Topic 3: Simulation

advertisement

Simulation

Downloads

Today’s work is in: matlab_lec03.m

Datasets we need today:

data_msft.m

Histograms: hist()

>>X=[2*ones(3,1); 3*ones(5,1); 7*ones(4,1)];

>>subplot(2,1,1);

>>hist(X); %draws histogram of X

>>subplot(2,1,2);

>>hist(X,[0:.25:10]); %draws histogram of X

%on the interval [0 10] with bins of size .25

Default is a histogram with 20 bins,

from min(X) to max(X)

hist(X,n) will keep default min and max

but make n bins

Uniform rv: rand()

A uniform random variable (rv) has

equal probability of occurring at any

point on its support

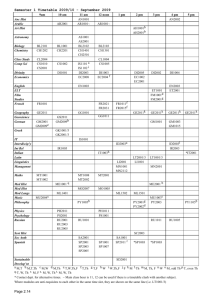

>>T=1000;

>>X=rand(T,1); %creates a matrix of size

%(Tx1) of uniform rv’s on (0,1)

>>a=5; b=50;

>>Y=a+b*rand(T,1); %creates a matrix of

%size (Tx1) of unifrom rv’s on (a,a+b)

Using hist()

and rand()

>>subplot(3,1,1);

>>hist(X,[-.25:.025:1.25]); %draws

%histogram of X

>>subplot(3,1,2);

>>hist(Y,[.9*a:(b/30):1.1*(a+b)]); %draw

>>T=100000; Z=a+b*rand(T,1);

>>subplot(3,1,3);

>>hist(Z,[.9*a:(b/30):1.1*(a+b)]);

subplot;

Law of Large

Numbers (LLN)

Note that E[X]=.5

>>X=rand(5,1); disp(mean(X));

>>X=rand(10,1); disp(mean(X));

>>clear Y;

for i=1:200;

Y(i)=mean(rand(i,1));

end;

>>plot(Y);

How quickly does Y tend to .5? CLT will tell

us

Discrete rv’s

Oftentimes you will need to simulate rv’s

with a small number of possible outcomes

You can use the uniform rv to create

discrete rv’s (ie coinflips)

%x=1 with probability p and 0 with (1-p)

>>p=.25; if rand(1,1)<p; x=1; else; x=0; end;

%x=3 with p=.25, 2 with p=.5, 1 with p=.25

>>y=rand(20,1);

>>x=3.*(y>.75)+2*(y<=.75 & y>.25)+1*(y<=.25);

>>hist(x,[0:.25:4]);

Central Limit

Theorem (CLT)

Tells us that means of many rv’s

converge to a normal rv

This is why normals are so common in

nature!

Let x=uniform rv

Let y=0 if x<.3 and 1 if x>=.3

Let z be the mean of j binomial rv’s

Note that z itself is a rv, in particular,

when j=1, y=z

CLT (cont’d)

Think of y as a biased coin flip

Think of z as the mean of j coinflips

>>A=[1 5 10 25 50 100];

for k=1:6;

j=A(k);

for i=1:5000;

x=rand(j,1);

y=(x<.3)*0+(x>=.3)*1;

z(i,k)=mean(y);

end;

end;

CLT (con’d)

>>for k=1:6;

subplot(3,2,k); hist(z(:,k),50);

end;

subplot;

We will now have 6 plots. Each will have a

histogram of rv z, which is a mean of j

binomial rv’s y.

What do distributions with high j look

like?

Ever wonder why distribution of human

heights looks like a normal rv?

Normal rv:

randn()

Works same as uniform, but produces

a normal of mean 0, standard

deviation 1

>>X=randn(10000,1);

>>subplot(2,1,1); hist(X,50);

To produce normal rv’s with different

mean or variance, just skew and shift

>>m=1.1; s=.16; X=m+s*randn(10000,1);

>>subplot(2,1,2); hist(X,50);

A simple

security process

R(t)=mu+sigma*x(t) (x is normal, R is

normal)

10% annual return and 30% annual

standard deviation are quite typical for

equity

>>T=10000; mu=1.1; sigma=.3;

>>x=randn(T,1);

>>R=mu+sigma*x;

>>subplot; hist(R,50);

Do you notice anything “strange” about

this process or the histogram?

A better process

R=exp(mu+sigma*X(t)) (R is lognormal)

exp(x) is approximately 1+x, so if

want mean of process approximately

1.1, you need x to be approximately

.1

Can this return be negative?

Calibration Issue:

Jensen’s Inequality

Jensen’s Inequality: E[f(X)] ≠ f(E[X])

Stein’s Lemma:

E[exp(X)]=exp(m+.5*s2) where X is

normal rv with mean m, standard

deviation s

If you want R to have mean exp(m),

than make sure rv X inside of exponent

has mean m-.5*s2

With non-normal processes (ie jumps),

things will be more complicated

Calibration Issue:

Interval length

The “right” way to simulate is:

R(t ) exp m * dt X (t ) * * dt

X(t) is N(0,1)

dt=1/T where T is the number simulations per period

m is the mean per period, σ is the standard deviation

per period

For example, if one period is one year and we are

simulating monthly, than T=12, m is the annual mean

(ie 10%), σ is the annual standard dev (ie 20%)

When the length of the period (over which we measure

parameters) is equal to the simulation period, than T=1

and this reduces to what we saw earlier

Calibrate Microsoft

Get daily microsoft data from CRSP or

course website

>>data_msft;

>>disp(mean(msft(:,4)));

>>disp(std(msft(:,4)));

%Microsoft returns have a daily mean of

%.097% and standard deviation of 2.21%

>>subplot(2,1,1); hist(msft(:,4),[-.2:.01:.2]);

>>axis([-.2 .2 0 800]); xlabel('Actual');

Simulate Microsoft

>>T=3022;

>>mu=.00097-.5*.0221^2; sigma=.0221;

>>x=randn(T,1);

>>r=exp(mu+sigma*x)-1;

>>subplot(2,1,2);

>>hist(r,[-.2:.01:.2]); axis([-.2 .2 0 800]);

>>disp(mean(r)); disp(std(r));

>>disp([skewness(r) skewness(msft(:,4))]);

>>disp([kurtosis(r) kurtosis(msft(:,4))]);

Compare

simulated to actual

Mean, standard deviation, skewness

match well

Kurtosis (extreme events) does not

match well

Actual has much more mass in the tails

(fat tails)

This is extremely important for option

pricing!

CLT fails when tails are “too” fat

Next Week:

Modelling Volatility

How to make tales fatter?

Add jumps to log normal distribution to

make tails fatter

Jumps also help with modeling default

Make volatility predictable:

Stochastic volatility, governed by state

variable

ARCH process (2003 Nobel prize, Rob

Engle)

Optional

Homework (1)

Create a function that will simulate

microsoft stock using a log-normal

process

The function should take in

arguments mu (mean), sigma

(standard deviation), and T (number

of days)

Its output should be a vector of daily

returns