November 2009 Microsoft PowerPoint slide presentation by Doug

advertisement

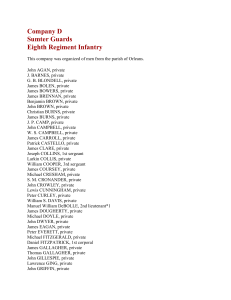

Patrick County Taxpayer Watchdog Group (PCTWG) Mission statement: To enable a greater public understanding of the costs of governing in Patrick County, to be an entity to receive public comment on issues affecting local taxation and to be a representative body to coordinate these comments and present them to the governing agencies. BOARD MEMBERS - CONTACT INFORMATION Chairman; Jerry Webb dandc@swva.net (540) 520-9325 Vice Chairman Danny Foley hdfoley@kimbanet.com Treasurer Secretary (276) 340-0465 Owen Caldwell Blue Ridge District 163 Willis Rd, M.O.D. Mayo River District (276) 627-1029 Karen Cowdrey 5088 Pleasant View Drive, Patrick Springs Mayo River District (276) 694-3054 Dan River District kcbc24@yahoo.com Board of Directors: Bill Andrus (276) 930-1461 Smith River District Bill Cottrell (276) 694-4442 chibillcottrell@embarqmail.com Mario Delgado (276)694-7050 876 Stuart Dr, Stuart 24171 Clayton Kendrick (276) 694-7786 (w) (276) 340-8786 (c) Mildred Layman (276) 340-0549 Peters Creek District Carl Stone (276) 930-2608 Smith River District Charles Vivier (276) 952-2691 2831 Pilot View Rd, Hillsville, VA 24343 John Wingfield (276) 629-5715 Charlotte Smith (276) 930-3011 Larry Ethier (276) 251-1084 wiandrus@yahoo.com vivi.arriba@gmail.com ckendrick@embarqmail.com m.anitalayman@harvestwc.net StoneynLucy@gmail.com 3635 Pleasant View Dr, PS, 24133 Smith River District vivier@swva.net PCTWG GOALS • • Immediate taxpayer relief: Delay for one year the change to semiannual billing until June 5, 2011. Taxpayers have just been hit with almost a $3 million surcharge above last December’s billing that totaled $5.5 million. The actual billings ($5,489,173 prior to $8,151,809 current) represent a total increase of about 50 percent. However, many owners have seen increases to as much as 400%. Instead of having a year to recover, they will be required to again pay half their bill in June 2010. Meeting the burdens will be difficult in these times of high unemployment and a slowly recovering economy. • When preparing the next budget, slow down the accumulation of contingency funds by $1 million to a fund balance of $1 million, not $2 million. The total real estate assessments are currently $1.7 billion. A $0.06 / 100 reduction in the levy will reduce the revenues by $1 million. The reduction will reduce the tax bill on $100,000 value by $60 per year. • Appoint a study group similar to the Land Use panel to report on the pros and cons of establishing a Patrick County Department of Real Estate Appraisal for the purpose of doing a general reassessment to be finished in two years by December 1, 2011. Any action to adopt Land Use should be delayed until the findings of the group have been received. A policy of having realistic market values could overcome the need for tax relief through Land Use or other alternatives such as conservation easements or agricultural districts. • Budget oversight: – • Review the analysis document “COMPARISON OF PUBLISHED ANNUAL COUNTY BUDGETS PATRICK COUNTY” and form study committees on budget line items. Overall this would be an ongoing process that might call into question the need or timing of proposed expenditures. Review audit reports for comparison to budget for actual expenditures Patrick County Land Book 2009 Assessed Value Percentage Change 300% 250% 200% BLDGS 150% LAND 100% 50% 0% P1 P2 P3 P4 P5 S3 Blue Ridge Dan River Mayo River Peters Creek Smith River Tow n - Mayo S4 Tow n - Peters 2009 averages District LAND BLDGS TOTAL VALUE TOTAL TAX Blue Ridge P1 155,824,900 121,432,500 277,257,400 1,330,835.52 Dan River P2 152,369,200 130,452,500 282,821,700 1,357,544.16 Mayo River P3 227,513,200 238,433,800 465,947,000 2,236,545.60 Peters Creek P4 130,859,700 96,152,000 227,011,700 1,089,656.16 Smith River P5 194,191,700 130,428,700 324,620,400 1,558,177.92 Town - Mayo S3 13,889,200 63,390,300 77,279,500 370,941.60 Town - Peters S4 8,837,100 34,535,700 43,372,800 208,189.44 Total 2009 TOT. 883,485,000 814,825,500 1,698,310,500 8,151,890.40 LAND BLDGS TOTAL VALUE TOTAL TAX *Calculated Year 2008 to Year 2009 Percentage Change District Blue Ridge P1 220% 36% 101% 76% Dan River P2 138% 27% 69% 48% Mayo River P3 127% 22% 58% 38% Peters Creek P4 150% 27% 78% 55% Smith River P5 174% 30% 90% 66% Town - Mayo S3 47% 17% 22% 6% Town - Peters S4 43% 17% 22% 6% 151% 26% 70% 49% 2009 averages *Study made by Charles Vivier for the Taxpayer Watchdog Group 10/29/09 Press Release – November 13, 2009 – Stuart, VA To request the board of supervisors to study the establishment of a permanent Department of Real Estate Assessment to be staffed locally was a decision agreed to by the Patrick County Taxpayer Watchdog Group at its fifth meeting held on November 12 at the Hooker Building at Rotary Field in Stuart. Attendees at the group’s meeting expressed dissatisfaction with the current reassessment process that was completed by contract appraisers. Complaints included statements that appraisals of land tracts were “done from the curb” and didn’t reflect the value of marshes and sloping land “beyond the trees in front of their eyes”. Not yet having obtained any legal guidance, the group’s study committee made a qualified reference to Virginia State Code § 15.2-716 if the supervisors do not take the initiative. The code says that “a referendum may be initiated by a petition signed by 200 or more qualified voters of the county filed with the circuit court, asking that a referendum be held on the question of whether the county shall have a department of real estate assessments.” The group is confident it can muster the required signatures. “If a department of real estate assessments is appointed as above provided, the governing body of the county shall annually appoint a board of equalization of real estate assessments.” This body is expected to resolve complaints about landowners “not receiving replies from the equalizers”. The six year $400,000 reassessment revalued taxable real property in Patrick County at $1.7 billion dollars. The code states that “when a department of real estate assessments is appointed, the county shall not be required to undertake general reassessments of real estate every six years.” The group doesn’t expect the new department will reduce reassessment expenditures but expects that, even at $100,000 annual costs, on board personnel making annual updates to the system will be a better service to the county. Charles Vivier, 276-952-2694, publicity committee Facts You Should Know • • On motion by Lock Boyce seconded by Ron Knight and carried 3 to 2 the Board approved the addition of one full time employee at $21, 000.00 plus benefits for at total of $29,828.00 due to the extra workload of twice year billing. Voting Aye: Boyce, Knight, Large Voting Nay: Harris, Weiss* • • • • On motion by Lock Boyce seconded by Ron Knight to have twice yearly billing for taxes and carried 4 to 1: Voting Aye: Knight, Large, Weiss, and Boyce Voting Nay: Harris ** • *From Board of Supervisor minutes dated July 13th, 2009 • **From Board of Supervisors minutes dated August 10,2009 • Letter to Editor of Enterprise • • • • • • • • • • • • Letter - Voodoo economics of a Windfall The Board of Supervisors should immediately reverse the decision of changing to semi-annual billing for property taxes. Their decision amounts to voodoo economics to get through a July 2010 cash flow crunch to fund a down payment for new debt service of the new jail. Our group supports the opposition voiced at earlier public hearings and calls for a reversal of strategy. Semiannual billing sets in motion a permanent burden on the taxpayer and the staff of the treasurer’s office. Heretofore the County has managed cash flow without short term borrowing. For June 5, 2010, it wants a “windfall short term” loan from the taxpayers to make a down payment on the new jail. It will be a permanent advance unlikely to be refunded to the taxpayers. This one time “windfall” cash fix will be due just after we’ve been shortchanged for Christmas 2009 by collections for real estate taxes that have gone from $5 million to $8 million. The fix will come due after heating bills and early season farming expenses have been paid, to name a few. The supervisors throw up their arms crying there is nothing they can do because projects were set in motion. We have identified and experienced a declining economy since mid-2008. The State of Virginia set in motion spending cuts and forecasts a $1 billion shortfall of revenues. A 38% drop in 2009 net farm income is forecast by the USDA. Unemployment figures are high. Social Security cost-of-living-adjustments are frozen for 2010 for the first time since 1975. The June 8, 2009 Board meeting will go down in history as one of the slickest sessions perpetrated on the citizens of Patrick County. There was a public hearing of a published annual budget that conveniently omitted a June 5, 2010 prepaid taxes billing for $4 million that will eventually be identified in the FYE June, 30, 2010 audit. What followed was a public hearing on twice-yearly billing which was passed along with modifications to school items and library items. No mention was made to modify the budget for the additional $4 million before it was adopted. The first $8 million in budgeted real estate taxes includes money for a $2 million contingency fund. That’s a justin-case savings account. Everyone can afford one, right? Supervisors fully expected to pass semi-annual billing to generate another $4 million just-in-case the jail got completed. Stop the smoke and mirrors governing. Permanently repeal the change to semi-annual billing. Charles Vivier 952-2691 Taxpayer Watchdog Group Charles Vivier, 2831 Pilot View Rd, Hillsville, VA 24343 Tele. 276.952.2691 Patrick County 2009-2010 Budget Including Federal and State Income Moneys Community Development 2% Parks,Recreation & Cultural 1% Nondepartmental 4% Health & Welfare 5% Public Works 3% Public Safety 10% Judical Admin 2% General Govt Admin 3% Education & Schools 70% Education & Schools- 70% General Govt Administration-3% Judical Administration-2% Public Safety-10% Public Works-3% Parks,Recreation & Cultural-1% Community Development-2% Nondepartmental-4% Health&Welfare-5% TOTAL REVENUE / FUNDING SOURCES 38,634,239 41,119,370 2,485,131 6.4% FYE 6/30/09 FYE 6/30/10 $ change % change 1,880,053 1,481,942 -398,111 -21.2% 708,119 692,391 -15,728 -2.2% TOTAL PUBLIC SAFETY EXPS. 3,887,480 4,292,123 404,643 10.4% TOTAL PUBLIC WORKS EXPS. 1,065,729 1,300,036 234,307 22.0% 65,608 96,637 31,029 47.3% TOTAL PARKS, REC & CULTURAL EXPS. 192,211 206,752 14,541 7.6% TOTAL COMMUNITY DEVELOPMENT EXPS. 929,637 978,699 49,062 5.3% TOTAL NONDEPARTMENTAL EXPS. 231,263 1,805,787 1,574,524 680.8% 2,124,514 1,928,463 -196,051 -9.2% TOTAL SCHOOL & DEBT EXPS. 27,549,625 28,336,540 786,915 2.9% TOTAL ESTIMATED EXPENDITURES 38,634,239 41,119,370 2,485,131 6.4% 5,107,000 8,127,873 3,020,873 59.2% ESTIMATED EXPENDITURES TOTAL GEN. GOVERNMENT ADMIN. EXPS. TOTAL JUDICIAL ADMINISTRATION EXPS. TOTAL HEALTH AND WELFARE EXPS. TOTAL H&W - VIR. VA PUBLIC ASSISTANCE EXPS. * Includes this line item for Real estate taxes Prepared by Charles Vivier for Tax Watchdog Committee 11/4/09 Land Use Program • • • • • • • • • • • • • • LAND USE PROGRAM In accordance with the Virginia State Code 58.1-3230 through 58.1-3239, the Carroll County Board of Supervisors adopted the special assessment program in 2003. This program allows for the assessment of land based on use value rather than market value. In November 2009, Patrick County received a report from its study committee that recommended adopting classifications of Agricultural use and Horticultural use and consider at a later date Forestry use and Open land use. Since it is likely that Patrick County will model the Carroll County ordinance, the following information is contained in that ordinance. In order to qualify for the two classifications, you must meet the requirements specified below. AGRICULTURAL USE and HORTICULTURAL USE - The qualifying land area shall be: A minimum of five (5) acres in production is required (excluding home site). Devoted currently and for the five previous consecutive years to the production for: AGRICULTURE: sale of plant or animal products useful to the public. HORTICULTURE: sale of nursery, greenhouse, cut flowers, plant materials, orchards, vineyards, and small fruit products. Crop or livestock production must be primarily for commercial use. Verification for sale of crop or livestock should be submitted to establish a bona fide commercial production. * Sales receipts “gross sales averaging more than $1,000 annually over the previous three years”. * Federal Income Tax Form: (1040F) Farm Expense and Income, (4835) Farm Rental Income and Expenses, or (1040E) Cash Rent for Agricultural Land. * FSA (Farm Service Agency) farm and tract number. The detailed acreage report provides listing by field number providing acreage and crop grown in each field. All owners must certify that the real estate is being used in a planned program of soil management and soil conservation practices which is intended to reduce or prevent soil erosion, maintain soil nutrients, and control brush, woody growth and noxious weeds on row crops, hay and pasture. Field crop production must be primarily for commercial use and the average crop yield per acre on each crop grown on the real estate during the immediate three (3) years previous, must be equal to at least one-half (1/2) of the county average for the past three (3) years. There shall be a minimum of twelve (12) animal unit months of commercial livestock or poultry per five (5) acres of open land in the previous year. An animal unit is: 1 Cow, 1 Horse, 5 Sheep, 5 Swine, 100 Chickens, 66 Turkeys, & 100 Other Fowl. EXAMPLES: 1 Cow per 5 acres for 12 months 2 Cows per 5 acres for 6 months 3 Cows per 5 acres for 4 months 100 Chickens per 5 acres for 12 months 200 Chickens per 5 acres for 6 months 2009 Patrick County Land Book Assessed Market Values by Class Code 2009 Patrick County Land Book Assessed Market Values by Class Code 1,800,000,000 1,600,000,000 2009 Assessed Value 1,400,000,000 1,200,000,000 1,000,000,000 Bldgs. Land 800,000,000 600,000,000 400,000,000 200,000,000 0 1 2 3 4 5 6 Residential 019 ac. Multifamily Commercial & Indus. Bldgs. 38,435,400 545,873,100 6,688,800 107,320,000 97,728,900 18,779,300 814,825,500 Land 11,843,800 340,714,900 1,120,500 24,441,700 352,913,400 152,450,700 883,485,000 Class Code Agriculture 2099 ac. TOT Tow n Single Family Agriculture 100+ ac. Patrick County School System Facts You Should Know Woolwine Elem Meadows of Dan Elem Blue Ridge Elem Patrick County High Stuart Elem Patrick Springs Elem Hardin Reynolds Patrick County Schools • Patrick County High School • • • 976 students 77 teachers (www.publicschoolreview/school.com) • Stuart Elementary • • • 435 students 34 teachers (www.localschooldirectory.com) • Woolwine Elementary • • • 240 students Teachers-N/A (www.greatschools.net) • Hardin Reynolds Elementary • • • 290 students (2007) Teachers-N/A (www.city-data.com) • Meadows of Dan Elementary • • • 125 students Teachers-N/A (www.greatschools.net) Blue Ridge Elementary 277 students Teachers-appx 25 (www.greatschools.net) Patrick Springs Elementary 264 students 20 teachers (www.localschooldirectory.com) Sources of Patrick County Local Tax Revenues Budget Year 2009-2010 $11,371,518.00 PPTRA-6% Mobile Home-1% Machinery & Tools-6% Real Estate-$8,127,873 Personal Property14% Public Utilities-$229,000 Personal Property-$1,553,149 Machinery &Tools-$673,561 Mobile Home-$99,276 PPTRA-$688,659 Public Utilities-2% Real Estate- 71% Facts You Should Know • • • On motion by Lock Boyce seconded by Karl Weiss and carried unanimously the Board approved to amend the school division total 2008 – 2009 budget from $28,385,487.83 to $28,607,442.83 or a difference of $221,955 due to the replacement of the serving lines to meet ADA guidelines.* • On motion by Lock Boyce seconded by Ron Knight and carried 4 to 1 the Board set the tax levy at 48 cents per $100. Voting Aye: Boyce, Knight, Weiss, and Large Voting Nay: Harris* • • • • • • On motion by Karl Weiss seconded by Ron Knight and carried 4 to 1 the Board adopted the $41,119,369.63 with the noted change to reduce the cut from 5% to 2.5% to the Library’s contribution. Voting Aye: Boyce, Knight, Weiss, and Large Voting Nay: Harris* • * From Board of Supervisors minutes dated June 8th,2009 Facts You Should Know • Patrick County Budget-$41,119,369.00 • School Budget 2008/2009- $28,607,442.83 • Total students approximately 2607 • Per child cost of $10,973.31 • 46% of PC Tax Revenues($5,230,898) goes to schools-2607 students • Remaining 54% serves 16,237 citizens From Dr. Roger Morris Division Superintendent • Dr. Morris stated to The Enterprise that Patrick County school system ranked 130th out of 132 school divisions in Virginia in terms of a teacher’s salary plus fringe benefits. A teacher with 10 years of experience made $41,894 in salary and benefits in Patrick County. • Please note the following information from the Virginia Department of Education. Are our teachers being paid fairly? Virginia Department of Education 2008-2009 Salary Survey - Teachers Classroom Teacher Salary Survey (Including Librarians and Guidance Counselors) Division 001 010 018 031 044 070 005 081 086 035 036 048 056 062 069 005 068 087 094 098 Name Accomack County Public Schools Bedford County Public Schools1 Carroll County Public Schools Floyd County Public Schools Henry County Public Schools Patrick County Public Schools Amherst County Public Schools Rockbridge County Public Schools Smyth County Public Schools Giles County Public Schools Gloucester County Public Schools King George County Public Schools Madison County Public Schools Nelson County Public Schools Page County Public Schools Amherst County Public Schools Orange County Public Schools Southampton County Public Schools Washington County Public Schools York County Public Schools FY 2007 Actual Average Teacher Salary 39,973 39,694 37,024 41,891 38,302 39,783 41,935 40,043 36,969 39,804 44,543 44,936 42,577 42,627 41,602 41,935 43,133 42,082 41,560 46,925 FY 2009 FY 2007 to FY FY 2008 Budgeted 2008 Percent Actual Average Average Increase/ Teacher Salary Teacher (Decrease) Salary 39,576 40,827 36,938 41,896 40,181 40,120 42,816 40,621 42,986 40,903 45,857 46,172 44,253 44,422 43,956 42,816 41,800 43,078 42,599 48,136 (0.99%) 2.85% (0.23%) 0.01% 4.91% 0.85% 2.10% 1.44% 16.27% 2.76% 2.95% 2.75% 3.94% 4.21% 5.66% 2.10% (3.09%) 2.37% 2.50% 2.58% 40,315 42,314 37,196 43,127 43,849 45,505 41,469 42,571 44,902 41,953 47,680 47,981 45,099 45,225 45,697 41,469 40,107 45,462 44,070 50,795 FY 2008 to FY 2009 Percent Increase/ (Decrease) 1.87% 3.64% 0.70% 2.94% 9.13% 13.42% (3.15%) 4.80% 4.46% 2.57% 3.98% 3.92% 1.91% 1.81% 3.96% (3.15%) (4.05%) 5.53% 3.45% 5.52% Teacher salary comparison Division Nam e School Num ber School Nam e Average 20082009 Salary 070 Patrick County Public Schools 150 MEADOWS OF DAN ELEM. 41,354.00 070 Patrick County Public Schools 320 STUART ELEM. 40,150.00 070 Patrick County Public Schools 350 HARDIN REYNOLDS ELEM. 35,458.00 070 Patrick County Public Schools 440 BLUE RIDGE ELEM. 43,745.00 070 Patrick County Public Schools 680 PATRICK SPRINGS ELEM. 40,782.00 070 Patrick County Public Schools 700 PATRICK COUNTY HIGH 41,278.00 070 Patrick County Public Schools 80 WOOLWINE ELEM. 39,033.00 044 Henry County Public Schools 10 BASSETT HIGH 42,124.00 044 Henry County Public Schools 20 MAGNA VISTA HIGH 42,555.00 044 Henry County Public Schools 220 SANVILLE ELEM. 40,577.00 044 Henry County Public Schools 480 CARVER ELEM. 40,800.00 044 Henry County Public Schools 530 DREWRY MASON ELEM. 43,859.00 044 Henry County Public Schools 590 CAMPBELL COURT ELEM. 44,050.00 044 Henry County Public Schools 620 FIELDALE-COLLINSVILLE MIDDLE 40,279.00 044 Henry County Public Schools 630 IRISBURG ELEM. 39,560.00 044 Henry County Public Schools 661 JOHN REDD SMITH ELEM. 40,277.00 044 Henry County Public Schools 662 COLLINSVILLE PRIMARY 41,752.00 044 Henry County Public Schools 670 LAUREL PARK MIDDLE 40,237.00 044 Henry County Public Schools 740 RICH ACRES ELEM. 39,772.00 044 Henry County Public Schools 750 AXTON ELEM. 39,573.00 044 Henry County Public Schools 760 STANLEYTOWN ELEM. 43,827.00 044 Henry County Public Schools 872 MT. OLIVET ELEMENTARY 41,805.00 018 Carroll County Public Schools 1110 ST. PAUL SCHOOL 38,440.00 018 Carroll County Public Schools 1130 OAKLAND ELEMENTARY SCHOOL 41,364.00 018 Carroll County Public Schools 1150 GLADESBORO ELEMENTARY SCHOOL 38,596.00 018 Carroll County Public Schools 1160 LAUREL ELEMENTARY SCHOOL 38,906.00 018 Carroll County Public Schools 1170 HILLSVILLE ELEMENTARY SCHOOL 38,205.00 018 Carroll County Public Schools 1180 FANCY GAP ELEMENTARY SCHOOL 40,492.00 018 Carroll County Public Schools 1210 GLADEVILLE ELEMENTARY SCHOOL 38,815.00 018 Carroll County Public Schools 1230 CARROLL COUNTY HIGH SCHOOL 39,310.00 018 Carroll County Public Schools 360 CARROLL COUNTY INTERMEDIATE SCHOOL39,444.00 018 Carroll County Public Schools 450 WOODLAWN SCHOOL 38,554.00 • PETERS CREEK DISTRICT Supervisor Lock Boyce 21047 Jeb Stuart Highway Stuart, VA 24171 Ph: 276-694-3564 Email: boyce-holland@embarqmail.com • SMITH RIVER DISTRICT Supervisor Crystal Harris Smith River District 763 Ridge Road Woolwine, Virginia 24185 Ph: 276-930-2127 Email: dragonfly24185@yahoo.com Current Term Expires: 12/31/2009 • MAYO RIVER DISTRICT Supervisor Ron Knight 105 Kelly Mill Road Stuart, VA 24171 Cell Phone 276-692-5481 Ph: 276-694-5291 Email: midwayent04@embarqmail.com • Blue Ridge District Karl Weiss 13139 Jeb Stuart Highway Stuart, VA 24171 Ph: 276-694-7288 Email: karlvweiss@hotmail.com Dan River District. Supervisor Jonathan Large Dan River District 938 Raven Rock Road Ararat, VA 24053 Ph: 276-251-1957 Current Term Expires: 12/31/2009