Harding Township School Preliminary Budget Report II

advertisement

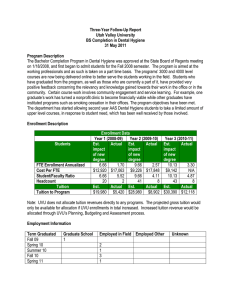

Alex Anemone, Superintendent of Schools Bob Brown, Interim Business Administrator February 2, 2015 Mr. Davor Gjivoje - President Mr. John Flynn –Vice-President Mrs. Kim Macaulay Mr. Abi Singh Dr. Howard Kotkin Math Facts Assessments/K-5 students. District Writing Assessment/K-8 students. PARCC preparation and communication. Continue Data Dashboard. The proposed 2015-2016 budget will support yet to be named goals for the 20152016 school year. The operating budget is: ◦ A statement, in financial terms, of the district’s educational priorities. ◦ A management tool that projects and balances the district’s revenues and expenses. ◦ A process that gauges efficiency. ◦ A consensus document – BOE, Administration, Parents, Staff, Community. ◦ A reflection of the community’s values (small class size, technology, co-curricular activities, facilities maintenance, etc.) Limited by a +2.0% cap (plus allowable exemptions) on the local tax levy – NOT the total budget. 2.0% increase to local tax levy will equal an increase of approximately 1.8% in the operating budget. This is due to the fact that approximately 90% of our budget derives from local property taxes. Our budget has many line items that are increasing at a faster rate. These items include salaries, health benefits, and special education. These items “crowd out” other portions of the operating budget. NOT developed by increasing each line by a certain percentage. Projections are made up to 17 months in the future. For example, budget (revenues and expenses) estimates made in February 2015 will have to remain accurate until June 30, 2016! Review CAFR, 14/15 budget and plan ahead for 15/16 operating budget. (ongoing) Refine and update position control roster. (completed) Audit health benefits roster. (completed) Principal – curriculum items. (completed) Forecasting and budgeting for OOD placements for 2015-2016. (ongoing) Refine revenue (tuition, federal grants, state aid) estimates for 2015-2016. (ongoing) Factors affecting operating budget: ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Student achievement. Staffing – anticipating one additional Sp.Ed. teacher. Increases in health benefits premiums. +12-15% Enrollment - predicted to be flat. Curriculum development and support. Professional development and other unfunded mandates. Maintaining small class size. Continued technology upgrades. Ongoing maintenance needs. HTEA salary increases. +2.60% (as per CBA) State aid $233,677 n/c Tuition revenue $52,300 n/c Budgeted fund balance $274,680 +$119 Federal grants $55,000 ($8,548) Misc. revenue $33,225 n/c Transportation fees $10,000 n/c Extraordinary Aid $190,000 ($10,000) Building usage fees $9,000 n/c Tier IV/health benefits contribution n/c 2009-2010 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015 $364,473 $0 $181,191 $225,137 $225,137 $233,677 2015-2016 $233,677 (est.) $300,000 $250,000 $200,000 $150,000 BFB $100,000 State Aid $50,000 $0 FY FY FY FY FY 11/12 12/13 13/14 14/15 15/16 1997-2011 (average) 2011-2012 2012-2013 2013-2014 2014-2015 +6.01% +1.96% +1.78% +1.50% +2.60% 2015-2016 +2.96% (est.) Please note this number reflects saved “banked cap” generated during the 2012-2013 budget cycle. All other revenue lines (state aid, federal grants, budgeted fund balance, tuition, etc.) are flat or down slightly. Includes one new teacher of students with disabilities. (new) HTEA salary increase +2.6% (as per CBA) Health benefits premiums +12-15% (est.) Dental benefits premiums +5% OOD special education tuition +3-6% Facilities improvements – E.S. bathroom renovation – five year lease/purchase. Estimated $70,000/year (15/16 – 19/20). Power School. Honeywell. T-Eval/Marshall Model. My Learning Plan. My School Building/School Dude. AESOP (staff attendance and substitute procedures). Applitrack (human resources tool). School Wires (website management). Safe Schools (staff professional development). CDK (accounting software). Professional development and curriculum development. Technology upgrades. Year Saved $ Amount Year Expires 2012-2013 $82,496 2015-2016 2013-2014 $74,390 2016-2017 2014-2015 $0 N/A 2015-2016 $0 (est.) N/A Oct.-Dec. – Administrative meetings November 3 – Budget guidelines approved/BOE December 15 – Preliminary budget report I February 2 – Preliminary budget report II February 27 – State aid figures released March 16 – Tentative budget presented to BOE March 20 – Tentative budget submitted to ECS April 27 – Public hearing on the budget July 1 – New fiscal year begins