Ronni McCaffrey at Graland – 2014

advertisement

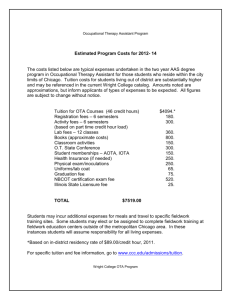

Head’s Network - Women’s Leadership Seminar Finance… what school leaders need to know October 18, 2014 You are a finalist in a Head Search. You are wondering about the financial stability of this school… What questions would you ask? What sources of information would you seek? How would you evaluate the data you receive? Where do you begin? Graland Mission Statement Achieve intellectual excellence Build strong character Enrich learning through the arts and athletics And prepare our students to be Engaged citizens and thoughtful leaders. Graland Strategic Plan 2011-17 Provide a program that brings the Graland Mission to life Create a dynamic learning community composed of highly effective teachers, administrators and staff Foster an inclusive community focused on supporting Graland’s Mission and Guiding Principles Ensure financial sustainability and maintain campus and facilities that optimize Graland’s program Implement Board governance practices that serve Graland’s Mission Basic Assumptions Finance is a key component in achieving the school’s mission It is a reflection of the school’s true priorities The Head must be actively involved in all phases of the budget The critical question is: Does the school have or can the school generate the resources needed to meet the mission? Staffing Plant Financial Aid Program Technology Budgeting Budgeting is the allocation of resources required to achieve the School’s mission Top Down Bottoms Up Strategic Indicators for Independent Schools Revenue Financial aid Expenses Faculty profile Budget excess/deficit Demographics Enrollment data Deferred maintenance Student/faculty ratio Annual Fund Debt Endowment Capital projects Who is Involved? Budget Managers *CFO* Head Finance Committee Board What Happens Know goals from planning processes and multi-year financial plan Gather input Start budget building and prioritizing Timeframe Fiscal year usually July 1-June 30 Oct/Nov Dec/Jan Jan/Feb April/May or Aug/Sept • Input, define assumptions • Preliminary budget approval for tuition setting • Appointment renewals, contracting, budget setting • Budget finalization Operating Income 2013-14 Actual Operating Income 3% 5% Tuition 6% ($13,788,323) Endowment ($970,001) 86% Misc. Income ($414,356) Annual Fund ($879,623) Operating Expenses 2013-14 Actual Operating Expenses = $13,599,761 5% 6% Instructional Salaries 6% Adminstrative Salaries Instructional Materials 8% 47% 11% 17% Maintenance Expense Lunchroom Expense Adminstrative Expenses Technology Financial Aid and its sources FA as a % of tuition income / benchmark Mission based Discounting to fill seats Financial Aid Endowment Restricted Annual Giving Faculty Class sizes Student/Teacher ratios Class size studies public school – Tennessee, Texas Gains with smaller class size early grades No impact after grade 5 Workload Student facing hours Prep hours Extra Capacity - Schedule Graland Compensation Philosophy Graland Country Day School commits to attracting, retaining and rewarding highperforming employees – those that demonstrate the qualities of innovation, collaboration, professionalism, leadership and actively contribute to further the mission of the School. Compensation Compensation Philosophy to drive decisions Understand marketplace National benchmarks Local benchmarks Demographics of faculty and staff Family health insurance coverage Retirement Employee childcare Faculty Salaries Benchmark Faculty Salaries 11-12 Lowest 11-12 Median 11-12 Highest Graland $36,885 $53,438 $77,976 NAIS Day School (50th percentile) $37,743 $52,275 $76,556 Denver Public Schools (Step 1 with BA): $37,551 THEN A MIRACLE OCCURS Alumni Program Part-time Alumni Director Alumni Expenses Total Investment $35,000 $21,250 $56,250 Return on Investment: Annual Fund – 8% Participation Alumni Speakers – 6 Visits 7 Alumni Kindergarten Students Total Return $128,000 $6,000 $136,500 $270,500 What to look for Are there any unexplained significant trends evident in the historical financial summary Does the school have reserves? Does the school have sufficient funds to pay the debt service? Is there a strategic plan to retire the debt? Cash Flow? Does the school pay this year’s bills with next year’s money? What to look for continued Does the school have any standards violations in its accreditation report? What is the ratio of debt to endowment? What is in the most recent Management Letter? Is there any “going concern” issue due to unexpected losses, failure to meet loan covenants or mismanagement? What to look for continued Are checking accounts reconciled quickly and systematically? Are vendors paid on a timely basis Are IRS 990’s filed on time? Are audits done smoothly and efficiently on a regular schedule Has the school done financial projections of income and expenses? Questions? Balance Sheet Total Assets = Total Liabilities and Total Net Assets OR What you own = What you owe plus what you are worth Assets Cash Accounts Receivable (Tuition and Fees) Contributions Receivable Equipment Property Liabilities Accounts payable (your bills) Accrued Expenses (e.g. salaries and benefits of employees) Deferred Revenue Registration Deposits Notes Payable (Loans, Mortgages, LOC, etc.) Net Assets Unrestricted Temporarily Restricted Permanently Restricted Total Net Assets = What you are worth Almost nothing can be accomplished in one year! Remember: Just because we are “not for profit,” it does not follow that we are “for loss.” Financial Forecast-Key Drivers Operating Enrollment Annual Tuition Increase Financial Aid Staffing Salary & Benefits Non-Operating Annual Fund Endowment Capital Expenditures Debt Service Drivers and Dynamics in School and Financial Models Size of school Dependence on tuition for income Endowment Debt Deferred Maintenance Salaries and Benefits (labor intensive) Drivers, continued Financial Aid and its sources Endowed Financial Aid Restricted Annual Giving FA as % of tuition income Mission based financial aid v. financial aid as discount to tuition Other Drivers Technology Specialized program needs Athletics and transportation And so many more… Budget vs. Actual Graland Country Day School 2013-14 2013-14 Favorable/ Budget Actual (Unfavorable) ENROLLMENT 681 683 FTE - Instructional 97.8 97.8 Student/Teacher Ratio FTE – Admin and Staff TUITION AND FEES PER STUDENT 6.97 37.6 20,164 6.98 37.6 20,188 FINANCIAL AID AS % OF TUITION & FEES 12.6% 12.9% SALARIES & BENEFITS AS % OF TOTAL EXP. 73.5% 73.2% OPERATING EXPENSES (Excl. Fin. Aid, Cap Campaign & New bldg) Salaries Benefits All Other 7,860 2,116 3,632 7,830 2,121 3,648 30 (5) (16) Year by Year Budget From a school in New York City 2001-02 Actual 2002-03 Actual 2003-04 Actual 2004-05 Actual 2005-06 Actual 2006-07 Actual 2007-08 2008-09 Actual Actual ENDOWMENT Endowment fund, beginning of year Gift income Realized gains/(losses) Unrealized gains/(losses) Transfers to/from Operating Endowment fund, end of year 39,363 354 (976) (1,373) 991 38,359 38,359 2,683 (142) 1,955 2,068 44,923 44,923 4,446 1,181 1,346 230 52,126 52,126 5,260 344 2,705 179 60,614 60,614 2,823 550 2,723 203 66,913 66,913 1,299 416 9,904 (3,685) 74,847 74,847 67 1,056 (7,986) (1,634) 66,350 66,350 180 (3,575) (9,439) (751) 52,765 DEBT Outstanding balance, June 30th 18,238 16,684 16,022 15,369 14,687 18,965 18,503 17,701 520 1,097 0 555 1,074 0 620 774 0 610 755 0 640 726 0 680 694 0 720 659 300 760 623 137 320 0 387 0 389 0 301 0 345 0 557 9,542 522 124 880 79 20,774 20,212 19,664 19,036 18,474 27,049 26,947 26,448 Principal payment - Bond Interest Expense - Bond Interest Expense - Loan CAPITAL EXPENDITURES Capital Expenditures - 20 East 92nd Capital Expenditures - Other FACILITIES Property and Equipment, net of depreciation