual knowledge and best effort documentation is common Automated, defensible documentation of all edits and guidance. 11. Price falls below cost and/or fee schedules Lost revenue on all contracts paying lesser Line item comparison to fee schedule benchmark NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.24 But How? NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.25 THE CHARGEMASTER is a key strategic asset in the fight to Stop Revenue Leakage and make the shift to Revenue Integrity – The more accurately it’s managed, the more value it delivers NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.26 6 MEDICAL MANAGEMENT 7 CHARGE CAPTURE & ENTRY 8 MEDICAL 8 RECORDS & CODING 9 CLAIMS SUBMISSION 5 10 REGISTRATION & POS CASH COLLECTIONS THIRD PARTY FOLLOW-UP Revenue Management = Patient Access Functions 4 11 = Medical Management Functions FINANCIAL COUNSELING PAYMENT POSTING = Receivables Management Functions 12 3 REJECTION PROCESSING INSURANCE VERIFICATION 13 2 PRE-REG & PRE-CERT 1 SCHEDULING 14 CONTRACT NEGOTIATION/ ADMIN. DENIAL & APPEAL MANAGEMENT NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.27 Why are hospitals having more claim rejections and denials Patient Financial Services has lost ability to completely “clean-up” claims on the back-end to positively affect reimbursement! Appropriate “time” for control may be lost if all processes are not in place “prior” to provision of the service Patient Financial Services (Business Office) does not: • register / schedule / admit • review for medical necessity prior to service • maintain the chargemaster • select / post charge • code the HCPCS / CPT-4 codes • code diagnoses / procedures • add modifiers NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.28 Inpatient and outpatient claims undergo thousands of edits looking at patient status, diagnosis and procedure data, services provided and demographic data – they either pay or reject or deny. Rejections and denials are not contractual write-offs. Perplexing Points This distinction is an important one. to Ponder Patients remaining in acute care past the average LOS are estimated to cost hospitals over 50 million dollars per year. Hospitals are fined (or placed under a Quality Improvement Agreement) due to patients being admitted as inpatients when they do not meet inpatient admission criteria. (RAC recoupments!) NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.29 When is revenue not really “CASH”? When it’s still in “CHARGES” 2001 – 57% of hospitals were paid less than the actual cost of caring for their Medicare patients¹ 92% of hospitals lose money on outpatient services – the fastest growing segment of hospital billable services • Medical necessity denials “cost” hospitals more dollars than received in collections in some hospitals “Lost” revenue has contributed to the negative margins experienced by nearly one-third of all U.S. hospitals every year ¹AHA, The Case for Hospital Payment Improvement, May 2003 NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.30 Where do denials begin? Patient Access: Why the final bill does not originate in the billing office! Opportunity vs. Reality: “Know” the facility’s strengths and weaknesses Pre-registration is a “must” for accurate reimbursement Insurance verification builds up speed for quicker payment Scheduling “stops” that may slow down the billing process • Registration collaboration essential!!! • Case Management involvement earns $$ • Manage physician relationships for appropriate reimbursement Outpatient is not Inpatient – Why the difference means $$ • Medicare “inpatient only” procedures cause denials NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.31 Patient Access Strategies for Shifting to Revenue Integrity Evaluate each and every access point, to flow-chart how patients are brought into the hospital to receive services; as well as set goals for planned improvement in data gathering and POS cash collections Perform monthly “admissions” review – graph data for ALOS Pay particular attention to ER admissions. Involve CM / UR in the “Patient Status” decision-making process Track all inpatient admissions denied by payer Establish accountability for medical necessity and the Medicare “required” Advanced Beneficiary Notice (ABN) or Health Insurance Notice of Non-coverage (HINN) procedures Use “compliance” software for diagnosis review for outpatients Institute required financial counseling sessions with all beneficiaries NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.32 Medicare’s Advanced Beneficiary Notice (ABN) for outpatients and Hospital Issued Notice of Non-Coverage (HINN) for inpatients Caution flags to watch out for Is your facility providing “bed and breakfast” along the trip? Observation after OP Surgery – Non-covered by Medicare Must have physician documented “complication” of the OP surgery to qualify for Observation – even then, it is not reimbursed Nausea and vomiting generally considered not a complication NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.33 Charge Capture Strategies Continued training for: • clinical areas on Medicare coverage and coding requirements • “charge” posting staff on ensuring all services being charged Continual review of CDM to ensure all line items are correct • Incorporate payer specific coding for reimbursement Is there a line item for every service, test, exam, drug, supply (non-routine) and procedure the hospital may provide? Is CDM coding revised quarterly? • CMS publishes new OPPS edits and Addendum B (APC by HCPCS code) each quarter NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.34 Charge Capture Strategies Review of UB to determine if “coded” HCPCS are dropping to the claim Does a soft-coded HCPCS override a CDM HCPCS? • “Test” claims important for accurate and compliant billing Is the HCPCS appearing under the correct Revenue Code? Who audits charge process to ensure all services provided have been charged appropriately? • “Strength” in identification and correction of lost charges • Important for optimum payment but most important for compliant reimbursement and ability to retain $$ after RAC or Medicaid Integrity audits NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.35 Charge Capture Strategies for Claim Edits Compliance (medical necessity) edits – “front-end” edits •Compile “write-offs” by line item service, department, physician, and registrar •Publish results and communicate to all parties •Use results for educational sessions for registrars/departments Pre-bill edits – “back-end” edits prior to claim transmission •Require review by “eagle-eyed” manager prior to reversing to the department whose revenue cannot be collected •Post to spreadsheet for reporting to departmental managers FISS edits – “return-to-provider” claims with error reason codes •Require weekly report (itemized list) by biller or collector of claims in the FISS that have not been cleared for payment. NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.36 Charge Capture Strategies for Claim Edits Erroneous information provided by patient •No coverage on date of service – Commercial, and, yes, Medicare •Medicare should be billed as “secondary” payer – not primary oAuto or other accidents require “primary” payer information Typographical error at time of registration or billing Inconsistent information within claim form •Therapy date of onset of symptoms, number of prior visits Insufficient information required to consider claim for payment Overlapping dates of service – Home Health & SNF patient •Need accurate and complete Discharge Planning data OP services provided within 72 hours of IP admission NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.37 Comparing Apples to Oranges “Returned to Provider” or “Denied” Error messages are sometimes difficult for collectors to understand – maintain “error resolution” manual with screen prints and instructions on corrections Medicare Fiscal Intermediary Standard System (FISS) errors (glitches) cause payment delays – analyze $$ and call FI or MAC if substantial Create task force for focused correction for specific payers if problems exist Know standard “payment receipt” time (days in collection) by payer NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.38 Comparing Apples to Oranges Health Information Management Promote collaboration of HIM staff and clinical charge posting staff Track problematic accounts that require additional work or re-work by HIM Establish written procedure for clinical area review or HIM review of line items rejected for modifier determination Ask HIM to meet with PFS to discuss accounts on hold Track by outpatient area, by physician and by error message Drill down into DNFB for inpatient accounts to establish $$ by issue NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.39 Comparing Apples to Oranges Medical Management Although Case Management and Utilization Review have been considered components of the Revenue Cycle, NOW is the time to ensure their participation in optimization of payment. Consider defining written procedure for admission practices! Important component of compliance. Often given “responsibility” with no “authority” •Identify CM strengths and weaknesses •Draft improvement plan •Measure performance •Ensure measurable outcomes to document and report “quality” initiatives NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.40 Comparing Apples to Oranges “I sometimes visit a hospital where PFS staff state they have no Medicare denials…” •Why do they think there are no or very few denials? •What change does this thinking require? •Do you know? What was the total dollar amount of all the services provided in your hospital last month that did not result in a payment? NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.41 Receiving the Remittance Advice How sweet is its arrival or does it ever arrive? 1. Payment 2. Denials 3. Reasons for Denials 4. Appeals NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.42 Communication – How do we know we have made the shift to Revenue Integrity? Revenue Cycle Management – Establish monthly meeting to review: • Total revenue earned • Total cash received • Total “non-collectable” charges • And all “benchmark” and best practice data the hospital can track! Quality Assurance for Revenue Integrity • Set goals and quantify! Celebration! NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.43 Questions? Emily Casto Linda Corley, MBA, CPC Territory Sales Manager New York State Corporate Compliance Officer Revenue Cycle Solutions Craneware, Inc. Dell Services e.casto@craneware.com Linda_Corley@dell.com NOTICE: This document contains confidential or proprietary information which may be legally privileged. It is intended only for the named recipients, and may not be shared with vendors outside of Craneware. p.44