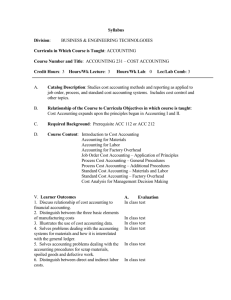

Document

Chapter 10

Accounting

Systems for

Manufacturing

Businesses

Learning Objectives

After studying this chapter, you should be able to…

Distinguish the activities of a manufacturing business from those of a merchandising or service business.

Define and illustrate materials, factory labor, and factory overhead costs.

Describe cost accounting systems used by manufacturing businesses.

Describe and illustrate a job order cost accounting system.

Use job order cost information for decision making.

Describe the flow of costs for a service business that uses a job order cost accounting system.

Describe just-in-time manufacturing practices.

Describe and illustrate the use of activity-based costing in a service business

Learning Objective 1

Distinguish the activities of a manufacturing business from those of a merchandising or service business

Nature of Manufacturing Businesses

• Service firms earn revenue from providing services.

• Merchandising firms earn revenue from selling merchandise inventory.

• Manufacturing firms…

– Earn revenue from manufacturing and selling finished goods.

– Have three inventories: materials, work in process, and finished goods.

Learning Objective 2

Define and illustrate materials, factory labor, and factory overhead costs

Illustrative Example

• Costs can provide an immediate benefit or a benefit that is deferred to future periods

Direct Materials Cost

• Include the cost of materials integral to the product

• For Legend Guitars: wood, guitar strings, and guitar bridges

• The cost of materials that are not an integral are called indirect materials

Direct Labor Cost

• The cost of employee wages who are directly involved in converting materials into the manufactured product.

• For Legend Guitars: wages of the employees who operate the saws/cutting machines and assemble the guitars.

• Labor costs that do not enter directly into the manufacture of a product are called indirect labor

Factory Overhead Cost

• Costs other than direct materials cost and direct labor cost incurred in the manufacturing process.

• For Legend Guitars: machine depreciation, factory supplies, factory insurance, overtime/idle time, and many others…

Analysis and Reporting Terms:

Prime and Conversion Costs

• Prime Costs: direct material, direct labor

• Conversion Costs: direct labor and factory overhead.

Financial Reporting Terms:

Product Costs and Period Costs

• Product Costs: direct material, direct labor, factory overhead

• Period Costs: selling and administrative expenses

Learning Objective 3

Describe cost accounting systems used by manufacturing businesses

Cost Accounting Systems

• Objective: accumulate product costs

• Used to establish prices, control operations, and develop financials

• Two main types:

– Job order cost systems (this chapter)

– Process cost systems (next chapter)

Job Order vs. Process Cost Systems

• Job Order

– Costs are accumulated by job.

– Used for custom products or companies with a large variety of products.

– Service firms often use job order systems.

• Process

– Costs are accumulated by department or process.

– Used for products that are not distinguishable from each other during a continuous production process.

Learning Objective 4

Describe and illustrate a job order cost accounting system

Job Order Cost System for Legend Guitars

Materials

• Accounting for the purchase of materials on credit

Materials Cost Flows

Materials information and cost flows for the wood received and issued to production by

Legend Guitars

Requisitioning Materials

• Flow of materials from the storeroom to production.

Direct Labor Cost Flows

Labor information and cost flows (time tickets) for

Legend Guitars

Factory Labor

• Two primary objectives:

– Determine the correct amount to pay each employee for each pay period.

– Properly allocate factory labor costs to factory overhead and individual job orders.

Factory Overhead Cost

• Includes all manufacturing costs other than direct materials and direct labor.

• Comes from various sources, including depreciation, indirect materials, indirect labor, and factory utilities.

Allocating Factory Overhead

• Overhead gets assigned to jobs through cost allocation

• The measure used to allocate overhead is called an activity base

– Should be a measure that reflects the consumption or use of overhead

– Examples: direct labor hours, machine hours, or direct material dollars

Predetermined Factory Overhead Rate

• Overhead may be applied using a predetermined factory overhead rate

Estimated Total Factory Overhead

Estimated Total Level of the Activity Base

Predetermined Factory Overhead Rate – Legend Guitars

• Assume Legend Guitars estimates $50,000 of total factory overhead for the year and the activity base to be 10,000 direct labor hours.

Why Use Predetermined Rates?

• For timely information

• Waiting until the end of a period when overhead costs are known would be accurate, but not timely for decision-making

• Some companies use activity-based costing - it allocates overhead costs using multiple predetermined rates

Applying Factory Overhead to Work in Process

Overhead costs are applied to work in process using job sheets and the predetermined rate.

Applying Factory Overhead to Work in Process

• The $4,250 of applied overhead is recorded as a transfer out of factory overhead into work in process.

Actual Overhead vs. Applied Overhead

• Actual factory overhead costs incurred will likely differ from the amount applied

• Over-applied overhead occurs when the amount applied exceeds actual costs

• Under applied overhead occurs when the amount applied is less than actual costs

• Large under-/over-applied balances need to be investigated

Disposal of Factory Overhead Balance

• The balance in factory overhead is carried forward from month to month, but needs to be closed out at the end of the year.

• One approach is to transfer the balance to cost of goods sold.

Work in Process

Costs incurred for various jobs are accumulated on job cost sheets and these jobs sheets represent work in process

Completion of Job 71

• When Job 71 was completed, total manufacturing costs were transferred out of the work in process account and into the finished goods account.

Finished Goods Ledger for Legend Guitars

• Finished goods is a controlling account comprised of individual finished goods subsidiary ledgers.

Sales and Cost of Goods Sold (COGS)

• Manufacturing business sales are treated the same as merchandising business sales.

• Assume Legend Guitars sold 40 guitars for $850 each (cost was $500 each).

Period Costs

• Expenses used in generating revenue during the current period

• Not involved in the manufacturing process

• Two categories:

– Selling – marketing the product and delivering it to customers.

– Administrative – administration of the business (not related to manufacturing or selling).

Selling Expenses and Administrative Expenses

Accounting for Selling and Administrative Expenses

• Assume Legend Guitars has sales salaries of $2,000 and office salaries of

$1,500.

Summary of Cost Flows for Legend Guitars

December Income Statement for Legend Guitars

Learning Objective 5

Use job order cost information for decision making

Job order cost systems can be used to evaluate an organization’s cost performance

• Job 63 used 100 more board feet of wood to manufacture the same number of guitars. Why?

Job Order Costing for Decision Making

• Possible reasons for the extra use of materials for

Job 63:

– Inexperienced labor

– Poor quality materials

– Cutting tools needing repair

– Carelessness

– Incorrect instructions

Learning Objective 6

Describe the flow of costs for a service business that uses a job order cost accounting system

Job Order Cost Systems for Service Businesses

• Useful for planning and controlling operations

• Focus is on direct labor and overhead. They are accumulated in a work in process account

• When jobs are completed, the cost of the job is transferred to a cost of services account (similar to COGS)

Job Order Cost Systems for Service Businesses

• There isn’t a finished goods account since revenues are recorded after the service has been provided.

Learning Objective 7

Describe just-in-time manufacturing practices

Just-In-Time Practices

• Manufacturing approaches are changing as companies need to produce products with high quality, low cost, and instant availability.

• JIT focuses on reducing time, cost, and poor quality within manufacturing processes.

Just-In-Time versus Traditional Manufacturing

Reducing Inventory

Machine

Breakdowns

Untrained

Employees

Poor

Quality

Unreliable

Suppliers

RIVER

(Inventory)

As the water level in the river drops (inventory levels), the rocks (production problems) become visible

Reducing Lead Times

Reducing Set-Up Times

Set up equipment to make brown bags

Set up equipment to make sky blue bags

Set up equipment to make basic white bags

Emphasizing Product-Oriented Layout

• Product-oriented layout : manufacturing process organized around product

• Process-oriented layout: manufacturing process organized around process

Emphasizing Employee Involvement

• Grants employees responsibility and authority to make decisions.

• Employees are often cross-trained to perform any operation within a product cell.

Emphasizing Pull Manufacturing

• Products manufactured only as they are needed by the customer

• Kanban: the Japanese system of pull manufacturing

• Traditional manufacturing emphasizes push manufacturing

Emphasizing Zero Defects

• Eliminate poor quality

• Six Sigma approach to zero defects

Emphasizing Supply Chain Management

• Electronic Data Exchange (EDI)

• Radio frequency identification device (RFID)

• Enterprise Resource Planning

(ERP)

Learning Objective 8

Describe and illustrate the use of activity-based costing in a service business

Activity-Based Costing (ABC)

• Uses multiple overhead rates to allocate factory overhead more accurately than using a single, plant-wide rate.

• Costs are initially accounted for in cost pools – each pool has its own rate.

Cost Pools and Rates for Hopewell Hospital

Overhead Allocation Using Activity Based Costing

Profitability Report Using Activity Based Costing