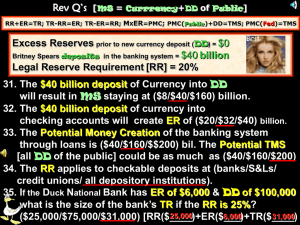

Potential Money Creation in the banking system is ______.

advertisement

Banks and the Public RR+ER=TR; TR-RR=ER; TR-ER=RR; M x ER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS MS = currency + DD of Public Banks & Public (all DD of Public are subject to the RR; rest is ER & can be loaned out) 1. No ER & RR is 20%; DD of $10 M is made in the Thunder Bank. MS is 8 10 $_____M. ER increase by $____M. Potential Money Creation in the 40 banking system is $_____M. Potential TMS is $____million. 50 2. There are no ER & RR is 25% & $16,000 is deposited in the Duck Bank. MS is 16,000 This one bank can increase its loans by a maximum of $_______. 12,000 Potential Money Creation in the banking system is $_________. 48,000 $_______. 64,000 Potential Total Money Supply could be $__________. 30,000 3. Econ Bank has ER of $5,000; DD are $100,000; RR is 25%. TR are $_______. 4. DD are $10,000; ER are $1,000; TR are $3,000; RR are $2,000 _________. [TR-ER=RR]. $50,000 5. Nomics Bank has ER of $10,000; DD of $100,000; RR of 40%. TR are $_________. 25,000 With ER above, Potential Money Creation in the banking system is $__________. 40,000 6. Friar Bank has DD of $100,000; RR is 20%; RR & ER are equal. TR are $________. 30,000 7. If ER in a bank are $10,000; DD are $200,000, & the RR are 10%. TR are $_______. 100,000 This single bank can 8. No ER & RR is 25%. DD of $100,000 is made. MS is $_______. 400,000 75,000 PMC in the system is $________. 300,000 TMS is $_________. increase its loans by $______. Banks and the Fed [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] MS = Currency + DD of Public [Money borrowed from the Fed [or gained thru bond sales] is ER & can be loaned out] 9. RR is 25%; Econ Bank borrows $25,000 from the Fed; its ER are increased by 25,000 Potential Money Creation in the system is $_______. 100,000 Potential TMS is $_______. 100,000 $______. 10. RR is 50%; a bank borrows $20,000 from the Fed; this one bank’s ER are increased 40,000 40,000 Potential TMS is $______ by $20,000 _____. Potential Money Creation in the system is $______. 11. RR is 20%; the Duck Bank sells $10 M of bonds to the Fed; Duck Bank’s ER are 50 million TMS is $__________. 50 million increased by $______mil. PMC in the system is $___________. 10 12. RR is 20%; Fed buys $50,000 of securities from Keynes Bank. Its ER are increased by $___________. 50,000 Potential Money Creation in the banking system is $______________. Potential TMS is $______________. 250,000 250,000 13. 25% RR; Fed buys $400 million of bonds from the Friar Bank. This one 400 bank’s ER are increased by $_______million. 14. RR is 50%; the Fed sells $200 million of bonds to a bank; its ER are 200 M Potential Money Creation in the (increased/decreased) by $_______. 400 M banking system is (increased/decreased) by $________. 15. RR is 10%; a bank borrows $10 million from the Fed; this one bank’s ER are increased by $_______ million. PMC in the banking system is 10 100 100 $_______million. Potential TMS is $_______million. Fed and the Public [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] MS = Currency + DD of the Public [When Fed buys securities from Public, they will put the money in their DD] 16. RR is 50%; Fed buys $10 M of bonds from the Public. MS is increased by $10 _______. M M ER are increased by$5 ____. _______. _______. M PMC in the system is $10 M Potential TMS is$20 17. RR is 25%; Fed buys $100 M of bonds from the Public. The MS is increased$_______. 100 M ER are increased by$______. 300 M Potential TMS is ________. $400 M 75 M PMC in the system is$_______. 18. RR is 50%; Fed sells $200 M of bonds to the Public. The MS is (incr/decr) by 100 M PMC in the banking system is $200 M __________. ER are (incr/decr) by $ _________. 400 M (increased/decreased) by $_______. 200 M Potential TMS is (incr/decr) by $_______. 19. RR is 20%; Fed buys $5 million of securities from the Public. The MS $4 M Potential Money is increased by _______. $5 M ER are increased by _______. M Potential TMS is $25 M Creation in the banking system is$20 _______. _________. 20. RR is 10%; Fed buys $50 million of bonds from the Public. The MS is M ER are increased by$45 M PMC in the banking increased by$50 _______. _______. system is __________. $500 M $450 M Potential Total Money Supply is __________. Practice Money Quiz [MS=Curr. + DD of Public] [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC; PMC(Public)+1stDD=TMS; PMC(Fed)=TMS] Commercial Banks Fed Public 1. The Brown Bank [with no ER] borrows $100,000 from the Fed. With a RR of 50% 100,000 PMC in the the Brown Bank can increase its loans by a maximum of $__________. 200,000 Potential TMS is$200,000 banking system is$__________. ______________. 2. The Tyll Bank has DD of $10,000; RR is 10%; RR & ER are equal. TR are $2,000 _______. 3. RR is 20%; Fed buys $50,000 of securities from the public. Possible Money Creation in the banking system is$200,000 __________. Potential TMS is $250,000 ____________. 4. RR is 40%; Ray Bank borrows $1 million from the Fed. This bank can increase $1 mil. PMC is $2.5 mil. TMS is __________. $2.5 M its loans by a maximum of __________. __________. 5. RR is 10% & there are no ER; $10,000 is deposited in the Alvarado Bank. This bank can increase its loans by a maximum of $9,000 __________. Possible Money $100,000 Creation in the banking system is $90,000 ___________. Potential TMs is _____________. 6. There are no ER in the Clark Bank. Nicole now deposits $10.00. With $40.00 Potential TMs is ___________. $50.00 a RR of 20%, PMC in the system is __________. 7. The Cochran Bank has a RR of 50%; the Fed buys $50 million of bonds from this bank. PMC in the system is __________. $100 M Potential TMS is __________. $100 M $70,000 8. Riley Bank has ER of $50,000; DD of $100,000, & a RR of 20%. TR are ________. 9. RR is 40%; the Collins Bank borrows $10 million from the Fed. This bank’s ER $25 M Potential TMS is ___________. $25 M are increased by $10 _________. M PMC is __________. 10. RR is 10%; Joseph Bank borrows $5 from the Fed; the Joseph Bank’s ER are increased by $5.00 _______. PMC is __________. $50.00 Potential TMS is __________. $50.00 Money Quiz 1 [MS = Curr. + DD of Public] [RR+ER=TR; TR-RR=ER; TR=ER=RR; MxER=PMC; PMC(Public)+1st DD=PMC; PMC(Fed)=PMC] Banks Fed Public $100,000 1. RR is 25% & the Rostro Bank has no ER. Suzy deposits(DD) $100,000 there. This bank can increase its loans by a maximum of$______. 300,000 TMS is$_______. 400,000 75,000PMC is$______. 2. RR is 50%; the Tuason Bank borrows $100,000 from the Fed. This one bank can increase its loans by a maximum of$100,000 _______. PMC is$200,000 _______. TMS is $200,000 _______. 3. RR is 25%; Fed buys $100,000 of securities from the public. Potential Money Creation in the system is$300,000 _______. Potential TMS is $400,000 _________. 4. The Volante Bank has DD of $200,000; RR is 10%; RR & ER are equal. TR are $40,000 _______. 5. The Luu Bank, with no ER, borrows $200,000 from the Fed. With a RR of 10%, $2 million 200,000 PMC in the system is __________. this bank can increase its loans by$_________. 6. RR are 20%; the Gohsman Bank borrows $1 from the Fed; this bank can increase 1.00 its loans by a maximum of $_________. PMC in the banking system is$__________. 5.00 7. RR is 50%; the Alvarado Bank borrows $1 million from the Fed; this bank’s ER mil. are increased by $ _______. __________. TMS is $2 __________. 1 mil. PMC in the system is$2 mil. 8. The Tyll Bank has ER of $20,000; DD of $200,000, & a RR of 10%. TR are _____. $40,000 9. RR is 25%; Fed buys $100 million of bonds from the Brown Bank. Potential mil. Potential TMS is _________. $400 mil Money creation in the banking system is$400 ________. 10. There are no ER in the Clark Bank. Lou deposits $2.50. With RR of 20%, PMC in the banking system is $10.00 ____________. Potential TMS is _____________. $12.50 Money Quiz 2 [MS = Curr. + DD of Public] [RR+ER=TR; TR-RR=ER; TR-ER=RR; MxER=PMC;PMC(Public)+1st DD=TMS; PMC(Fed)=TMS] Commercial Banks Fed Public 1. RR is 5% & there are no ER in the Cochran Bank. LuLu deposits[DD] $1.00 .95 there. This one bank can increase its loans by a maximum of _______. 2. RR is 25%; the Collins Bank borrows $1 million from the Fed. million This one bank can increase its loans by a maximum of $1 ____________. 3. RR is 50%; the Fed buys $100,000 of securities from the public. $100,000 Potential Money Creation in the banking system is ____________. 4. The Joseph Bank has DD of $400,000; RR is 10%; RR & ER are equal. TR are $80,000 ____________. 5. The Ray Bank , with no ER, borrows $500,000 from the Fed. With a RR $500,000 of 10%, how much can this single bank increase its loans? ____________ 6. RR are 20%; the Fed buys $25,000 of securities from the public. Potential Money Creation in the banking system is $100,000 ____________. 7. RR is 20%; the Riley Bank borrows $1 million from the Fed. $1 million This single bank’s ER are increased by ____________. 8. RR is 25%; Fed buys $200 million of securities from the public. Potential Total Money Supply[TMS] could be as much as ____________. $800 million. 9. The RR is 25% & the Fed buys $10 million of bonds from the Rostro Bank. million Potential Money Creation in the banking system could be $40 ____________. 10. There are no excess reserves in the Tuason Bank. With RR of 50%, Angela deposits [DD] $50.00 there. Potential Money Creation in the system is$50.00 _______. NS 48-58 (MS = DD + Currency of Public) 48. The 3 tools of monetary policy are open market operations, changes in RR, & (changes in T/changes in G/ changes in discount rate). 49. The main tool of the Fed in regulating the MS is (open-market operations/DR/RR). 50. When the Fed[$$] sells securities to the PUBLIC[T-bills], DD (don’t change/incr/decr) & banking system RR, ER & TR (incr/decr). 51. When the Fed[T-bills] buys securities from commercial banks[$$], DD (don’t change/increase/decrease) & ER and TR (increase/decrease). 52. When the commercial banking system[$$] borrows from the Fed, DD (don’t change/increase/decrease) but ER & TR (incr/decr). 53. When commercial banks[$$] sell government securities to the Fed[T-bills], DD (don’t change/incr/decr) but their ER & TR (do not change/incr/decr). 54. When the PUBLIC[T-bills] buys securities from the Fed[$$], DD (don’t change/incr/decr) and RR, ER, & TR of banks (don’t change/incr/decr). 55. When a commercial bank gets a loan from the Fed, their lending ability (incr/decr). 56. Assume that the RR is 25% & the Thunder Bank borrows $100,000 from the 100,000 Fed., commercial bank ERs are increased $________. PMC in the banking 400,000 400,000 TMS can be as much as $________. system are increased by $_______. 57. The (margin requirement/discount rate) specifies the size of the down payment on stock purchases. 58. If the Fed were to increase the RR [10% to 20%] we would expect (higher/lower) interest rates, a (reduced/expanded) GDP and (appreciation/depreciation) of the dollar. [less “C”, “Ig”, & “Xn”] NS 57-66 59. When the RR is increased [10% to 50%], the ER of member banks are (increased/decreased) and the monetary multiplier is (incr/decr). 60. Assume the RR is 25% and the Fed buys $4 M of bonds from the public. The MS is increased by ($3/$4/) million and the PMC is increased by ($16/$12) M. Potential TMS is ($3/$4/$12/$16) M. 61. When the Fed lends to commercial banks, this is called the (Fed Funds Rate/discount rate) and when commercial banks make loans to one another, this is the (Fed Funds Rate/ Discount Rate). 62. The Keynesian cause-effect chain of an easy money policy would be to (buy/sell) bonds; which would (increase/decrease) the MS, which would (lower/raise) interest rates & (incr/decr) Ig, “C”, Xn, & Y. 63. If the Fed were to buy government securities in the open market, we would anticipate (lower/higher) interest rates, an (expanded/contracted) GDP, and (appreciation/depreciation) of the dollar. 64. If the Fed were reducing demand-pull inflation, the proper policies would be (lower/raise) the discount rate, (lower/raise) the RR and ((buy/sell) government bonds. 65. Monetary policy is thought to be more effective in (controlling inflation/ fighting depressions) and fiscal is more effective (controlling inflation/ fighting depressions). 66.The “net export effect” of an “easy” money policy (strengthens/ weakens) that policy, while the “net export effect” of “expansionary” fiscal policy (strengthens/weakens) that policy. [impact of interest rates] DI MS1 MS2 MS3 9% 9% 6% 6% 3% 3% 0 Dm $100 120 140 Money Market 0 NS 67-70 AD3 AD1 AD I=$60 I=$50] 2 I=$70 A S PL3 PL2 PL 1 $50 $60 $70 QID Investment Demand YR Y* YI RDO 67. If AD is AD3, what must the Fed do to get to AD2(FE GDP [Y*])? (increase/decrease) the MS from ($120/$140) to ($100/$120). 68. If the MS is MS1, & the goal of the Fed is FE GDP[Y*], they should (increase/decrease) the MS from ($100/$120) to ($120/$140). 69. Which of the following would shift the MS curve from MS3 to MS2? (buying/selling) bonds. 70. If the MS is MS2 and the goal of the Fed is FE GDP of Y*, they should (increase/decrease/don’t change) the Ms. NS 71-72 71. An easy money policy will (apprec/deprec) the dollar & (incr/decr) U.S. Xn. A tight money policy will (apprec/deprec) the dollar & (incr/decr) U.S. Xn. 72. If the economy were in a severe recession, proper monetary policy would call for (lowering/raising) the discount rate, (lowering/raising) the RR, & (buying/selling) bonds. Proper fiscal policy would be to (incr/decr) “G” & (incr/decr) “T”, both of which would result in a bugetary (deficit/surplus). Money, Banking, & Fed Test Review 1-8 1. If your bank borrows $50,000 from the Fed, does this automatically No Does this loan increase the amount in RR?_____ No increase the MS? _____ ER? Yes ____ With 10% RR, PMC is $500,000 __________. TMS is $500,000 __________. 2. If the RR is 50% & the Fed buys $100 mil. of securities from the public, $200 mil. $100 mil.PMC is _________. $100 mil. TMS is ________. then: MS is increased by ________. 3. What will cause the Dt(& total demand) for money curve to shift right? (increase/decrease) in nominal (money) Y? 4. When the Fed buys bonds from banks [or gives them a loan], DD are (incr/decr/ unchanged) but their ER & TR both (incr/decr/unchanged). 5. If the Fed buys $10 million of securities from the public, with a RR of $25 mil. $15 mil. TMS is ________. $10 mil. & PMC is _________. 40%, MS is increased by ________ 6. If the Fed decreased the RR from 20% to 10%, we would expect (higher/lower) interest rates, (appreciation/depreciation) of the dollar, and an (increase/decrease) in GDP. 7. DD of $100,000 and RR of 25% in a commercial banking system with TR of $40,000. PMC in the banking system is ($240,000/$60,000). 8. If you are estimating your expenses for the prom at $3,000, money is functioning as (unit of account/medium of exchange/store of value). TR 11-14 MS = Currency + DD of Public RR is 20% Assets DD(Liabilities) TR[RR+ER]=$20 mil. $100 million 11. How much can this bank loan out? $______ 0 12. If Pam Anderson puts $1,000 in this 800 bank(DD),ER will increase by $_______. 4,000 13. Possible Money Creation in the system could be $________. 5,000 14. Potential Total Money Supply could be as much as $_________ TR 11-14 MS = Currency + DD of Public RR is 20% Assets DD(Liabilities) TR[RR+ER] = $20 mil. $100 million 11. How much can Pam’s bank loan out? $______ 0 12. If Pam Anderson’s Bank borrows $1,000 from the Fed ER will increase by $1,000 _______. Pam Anderson’s Bank Fed 5,000 13. Possible Money Creation in the system could be $_______. 5,000 14. Potential Total Money Supply could be as much as $________. Extra Practice MS = Currency + DD of public RR is 50% Assets DD(Liabilities) TR[RR+ER]=$50 mil. $100 million 1. How much can this bank loan out? $______ 0 2. If Cameron Diaz puts $5,000 in this bank(DD), 2,500 ER will increase by $_______. Cameron fell in March, 2005 and had to have 19 stitches in her head but she is OK now. 5,000 3. Possible Money Creation in the system could be $________. 10,000 4. Potential Total Money Supply could be as much as $_________. Extra Practice MS = Currency + DD of Public RR is 50% Assets DD(Liabilities) TR[RR+ER] = $50 mil. $100 million 11. How much can Cameron’s bank loan out? $______ 0 12. If Cameron Diaz’s Bank borrows $5,000 from the Fed ER will increase by $5,000 _______. Cameron Diaz’s Bank Fed 10,000 13. Possible Money Creation in the system could be $________. 10,000 14. Potential Total Money Supply could be as much as $________. Test Review 15-19 DI MS1 MS2 MS3 9% 9% 6% 6% 3% 3% 0 Dm $100 120 140 Money Market 0 AD1 AD3 AD I=$60 I=$50] 2 I=$70 A S PL3 PL2 PL 1 $50 $60 $70 QID Investment Demand YR Y* YI RDO 15. If the goal is F.E., & the interest rate is 9%, a(an) (recess/ inflat) gap exists, the Fed should (incr/decr) the in. rate. 16. If the interest rate is 3%, a(an) (recess/inflat) gap exists, the Fed should (increase/decrease) the interest rate. 17. If the interest rate is 6%, the Fed should (incr/decr/do nothing) to the interest rate. 18. To reduce inflation, the Fed should (lower, lower, buy/raise, raise, sell) 19. To get out of a recession, the Fed should (lower, lower, buy/raise, raise, sell) Additional Practice on Money Creation 1. If the RR is 40% and the Fed buys $100 M of bonds from $100 ER M are the public, then the MS is increased by _______. $150 M TMS would be $250 $60 M PMC is _______. M increased by ______. ______. 2. RR is 50% and the Bishop Bank borrows $100 M from the 0 Fed. As a result, RR are increased by ______. ER is increased $200 M $100 M PMC and TMS is increased by ________. by _______. 3. Your bank has DD of $400,000 and the RR is 25%. If RR $200,000 and ER are equal, then TR are _______. 4. The Duck Bank has ER of $60,000 & DD is $200,000. If the $100,000 RR is 20%, TR are _________. 5. RR is 20% & the Fed buys $50 million of bonds from the $50 M public. The MS is increased by _______. ER are increased $200 M TMS would be _________. $250 M $40 M by _______. PMC is _______. Banks Public Fed Hard Money Quizes Coming Up Q 4 Answ: 1. $180.00 2. $80,000 3. $24,000 $4 mil. 5. $40 mil. uiz Commercial Bank 4. Fed Public 6. $150 mil. 7. $40 mil. 8. $100 bil. 9. $50 mil. 10. $600.00 1. RR are 10% & there are no ER in the Riley Bank. Matt deposits (DD) $200.00 there. This one bank can increase its loans by a maximum of $______. 2. RR are 20%; the Rostro Bank borrows $80,000 from the Fed. This one bank can increase its loans by a maximum of $___. 3. RR are 25%; the Fed buys $8,000 of securities from the Public. Potential Money Creation in the banking system could be $____. 4. The Tuason Bank has DD of $10 million; RR are 20%; RR & ER are equal. TR are $_____. 5. The Tyll Bank, with no ER, borrows $20 M from the Fed. With a RR of 50%, PMC in the banking system could be $___. 6. RR are 40%; the Fed buys $100 M of securities from the Public. Potential Money Creation in the banking system could be $____. 7. RR are 50%; the Volante Bank borrows $40 M from the Fed; this single bank’s ER are increased by $_______. 8. RR are 50%; Fed buys $50 billion of securities from the Public. Potential Total Money Supply (TMS) could be as much as $____. 9. The RR is 40% & the Fed buys $20 M of bonds from a bank. Potential Money Creation in the banking system is $_____. 10. No ER in a bank & RR is 25%. DD of $200 is made. PMC is $__ 2. $1 mil. 3. $250,000 4. $200,000 5. $200,000 Q uiz1.5$5.00 C ommercial Bank Fed Public 6. $60,000 7. $150 mil. 8. $800 mil. 9. $160 mil. 10. $500.00 Answ: 1. RR are 50% & there are no ER in a Bank. Suzy deposits (DD) $10.00 there. This one bank can increase its loans by ?____. 2. RR are 50%; the Luu Bank borrows $1 mil. from the Fed. This bank can increase its loans by a maximum of of $_____. 3. RR are 40%; the Fed buys $100,000 of securities from the Public. Potential Total Money Supply could be as much as $______. 4. The Gohsman Bank has DD of $400,000 and RR is 25%. RR & ER are equal. Total Reserves are $_____. 5. The Alvarado Bank, with no ER, borrows $200,000 from the Fed. With RR of 40%, this one bank can increase its loans by $__. 6. RR are 50%; the Fed buys $60,000 of securities from the Public. Potential Money Creation in the banking system is $_____. 7. RR are 10%; the Cochran Bank borrows $150 million from the Fed. This single bank’s ER are increased by $_____. 8. RR are 25%; Fed buys $200 M of securities from the Public. Potential Total Money Supply could be as much as $____. 9. RR are 25% & the Fed buys $40 M of bonds from the Collins Bank. Potential Money Creation in the banking system could be $___. 10. RR are 20% & no ER in the Joseph Bank. Steph deposits $125.00 there. Potential Money Creation in the system is $____. 1. $60.00 2. $9 mil. 3. $20,000 $500,000 Quiz 6 Commercial Banks 4. $80,000 Fed 5.Public Answ: 6. $500,000 7. $5 mil. 8. $100 mil. 9. $32 mil. 10. $500.00 1. RR are 40% & there are no ER in a Bank. Bo deposits (DD) $100.00 there. This one bank can increase its loans by ?____ 2. RR are 10%; the Torres Bank borrows $9 mil. from the Fed. This bank can increase its loans by a maximum of of $_____ 3. RR is 50%; the Fed buys $10,000 of securities from the Public. Potential Total Money Supply could be as much as $____ 4. The John Bank has DD of $100,000 and RR is 40%. RR & ER are equal. Total Reserves are $_____. 5. The Martin Bank, with no ER, borrows $500,000 from the Fed. With RR of 20%, this one bank can increase its loans by $___ 6. RR are 50%; the Fed buys $500,000 of securities from the Public. Potential Money Creation in the banking system is $_____ 7. RR are 10%; the Matthews Bank borrows $5 million from the Fed. This single bank’s ER are increased by $_____ 8. RR are 10%; Fed buys $10 M of securities from the Public. Potential Total Money Supply could be as much as $____ 9. RR are 25% & the Fed buys $8 M of bonds from the Weber Bank. Potential Money Creation in the banking system could be $____ 10. RR are 20% & no ER in the Clark Bank. Steph deposits $100.00 there. Potential Total Money Supply is $____ Monetary Questions From 2000 AP Exam Money and the Fed 1. (61%) In the Keynesian model, an expansionary monetary policy will lead to a. lower real interest rates and more investment b. lower real interest rates and lower prices c. higher real interest rates and lower prices d. higher real interest rates and higher real income e. higher nominal interest rates and more investment 2. (58%) Which of the following will most likely occur in an economy if more money is demanded than is supplied? a. the amount of investment spending will increase. b. the demand curve for money will shift to the left c. the demand curve for money will shift to the right. d. interest rates will decrease e. interest rates will increase. 3. (64%) When consumers hold money rather than bonds because they expect the interest rate to increase in the future, they are holding money for what purposes? a. transactions b. unforeseen expenditures c. speculation (asset) d. illiquidity When interest rates are too low, people will hold more asset (speculation) money. They don’t want to tie their money into interest rate bearing assets (like CDs & bonds) getting low returns. They will hold the speculative money until interest rates go back up. Money Creation 4. (80%) If on receiving a checking deposit of $300 a bank’s ER increased by $255, the RR must be: a. 5% b. 15% c. 25% d. 35% e. 45% 5. (62%) The money-creating ability of the banking system will be less than the maximum amount indicated by the money multiplier when a. interest rates are high b. the velocity of money is rising c. people hold a portion of their money in the form of currency d. the unemployment rate is low 6. (71%) RR is 20%. If a bank initially has no ER and $10,000 cash is deposited in the bank, the maximum amount by which this bank may increase its loans is a. $2,000 b. $8,000 c. $10,000 d. $20,000 e. $50,000 7. (86%) RR is 15% and that bank receives a new DD of $200. Which of the following will most likely occur in the bank’s balance sheet? Liabilities(DD) Required Reserves a. increase by $200 b. increase by $200 c. increase by $200 d. decrease by $200 e. decrease by $200 increase by $170 increase by $30 no change decrease by $30 decrease by $170 The Fed and Monetary Policy 8. (89%) The Federal Reserve can increase the money supply by a. selling gold reserves to the banks b. selling foreign currency holdings c. buying government bonds on the open market d. borrowing reserves from foreign governments 9. (73%) An increase in the money supply is most likely to have which of the following short-run effects on real interest rates and real output? Real Interest Rates Real Output a. decrease b. decrease c. increase d. increase e. no change decrease increase decrease no change increase 10. (81%) Under which of the following conditions would a restrictive (contractionary) monetary policy be most appropriate? a. high inflation d. low interest rates b. high unemployment e. a budget deficit c. full employment with stable prices 11. (82%) The Fed can change the U.S. money supply by changing the a. number of banks in operation b. velocity of money c. price level d. prime rate e. discount rate 12. (*30%) If the money stock decreases but nominal GDP remains constant, which of the following has occurred? a. income velocity of money has increased. b. income velocity of money has decreased. c. price level has increased. d. price level has decreased. e. real output has decreased. 13. (54%) Policy-makers concerned about fostering long-run growth in an economy that is currently in a recession would most likely recommend which of the following combinations of monetary and fiscal policy actions? Monetary Policy Fiscal Policy a. sell bonds b. sell bonds c. no change d. buy bonds e. buy bonds reduce taxes raise taxes raise taxes reduce spending no change The reason you don’t incr G here is that it would push up interest rates and offset the lower interest rates of the Fed’s buying bonds. 14. (76%) Open market operations refer to which of the following activities? a. the buying and selling of stocks in the New York stock Market b. the loans made by the Fed to member commercial banks c. the buying and selling of government securities by the Federal Reserve d. the government’s purchases and sales of municipal bonds e. the government’s contribution to net exports 15. (58%) An open market sale of bonds by the Fed will most likely change the money supply, the interest rate, and the value of the U.S. dollar in which of the following ways? Money Supply Interest Rate Value of the Dollar a. increase decrease decrease b. increase decrease increase c. decrease decrease decrease d. decrease increase increase e. decrease increase decrease 1995 AP Exam 16. (82%) Commercial banks can create money by a. transferring depositors’ accounts at the Fed for conversion to cash b. buying Treasury bills from the Federal Reserve c. sending vault cash to the Fed d. maintaining a 100% reserve requirement e. lending excess reserves to customers 17. (65%) If the RR is 20%, the existence of $100 worth of ER in the banking system can lead to a maximum expansion of the money supply equal to a. $20 b. $100 c. $300 d. $500 e. $750 5x$100=$500 18. (71%) If the Fed lowers the RR, which of the following would most likely occur? a. Imports will rise, decreasing the trade deficit. b. The rate of saving will increase. c. Unemployment and inflation will both increase. d. Businesses will purchase more factories and equipment. More MS means lower I.R. & more Ig e. The budget deficit will increase. 19. (61%) If the public’s desire to hold money as currency increases, what will the impact be on the banking system? a. Banks would be more able to reduce unemployment. b. Banks would be more able to decrease AS. c. Banks would be less able to decrease AS. d. Banks would be more able to expand credit. e. Banks would be less able to expand credit Holding currency means less ER & higher I.R. 20. (86%) Which of the combinations is most likely to cure a severe recession? Open-Market Operations Taxes Gov. Spending a. Buy securities Increase Decrease b. Buy securities Decrease Increase c. Buy securities Decrease Decrease d. Sell securities Decrease Decrease e. Sell securities Increase Increase 21. (61%) The demand for money increases when national income increases because a. spending on goods and services increases d. the MS increases b. interest rates increase e. the budget deficit increases c. the public becomes more optimistic about the future 22. (76%) Suppose the RR is 20% and a single bank with no ER receives a $100 DD from a new customer. The bank now has excess reserves equal to a. $20 b. $80 c. $100 d. $400 e. $500 23. (45%) Which of the following is most likely to increase if the public decides to increase its holding of currency? a. the interest rate Holding MS; banks d. Employment b. The price level have less; higher I.R.e. The reserve requirement c. Disposable personal income 24. (47%) During a mild recession, if policymakers want to reduce unemployment by increasing investment, which of the following policies would be most appropriate? a. Equal increases in government expenditure and taxes b. An increase in government expenditure only c. An increase in transfer payments d. An increase in the reserve requirement e. Purchase of government securities by the Fed 25. (73%) Which of the following monetary and fiscal policy combinations would most likely result in a decrease in AD? Discount Rate Open-Market Operations Gov. Spending a. Lower Buy bonds Increase b. Lower Buy bonds Decrease c. Raise Sell bonds Increase d. Raise Buy bonds Increase e. Raise Sell bonds Decrease 26. (35%) Under which of the following circumstances would increasing the MS be most effective in increasing real GDP? Interest Rates Employment Business Optimism a. High Full High b. High Less than full High c. Low Full High d. Low Full Low e. Low Less than full Low 27. (57%) According to both monetarists and Keynesians, which of the following happens when the Fed reduces the discount rate? a. The demand for money decreases and market interest rates decrease. b. The demand for money increases and market interest rates increase. c. The supply of money increases and market interest rates decrease. d. The supply of money increases and market interest rates increase. e. Both the demand for money and the MS increase and market interest rates increase. 28. (79%) All of the following are components of the MS in the U.S. EXCEPT a. paper money b. gold bullion c. checkable deposits d. coins e. demand deposits 29. (47%) If the Fed undertakes a policy to reduce interest rates, international capital flows (financial capital like CDs, bonds) will be affected in which of the following ways? a. Long-run capital outflows from the U.S. will decrease. b. Long-run capital inflows to the U.S. will increase. c. Short-run capital outflows from the U.S. will decrease. Lower U.S. interest rates will d. Short-run capital inflows to the U.S. will decrease. result in fewer capital inflows e. Short-run capital inflows to the U.S. will not change. 30. (73%) If the Fed wishes to use monetary policy to reinforce Congress’ fiscal policy changes, it should a. increase the MS when government spending is increased This would keep the interest b. increase the MS when government spending is decreased rate from going up. c. decrease the Ms when government spending is increased d. increase interest rates when government spending is increased e. decrease interest rates when government spending is decreased