Credit scoring

advertisement

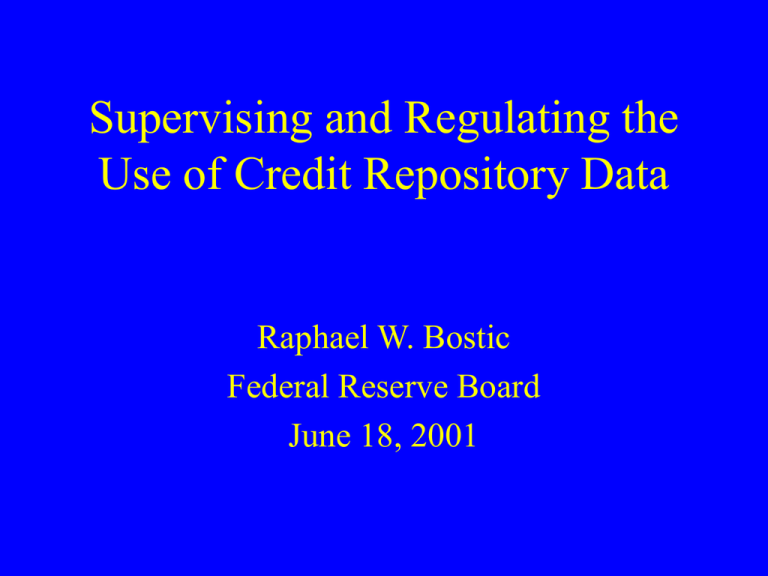

Supervising and Regulating the Use of Credit Repository Data Raphael W. Bostic Federal Reserve Board June 18, 2001 Introduction • Federal Reserve oversees activities of institutions that use data at credit repositories • Our concerns: – Data are accurate – Data are complete Regulatory Structure • What data can be kept – Prohibitions against collecting certain data – Examples: gender, race, marital status Regulatory Structure • What data can be kept • How long data can be kept – Allows for opportunity to recover Regulatory Structure • What data can be kept • How long data can be kept • Who can access the data – Grounds for obtaining personal information – Legitimate business purpose required Regulatory Structure • • • • What data can be kept How long data can be kept Who can access the data How are disputes handled – Critical for addressing accuracy concerns Institutional Structure • Repositories have an incentive to make their data complete – Profit motive: lenders want models that work best Institutional Structure • No regulatory requirement to report credit information • A self-enforcement mechanism – Lenders do not have to report – Repositories do not have to provide access Introduction to Regulation and Supervision • Credit scoring and safety and soundness • Credit scoring and fair lending enforcement Credit Scoring and Safety and Soundness • Credit scoring uses – Rank applicants according to credit quality – Estimate probability of default • for individual applicants • at portfolio level Credit Scoring and Safety and Soundness • If the scoring model does not work, an institution can face significant, and unforeseen, risks • Could potentially results in institutional stress Credit Scoring and Safety and Soundness • Supervisors must monitor the performance of scoring models - “Model validation” • In the US, model validation is done by specialists at the banking regulatory agencies Credit Scoring and Safety and Soundness • Validation objectives – Evaluate model stability, reliability, and accuracy – Conduct benchmark analysis/back-testing Credit Scoring and Safety and Soundness • Validation process – Evaluate sample design – Evaluate model design – Assess internal validation procedures Credit Scoring and Fair Lending • Ensure that discrimination against protected classes does not occur – Overt discrimination – Disparate treatment – Disparate impact Credit Scoring and Fair Lending • In the US, fair lending oversight is conducted by examiners of the banking regulatory agencies Credit Scoring and Fair Lending • Model validation – Was the model developed in accordance with fair lending laws? Credit Scoring and Supervision and Regulation • Final point – “I don’t know” is not an acceptable answer!