Click here for story ideas discussed during the webinar.

advertisement

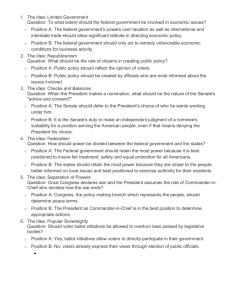

On March 3, Stateline.org reporters and editors held a webinar for Capitolbeat members. Below is a summary of themes, story ideas and additional resources presented during the webinar. Barb Rosewicz, editor with Pew Center on the States: The main themes of this year’s State of the States publication can be overlaid on individual states. Policymakers and voters in 2010 are poised to make decisions that could have long-term consequences, a parallel track that could be fruitful to report even as attention rightfully is focused on how to fill immediate budget gaps. Keep in mind that even if the national recession is over, states’ worst times historically come in the year or two after a recession ends (true for your state?) and states may not recover until much later this decade. Some states will never be the same. For example, will Michigan – once a wealthy state – fall to one of the 10 poorest states in per-capita income this year? How is your state faring? Watch for March 25 stats update from U.S. Bureau of Economic Analysis -http://bea.gov/regional/spi/default.cfm?selTable=summary In real terms, what does a rise or fall say about the recession’s effects on citizens, and state government? In what ways has your state fallen or risen in other national rankings as a result of the recession? Could provide a time peg for a deeper piece on lasting changes. So, “normal” is being redefined. But we’re just at the outset of seeing whether permanent, fundamental change (in both government and consumers) is wrought from this crisis. Do you see any clear signs of change in state government? What changes will be permanent? What if anything is being eliminated, not just starved? What do long-term trends for expenses such as Medicaid and pension liabilities show in your state? Are lawmakers taking ownership of the problem? Candidates can be asked these hard questions. Steve Fehr, Stateline.org staff writer and author of “Recession could reshape state governments in lasting ways” in State of the States 2010: Is the way your state structures its tax system going to be adequate to bring in future revenue to cover expenses? Can your state’s revenue structure be changed to include new sources of revenue or changes to existing taxes that would generate additional money? Look at the whole question of taxing services such as dry cleaning, car repairs and haircuts. We are increasingly a service economy, and yet most of those services are not taxed. (See March 3, 2010, Stateline story: Do you want a tax with that?) Look at the tax breaks your state offers to various businesses and individuals, many of which were enacted when states had more money and could afford to do that. Is it time for some of those tax exemptions to be ended? Check whether your state has studied how much money it loses a year to Internet retailers who don’t have to pay taxes on sales conducted by affiliates based in your state. Wyoming’s governor wants to tax wind energy. Does your state plan to be a big wind energy producer? Do elected officials believe wind energy should be taxed? What’s it like to be a state employee these days? Depending on the state, you might be furloughed, laid off, working four days a week, had your pension cost-of-living adjustment or your pay frozen. Why would anyone want to join state government these days? It used to be a stable employer with a clear mission of helping people. Morale has to be at an all-time low depending on how severe the cuts have been in your state. Also, who’s leaving state government? Is there a brain drain because of early retirement incentives, layoffs? Do agency managers worry about that? There is a good story that you could expand beyond your state on how some states are weighing proposals to reduce states’ roles in the liquor business. Virginia, North Carolina, Washington, Vermont and Mississippi are all looking at that. States are shifting costs from government to the people, not only taxes but fees. Compare the cost of driving five years ago to the cost now. Look at every cost associated with driving that the state touches. Start with a new car. Compare registration, titling, lien fees. If you keep the car, what are registration renewal fees? What was the fee you paid five years ago for a speeding ticket and what is it now. That would lend itself to a great graphic. You could do the same comparison for a college student. What was the cost of going to school in your state five years ago compared to now? What are the percentage increases for tuition, fees, books, room and board, etc. Christine Vestal, Stateline.org staff writer and author of “Is it time for a new balance in the federal and state fiscal partnership?” in State of the States 2010: How did your state rank in the amount of federal stimulus money for various programs, including highways, welfare, job training, weatherization, energy conservation and other grants? When total stimulus dollars are totaled, how does your state compare to the other 49? How good a job is your state doing at spending stimulus funds and creating jobs? What share of your state’s budget is taken up by Medicaid? Has it changed in the last three years? What are fiscal experts predicting your state’s share will be in 10 years – with or without national health care reform? Does your state have any innovative waivers to the Medicaid program that have helped cut health care spending? Do policymakers have any new cost-cutting measures in the works? Are lawmakers in your state considering a bill that would block national health care reform? A majority of states have so-called freedom of choice in health care bills, but it is unclear how many will become law. Has your state enacted unemployment laws that would make it easier for low-wage workers to receive benefits? If so, are there any studies that show whether more people are getting benefits or unemployment business taxes are likely to go up? Has your state borrowed money from the federal government to replenish its unemployment trust fund? If so, are business taxes slated to rise? How does your state compare to others that are borrowing from the federal government? Is your state relying on continued federal help with Medicaid to balance its 2011 budget? Are policymakers talking about cutting or even opting out of Medicaid? When all federal-state programs are totaled – including highways, education, welfare, job training and Medicaid – what share of your state’s budget goes to national programs? Is there a perception among policymakers that the share is too high, or is greater use of federal money considered desirable? Has your state lost out on any federal money because it could not come up with matching funds? Is your state one of only a handful that received new education grants under the so-called Race to the Top program? What is the overall percentage of your state’s K-12 education budget that comes from federal grants? Is that number growing or shrinking? Pamela Prah, Stateline.org staff writer and author of “2010 Elections: New faces, daunting problems” in State of the States 2010: Will incumbent governors and/or state legislators pay a political price for raising taxes or cutting popular programs? The last time a big gubernatorial election fell during a state budget crisis was 2002, and voters ousted four sitting governors and party control flipped in half of the 36 governors’ seats on the ballot. What does history teach about your electorate’s attitude to tax increases? How will the Tea Party movement and anti-tax advocates affect state races and ballot measures? Anti-tax advocates lost on tax and spending ballot measures last year in Maine and Washington, but voters in Oregon this year approved a tax increase. Is your state one of about a dozen in which statehouse chambers are so narrowly divided that either party could win? (See State of the States poster for which states.) Is your state one in which term limits apply this year for statehouse races? If so, who is forced to leave and what does it mean? Do lame ducks take the high road or the quickand-easy road to making decisions to fix long-term problems? Will your state pick up or lose congressional seats after redistricting and how is redistricting done in your state? This is where voters’ choices will have long-term consequences. Sources from Pam, not included in the PowerPoint: Stateline’s printable PDF map of governors’ races Stateline’s printable PDF map of attorneys general races Stateline’s printable PDF map of secretary of state races State of the States 2010 Election Guide, listing all 50 states’ key statewide races, lists of polling hours, registration dates and voter ID requirements. Page 26-27 in hard copy, or voters’ information section digitally here. Pew Center on the States poster with party control of legislatures, governors’ offices and dates of legislative sessions. Email Fred Schecker to request a copy: fschecker@pewtrusts.org For national perspective on how your state’s governor’s race is handicapped, check out: CQ Politics.com’s map The Rothenberg Report Cook Political Report (subscription service but has a map on its free web site): For state legislative races, check out: Democratic Legislative Campaign Committee Republican State Leadership Committee Ballot measure information National Conference of State Legislature’s ballot database