Sales - Automotive News

advertisement

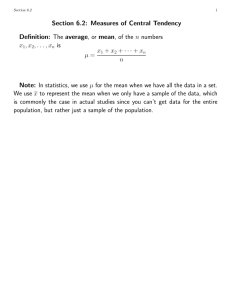

John Holt, CEO Automotive News World Congress 2006 Today’s Takeaways: Observations from 10 + Years in this Business > The Internet has arrived – at long last! > Its short-term effect was exaggerated; its long-term impact has been under-estimated > A comprehensive Internet strategy requires focus on both creating and converting opportunities - We have opportunities to transform existing spends and create opportunities for unheard of value - The average dealership is losing far more opportunities than it’s winning; conversion matters too > Internet impact and ROIs justify our attention and commitment Cobalt Strategy Create and Convert Opportunities • OEM Portals • Websites • Search • Dealix Leads Website Leads (phone, email, walk-up) Cobalt CRM 3rd Party Leads Create Opportunities Convert Opportunities Topics > State of the World - Overall Internet Usage / Ad Spending - Automotive Industry Trends > Insights from Recent Surveys and Research - eBusiness Performance Data > Implications / Actions State of the World: Internet Usage Keeps Growing Growing Internet Usage (Millions) 287.9 Internet Users 296.2 ► 68% of total population ► More than doubled in five years 202.9 95.4 2000 2005 Internet Users Source: Nielsen NetRatings, ITU Internet Ad Spending (and Paid Search) is Growing, Primarily at Expense of Newspapers Internet Ad Spending ($ Billions) Ad Spend Budget by Medium $19 100% 90% $8 $12 80% 70% 60% $4 50% 40% 30% 20% 10% 0% 2005 Other Internet 2010 Paid Search 1995 Newspaper Radio 2005 Internet Other Source: Park Associates. Jupiter Source: American Advertising Federations TV Automotive Internet Ad Spending Driving Car Sales Automotive Internet Ad Spending ($ Billions) Internet-Generated New Car Sales (Millions) $1.8 6.1 M 33%* 3.0 M 18%* $0.4 2003 2007 Source: Jupiter, Borrell Assoc. 2003 2009 * Percent of total car sales. Source: Jupiter Most Retailers Are Doing OK, But… Sales ($ M) Net Profit (%) $34.0 Success Factors 2.5% $33.0 2.0% ► High Sales Volumes – 8th consecutive year of $32.0 $31.0 1.5% $30.0 1.0% $29.0 0.5% $28.0 16+ M vehicles sold ► Manageable Margin Pressure – OEM incentives $27.0 0.0% 2000 2001 Dealership Sales 2002 2003 2004 Net Profit before Tax Source: NADA Average Dealership Profile – Low interest rates – Profit diversification Dealer Ad Spend per Vehicle Increasing Faster than Rate of Inflation Implications CAGR: 7% $500 ► Growing Pressure – Identify advertising / marketing efficiencies and efficacy $250 ► Internet’s Appeal – Buyers are there – Efficient, measurable 1995 2005 Source: Park Associates. Jupiter means to attract in-market car buyers Third-Party Leads Growing in Importance Great ROI 3rd Party Leads as % of Total Dealer Internet Marketing Budget Percentage of Dealers Using 3rd Party Leads 41% 79% 82% 33% 29% 50% 2002 2003 Source: Jupiter 8/05 2004 2004 2005 Source: Jupiter 8/05 2006E The Huge and Coming Impact of Search Great ROI ► 67% of Auto Buyers Research Online* ► 70% Start at a Search Engine** OEM Website Dealer Website Auto Buyers * JD Power 2004 Autoshopper.com 2004 study ** Yahoo! Complete 2005 auto study 3rd Party Website Dealership Insights from Cobalt Research Research Overview: Approach > Studied 12 months of leads to 1,329 dealerships - Over 1.1 million leads matched to actual vehicle sales by R.L. Polk - Analyzed close rates, sales cycle, brand defection, cross shopping > Telephone survey – interviewed 4,000 customers that submitted leads to evaluate their perceptions of dealership lead handling > Industry-wide eMystery Shop – over 4,000 dealers / 22 brands - Responsiveness, response times, quality of response > Conducted 20 onsite evaluations of high performers - Determined common best practices that lead to higher conversions Research Overview: Key Findings 1. The majority of leads turn into sales 2. Most customers have a very short purchase timeframe 3. Most dealerships are experiencing a significant amount of “lost opportunities” 4. Dealership responsiveness to leads is improving, but the quality of those responses is not 5. High performers utilize a remarkably common set of absolutely teachable best practices Leads Are Real 100% Leads not converted to a sale 75% 512,685 44% 100% 50% Leads converted to a sale 144,842 75% 56% of the leads resulted in a sale 100% 25% 644,957 56% 75% 50% 0% All New Vehicle Leads 52,408 50% 199,656 25% 592,549 0% 248,051 25% 0% Based on registration information supplied by R.L. Polk & Co. Sales/leases have been adjusted for matching efficiency by a factor of 1.36, which represents a 73% historical match rate Customers Have a Short Purchase Timeframe Time to close a lead 300,000 273,886 68% of leads closed to a sale within 90 days Number of Closed Leads 250,000 204,486 200,000 42% 150,000 32% 103,130 100,000 63,455 50,000 16% 10% 0 0-30 31-60 61-90 Days to Close 91+ Based on registration information supplied by R.L. Polk & Co. Sales/leases have been adjusted for matching efficiency by a factor of 1.36, which represents a 73% historical match rate Elapsed time between the date of lead submission and date of lead closure Lost Opportunity is Significant 100% Leads not converted to a sale 75% 512,685 44% 8% closed at the original dealership 92% closed at other dealerships = “lost opportunity” 100% 50% 8% Bought at Intended Dealer Leads converted to a sale 100% 25% 644,957 56% 52,408 75% Sold at “Other” Dealer 50% 592,549 0% All New Vehicle Leads 25% 144,842 75% 50% 199,656 25% 0% 248,051 92% 0% All Leads converted to a Sale Based on registration information supplied by R.L. Polk & Co. Sales/leases have been adjusted for matching efficiency by a factor of 1.36, which represents a 73% historical match rate Lost Opportunity is Significant 100% Leads not converted to a sale 75% 66% purchased the intended brand or a used vehicle at another dealership 512,685 44% 100% 50% 8% Bought at Intended Dealer Leads converted to a sale 100% 25% 644,957 56% 52,408 75% Sold at “Other” Dealer 50% 592,549 0% All New Vehicle Leads 25% 92% Intended Make (New) 144,842 75% 24% Other Make (New) 50% 25% 0% 199,656 34% Lost Opportunity Used (Any Make) 248,051 42% All "Missed" Sales 0% All Leads converted to a Sale Based on registration information supplied by R.L. Polk & Co. Sales/leases have been adjusted for matching efficiency by a factor of 1.36, which represents a 73% historical match rate Dealership Responsiveness to Leads is Improving Industry eMystery Shop Metrics 2004* 2005* 60.0% 69.7% 9.5 6.5 Answered the Shoppers Questions 38.2% 25.9% Used Brand or Product Highlights NA 23.9% Overall Responsiveness Response Time Average (hrs) Quality of Responses: *Source Cobalt 2004/2005 Industry-wide eMystery Shop But Response Quality Has Slipped Industry eMystery Shop Metrics 2004* 2005* 60.0% 69.7% 9.5 6.5 Answered the Shoppers Questions 38.2% 25.9% Used Brand or Product Highlights NA 23.9% Overall Responsiveness Response Time Average (hrs) Quality of Responses: *Source Cobalt 2004/2005 Industry-wide eMystery Shop Customers Cite Importance of a Quality Response What is the primary reason you bought a vehicle from the (intended) dealership? Trade-In (fair trade-in value offered) Other Existing Relationship (with dealership) Inventory (had what looking for) Proximity (dealership in close proximity) Dealership Response (good, quick) Price (price was competitive) 0.7% 1.2% 4.3% Inventory 9.6% Proximity (Dealership) 14.2% Dealership Response (good, quick) 21.4% Price (price was competitive) 0% 5% 10% 15% 39.3% 20% 25% 30% 35% 40% 45% Customers Cite Importance of a Poor Response What is the primary reason you bought a vehicle from another dealership? Trade-In (poor trade-in value offered) 0.2% Other Existing Relationship (none with this dealership) 1.1% Proximity (dealership in distant proximity) Inventory (inadequate) 1.5% 3.3% 3.7% Price (too high) Price (price was not competitive) Dealership Response (poor, slow) Other Brand (customer decided to buy a different brand new vehicle) 14.4% Dealership Response (poor) 20.4% Other Brand (customer decided to buy a different brand new vehicle) 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 55.4% 60.0% Closing Remarks > What should you remember? The Internet matters! - It’s where the buyers are - It’s time to transform historic media spends; doing things the same old way “out of habit” is irrational and wasteful - The Internet requires focus on both creating and converting; doing it right means buying the right assets and making a commitment to people/process too - The ROIs justify the effort - We’re damn lucky to work on something so transformative Thank You John Holt, CEO jwpholt@cobaltgroup.com