Contract Farming for Exports in ACMECS: Lessons & Policy

advertisement

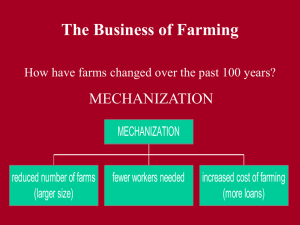

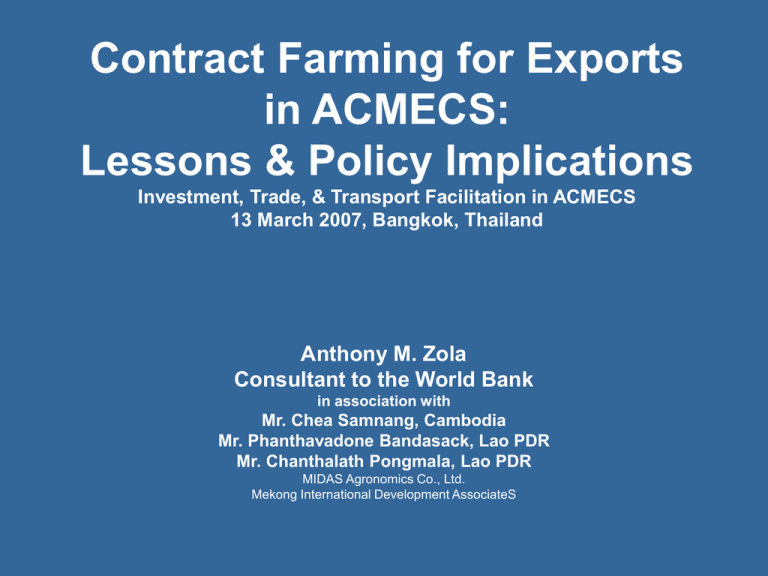

Contract Farming for Exports in ACMECS: Lessons & Policy Implications Investment, Trade, & Transport Facilitation in ACMECS 13 March 2007, Bangkok, Thailand Anthony M. Zola Consultant to the World Bank in association with Mr. Chea Samnang, Cambodia Mr. Phanthavadone Bandasack, Lao PDR Mr. Chanthalath Pongmala, Lao PDR MIDAS Agronomics Co., Ltd. Mekong International Development AssociateS Outline of the Presentation • Tasks of the assignment • Methodology • Assumptions vis-à-vis agriculture valuechains in the GMS / Context • Hypothesis • Preliminary findings from Lao PDR • Preliminary findings from Cambodia • Some indicative policy implications 2 Tasks of the Assignment • Status of contract farming for export in Laos & Cambodia • Potential for additional contract farming for export • Obstacles / constraints to expansion of contract farming for export • Actions required to increase benefits of contract farming to farmers / economy 3 Methodology • Literature review • Interviews: farmers, officials, agribusiness operators, consultants, researchers, NGOs • Field visits to contract farming sites in Cambodia & Laos (and previously to sites in China & Thailand) • Observation visits to border crossings 4 Methodology: Literature Review–Principle Sources of Data & Information • GMS: Research for the Rockefeller Foundation: Study on Enhancing Upland Food Security and Crossborder Agricultural Production Supply Chains in the Greater Mekong Subregion, 2004-present • GMS: Presentation for UNESCAP workshop on The Role of Global Value Chains in Agribusiness SME Development in the GMS, Kunming, 2006 • Laos: ADB project preparation technical assistance for a Participatory Livestock Development Project, 2005 • Laos: ADB supported Northern Regional Development Strategy, 2002-2004 • GMS: Selected Issues Related to Contract Farming of Organic Agriculture in the Greater Mekong Subregion, Asian Development Bank Institute/ ADBI, August 2004 • Laos: ADB/Greater Mekong Subregion/Working Group on Agriculture, Report on Training to Initiate Contract Farming in Oudomxay Province, Lao PDR, 2004 5 Methodology: Interviews & Field Visits • Laos: Field work to update & • Laos: Field work for the Lao confirm information, 3-5 March 2007 Northern Regional Development Strategy, 20032004 • Cambodia: Field work to research status of contract farming, 6-17 March 2007 • Thailand, Laos, China & Viet Nam: Field visits for Rockefeller Foundation research on food security and crossborder agricultural production supply chains, 2004-2005 Friend of the Upland Farmer Co., Ltd, Luang Namtha Province, northern Lao PDR, producing corn, soybeans, & cardamom under contract farming for export to China 6 Methodology: Recent Observation Visits to Border Crossings • Laos: Field work to update & confirm information, 3-5 March 2007 – with Meng-la, Yunnan, China at Boten, Luang Namtha & Naa Moh, Oudomxay • Laos: ADB project preparation, Participatory Livestock Development Project, 2005 – with Meng-la, Yunnan, China at Boten, Luang Namtha & Naa Moh, Oudomxay – with Viet Nam at Nam Kan, Xieng Khouang; at Naa Meo, Houa Phanh; • Laos: ADB / Northern Regional Development Strategy, 2002-2004 – – with Viet Nam at Mouang Et & Naa Meo, Houa Phanh;at Nam Kan, Xieng Khouang; with China at Mouang Singh & Boten, Luang Namtha; at Na Moh, Oudomxay with Thailand at Kaen Thao, Xayaboury & Tha-ly, Loei; at Sanakham, Vientiane Province & Chiang Khan, Loei; at Mouang Ngeun, Xayaboury & Chalermphrakiat, Nan; at Ton Pheung & Huay Xay, Bokeo & Chiang Saen & Chiang Khong, Chiangrai; at Mouang Mom, Bokeo & Shan State, Myanmar • Myanmar: Study visit to Shan State with Mae Fah Luang Foundation March, 2004 - with China at Mong La, Mong Pawk, & Pangsang The Lao-Viet Nam frontier at Nam Kan Nonghet District, Xieng Khouang Province, where Vietnamese authorities claimed they are not equipped to facilitate exports by Lao traders to Viet Nam. 7 Assumptions vis-à-vis global value-chains & implications for agricultural development in the GMS (Context) • Current trends in global agribusiness – Concentration and consolidation – Vertical / horizontal integration & globalization • Regional development factors • Questioning of the development paradigm 8 Assumptions: Concentration and Consolidation Global value chains are impacted by lower cost producers in North America resulting from: • Increase in market concentration in nearly all agricultural sectors. – e.g., Livestock. In 2004, the 4 largest beef firms processed 81% of all the cattle; the 4 largest pork firms process 59% of pork; and 4 chicken firms process 50% of all broilers • Emergence of vertically and horizontally integrated multinational food and agricultural corporations. – e.g., Grains. The 4 largest wheat processors have 61% of the market; the 4 largest soybean processors have 80% of the market • Consolidation of retailers / who also may be producers Source: Research conducted by the National Farmers Union, USA, 2004 9 Assumptions: Concentration and Consolidation Five Top Grocery Retailers in the USA 1997 2000 2003 Kroger Kroger Walmart Safeway Walmart Kroger American Stores Albertson’s Albertson’s Albertson’s Safeway Safeway Ahold USA (TOPS) Ahold USA (TOPS) Ahold USA (TOPS) Top 5 = 24% Top 5 is percentage of market share held by 5 top retailers Top 5 = 42% Top 5 = 54% (est.) Source: Research conducted by the National Farmers Union, USA, 2004 10 Assumptions: Vertical Integration and Globalization – Case of Walmart Processors: • Tyson’s Food • IBP, Inc. • Farmland Foods • Smithfield Poultry Beef Pork Retailer: Walmart Walmart operations in: • United Kingdom (#3) • Germany • Argentina • Brazil • Canada • Mexico • China • Korea • United States (#2) 11 Assumptions: Implications for Global Value Chains • Consolidation of agribusiness multinationals is creating large agro-industrial operations that pay less for raw materials & production inputs. • Vertical integration connects retailers back to the production and processing stages of the food system. – Retailers can now dictate terms to SME food manufacturers forcing changes back through the system to the farm level. – As the balance of power shifts to the retailers, SMEs in all parts of the food system are being marginalized. – SMEs and households in rural areas are likely to be left out of the development paradigm dominated by large retailers. • Only in certain niche markets can Asian farmers still compete, and these too can be expected to decrease as the North American Free Trade Agreement (NAFTA) expands to include Asian competitors in Central America and the Caribbean. 12 Assumptions: Regional Development Factors with implications for farmers & SMEs in ACMES seeking access to global value chains for agricultural products • Creation of economic development corridors • Emergence of middle class consumers with changed tastes and preferences in China, Thailand, Viet Nam • Trade liberalization (ASEAN, GMS, ACMECS) • WTO membership for China and Viet Nam with new legal obligations • Thailand’s obligation to impose SPS standards on products from neighboring countries; subject to supply side audits • Use of the Mekong River for trade, facilitating trade between China & Thailand 13 Assumptions: Questioning of the Current Development Paradigm in the GMS / ACMECS • International Conference "Critical Transitions in the Mekong Region" 29-31 January 2007, Chiangmai – Discussed: migration, reduction of poverty and social and economic disparity among peoples of the Mekong region. – "Connecting markets (by itself) doesn't always work," JeanPierre Verbiest, ADB country director for Thailand. – Highways can also lead to environmental risk and degradation. – The focus on social concerns has lagged behind. "While there is general growth, when you look at the distribution of growth, you see a different picture." (Rosalia Sciortino, a professor at Mahidol University and Chulalongkorn University). 14 Hypothesis • Link smallholder farmers to regional & global value chains through contract farming – Linkages with local & regional SMEs that can have downstream linkages to transnational & multinational companies and retailers 15 A value chain is a string of agro-enterprises working together to satisfy market demand for a particular product. Input Supplier SME Contract Farming: Credit & Technology Transfer SME Farmer In-field & Post-harvest Quality Control SME Transport & Storage SME Preliminary Processor SME Market / Consumer Food Processor, Distributor, Wholesaler Retailer Input Supplier SME SME = indicates a potential role for SMEs & / or farmers to add value Market / Consumer 16 Lao PDR: Northern Region Develpoment Strategy Major Exports by Province. Preliminary Findings from Lao PDR Major exports (to China & Thailand). Export include: Palm fruit, Cardamom, Sugar cane, Lumber, Rice, and Handicrafts. Major exports (to China, Thailand and Viet Nam) Wood, Clinber bark, Tiger grass (Thysanolaena maxima), Bakerin praen (Afzelia xylocarpa), Maize, Chillies, Palm fruit, Cardamom, Sesame, Mulberry paper, Ginger, Cotton, and Sugar cane Major exports (about 85% to China and 15% to Viet Nam) Exports include: Cardamom, Sugar cane, Benzoin, Livestock, Sesame, Honey, Wood products, and Chillies. PHONGSALY Maojr exports (to Viet Nam and France) Soy beans, Maize, Peanuts, Cardamom, Clinber bark, Oil palm fruit, Ginger, Longan, Mango, White benzoin, Handicrafts, and Cedar LUANG NAMTHA OUDOMXAI Pakmong HOUAYSAI XAM NEUA Major exports (to China & Thailand) Maize, Soyban, Green vegetables, Paddy rice, Tobacco, Oranges, White Sesame. Major export (Mostly to Thailand) Sesame, Job's tears, Mulberry, Dragon blood (Dracaena cambodiana), Jute, Palm fruits, Beans, Cardamom, Benzoin, Resin, and Tiger grass (hysanolaena maxima), LUANG PHRABANG Xam Tai PHONSAVANH Phoukhoun Namkan Khoun SAYABOURI Vang Vieng Thong Khoun XAISOMBOUN Major exports (Viet Nam) Paddy rice, Maize, Livestock, Bananas, Starch root crops, and Pine Major exports (Thailand and Viet Nam) Wood and wood products, and NTFPs PHONHONG Longsan Khock Khao Do Major exports (Thailand) Maize, Peanuts, Sesame, Job's tears, Mulberry paper, Resin, Wood products, Ginger, Cotton, Tamarind, Vegetables, Livestock, Medicinal herbs, and Handicrafts Houay Hung Na Sack VIENTIANE LEGEND National Capital N Provincial Capital District town National Road ADB-Financed Roads Proposed ADB-Financed Roads River 17 Preliminary findings from Lao PDR: Principal Contract Farming Crops for Export, Locations & Export Markets • Short-term crops mostly for export to China: watermelon, green bell peppers – Singh District, Luang Namtha • Upland crops for export to China & Thailand: corn, sugar cane, cassava, soybeans, sesame, cotton – Corn, soybeans, sesame for China & Thailand: Bokeo, Luang Namtha, Oudomxay, Xayaboury – Sugar cane for China: Oudomxay, Luang Namtha, Phong Saly – Cassava for China: Oudomxay, Luang Namtha – Cotton for Thailand: Xayaboury – NTFPs: cardamom & Styrax • Cardamom for Thailand & China: Luang Namtha & Oudomxay • Styrax for benzoin for France & China: Houa Phanh (photo) – Permanent crops: tea, rubber • Tea for China: Houa Phanh, Phong Saly, Oudomxay • Rubber for China: Luang Namtha, Oudomxay, Luang Prabang – Most Thais and Vietnamese are collectors Contract farming of Styrax tonkinensis for benzoin, Houa Phanh Province, northern Lao PDR, for export to Europe & China 18 Preliminary findings from Lao PDR Contract Farming Modalities • Concessions / rubber, sugar cane, cassava, Jatropha, tree plantations – Some are operated as nucleus estates with technical outreach programs – Some companies rent farmers’ land & hire farmers as laborers; rubber – Contract farming between smallholders & Chinese companies; split: 50-50 or 6040; rubber • Joint ventures – Usually between Lao & Chinese individuals; registered / not registered – Chinese guarantee the market, but not the price • Marketing groups – Some villages organize farmer marketing groups • Provincial associations – Local investors establish an association, register with the provincial authorities, organize contract farming of a crop (e.g., Jatropha) & obtain the sole right to market a crop in that province • Most Thai & Vietnamese firms act as collectors & depend on Lao middlemen • Some Thai firms provide credit in kind and ploughing services; no written contracts nor fixed or guaranteed prices 19 Preliminary findings from Lao PDR Issues with Contract Farming -- Indicative • Farmers – Companies cannot be trusted; do not return to purchase; do not buy total harvest; most often with Chinese firms, even when brought to village by district officials – Companies not carefully checked out – Required quality standards are too high – Training is insufficient; superficial (e.g. rubber tapping at 0300 hours) – Some farmers are obligated to cultivate rubber to meet international agreements • Potential Solutions Offered – Examine more carefully the previous experience & contract farming record of the interested company – Company & district agriculture extension agents should provide farmer training: use of lead farmers; frequent refresher training – Contract farming should be voluntary, with clear understanding of all aspects of production 20 Preliminary findings from Lao PDR Issues with Contract Farming -- Indicative • Companies – Farmers cannot be trusted; often sell to traders offering highest price – Quality of produce is poor; farmers lack basic agricultural skills; – Farmers operate to their own calendar – Farmers lack understanding of needs of agribusiness processors – Transport costs are high – Poor quality village access roads – High transaction costs at borders – Lao traders cannot transport to China or to Viet Nam, but traders from both countries can import from Laos – Traditional border crossings are preferred to international crossings; rules are more flexible • Potential Solutions Offered – Organize community marketing groups; self-enforcement of contracts by peers – Repeated training; community selection of lead farmers for intensive training; training as trainer – Creative initiatives – Repeated training – Farmers transport to buying centers using appropriate local transport – Duty, responsibility, obligation of central government; Foreign Affairs, Customs, Immigration, Agriculture; detailed & prioritized in the NRDS – Increase the frequency of market days at traditional border crossings 21 Preliminary findings from Cambodia: Principal Contract Farming Crops for Export, Locations & Export Markets • • Short-term crops for domestic consumption (aiming for export later): rice & organic rice – Organic rice: Mostly in Takeo, and Kompong Speu – Rice for Thailand: Battambang – Rice for Viet Nam: Kompong Cham, Kandal Upland crops mostly for domestic consumption with some export to Korea, Thailand & Viet Nam: tobacco, cotton, cassava, sugar cane, castor beans – Tobacco, cotton, for domestic use & Viet Nam: Kompong Cham, Kandal – Cassava for Viet Nam: Rattanakiri, Kratie – Cassava for Korea: Kompong Speu – Castor beans for Korea: Kompong Thom – Corn for Thailand: Battambang British American Tobacco Cambodia’s tipping & stemming factory, Kampong Cham 22 Preliminary findings from Cambodia: Principal Contract Farming Crops for Export, Locations & Export Markets • Permanent crops: – Rubber for Viet Nam: Kompong Cham, Mondulkiri, and Kratie – Oil palm for Malaysia: Kompong Som – Sugar palm for Europe: Kompong Speu, Kompong Cham – Organic cashew nuts for domestic use (later for export): upland minority areas Lead farmer (left) for British American Tobacco Cambodia in Kompong Cham Province & BAT technicians. BAT farmers have moved up the supply chain by investing in tobacco curing houses. 23 Preliminary findings from Cambodia Contract Farming Modalities • Joint ventures – Often between Cambodian & Vietnamese individuals; registered / not registered; – British American Tobacco is a large registered joint venture – if <$1 million, can be registered at the provincial investment office Cambodian investors – Oil palm, sugar cane, rice, rubber, cassava – Linked to processing & domestic or export markets – Contract farming of vegetables for domestic consumption: Sre Khmer Concessions – Most domestic concessions have not been successful due to poor management – Concessions are available to foreign investors – <200 ha can be approved at provincial level – rubber, cassava, sugar cane, oil palm – Pilots for concession management underway in Siem Reap & Battambang • • • Foreign investors – Tobacco, sugar palm, cotton – Linked to processing & domestic or export markets • Most Vietnamese traders act as collectors & work with Cambodian middlemen Manhattan Textiles contract farmers in Kompong Cham with harvested cotton 24 Preliminary findings from Cambodia Issues with Contract Farming -- Indicative • Farmers – Prices are too low; especially cotton – Confused about which crop to grow; due to price volatility & small farm size – Bad seed – Insufficient training – High cost of transporting crop to factory • Potential Solutions Offered – Provide special tax incentives for firms promoting contract farming of cotton to allow firms to offer higher prices to farmers – Seed quality control by the company – Additional training by company contract farming outreach program; training in IPM – With tax incentives (above) company could provide transport services (or outsource to a SME) – High cost of production: fuel (for pumps & tractors) 25 Preliminary findings from Cambodia Issues with Contract Farming -- Indicative • Companies • Potential Solutions Offered – Farmers operate to their own calendar; farmers lack a business mind-set & any understanding of marketing – Low agricultural skills of farmers – Cost of obtaining organic certification by foreign organization is very high – Creative initiatives (BAT approach) – Farmers think as individuals; lack cooperation – Farm size per household is small; leads to increased costs of operation – Organize group activities; marketing groups – Organize farmer groups to purchase as groups, reducing buying costs – Farmers have inadequate land for contract farming; land held back for family food security – Transport costs are high – Poor quality village access roads – Improve irrigation to allow for second & third cropping; intensified land use – Farmers transport to buying centers using appropriate local 26 transport – Increase the frequency of training – Establish a Cambodian body to be certified and to certify other Cambodians; mutual recognition by ASEAN / GMS / ACMECS Border Crossing Points covered under the GMS Transport Agreement & Locations of the principal contract farming areas (in green) in Cambodia & Lao PDR 27 Some Indicative Policy Implications Cambodia • Increased investment in rural infrastructure: upgrading rural market access roads & dry season irrigation • Carefully examine the BAT model of contract farming • Tax incentives for companies that operate reliable contract farming programs 28 Some Indicative Policy Implications Lao PDR • Foreign companies & joint ventures interested in pursuing contract farming should be registered with provincial commerce & agriculture offices. • Intensive farmer training in cultivation techniques for selected crops (i.e., rubber), irrigated agriculture & postharvest technologies & on-farm irrigation water management in areas, targeted for contract farming • Support national & regional forums for networking between Lao SMEs & large-scale wholesalers, distributors, and retailers; SMEs operating contract farming programs are the principal link back to the smallholder farmer 29 The End Thank you