Finance 321 Advanced Corporate Finance

advertisement

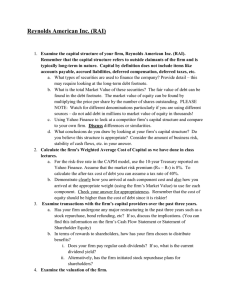

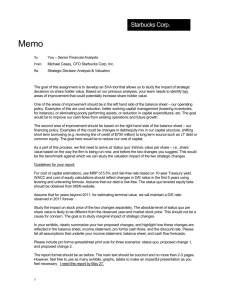

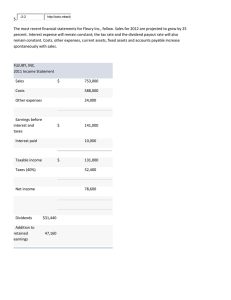

Course Review • • • • Complete ERM lecture What you should have learned from this class Final exam details Sample exam questions Current State of Financial Risk Management • Modeling is used extensively in measuring market risk • Interest rate sensitivity measures depend on cash flow models and term structure models • Value-at-Risk measures also depend on models • Don’t be fooled by indicated precision of measures • Understand the models underlying the calculations Operational and Strategic Risk Analytics • Analytic methods are primitive • Top-Down Approaches – Analogs • Remove identifiable risks first • Remaining risk is classified as operational risk – Historical loss data • Bottom-Up Approaches – Self assessment – Cash flow model Solvency Related Risk Measures • • • • Probability of Ruin Shortfall Risk Value-at-Risk (VaR) Expected Policyholder Deficit (EPD) or Economic Cost of Ruin (ECOR) • Tail Value at Risk (Tail VaR) or Tail Conditional Expectation (TCE) • Tail Events Performance Related Risk Measures • • • • Variance Standard Deviation Semi-variance and Downside Standard Deviation Below-target-risk (BTW) Conclusion • There is a standard approach for dealing with each type of risk • Each area has its own terminology and techniques • The ERM challenge is to combine these different approaches into a common method that can deal with risk in an integrated manner • The first step is to understand the different approaches Acknowledgements • Frank Strenk, Lockton Companies • James Lam • Mark Vonnahme, Department of Finance, U of I In This Course You Should Have Learned How to: • Analyze the financial condition of a corporation • Calculate the cost of capital for a project • Recognize the various ways the risk of the project can be altered • Determine whether a corporation should invest in a project • Compare debt, equity and alternative financing approaches • Explain how a particular project should be structured and funded Combined Final Exam Both 8:30 am and 10 am sections Friday, May 4, 2007 8-11 am 120 Architecture Building Conflict exam 8-11 am Monday, May 7 115 DKH You have to let me know by today if you want to take the conflict exam and explain why (See signup sheet) Final Exam Details • Exam is open book, open note. • You may use calculators, including financial calculators, but not laptops, cell phones or any other communication devices. • Test covers material from the entire semester, including guest speakers and student presentations, assignments 1-4 and all three cases. – Keys for assignment 4 will be posted today (5/1) • Exam tests your ability to make informed corporate finance decisions, perform financial calculations and to explain corporate finance concepts. Test Taking Advice • First answer all the questions you can without relying extensively on your notes. • Then work on the remaining questions if time permits. Exam Topics Include - 1 • • • • Corporations Roles and Titles of Financial Managers Principal-Agent Problems Financial Statements – Balance Sheet (Figure 29.1) – Income Statement (Figure 29.2) – Sources and Uses of Funds (Figure 29.3) • • • • • • Measuring a Firm’s Financial Condition Key Financial Ratios Financial Planning Introduction to Present Value Objectives of the Firm Corporate Governance Exam Topics Include - 2 • Calculations – – – – • • • • • • • • Valuing Assets Perpetuities and Annuities Compound Interest Nominal and Real Interest Rates Bond Valuation Stock Valuation How Common Stocks are Traded Estimating the Cost of Equity Capital Linking Stock Price and Earnings per Share Net Present Value Internal Rate of Return Alternative Investment Decision Rules Exam Topics Include - 3 • • • • • • • • • • • • Capital Asset Pricing Model What Discount Rate to Use Risk and Return The Market Risk Premium Capital Asset Pricing Model Considerations Determining Beta Arbitrage Pricing Model Certainty Equivalents Why Manage Diversifiable Risk? Types of Risk Traditional Approach to Risk Management Enterprise Risk Management Exam Topics Include - 4 • • • • • • • • • Sensitivity Analysis Scenario Analysis Monte Carlo Simulation Real Options Decision Trees Market Values Economic Rents and Competitive Advantage Warren Buffet on Growth and Profitability Sources of Funds for Corporate Financing – Internal financing – Stock – Debt Exam Topics Include - 5 • How Corporations Issue Securities – Role of venture capital – IPOs – Private placements • Payout Policy – Dividends – Stock repurchases • Debt Policy – Modigliani and Miller propositions – WACC (before and after tax) • Why M&M Does Not Hold – Taxes – Financial distress Exam Topics Include - 6 • Theories of Capital Structure – Trade-off theory – Pecking order of financing choices • Financing and Valuation – After-tax WACC – Adjusted present value • Capital Investment Process – Agency problems – Monitoring – Incentives • Stock Options – Valuation – Appropriate and inappropriate uses Exam Topics Include - 7 • Integrating Capital and Risk – Insurative model – Total Average Cost of Capital • Enterprise Risk Management – Concept – Applications – VaR Sample Question The WACC for a firm is 10%. The after-tax WACC is 8.5%. The cost of debt is 8%. The cost of equity is 13%. The opportunity cost of capital for a project is 20%. The firm’s marginal tax rate is 35%. What is the appropriate interest rate to use to determine the NPV of this project if it will be financed entirely by debt? A) 5.0% D) 20% B) 8.5% E) None of the above C) 13.0% Increasing the corporate tax rate while leaving personal tax rates unchanged would have what effect on the value of leverage per $ of debt for a leveraged firm compared to an unlevered firm? A) Increase B) Decrease C) No effect D) It depends on the relationship among the tax rates E) None of the above What is the present value of the corporate tax shield if a firm plans to borrow $1 million for 1 year at an interest rate of 10% to invest in a project with an opportunity cost of capital of 15%? The firm’s marginal tax rate is 35% and average tax rate is 25%. A) 21,739 D) 31,818 B) 22,727 E) None of the above C) 30,435 A firm is financed with 50% debt and 50% equity. The interest rate is 10%, the firm's cost of equity capital is 20%, and the firm's marginal tax rate is 35%. What is the firm's weighted average cost of capital? A) 10.00% B) 13.25% C) 16.04% D) 20.00% E) None of the above A firm is financed with 30%, 60% common equity and 10% preferred equity. The interest rate is 5%, the firm's cost of common equity is 15%, and that of preferred equity is 10%. The marginal tax rate is 30%. What is the firm's weighted average cost of capital? A) 10.05% B) 11.05% C) 12.5% D) 15% E) None of the above Given the following data for Year 1: Profit after taxes = $5 million; Depreciation = $2 million; Investment in fixed assets = $4 million; Investment net working capital = $1 million. Calculate the free cash flow for Year-1: A) $7 million B) $3 million C) $11 million D) $2 million A firm has zero debt in its capital structure. Its overall cost of capital is 8%. The firm is considering a new capital structure with 50% debt. The interest rate on the debt would be 5%. Assuming that the corporate tax rate is 40%, its cost of equity capital with the new capital structure would be? A) 9.8% B) 9.2% C) 11% D) None of the above A firm has an average investment of $10,000 during the year. During the same time the firm has an after tax income of $2,000. If the cost of capital is 15%, what is the net return on the investment? A) 5% B) 15% C) 20% D) 35% E) None of the above A firm has an average investment of $10,000 during the year. During the same time the firm has an after tax income of $2,000. If the cost of capital is 15%, calculate the economic value added (EVA) for the firm. A) $500 B) $1,500 C) $2,000 D) $10,000 E) None of the above What is TACC if: D = 500; Cost of debt = 10% E = 400; Cost of equity = 20% I = 100; Cost of insurance = 5% A) 8.5% B) 13.0% C) 13.5% D) 14.5% E) None of the above Which was the first force that began to drive ERM? A) Corporate disasters B) Regulatory actions C) Industry initiatives D) Best practices E) None of the above For assignment 4, question 10, what method did you use to determine VaR? A) Historical simulation B) Variance-covariance method C) Monte Carlo simulation D) Equity allocation method E) None of the above What factors need to be considered when a firm is trying to determine its appetite for risk? I the amount of risk it can accept II the expected return for taking a risk III the best alternative for treating a risk A) I only D) I, II and III B) II only E) None of the above C) III only Pre-Exam Office Hours 311 Wohlers Hall Wednesday, May 2 1-2:30 pm