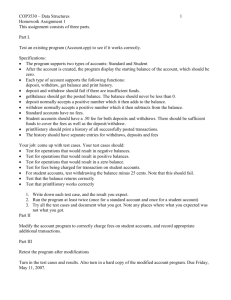

Slide

advertisement

Negative Interest Rates and the Payment System Conference on Removing the Zero Lower Bound on Interest Rates Imperial College, London May 18, 2015 Dave Humphrey, Florida State University Central Banks and the Payment System Banks hold balances with central banks for: Reserve requirement Payment clearing Asset liquidity purposes (excess reserves). Non-Cash Payment Clearing: Card, giro, ACH, and check settlements Interbank wire transfers Maintaining Currency Fitness: Deposit unfit cash, withdraw fit cash Allow for normal cash growth Negative Interest Rates and the Demand for Cash 1. Negative interest rate on central bank balance Cash has zero interest rate, vs negative rate on balance Banks have incentive to withdraw cash 2. If bank costs are passed on to depositors as fee on balance then: Depositors also have incentive to withdraw cash 3. If solve problems 1 and 2, then negative interest rates will not have much effect on the payment system or payment instrument use. Some Proposed Solutions Main Issue: How to tax "non-normal" use of cash with the least disruption? Eliminating cash Some benefits, but disruptive and not politically feasible. Cash replacement Government-issued reloadable stored-value card less disruptive. Not yet politically feasible. Bank tests in Europe/U.S. not supported. Bar coding currency Would work but administratively difficult. Exchange rate between currency and electronic money Would work but disrupts established norms. Would not be popular. Who to Target? 1. Banks: Already deposit & withdraw cash from central bank balance. 2. Retailers: Deposit & withdraw cash at banks over-the-counter & by armored courier. 3. Non-Retail Firms: Use little cash. Seek to hold low idle balances at banks. 4. Consumers: Withdraw cash from bank ATMs or over-the-counter. Need to target banks and consumers. Business is not the problem. The Stock/Flow Cash Circle 2014 Central Bank $676 B Banks $777 B Cash in Circulation $1.13 T * Cash Deposits Banks Cash Withdrawals ATM $687 B Over-the-Counter $1.5 T Consumers & Business * Domestic stock of cash is $636 B. Using Existing Procedures to Tax Bank Cash Use 1. Banks: Central bank currently charges banks for both cash deposits and withdrawals. A. Central bank can charge a negative interest rate on a bank's net quarterly withdrawal of cash (adjusted for net currency growth of 2% or $82 B a year). OR B. If bank vault cash counts as satisfying reserve requirements, any net quarterly withdrawal of cash could raise reserve requirements by an equal amount. Using Existing Procedures to Tax Consumer Cash Use (1) 2. Consumers: Withdrawing cash from ATMs or over-the-counter at banks. A. Account maintenance fees typically fixed per account ($10/mo, $120/yr). If consumers face a higher fixed monthly fee per account, there is no incentive to withdraw cash. Regardless of deposit balance, withdrawing more cash won't save money. B. Currently, fees on size of balance do not exist in U.S. (nor elsewhere?) Only if the deposit fee is a function of the size of the balance is there an incentive to withdraw cash. Exception: a capital requirement to limit volatile S-T funding (e.g., large hedge fund DDA balances carry a capital “fee”). Using Existing Procedures to Tax Consumer Cash Use (2) C. If fee applies to deposit balance (rather than to deposit account), banks can impose/raise ATM fees to limit cash withdrawals. Extra Fee on ATM? Weekly $118 cash withdrawals reduce deposits by $531/mo. A 2% (5%) tax on ATM withdrawals could be $0.90 ($2.20)/mo. Extra Fee on Deposit Balance? Median family income $60,000, so after tax deposit ≈ $4,000/mo. and average deposit balance ≈ $2,000/mo. A 2% (5%) monthly tax on this balance is $3.33 ($8.33) vs. current average fixed fee of $10. Being paid bi-weekly reduces fee to $1.50 ($3.80) per month. Fees may only be 25% of negative interest rates, as deposits ($11 T) > balances ($2.8 T) at US and most central banks. Impact on Payments if Consumers do Use More Cash Current Demand for Cash ATM cash withdrawals = $687 B and are 26% of domestic stock of cash ($636 B). Potential Reduction in Bank Card Income Average ATM cash withdrawal is $118. If an extra $50 is withdrawn each time and used for card transactions at the POS, then card payments would fall by $290 billion (5.8 B ATM transactions x $50). Card payments are $3 T. A $290 B substitution of cash for cards reduces bank interchange income by 10%, but is only 0.6% the $11 T in bank deposit funding. Other Effects on Payments With negative interest rates assessed on bank deposit balances, other payment changes are possible (McAndrews & Garbade, 2012). 1. Pay bills/invoices early, rather than delay these payments. 2. Increased demand for travelers checks and cashiers checks (made out to the purchaser) but held idle. 3. Over-pay quarterly tax pre-payments or pre-pay credit card balances. 4. Pay workers bi-weekly vs. monthly (reduces average deposit balance). 5. If negative interest rates are large and not temporary, a non-bank firm may arise that takes only cash deposits and holds only cash assets, outsourcing transactions to a regular bank (like a MMMF today). Summary 1. Incentive to withdraw cash from central bank balance can be offset by charging a negative interest rate on any net quarterly cash withdrawal. Can do the same for businesses, although they are net depositors overall. 2. If banks place a fee on the size of a deposit balance then consumers have an incentive to withdraw cash from ATMs. Banks will have an incentive to raise ATM fees because: (1) Central banks will charge them for the extra ATM cash withdrawn and (2) banks face lower card income if cash replaces cards at the POS. 3. Can eliminate consumer/business incentive to withdraw cash, but cover bank costs from negative interest rates, by charging a fixed fee per account.