Case Study: Sara Lee Corporation

advertisement

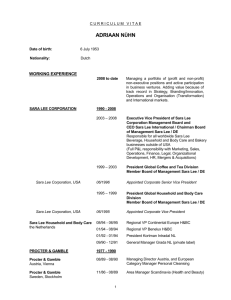

Emilio Veneziano Case 3: Sara Lee Corporation MGMT 471W Dr. Fairbank Sara Lee Corporation To: Brenda Barnes From: Emilio Veneziano Date: 11/12/13 Subject: Assessment of Sara Lee Corporation’s Corporate Strategy Brenda, your decision to spin-of Hanesbrands was a questionable one. This sector of the Sara Lee Corporation did not necessarily correspond with its other North American business, which were concentrated in the food industry. But, the sector did correspond with the businesses included in Sara Lee International, which would have allowed the additional distribution of apparel to other foreign markets. The primary products offered were not innovative or ground breaking products, but provided a strong and steady source of revenues for the company. Though revenues, gross margins, and operating margins were at a steady/flat rate, Hanesbrands saw an increase of over $103 million in net income after 2005. Returns on assets have fallen 5% since 2004 and return on equity was cut in half during the same period. Debt-to-equity ratios was around 0.5 in 2006 right before the spin-off, showing that Hanesbrands had been capable of keeping its debts low compared to the amount of equity it had on hand. After the spin-off of Hanesbrands, the business acquired significant debt in order to remain a standalone business. Though the company was able to pay off $100 million in longterm debt, the significant amounts of debt left over may hinder its ability to turn solid profits in the future. Sara Lee should have retained this business, allowing it to expand in foreign markets it already had a presence in while bringing in revenues which could be used to accelerate other businesses. This company has positioned itself with strong food products which make it successful in both the retail and foodservice industry. Sara Lee can utilize its strong growing meats in its Emilio Veneziano Case 3: Sara Lee Corporation MGMT 471W Dr. Fairbank food service business, saving costs within the company while building strong relationships with other businesses. Sara Lee’s thick-sliced bread is very popular in supermarkets, which has captured a strong market share while producing strong sales for the North American Retail Bread segment. Its desserts are not fairing as well, with sales approximated to decrease over the next several years. The desserts, however, hold a fair market share in the foodservice business, allowing Sara Lee to cater healthier options to fast-food customers. Sara Lee International has captured strong market share within Western Europe, utilizing the sales from its coffee pods. The Senseo coffee pods are the second best-selling coffee product in Europe, generating $25 billion in sales for SLI. SLI has taken advantage of the growing hot and cold coffee drink industry, innovating products that will allow it to grow market share within this segment. Bimbo, SLI’s number one brand of bread in Spain, should be able to take advantage of some of the growing packaged bread sales, though private label brands are preferred. Bimbo may not be able to continue its sales within the International Bakery segment due to the switch to private brands in the future. The company’s household brands are overshadowed by Kiwi, which generates almost $300 million in sales. Sanex is a cash cow for this segment, with the significant market share held in a slow-growing industry. The company should be able to continue generating its constant sales of $280 million. Though SLI has other insecticide and household brands, it diverts quickly from the company’s core line of businesses. Its other products generate large sales for the company, but stray away from the company’s main focus. The insecticide brands do have the largest market share, and are positioned to overtake the rapidly-growing Asian market. Its air fresheners are in a declining market, which may prevent its 3volution from generating large sales to improve value for the company. Sara Lee Has several positions that it can take that can strategically grow its profitability and help meet the company’s goals. The company currently has limited margins on its bakery line, especially from its dessert items. Since Sara Lee has significant market share with its packaged bread in North American, the company should eliminate its dessert sales and the sale Emilio Veneziano Case 3: Sara Lee Corporation MGMT 471W Dr. Fairbank of single-serving coffeemakers. Growth in this segment is very slow, and is not growing within the foodservice industry either. By selling off its dessert brands, Sara Lee can invest the profits of the sale into other innovations in its other business units. Sara Lee International should expand its household and body care brands into the United States. Its air freshener brands hold significant market share in Europe, which could be utilized in North America. The market for cleaning products and air fresheners is strong in the United States. Sara Lee’s innovations would be very successful in the growing market across the Atlantic. The company can also sell more of it insecticides in developing nations, where few treatments are available to prevent bacteria. Nations in Africa are still growing, and could utilize the insecticides to improve farming practices within the continent. Beverage products sold by Sara Lee International produce almost 50% of all profits. These beverages could be sold to local retail business, similar to what is done with Sara Lee Foodservice. The company has already begun selling beverages in retail operations, and with the current contacts and knowledge of the foodservice industry, profits could easily be managed. The strategy allows Sara Lee to develop larger profits by selling its teas and coffees within local businesses throughout Europe. If Sara Lee follows these strategies, the company will be able to obtain profits similar to what it had before its divestures.