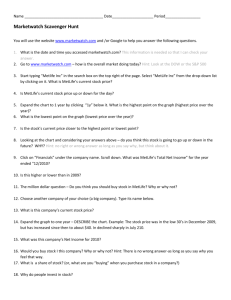

draft letter for participants to be mailed by providers on september

advertisement

September 15, 2011 Changes to the University of Texas Retirement Program Investment Lineup Dear University of Texas System Retirement Program participant: You are receiving this letter because you have all or part of your plan account balance in a funding option that will no longer be available for new contributions or transfers on and after November 15, 2011 through the UT System Retirement Program. The University of Texas (UT) System Retirement Program and MetLife Resources are dedicated to helping you plan for the future you want. As part of that commitment, UT regularly monitors the funding options according to established criteria that include (but are not limited to) overall performance objectives, fees, fund management, and fit within the line-up. The goal is to maintain an array of funding options to help you diversify your account according to your individual retirement planning needs, while offering an appropriate number that can be effectively monitored. We are pleased to announce, on behalf of UT, that as a result of its latest review, UT has introduced a streamlined fund line-up with competitively performing funds and competitive fees that provides you an array of quality funds across the risk spectrum while making it easier for you to select the funding options that best fit your individual situation. These changes will occur on November 15, 2011. The details of the changes are outlined in the follow pages. Not all funding options listed in the charts will apply to you. Also, there are funding options available under the UT System Retirement Program that are not affected. To review a complete list of Program funding options and your exact plan account holdings, log in to your MetLife website at www.metlife.com/uts or call Client Service at 1-800-236-8489. IMPORTANT: Actions to Consider If you are satisfied with how your contributions will be redirected on and after November 15, then you do not need to take any action. However, if you would like to change how your future contributions will be redirected, then you must update your contribution allocation no later than 3pm CST on November 14, 2011. After this date and time, you will still have the ability to change the direction of your future contributions, but some contributions may be redirected depending on when you notify us. You may transfer any part of your plan account balance into any funding option that is available through November 14, 2011, but, on and after November 15, 2011, you will not be permitted to transfer any part of your plan account balance into any funding option that will no longer be available. Any part of your plan account balance that you have in any funding option that will no longer be available on and after November 15, 2011, will remain in that funding option. However, you may transfer any part of your plan account balance out of those funding options on and after November 15, 2011, into any funding option that is available on and after that date . You may wish to take this opportunity to contact your MetLife representative in order to review your overall retirement plan allocations and goals. Please see the attached list of representatives. For additional information about your UT System Retirement Program fund offerings or for assistance with making any fund changes, please contact MetLife Client Services at 1-800-236-8489 or log onto the MetLife website at www.metlife.com/uts. Sincerely, MetLife Resources Variable annuities are offered by prospectus only, which is available from your registered representative. You should carefully consider the product's features, risks, charges and expenses, and the investment objectives, risks and policies of any underlying portfolios, as well as other information about any underlying funding options. This and other information is available in the prospectus, which you should read carefully before investing. Product availability and features may vary by state. Any annuity product guarantees are based on the financial strength and claims-paying ability of the issuing insurance company. Variable annuities are long-term investment vehicles designed for retirement purposes. Like most annuity contracts, MetLife contracts contain withdrawal charges, limitations, exclusions, holding periods, termination provisions and terms for keeping them in force. Contact your MetLife representative for costs and complete details. There is no guarantee that any of the variable investment options will meet their stated goals or objectives. The account value is subject to market fluctuations so that, when annuitized or withdrawn, it may be worth more or less than its original value. Annuity contracts contain exclusions, limitations, exceptions, reductions of benefits, waiting periods and terms for keeping them in force. Please contact a MetLife representative for costs and complete details. Mutual Funds are sold by prospectus, which is available from your registered representative. Mutual fund companies assess certain fees and expenses. MetLife and/or its affiliates receive fees from the mutual fund families or an affiliate for providing certain administrative, distribution and recordkeeping services. For more information regarding fees, please read each mutual fund prospectus carefully. Please carefully consider investment objectives, risks, charges and expenses before investing. For this and other information about any mutual fund investment, please obtain a prospectus and read it carefully before you invest. Investment return and principal will fluctuate with changes in market conditions, such that shares may be worth more or less than their original cost when redeemed. Diversification cannot eliminate the risk of investment losses, and past mutual fund performance is not a guarantee of future results. MetLife Resources is a division of Metropolitan Life Insurance Company (MLIC), 200 Park Avenue, New York, NY 10166. Securities, including variable products, offered by MetLife Securities, Inc. (MSI) (member FINRA/SIPC), 1095 Avenue of the Americas, New York, NY 10036. MLIC and MSI are MetLife companies. MLR19000541120 L0911207463(exp0912)(TX) UT Retirement System Fund Changes – Effective November 15, 2011 GOLD TRACK SELECT FUND CHANGES Asset Class New OR Current Funding Option for redirection of contributions Funding Option Name Future Contributions will be redirected into this fund Aggregate Bond Large Cap (Blend) Large Cap (Growth) Large Cap (Value) Small Cap (Value) BlackRock Bond Income Portfolio Class A Barclays Capital Aggregate Bond Fund Legg Mason ClearBridge Variable Fundamental Value Portfolio Class II MetLife Stock Index Fund Lord Abbett Growth and Income Series Fund Class B American Funds Growth-Income Fund Legg Mason ClearBridge Variable Appreciation Portfolio American Funds Growth Fund Fidelity VIP Contrafund® Portfolio Janus Forty Portfolio Legg Mason ClearBridge Variable Large Cap Growth Portfolio FI Value Leaders Portfolio (Fidelity) MetLife Stock Index Fund MetLife Stock Index Fund MetLife Stock Index Fund BlackRock Legacy Large Cap Growth Class A Legg Mason ClearBridge Variable Aggressive Growth BlackRock Legacy Large Cap Growth Class A BlackRock Legacy Large Cap Growth Class A MFS Value Class A Metropolitan Series Fund BlackRock Large Cap Value Class B Van Kampen Comstock Portfolio Class B Fidelity VIP Equity-Income MFS Value Class A Legg Mason ClearBridge Variable Large Cap Value Portfolio Third Avenue Small Cap Value Portfolio Class B Van Kampen Comstock Portfolio Class B Dreman Small Cap Value Portfolio Inflation Protected Bond PIMCO Inflation Protected Bond Portfolio International Morgan Stanley EAFE Index Portfolio International Harris Oakmark International Portfolio Allocation MetLife Aggressive Allocation Portfolio Allocation MetLife Conservative Allocation Portfolio Allocation MetLife Conservative to Moderate Allocation Portfolio Allocation MetLife Moderate Allocation Portfolio Allocation MetLife Moderate to Aggressive Allocation Portfolio MUTUAL FUND CHANGES Asset Class Intermediate-Term Bond Mid-Cap Value Mid-Cap Growth Small Growth Investment Name Ticker New OR Current Fund for redirect of contributions Future Contributions will be redirected into this fund Ticker MFXAX PIMCO Total Return Admin Pioneer Mid-Cap Value A PCGRX American Century Mid Cap Value Inv ACMVX Managers Cadence Mid Cap A MCMAX Hartford Midcap Y HMDYX Columbia Acorn USA Z AUSAX Morgan Stanley Inst Core Plus FI P PTRAX Prudential Jennison Small Company Z PSCZX World Stock Oppenheimer Global Y OGLYX World Bond Templeton Global Bond Adv TGBAX Inflation Protected Bond Retirement Income American Century Inflation Protected Bond Inv T. Rowe Price Retirement Income R APOIX RRTIX Target Date 2000-2010 T. Rowe Price Retirement 2005 R RRTLX Target Date 2011-2015 T. Rowe Price Retirement 2015 R RRTMX Target Date 2021-2025 T. Rowe Price Retirement 2025 R RRTNX Target Date 2031-2035 T. Rowe Price Retirement 2035 R RRTPX Target Date 2041-2045 T. Rowe Price Retirement 2045 R RRTRX Target Date 2050+ T. Rowe Price Retirement 2050 R RRTFX Target Date 2050+ T. Rowe Price Retirement 2055 R RRTVX University of Texas Representatives Campus UT Arlington UT Austin UT Brownsville UT Dallas UT El Paso UT Health Center - Tyler UT Health Science Ctr - Houston UT Health Science Ctr - San Antonio UT Health Science Ctr Houston - Psychiatric UT MD Anderson Cancer Center UT Medical Branch - Galveston UT Medical Branch Galveston - Prisons UT Pan American UT Permian Basin UT San Antonio UT Southwest Medical Ctr. - Dallas UT System UT Tyler Office Telephone Personal Contact Greg Jones Jens Busch Paul Mayhew Peter Berardino Stefani Price Joni Berardino David Scott Chuck Mulkey Thoma, Bill Bokal, Beth George Willingham Hansz, Aaron Chris Moore Joanne Resh Deborah Coffey Kevin Coffey Aaron Hansz Laura Heath Driskell, Delanie Marzetta, Dante (DJ) Mike Gonzalez Paul Mayhew Joni Berardino Walls, Dwayne Ryan Stainsby Chris Moore Joanne Resh Deborah Coffey Kevin Coffey Aaron Hansz Laura Heath Driskell, Delanie Representative 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 214-535-3917 512-970-8340 512-757-2278 512-482-9026 512-219-9755 512-482-9027 817-681-4114 214-395-7480 214-564-0652 915-256-7130 512-520-6228 832-439-3280 281-433-3941 713-962-0358 832-567-0451 832-723-4415 832-439-3280 409-682-6438 832-754-7882 281-221-4871 210-804-7231 512-757-2278 512-482-9027 210-438-7665 713-213-1733 281-433-3941 713-962-0358 832-567-0451 832-723-4415 832-439-3280 409-682-6438 832-754-7882 gjones5@metlife.com jbusch@metlife.com pmayhew@metlife.com pberardino@metlife.com sprice@metlife.com jberardino@metlife.com dscott3@metlife.com cmulkey@metlife.com bthoma@metlife.com bbokal@metlife.com gwillingham@metlife.com ahansz@metlife.com cnmoore@metlife.com jresh@metlife.com dlcoffey@metlife.com kcoffey@metlife.com ahansz@metlife.com lheath1@metlife.com ddriskell@metlife.com dmarzetta@metlife.com mgonzalez6@metlife.com pmayhew@metlife.com jberardino@metlife.com dwalls@metlife.com rdstainsby@metlife.com cnmoore@metlife.com jresh@metlife.com dlcoffey@metlife.com kcoffey@metlife.com ahansz@metlife.com lheath1@metlife.com ddriskell@metlife.com Email Address Marzetta, Dante (DJ) Debbie Coffey Chris Moore Joanne Resh David Hudson Aaron Hansz Laura Heath Tim Kish David Scott Laura Flores Kerry Norwood Mike Gonzalez Paul Mayhew Joni Berardino Walls, Dwayne Greg Jones Chuck Mulkey Jens Busch George Willingham Hansz, Aaron 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 800-236-8489 281-221-4871 832-567-0451 281-433-3941 713-962-0358 713-298-0076 832-439-3280 409-682-6438 254-681-6153 817-681-4114 432-550-0881 432-770-5857 210-296-9258 512-757-2278 512-482-9027 210-438-7665 214-535-3917 214-395-7480 512-970-8340 512-520-6228 832-439-3280 dmarzetta@metlife.com dlcoffey@metlife.com cnmoore@metlife.com jresh@metlife.com dhudson1@metlife.com ahansz@metlife.com lheath1@metlife.com tkish@metlife.com dscott3@metlife.com lflores@metlife.com knorwood@metlife.com mgonzalez6@metlife.com pmayhew@metlife.com jberardino@metlife.com dwalls@metlife.com gjones5@metlife.com cmulkey@metlife.com jbusch@metlife.com gwillingham@metlife.com ahansz@metlife.com