Accounting I

advertisement

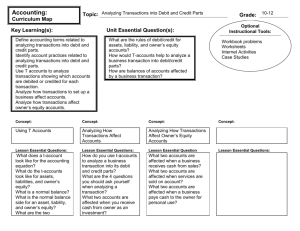

Accounting I Unit I Chapters 1-5 THE ACCOUNTING EQUATION How Business Activities Change the Accounting Equation RECEIVING CASH Transaction 1: August 1. Received cash from owner as an investment, $5,000.00 How Business Activities Change the Accounting Equation PAYING CASH Transaction 2: August 3. Paid cash for supplies, $275.00 Transaction 3:August 4. Paid cash for insurance, $1,200.00 How Business Activities Change the Accounting Equation Transactions on Account Transaction 4: August 7. Bought supplies on account from Supply Depot, $500.00 Transaction 5: August 11. Paid cash on account to Supply Depot, $300.00 How Transactions Change Owner’s Equity in an Accounting Equation Revenue Transactions Transaction 6: August 12. Received cash from sales, $295.00 Transaction 7: August 12. Sold services on account to Oakdale School, $350.00 How Transactions Change Owner’s Equity in an Accounting Equation Expense Transactions Transaction 8: August 12. Paid cash for rent, $300.00. Transaction 9: August 12. Paid cash for telephone bill, $40.00. How Transactions Change Owner’s Equity in an Accounting Equation Other Cash Transactions Transaction 10: August 12. Received cash on account from Oakdale School, $200.00 Transaction 11: August 12. Paid cash to owner for personal use, $125.00 Using T Accounts ANALYZING THE ACCOUNTING EQUATION Using T Accounts INCREASES AND DECREASES IN ACCOUNTS Analyzing How Transactions Affect Accounts RECEIVED CASH FROM OWNER AS AN INVESTMENT August 1: Received cash from owner as an investment, $5,000.00. Analyzing How Transactions Affect Accounts PAID CASH FOR SUPPLIES August 3: Paid cash for supplies, $275.00. Analyzing How Transactions Affect Accounts PAID CASH FOR INSURANCE August 4: Paid cash for insurance, $1,200.00. Analyzing How Transactions Affect Accounts BOUGHT SUPPLIES ON ACCOUNT August 7: Bought supplies on account from Supply Depot, $500.00. Analyzing How Transactions Affect Accounts PAID CASH ON ACCOUNT August 11: Paid cash on account to Supply Depot, $300.00. Analyzing How Transactions Affect Owner’s Equity Accounts RECEIVED CASH FROM SALES August 12: Received cash from sales, $295.00. Analyzing How Transactions Affect Owner’s Equity Accounts SOLD SERVICES ON ACCOUNT August 12: Sold services on account to Oakdale School, $350.00. Analyzing How Transactions Affect Owner’s Equity Accounts PAID CASH FOR AN EXPENSE August 12: Paid cash for rent, $300.00. Analyzing How Transactions Affect Owner’s Equity Accounts RECEIVED CASH ON ACCOUNT August 12: Received cash on account from Oakdale School, $200.00. Analyzing How Transactions Affect Owner’s Equity Accounts PAID CASH TO OWNER FOR PERSONAL USE August 12. Paid cash to owner for personal use, $125.00. Journals, Source Documents, and Recording Entries in a Journal General Journal Journals, Source Documents, and Recording Entries in a Journal Checks • Cash Payments • Check stub records the payment and maintains the checkbook balance Journals, Source Documents, and Recording Entries in a Journal Invoice • Sales Invoice: Selling on account (billing) • Purchase Invoice: Buying on account Journals, Source Documents, and Recording Entries in a Journal Receipt Calculator Tape • For Cash Sales Memorandum • Internal Transactions • For Receiving Cash or Checks Journals, Source Documents, and Recording Entries in a Journal RECEIVED CASH FROM OWNER AS AN INVESTMENT August 1: Received cash from owner as an investment, $5,000.00. Receipt No. 1. 1. Write the date in the Date column. 2. Write the title of the account debited. Write the debit amount 3. Write the title of the account credited. Write the credit amount. 4. Write the source document number in the Doc. No. column. Journals, Source Documents, and Recording Entries in a Journal August 3. Paid cash for supplies, $275.00. Check No. 1. August 4. Paid cash for insurance, $1,200.00. Check No. 2. Journals, Source Documents, and Recording Entries in a Journal August 7. Bought supplies on account from Supply Depot, $500.00. Memo No. 1. August 11. Paid cash on account to Supply Depot, $300.00. Check No. 3. Journals, Source Documents, and Recording Entries in a Journal August 12: Received cash from sales, $295.00. Tape No. 12. 1. Write the date in the Date column. 2. Write the title of the account debited. Write the debit amount. 3. Write the title of the account credited. Write the credit amount. 4. Write the source document number in the Doc. No. column. Journals, Source Documents, and Recording Entries in a Journal August 12. Sold services on account to Oakdale School, $350.00. Sales Invoice No. 1. August 12: Paid cash for rent, $300.00. Check No. 4. Journals, Source Documents, and Recording Entries in a Journal August 12. Received cash on account from Oakdale School, $200.00. Receipt No. 2. August 12. Paid cash to owner for personal use, $125.00. Check No. 6. Preparing a Chart of Accounts Preparing a Chart of Accounts 1. Write the account title after the word Account in the heading. 2. Write the account number after the words Account No. in the heading Posting From a Journal to Ledger 1. Write the date. 2. Write the journal page number. 3. Write the debit amount. 4. Write the new account balance. 5. Return to the journal and write the account number. Posting From a Journal to Ledger 1. Write the date. 2. Write the journal page number. 3. Write the credit amount. 4. Write the new account balance. 5. Return to the journal and write the account number. Posting From a Journal to Ledger 1. Write the date. 2. Write the journal page number. 3. Write the debit amount. 4. Write the new account balance. 5. Return to the journal and write the account number. Posting From a Journal to Ledger 1. Write the date. 2. Write the journal page number. 3. Write the debit amount. 4. Write the new account balance. 5. Return to the journal and write the account number. Proving Cash, and Making Correcting Entries 1. Identify the checkbook balance on the most recent check stub. 2. Identify the cash account balance within the general ledger. 3. Match the two balances Proving Cash, and Making Correcting Entries MEMORANDUM FOR A CORRECTING ENTRY Proving Cash, and Making Correcting Entries JOURNAL ENTRY TO RECORD A CORRECTING ENTRY November 13. Discovered that a payment of cash for advertising in October was journalized and posted in error as a debit to Miscellaneous Expense instead of Advertising Expense, $140.00. Memorandum No. 15. Checking Accounts COMPLETED CHECK STUB 1. Write the amount of the check. 2. Write the date of the check. 3. Write to whom the check is to be paid. 4. Record the purpose of the check. 5. Write the amount of the check. 6. Calculate the new checking account balance. Checking Accounts COMPLETED CHECK 1. Write the date. 2. Write to whom the check is to be paid. 3. Write the amount in figures. 4. Write the amount in words. 5. Write the purpose of the check. 6. Sign the check. Bank Reconciliation Bank Statement Bank Reconciliation Bank Statement Reconciliation 1. 2. 3. 4. Date Check Stub Balance Service Charge Adjusted Check Stub Balance 5. Bank Statement Balance 6. Outstanding Deposits 7. Subtotal 8. Outstanding Checks 9. Adjusted Bank Balance 10. Compare Adjusted Balances Bank Reconciliation Bank Statement Reconciliation 1. Write Service Charge $8.00 on the check stub under the heading “Other.” Check Stub Balance 2. Write the amount of the service charge in the amount column. Adjusted Bank Balance 3. Calculate and record the new subtotal on the Subtotal line. Bank Reconciliation JOURNALIZING A BANK SERVICE CHARGE August 31: Received bank statement showing August bank service charge, $8.00. Memorandum No. 3. 1. Write the date. 2. Write the title of the account debited. Record the debit amount. 3. Write the title of the account credited. Record the credit amount. 4. Write the source document number in the Doc. No. column. Dishonored Checks and Electronic Banking RECORDING A DISHONORED CHECK ON A CHECK STUB 1. Write Dishonored check $105.00 on the line under the heading “Other.” 2. Write the total of the dishonored check in the amount column. 3. Calculate and record the new subtotal on the Subtotal line. Dishonored Checks and Electronic Banking JOURNALIZING A DISHONORED CHECK November 29. Received notice from the bank of a dishonored check from Campus Internet Café, $70.00, plus $35.00 fee; total, $105.00. Memorandum No. 55. 1. 2. 3. 4. Write the date. Write the title and amount to be debited. Write the title and amount to be credited Write the source document number in the Doc. No. column. Dishonored Checks and Electronic Banking September 2. Paid cash on account to Kelson Enterprises, $350.00, using EFT. Memorandum No. 10. September 5. Purchased supplies, $24.00, using debit card. Memorandum No. 12. Petty Cash ESTABLISHING A PETTY CASH FUND August 17. Paid cash to establish a petty cash fund, $100.00. Check No. 8. 1. 2. 3. 4. Write the date. Write the title and amount to be debited. Write the title and amount to be credited Write the source document number in the Doc. No. column. Petty Cash REPLENISHING A PETTY CASH FUND August 31: Paid cash to replenish the petty cash fund, $30.00: misc. expense, $20.00; advertising, $10.00. Check No. 12 1. Write the date. 2. Write the title of the first account debited. Write the debit amount. Write the title of the second account. Record the debit amount. 3. Write the title and amount to be credited 4. Write the source document number in the Doc. No. column.