Chapter 5 The Time Value of Money - it

advertisement

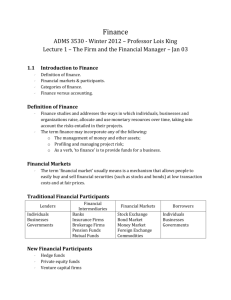

Chapter 2 Financial Management Chapter 2 Outline 2.4 Financial Management 2.1 FORMS OF BUSINESS ORGANIZATIO NS 2 2.2 The Goals of the Business Enterprise 2.3 The Role of Management and Agency Issues 2.1 Forms of Business Organizations 1. Sole proprietorship 2. Partnership 3. Limited liability company 4. Corporation Sole Proprietorship A sole proprietorship is a business owned and operated by one person. 4 The main advantage of a sole proprietorship is that setting one up is easy—no paperwork is involved, and the owner needs only to start doing business. This accountability is unlimited liability because an owner is liable not only to the extent of what is invested in the business but also for any other assets owned. Sole Proprietorship Advantages Disadvantages Easy to form Unlimited liability Business income is taxed once, at the individual’s personal level Lack of continuity Limited access to additional funds 5 Partnerships A partnership is a business owned and operated by two or more people. 6 A partnership can be formalized by having a lawyer create a partnership agreement, which establishes how decisions are made, such as how each partner can buy out the other in the event that one wants to dissolve the partnership. The partnership agreement stipulates how the partnership’s income is allocated among the partners. Types of Partnerships General partnership: partners share the management and income of the business Limited liability partnership (LLP) or simply limited partnership- at least one general partner who manages the business, but there may be any number of limited partners, who are passive investors. 7 Types of Partnerships As long as the limited partners are not active in the business, they have the advantage of limited liability; the most they can lose is their initial investment. The general partner, conversely, has unlimited liability as the operator of the business. In practice, however, many general partners are corporations (discussed later) and indirectly benefit from limited liability. 8 Partnerships Advantages Disadvantages Easy to form Unlimited liability for general partners Business income is taxed once, at the individual partners’ level Lack of continuity Limited access to additional funds 9 Corporations A corporation is a business organized as a separate legal entity under corporation law, with ownership divided into transferable shares. In tax law, such a business is generally taxed as a C corporation (C corp). A corporation is easy to recognize because it has Inc. for incorporated, Ltd. for limited, or, in Europe, PLC for private limited corporation or AG for Aktiengesellschaft, after its name. Owners have the benefit of limited liability: the maximum that owners can lose is their investment. 10 Corporations A corporation is usually formed by filing articles of incorporation and receiving a certificate of incorporation from the state. The articles of incorporation indicate the most basic information about the company, such as its mailing address, name, line of business, number of shares issued, names and addresses of the officers of the company, and so on. The critical feature is that the corporation is a distinct legal entity. 11 Corporations In corporations, the owners are the owners of the ownership interests—that is, the shareholders— who elect members of the board of directors, who in turn hire and monitor the company’s management. For smaller companies, the separation of management and ownership isn’t a problem, but for larger companies, it becomes a serious concern. This division is the fundamental problem of the governance structure of large companies 12 Corporations Advantages Disadvantages Limited liability Income taxed at the corporate level and at the owners’ level, when distributed Unlimited life Separation of owners and management Access to capital 13 Limited Liability Companies A limited liability company (LLC) is a business organized as a separate legal entity in which owners have limited liability, but the income is passed through to the owners for tax purposes. 14 Limited Liability Companies Advantages Disadvantages Limited liability for the owners Separation of owners and management Unlimited life Access to capital Income taxed only at the owners’ level 15 Subchapter S Corporations A subchapter S corporation (Sub S) is a corporation that elects to be taxed as a partnership. So how does a Sub S compare with an LLC? Let’s consider their basic characteristics: Characteristic Sub S LLC Taxation Pass-through Pass-through Ownership Maximum of 100 shareholders No maximum Liability Limited liability Limited liability Life 16 Perpetual Limited LLC v. Sub S v. C corp. v. ? An LLC can choose to be taxed as a Sub S Venture capitalists prefer C corporations Retaining profits? Use a C corp. LLCs can have more than one class of stock; Sub S’s cannot. Losses? You can pass through more losses through an LLC than with a Sub S. Distributing income? Must be by number of shares for a Sub S, but can be disproportionate for an LLC. 17 LLC v. Sub S v. C corp. v. ? Sub S limited to 100 shareholders and all must be US citizens or permanent residents. Sub S and C corp requires board of directors, annual reports, records of meetings, and other regulatory compliance; with LLC just need an operating agreement (may be informal). LLC has a limited life; Sub S and C corp are perpetual. Owners of LLCs must pay SE tax; Sub S and C corp distributions may be dividends, but reasonable compensation is required. Some states do not recognize Sub S status and some 18 tax double (NY: Sub S profits and s/h share of profits). Distribution of Number of Businesses and Revenues of Business by Form 19 Source of data: Internal Revenue Service, Statistics of Income Form of business Initial form of business Sole proprietorship 33% The predominant forms of business are the sole proprietorship, the limited liability company, and the Subchapter S corporation. Limited liability company 32% Other 0% Limited partnership 2% General partnership 3% C Corporation 9% Source of data: The Kaufman Foundation Subchapter S 21% Form of business over time Start-up companies begin their existence as sole proprietorships, limited liability companies, or Sub S corporations. Partnerships and C Corporations are rare. Portion of all start-ups Following the companies in their first 6 years 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Other Limited partnership General partnership C Corporation Subchapter S Limited liability company Sole proprietorship Initial 2 4 6 Year in the life of a business Source of data: The Kaufman Foundation How do they finance the business? The first 6 years Note that venture capital investors and angel investors do not play a large role in most start-ups. 100% Portion of all start-ups Start-up companies are largely funded by the owners themselves. As the business generates cash flows, fewer tap outside sources of funds. 90% Other 80% Venture capital 70% 60% Government 50% Investment companies Angel investors 40% 30% Parents 20% 10% Spouse 0% Owners Initial 1 2 3 4 5 6 Year in the life of a business How do owners get their funds? The first 6 years 100% The percentage of owners who rely on credit card funding – personal and business – is high. Portion of all start-ups 90% 80% 70% 60% Other sources 50% Personal loan - other Personal loan - Family 40% Personal loan - Bank 30% Personal credit card 20% Business credit card 10% 0% Initial 1 2 3 4 5 6 Year in the life of a business Who gets venture capital? Initial year Construction Manufacturing Though a limited source of funding, manufacturing receives more of the venture capital than other industries Wholesale trade Retail stores Delivery and storage Information Finance and insurance Scientific and technical services Waste management and remediation Health care Arts, Entertainment and recreation Example: Facebook Founded by Zuckerberg, Saverin, Moskovitz and Hughes Feb 2004 Incorporated in Delaware, with headquarters in Palo Alto, CA Dec. 2004 VC Peter Thiel invests $500,000 June 2004 25 Initial public offering May 2012 [$114 billion] 2.2 The Goals of the Business Enterprise 26 Stakeholder A stakeholder of a business is a party that is affected by the decisions and operations of the business entity. Stakeholders include not only the owners, but also the creditors, the employees, the suppliers, and the customers. 27 The Business Entity and Its Stakeholders 28 Primary Corporate Goal The goal of the company is to maximize the market value of the equity interest or, alternatively, maximize shareholder value. The company should take resources and create products that society values more highly than it values the inputs. The company should operate legally and in compliance with its contractual responsibilities, in the interests of its owners, by creating value for them. 29 2.3 The Role of Management and Agency Issues 30 Managers are employees and as such are agents working on behalf of the shareholders. We refer to this relationship as agency relationship. Despite the fact that managers have a duty to shareholders, there is always the possibility that managers will act in their own self-interest. This is the classic agency problem associated with the separation of ownership from management. The costs associated with the agency problem are referred to as agency costs. Aligning Managers’ and Owners’ Interests The different perspectives of managers and shareholders are evident in terms of performance measurement. For example, when being appraised, managers want to be judged relative to accounting numbers, such as profits and return on investment (ROI), because they can control these numbers to some extent. In contrast, shareholders are interested in stock market performance because they want managers to create shareholder value. 31 Aligning Managers’ and Owners’ Interests Shareholders and managers also differ in their approach to risk and financing: Shareholders take a portfolio approach because they hold many assets. This allows them to reduce risk by diversifying (that is, invest in assets whose returns are not perfectly in synch with one another), whereas managers may see their careers totally tied up with the company and tend to act more conservatively. 32 Aligning Managers’ and Owners’ Interests The challenge is to design compensation schemes that encourage managers to act in the best interest of shareholders. The elements that are typically included are salary, bonus, and options. 33 CEO Compensation (2012) 1-Year Pay 5 Year Pay ($mil) ($mil) 131.19 285.02 66.65 204.06 64.40 60.94 60.94 55.79 96.11 51.52 100.21 50.18 90.3 48.83 169.3 Shares Owned ($mil) 51.9 5,010.4 171.7 8,582.3 21.5 47.3 128.2 155.8 Rank 1 2 3 4 5 6 7 8 Name John H Hammergren Ralph Lauren Michael D Fascitelli Richard D Kinder David M Cote George Paz Jeffery H Boyd Stephen J Hemsley Company McKesson Ralph Lauren Vornado Realty Kinder Morgan Honeywell Express Scripts Priceline.com UnitedHealth Group 9 Clarence P Cazalot Jr Marathon Oil 43.71 67.23 30.3 10 John C Martin Gilead Sciences 43.19 214.92 90.9 34 Source: Forbes.com Aligning Managers’ and Owners’ Interests Notice that in all cases in the previous table, the salary compensation is relatively low compared with the total package. This is likely the result of the limitation of $1 million per executive for the deductibility of compensation for tax purposes. Annual bonuses are generally somewhat larger, but the largest component, by far, is share compensation. 35 This comes in two forms: grants of restricted stock awarded under incentive plans, and stock options, for which if the company’s stock price goes above a certain level, the executive gets the right to buy the stock at a fixed lower price, referred to as the exercise or strike price. The idea behind share incentive plans is simply to affiliate the best interests of CEOs and senior managers with those of shareholders. Problems Aligning Managers’ and Owners’ Interests 36 Few companies require executives to own the stock after exercising an option, so often the shares. obtained with an option exercise are sold immediately Some companies re-price the options if the stock’s price is far under the original exercise price, setting the exercise price much below the original price. It is challenging to establish a plan that compensates executives for making long-term strategy and investment decisions today that take the long-run view of maximizing owners’ equity. Aligning Managers’ and Owners’ Interests Corporate governance is the set of processes and procedures established to manage the organization in the best interests of its owners. In addition to the compensation structure, corporate governance includes 37 the composition and processes of the compensation committee of the company’s board of directors, the composition of the committee that selects and oversees the work of the independent auditor and the transparency of financial reporting. Aligning Managers’ and Owners’ Interests The compensation committees of the board of directors that design compensation systems were not always completely independent of the CEOs who received the compensation, but this changed with the Sarbanes-Oxley Act of 2002 (SOX Act). As a result of the SOX Act, publicly-traded companies in the U.S. must now have compensation committees that comprise independent directors. 38 2.4 Financial Management Financial management is the management of the financial resources of a business or government entity, where financial resources include both the investments of the entity, but also how the entity finances these assets. 39 Investment Decisions Capital budgeting or capital expenditure analysis- the framework for analyzing longterm investment or asset decisions Some of the most important decisions a company can make These long-term investments include building a new plant, introducing a new product, and acquiring another company. Without capital investments, the company will not continue as a going concern. 40 Investment Decisions Evaluating capital budgets requires analyzing the future incremental cash flows that a project is expected to generate, considering the project’s cost of capital. In most cases, a capital investment requires a substantial outlay at the beginning, but the investment is expected to generate incremental cash flows for a number of periods into the future. 41 Long-term vs. Short-term Investments Long-term investments make up only 16% of total assets, on average, for U.S. business entities. However, if we break this down by industry, we get a different picture: the investment of companies’ assets varies by industry. 42 Asset Composition for CSX, Wal-Mart Stores, and Darden Restaurants 43 Financing Decisions The financing decisions of a company involve the management of short-term obligations, such as bank loans, and long-term financing, which may be debt and/or equity. The management of short-term obligations requires understanding the needs of the company throughout the year for short-term borrowing and trade credit. There are many forms of short-term financing, and the financial manager must evaluate the cost of each available type. 44 Financing Decisions An important decision of a company regards its capital structure. A company’s capital structure is the mix of debt and equity that the company uses to finance its business. Debt capital consists of interest-bearing debt obligations, which may be notes or bonds, whereas equity capital consists of stock issues and retained earnings and is the ownership interest in a business enterprise. 45 Capital Composition for CSX, WalMart Stores, and Darden Restaurants 46 Corporate Finance Corporate finance is the financial management of assets and corporate financing decisions. Five major questions: How does a company decide between raising money through debt or through equity? 2. In terms of equity, how does a company raise the equity: through retaining earnings or through issuing new equity? 3. Why does a company decide to go public and issue shares to the general public vs. remaining a non-traded private company? 4. If a company decides to issue debt, what determines whether it is bank debt or bonds issued to the public debt market? 5. What determines whether a company accesses the shortterm money market vs. borrowing from a bank? 1. 47 Summary There are many different ways of organizing businesses, including the sole proprietorship, partnership, corporate, and limited liability company forms of business. Considerations in evaluating the form of business enterprise include liability, taxation, control, and continuity. 48 Summary, continued The management of a company should make decisions that maximize owners’ wealth, though this is not always the case. In large corporations, in which there is separation between management and owners, motivating management to act in the owners’ best interest is challenging. Agency costs may arise because managers may not act in the best interests of shareholders or because they must be induced to act optimally. 49 Summary, continued The primary decisions made by corporations involve the financial management of the company’s real and financial assets, as well as the associated corporate financing decisions. 50