CRITICAL LEGAL AND REGULATORY ISSUES FOR

INVESTMENT MANAGERS AND FUNDS

SHARIAH COMPLIANT FUNDS AND SOVEREIGN

WEALTH FUNDS

Jonathan Lawrence, Moderator

Clifford J. Alexander

Cary J. Meer

26 January 2009

DC #1288846

Copyright © 2009 by K&L Gates LLP. All rights reserved.

Shariah Compliant Funds and Sovereign

Wealth Funds

Shariah Compliant Funds

Al Safi Platform

Sovereign Wealth Funds

2

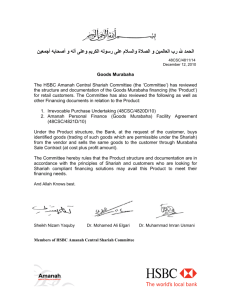

Shariah Compliant Funds

Divine law as revealed in the Quran and the words

and acts of the Prophet Mohammed governing the

practical aspects of a Muslim’s life

Shariah Supervisory Board or Committee

(3 – 5 scholars)

Investors elect to have fewer rights

3

Shariah Compliant Funds (cont.)

Obligations

Return based on actual fund earnings

Share loss and profit

Avoid uncertainty

Avoid speculation akin to gambling

4

Shariah Compliant Funds

(cont.)

Prohibitions

Guaranteed fixed rate of return

Earning money solely by passage of time

Dealing with traditional banks on an interest basis or

for fixed term returns

Alcohol, illegal drugs, gambling, pork, adult

entertainment, traditional insurance and reinsurance

Weapons manufacturing and sales

Lack of knowledge or excessive risk

5

Shariah Compliant Funds

(cont.)

Ijara/Lease Fund

Lease Fund

Income/Dividend

SPV

Investment

Income

Investment

Investor

Purchase Price

Asset Pool

Ownership

Leased

Assets

Lease

Rent

Lessee

6

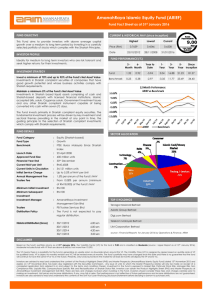

Shariah Compliant Funds (cont.)

Islamic Equity Funds

Stock selection

Industry screen

Financial screen

Non-compliant stocks: temporary, short-term or

permanent?

Disclosure concerns

7

Al Safi Platform

May 2008 Cayman Islands mutual fund

Shariah compliant alternative investments

Multi-class unit trust with multiple sub-trusts

Specific investment objective and strict segregation

between sub-trusts

8

Al Safi Platform (cont.)

Shariah Adviser (Shariah Capital): advises on each

sub-trust’s compliance with Shariah investment

guidelines and provides reports

Shariah Supervisory Board: supervises the Trust

and each sub-trust’s business, activities and

investments

9

Al Safi Platform (cont.)

Shariah compliant “short sale” of securities

“Arboon”: down payment; a non-refundable deposit

equal to a percentage of securities’ fair market

value

Closing date for payment of unpaid portion with

right of acceleration

10

Al Safi Platform (cont.)

Barclays Capital: prime broker and structured

product distributor

Dubai Multi Commodities Centre Authority (DMCC)

seeded $50m each to:

Tocqueville Asset Management: Gold

Lucas Capital Management: Energy/Oil and Gas

Zweig-DiMenna Intl Managers: Natural Resources

Black Rock: Global Resources and Mining

11

Sovereign Wealth Funds

Special purpose investment funds owned by the

central government and created for macroeconomic

purposes

SWFs hold, manage, or administer assets to

achieve financial objectives, and employ a set of

investment strategies, which include investing in

foreign financial assets

12

Sovereign Wealth Funds (cont.)

SWFs are commonly established out of:

balance of payments surpluses;

official foreign currency operations;

proceeds of privatisations;

fiscal surpluses; and/or

receipts resulting from commodity exports

13

Sovereign Wealth Funds (cont.)

Key Elements

Ownership

Investments

Purposes and Objectives

14

Sovereign Wealth Funds (cont.)

Estimated Worth

SWFs: $3.3 trillion

Hedge funds: $1.9 trillion

Private equity firms: $1.16 trillion

15

Sovereign Wealth Funds (cont.)

UK Regulation of SWFs

One of the least restrictive regulatory regimes

November 2007: Walker Guidelines for Disclosure

and Transparency in Private Equity?

Qatar Investment Authority vehicle Delta Two Limited

in bid for Sainsbury’s

16

Sovereign Wealth Funds (cont.)

US Regulation of SWFs

US Office of Foreign Assets Control

2007 Foreign Investment and National Security Act

(FINSA)

Review by Committee on Foreign Investment in the

United States (CFIUS)

March 2008: US Treasury Principles for SWF

Investment with Abu Dhabi and Singapore

April 2008: Withdrawal of proposed California ban on

pension funds investing in PE firms backed by SWFs

17

Sovereign Wealth Funds (cont.)

International Regulation of SWFs

June 2008: OECD Declaration on SWFs and

Recipient Country Policies

July 2008: European Parliament resolution

October 2008: IMF International Working Group of

SWFs Generally Accepted Principles and Practices

(GAPP) – the “Santiago Principles”

18

Sovereign Wealth Funds (cont.)

Issues for Contracting with SWFs

Authority to invest

Willingness to make representations and warranties

Willingness to waive sovereign immunity

Consent to jurisdiction in foreign courts

Regime change

19

CRITICAL LEGAL AND REGULATORY ISSUES FOR

INVESTMENT MANAGERS AND FUNDS

SHARIAH COMPLIANT FUNDS AND SOVEREIGN

WEALTH FUNDS

Jonathan Lawrence, Moderator

Clifford J. Alexander

Cary J. Meer

26 January 2009

DC #1288846

Copyright © 2009 by K&L Gates LLP. All rights reserved.