2U Project Paper

advertisement

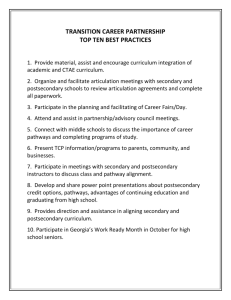

Company Analysis: 2U is a provider of software as a service (SaaS) to postsecondary institutions across the United States. Its innovative online learning platform provides postsecondary institutions with the ability to attract, enroll, educate and support students through its unique cloud based SaaS platform. 2U generates revenue by charging a percentage of tuition of those enrolled in the online educational services they provide through postsecondary institutions. 2U has signed several recognized institutions into long term contracts to provide their cloud based service. Postsecondary institutions may not have the capabilities or interest in developing these capital-intensive infrastructures by themselves and therefore can contract this work to the 2U company. These contracts include maintenance of the system, and regular maintenance and improvements. When assessing the value of 2U Inc., a few things to consider are the experience and expertise of management as well as the strength of revenues and cash flows. Despite 2U having scarce financial history, making it harder to predict future performance, all of these aspects can allow for a better understanding of the company value. Having a good management team is essential to having a successful business as it ensures good decisions. Good management is the basis for performance, growth and profitability. Although the company is relatively new, a lot of the managers at 2U have extensive experience working in similar positions and industries across comparable companies. For example, Christopher Paucek, co-founder of the company, has a lot of experience in education, while Catherine Graham previously worked for various online and financial technology companies before becoming chief financial officer at 2U. With these managers, and many others 2U appears to have a successful team assembled. Despite having negative earnings in the first few year of operations, it can be argued that the company is a micro-cap with a valuation of (xxx) million. Revenues at such an early stage are growing rapidly, from 29.7 million in fiscal year 2011 to over 83 million in 2013. This resulted in revenue growth rates over the last two years of roughly 88% and nearly 50% in the fiscal years of 2012 and 2013 respectively. Because the company has such high growth, they currently have a cash deficit. This suggests that 2U is growing above their sustainable growth rate. Some companies that have high initial growth rates, have the paradox of growing broke- when a company can be very profitable but still not have sufficient cash to pay for operations of the business. Issuing equity, through their IPO, and outsourcing are some alternatives 2U is using to fund their operations despite their cash deficit. As 2U continues to expand, they expect economies of scale to outweigh the added costs, decreasing their costs as a percentage of revenues. With these resources, they can continue to grow, to eventually provide their platform to more and more institutions across the US. -Debt? Industry Analysis: The firm of 2U is education and technology-based, the industry has its positive and negative aspects. Education is a stable industry in the sense that it is an essential commodity to our society and it is expected to be stable, if not expanding, in the near and long-term future. Currently online education is becoming more popular across universities and other postsecondary education institutions. This allows for companies, such as 2U, to sneak in and capture some of the expected increase in market share. Technology is also a growing industry that has booming popularity across various market segments. The current information age has increased the use of information technology making this a more attractive industry. With these growing industries, comes growing competition and barriers to enter. One of the cycles of the industry involves the patterns of revenues. Revenues and cash flows tend to fluctuate substantially because of the education industry, where courses start at various times across the education platforms that use their service. This means that the timing of revenue from tuition has a high degree of fluctuations for different semesters, and consequently affects the cash flow cycle of the company. The industry requires a lot of innovation in order to remain competitive. This is considered another barrier to entering the industry, as technology is constantly updating and can also be expensive. A fast changing industry requires timely movement as well as innovative content, marketing and technology to survive. Technology follows Moore’s law, meaning that every two years the power of processing doubles, thus requiring constant revision of technological processes as they outdate themselves. Macro Analysis With the prevalence of Wi-Fi allow access of cloud based learning globally, students are taking the opportunity to learn on the go from wherever they are situated. Universities and colleges have realized the potential revenue source as a higher margin than traditional campus based models. Cloud based computing removes the up front costs of property, upkeep, and maintenance. The education industry is currently evolving into accessible online learning platforms, and firms such as 2U, are part of this change. Competitively, all these developments come with significant ability for rapid change, leaving laggards behind. Post-secondary institutions have steady growth as the U.S population continues to grow. Cloud based learning allows for them to capital on this growing market, allow for them to obtain more students, even if the student is located in an area without a physical campus. According the National Center for Education Statistics, between 2000 and 2010, the number of 18-24 year olds attending post secondary schooling increased from 27.3 to 30.7 million, an increase of 12%. With more and more young people turning to post secondary education to prepare them for careers, 2U will be able to take advantage of this with their partnerships with universities and unique cloud based systems and content. School Enrollment Enrollment (in millions) 25,000 20,000 15,000 10,000 5,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 School Enrollment The U.S market has grow significantly over the past 30 years, and has recently rebounded from the past recession in 2007. 2U stands to gain from increased GDP growth in the US at 2.6% for 2013 and projected to increase to 2.8 for 2014. Consumer confidence at multi year highs, more people are turning to post-secondary education than ever before. As education becomes more and more of a requirement in today’s job market, people are required to have degrees/diplomas in the respected fields. GDP (in trillions) GDP 18 16 14 12 10 8 6 4 2 0 GDP 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Year With a growing GDP attributed to the increase in consumption from the population, and an increasing population, the macro environment is improving for growing firms offering essential commodities. Population (in millions) Population 320 315 310 305 300 295 290 285 280 Population Year POINTS FROM VIJAYS EMAIL: Attributes that makes a company good for an IPO: (included in company analysis) How does 2U compare? (in company analysis) Market climate: (how favorable?) IPO timing: (how appropriate is it) 3 Methods (which one most appropriate, why, show 2Us valuation) EV SHARE PRICE # of shares Recommendations: Discounted Cash Flow: Assumptions: - When starting a DCF calculation, we must first look at valuing the equity of a company. We took 6 comparable companies and unleveraged their betas accordingly, using a tax rate of 35%. (ref) After finding the average and median betas, we calculated the WACC using CAPM. We made an assumption using the risk free rate from the 10 year (3.67%) and 30 year (2.77%) treasury bill. We used these values to calculate our wacc. - - We found our most comparable companies to be CPLA and BPI because similar to 2U, they both started earning a net loss and eventually earned a profit through company growth. We also make an assumption about the going concern because the company is relatively new and we see them operating in to the foreseeable future. The main assumptions are made through our free cash flows. o 1) We modeled the growth rate of 2U by mirroring CPLA’s growth rate when they had a negative EBIT margin going in to the positive one, because they were the most comparable company. We used the years 2001-2007 for CPLA since these were the years that they went from having negative growth to positive growth, similar to 2U. o 2) For the DCF, we’re assuming 2U is basically a big capital expenditure and we’re simply valuing the business internally without comparing it to similar firms in the industry.