13

Cost Management

and Decision Making

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

13-2

Learning Objective 1

13-3

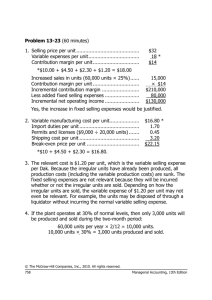

Decision-Making Process

Stage 1

Setting goals

and objectives

5

4

3

2

Stage 2

Gathering

information

Stage 3

Evaluating

alternatives

1

Stage 4

Planning and

implementation

Stage 5

Obtaining

feedback

13-4

Stage 1: Setting Goals and Objectives

Intangible objectives:

may provide guidance, but

tend to be abstract and

are difficult to measure

Organizations must set objectives

to provide clear guidance.

Tangible objectives

provide benchmarks

against which to

measure performance.

13-5

Target Profit and Target Cost

Determine target selling price.

Contract sales price

Determine target cost.

Estimate based

on market analysis

Determine target profit

Deduct target return on sales

Result is target cost

Compare target cost to currently

feasible total cost.

The difference is the cost-reduction

target

Redesign products and processes to

achieve the cost-reduction target.

Competitors’ pricing

13-6

Stage 2: Gathering Information

Information quality

and

decision usefulness

Relevance

Timeliness

Accuracy

Cost

vs.

quality

Objectivity

vs.

subjectivity

13-7

Learning Objective 2

13-8

Identification of Relevant Costs and

Benefits

Relevant costs are

costs to be incurred at

some future time and

that differ for each

option available to the

decision maker.

Costs incurred in the

past are not relevant.

They are called

called “sunk costs”.

13-9

Identification of Relevant Costs and

Benefits

Decision: Trading an old car for a new car.

Item

Cost of new car

Cost of old car

Insurance

AAA membership

Not

Relevant Relevant

X

X

X

X

Reason

Future cost that differs between alternatives

Sunk cost

Increased amount to cover new car is relevant

Does not differ between alternatives

13-10

Stage 3: Evaluating Alternatives

1. List decision

alternatives in the

order the

decisions must

be made.

2. Trace the

path of each

decision to its

ultimate

outcome.

3. Measure the benefits and costs of

each set of outcomes.

Consider qualitative as

well as quantitative factors.

13-11

Stage 3: Evaluating Alternatives

Anticipating future outcomes of each action

Consider the past

Although past costs are

sunk and therefore

irrelevant, they can be

used to help estimate

future costs that are relevant.

Completely new products

Use prototype products

to estimate costs.

Rely on consultants

who have knowledge

of similar products.

13-12

Learning Objective 3

13-13

Decision Tree

A

B

A useful decision aid in diagramming

decisions and alternative outcomes

Allows an evaluation of the costs and

benefits of each alternative (limb)

Steps in creating a decision tree:

Display decision alternatives in order

Identify the set of outcomes resulting

from each decision path

A1 A2 B1 B2 B3

Measure costs and benefits of each set

of outcomes

13-14

Decision Tree - Example

Status quo

Maintain

Status quo?

Change

Automate

Status quo is

unacceptable

Higher equipment cost

Lower employment level

Lower unit-level cost

Increase in profit

Automate or improve

Manual process?

Lower equipment cost

Manual

Same employment level

Lower unit-level cost

Increase in profit

13-15

Learning Objective 4

13-16

Outsourcing or Make-or-Buy Decision

When the company needs goods or services,

should they be “made” internally or “bought”

externally?

When goods or

services are

acquired externally,

it is called

outsourcing.

13-17

Outsourcing or Make-or-Buy Decision

13-18

Outsourcing or Make-or-Buy Decision

Identify the

variable costs

that would

disappear if we

outsource.

Identify the new

variable costs

that we would

incur if we

outsource.

Identify the fixed costs that we

could avoid if we outsource.

13-19

Outsourcing or Make-or-Buy Decision

Let’s look at a make-or-buy decision faced

by the management of Thor Company.

13-20

Outsourcing or Make-or-Buy Decision

Thor Co. manufactures 20,000 of part 457 that is

currently used in one of its products. The costs to

make this part are:

Direct materials per unit

Direct labor per unit

Variable overhead per unit

Fixed overhead

Allocated common costs

$

9.00

5.00

1.00

180,000

100,000

13-21

Outsourcing or Make-or-Buy Decision

Direct materials

$ 9.00

Direct labor

5.00

Thor Co. manufactures

20,000 of part 457 that 1.00

is

Variable overhead

($180,000 ÷ 20,000)

currently used inFixed

one overhead

of its products.

The costs9.00

to

Common costs ($100,000 ÷ 20,000)

5.00

make

this

part

are:

Unit cost

$ 29.00

Direct materials/unit

Direct labor/unit

Variable overhead/unit

Fixed overhead

Allocated common costs

$

9.00

5.00

1.00

180,000

100,000

Fixed manufacturing overhead is the cost of leasing and

operating the equipment necessary to produce part 457.

13-22

Outsourcing or Make-or-Buy Decision

Common costs are allocated on the basis of

direct labor hours.

Total unit cost of $29 is based on 20,000 parts

produced each year.

An outside supplier has offered to provide the

20,000 parts at a cost of $25 per part.

Should we accept the supplier’s offer?

13-23

Outsourcing or Make-or-Buy Decision

Make-or-buy analysis - 20,000 units

Make part

Buy part

Direct costs:

Direct materials

Labor

Variable overhead

Fixed overhead

Common costs

20,000 × $5 per unit

$

Difference

180,000

100,000

20,000

20,000 × $9 per unit

20,000 × $1 per unit

13-24

Outsourcing or Make-or-Buy Decision

Make-or-buy analysis - 20,000 units

Make part

Buy part

Direct costs:

Direct materials

Labor

Variable overhead

Fixed overhead

Common costs

$

$

180,000

100,000

20,000

180,000

100,000

580,000

20,000 × $29 per unit

Difference

13-25

Outsourcing or Make-or-Buy Decision

20,000 × $25 purchase price

Make-or-buy analysis - 20,000 units

Make part

Buy part

Direct costs:

Direct materials

Labor

Variable overhead

Fixed overhead

Common costs

$

$

180,000

100,000

20,000

180,000

100,000

580,000

$

500,000

$

100,000

600,000

Difference

$

320,000

(100,000)

(20,000)

(180,000)

$

20,000

The common costs remain unchanged.

13-26

Outsourcing or Make-or-Buy Decision

Make-or-buy analysis - 20,000 units

Make part

Buy part

Direct costs:

Direct materials

Labor

Variable overhead

Fixed overhead

Common costs

$

$

180,000

100,000

20,000

180,000

100,000

580,000

$

500,000

$

100,000

600,000

Difference

$

320,000

(100,000)

(20,000)

(180,000)

$

20,000

Should we make or buy

part 457?

13-27

Outsourcing or Make-or-Buy Decision

What is the relevant unit cost of making part 457?

Direct materials

Direct labor

Variable overhead

Fixed overhead ($180,000 ÷ 20,000)

Total relevant unit cost

$ 9.00

5.00

1.00

9.00

$ 24.00

Advantage of making

20,000 units × ($25.00 – $24.00) = $20,000

13-28

Outsourcing or Make-or-Buy Decision

If Thor could use the space currently being used to make

Part 457 for another purpose, resulting in a cost savings of

$45,000, would you change your decision?

Yes. The cost savings (opportunity cost) of $45,000

overcomes the $20,000 disadvantage of buying.

Now there is a $25,000 advantage to buying.

The real issue is the most profitable use of the space.

13-29

Pitfalls of Outsourcing

Supplier

technology and

knowledge base

may not be as

anticipated.

Freed-up

resources

are not used

as planned.

Customers

may object.

Loss of

sensitive

information

to supplier.

Customer

contact may

be reduced.

Supplier

quality is not

as high as

anticipated.

13-30

Decision to Add or Drop a Product,

Service, or Business Unit

If we shut down

our U.S. Digital

watch line, we

might anger our

American

customers.

. . . Not to

mention

the bad

press!

That is why we

have to consider

the relevant

benefits and the

relevant costs

BEFORE making

a final decision.

13-31

Decision to Add or Drop a Product,

Service, or Business Unit

Let’s get started.

The digital line

has become less

profitable and it is

difficult to compete

in the market.

. . . Not to

mention

the bad

press!

That is why we

have to consider

the relevant

benefits and the

relevant costs

BEFORE making

a final decision.

13-32

Decision to Add or Drop a Product,

Service, or Business Unit

Segment Income Statement

Digital watches

Sales

Less: variable expenses

Variable mfg. costs

Variable shipping costs

Commissions

Contribution margin

Less: fixed expenses

General factory overhead

Salary of line manager

Depreciation of equipment

Advertising - direct

Rent - factory space

General admin. expenses

Net loss

$

$

$

500,000

$

200,000

300,000

120,000

5,000

75,000

60,000

90,000

50,000

100,000

70,000

30,000

400,000

$ (100,000)

13-33

Decision to Add or Drop a Product,

Service, or Business Unit

Segment Income Statement

Digital watches

Sales

$ 500,000

If

the

digital

watch

line

is

dropped,

the

Less: variable expenses

fixed

general

factory overhead

and general

Variable

mfg. costs

$ 120,000

Variable

shipping costs

5,000

administrative

expenses will

be allocated

Commissions

75,000

200,000

to other product lines. $ 300,000

Contribution margin

Less: fixed expenses

General factory overhead

$

60,000

Salary of line manager

90,000

Depreciation of equipment

50,000

Advertising - direct

100,000

Rent - factory space

70,000

General admin. expenses

30,000

400,000

Net loss

$ (100,000)

13-34

Decision to Add or Drop a Product,

Service, or Business Unit

Segment Income Statement

Digital watches

Sales

The

equipment used to manufacture

Less: variable expenses

digitalmfg.

watches

Variable

costs has no $resale

120,000

value

or alternative

use. 5,000

Variable

shipping

costs

Commissions

Contribution margin

Less: fixed expenses

General factory overhead

Salary of line manager

Depreciation of equipment

Advertising - direct

Rent - factory space

General admin. expenses

Net loss

$

500,000

$

200,000

300,000

75,000

$

60,000

90,000

50,000

100,000

70,000

30,000

400,000

$ (100,000)

13-35

Decision to Add or Drop a Product,

Service, or Business Unit

Segment Income Statement

Digital watches

Sales

Less: variable expenses

Variable mfg. costs

Variable shipping costs

Commissions

Contribution margin

Less: fixed expenses

General factory overhead

Salary of line manager

Depreciation of equipment

Advertising - direct

Rent - factory space

General admin. expenses

Net loss

$

500,000

Should Market retain or drop

the digital watch line?

$

200,000

300,000

$

$

120,000

5,000

75,000

60,000

90,000

50,000

100,000

70,000

30,000

400,000

$ (100,000)

13-36

Decision to Add or Drop a Product,

Service, or Business Unit

DECISION RULE

Market should drop the digital watch

segment only if its fixed cost savings

exceed lost contribution margin.

Let’s look at this solution.

13-37

Decision to Add or Drop a Product,

Service, or Business Unit

Market Company

Solution

Contribution margin lost if

watches are dropped

Less fixed costs that can be avoided

Salary of the line manager

Advertising - direct

Rent - factory space

Net disadvantage

$

$ (300,000)

90,000

100,000

70,000

Should we drop the digital

watch segment?

260,000

$ (40,000)

13-38

Decision to Add or Drop a Product,

Service, or Business Unit

The same result can also be obtained

by preparing a differential analysis

showing operating results with and

without the digital watch segment.

Let’s look at this approach.

13-39

Decision to Add or Drop a Product,

Service, or Business Unit

Sales

Less variable expenses:

Mfg. expenses

Freight out

Commissions

Total variable expenses

Contribution margin

Less fixed expenses:

General factory overhead

Salary of line manager

Depreciation

Advertising - direct

Rent - factory space

General admin. expenses

Total fixed expenses

Net loss

Differential Analysis

Solution

Keep

digital

watches

$ 500,000

120,000

5,000

75,000

200,000

300,000

60,000

90,000

50,000

100,000

70,000

30,000

400,000

$ (100,000)

Drop

digital

watches

$

60,000

50,000

30,000

140,000

$ (140,000)

Difference

$ (500,000)

120,000

5,000

75,000

200,000

(300,000)

90,000

100,000

70,000

260,000

$ (40,000)

13-40

Decision to Add or Drop a Product,

Service, or Business Unit

Keeping the digital watch product line

may have an opportunity cost that we

have not yet considered.

The opportunity cost of retaining the digital

watch line is measured by the differential

profits given up if the next best use of the

production facilities is rejected.

Example: If the idled facilities can be used to make

a product generating $350,000 per year in contribution

margin, with no other change in fixed costs,

might this change your decision?

13-41

Decision to Add or Drop a Product,

Service, or Business Unit

Measuring cost savings and lost

revenues from closing a business unit is

only part of the story.

The closing will impact . . .

Employees’ personal lives,

Morale of retained employees,

The community at large.

13-42

Relevant Costs of Replacing

Equipment

Which costs are relevant to the decision to

replace an old machine with a new machine?

Old machine cost $5,400 when purchased.

Old machine has a book value of $1,500.

Purchase price of a new machine is $10,000.

New machine will reduce labor from $12.00 to

$11.00 per unit.

New machine is expected to last two years.

Repairs to old machine would be $4,600 and

would allow two more years of productivity.

Power for either machine is expected to be $2.50

per unit.

Expected level of output: 1,000 units per year.

13-43

Relevant Costs of Replacing

Equipment

Which costs are relevant to the decision to

replace an old machine with a new machine?

Relevant

because

of labor

savings

over the

2-year life.

Old machine cost $5,400 when purchased.

Old machine has a book value of $1,500.

Purchase price of a new machine is $10,000.

New machine will reduce labor from $12.00 to

$11.00 per unit.

New machine is expected to last two years.

Repairs to old machine would be $4,600 and

would allow two more years of productivity.

Power for either machine is expected to be $2.50

per unit.

Expected level of output: 1,000 units per year

13-44

Relevant Costs of Replacing

Equipment

1,000 units @ $12.00 for 2 years

1,000 units @ $11.00 for 2 years

Cost

Labor

Repair cost

Purchase cost

Total

Keep old Replace old

machine

machine

$

24,000 $

22,000

4,600

10,000

$

28,600 $

32,000

Conclusion: keep old machine.

13-45

Pricing Decisions

What influences prices?

13-46

Pricing Decisions

Prices are determined by the market, subject

to costs that must be covered in the long run.

Costs

Market

forces

Prices are based on costs, subject to

reactions of customers and competitors.

13-47

Pricing Law in the United States

13-48

Special-Order Price Decisions

We just received

a special order. Do

you think we should

accept it?

13-49

Special-Order Price Decisions

A travel agency offers Worldwide Airways

$150,000 for a round-trip flight from Japan to

Hawaii on a jumbo jet.

Worldwide usually gets $250,000 in passenger

ticket revenue from this flight.

The airlines is not currently planning to add any

new routes and has two planes that are idle and

could be used to meet the needs of the agency.

The next screen shows cost data developed by

managerial accountants at Worldwide.

13-50

Special-Order Price Decisions

Typical Flight Between Japan and Hawaii

Revenue:

Passenger

$

Cargo

Total

Expenses:

Variable expenses

Allocated fixed expenses

Total

Profit

250,000

30,000

$

280,000

$

190,000

90,000

90,000

100,000

Worldwide will save about $5,000 in reservation

and ticketing costs if the charter is accepted.

13-51

Special-Order Price Decisions

Assuming excess capacity

Special price for charter

Variable cost per flight

Reservation cost savings

Variable cost of charter

Contribution from charter

$ 150,000

$ 90,000

(5,000)

$

85,000

65,000

Since the charter will contribute to fixed costs and

Worldwide has idle capacity, the company should

accept the flight.

13-52

Special-Order Price Decisions

What if Worldwide had no excess capacity? If

Worldwide adds the charter, it will have to cut

its least profitable route that currently

contributes $80,000 to fixed costs and profits.

Should Worldwide still accept the charter?

13-53

Special-Order Price Decisions

Assuming no excess capacity

Special price for charter

Variable cost per flight

Reservation cost savings

Variable cost of charter

Opportunity cost:

Lost contribution on route

Total

$ 150,000

$ 90,000

(5,000)

85,000

80,000

165,000

$ (15,000)

Worldwide has no excess capacity, so it

should reject the special charter, or try to

renegotiate a higher price.

13-54

Special-Order Price Decisions

With excess capacity . . .

Relevant costs usually will be the variable costs

associated with the special order.

Without excess capacity . . . .

Same as above but opportunity costs of using

the firm’s facilities for the special order are also

relevant.

13-55

Special-Order Price Decisions

Additional considerations

•Impact on regular customers and markets

•Will the special order lead to future

regular business?

13-56

End of Chapter 13