Managerial Economics & Business Strategy

advertisement

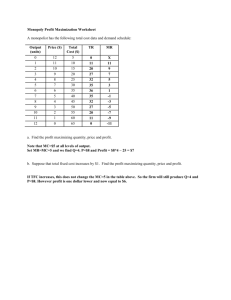

Managing in Perfectly Competitive and Monopolistic Markets Perfect Competition Conditions: • Large number of buyers and sellers • Homogeneous product • Perfect knowledge • Free entry and exit • No government intervention Key Implications: • Flat firms’ demand determined by market equilibrium price • Market participants are price takers without any market power to influence prices (have to charge MR = P = MC) • In the short run firms earn profits or losses or shut down • In the long run profit = normal = 0 (firms operate efficiently) Monopoly Conditions: • Large number of buyers and one sellers • Product without close substitutes • Perfect knowledge • Barriers to entry • No government intervention Key Implications: • Downward sloping firm’s demand is market demand • Firm has market power and determines market price (can charge P > MR = MC) • In the short run monopoly earns profit or loss or shuts down • In the long run profit > normal is sustainable indefinitely but even with profit = normal = 0 (monopoly does not operate efficiently) Sources of Monopoly Power Natural: • Economies of scale and excess capacity • Economies of scope and cost complementarities • Capital requirements, sales and distribution networks • Differentiated products and brand loyalty Created: • Patents and other legal barriers (licenses) • Tying and exclusive contracts • Collusion (tacit or open) • Entry limit pricing (predatory pricing illegal) Unrealistic? Why Learn? • Many small businesses are “price-takers,” and decision rules for such firms are similar to those of perfectly competitive firms • It is a useful benchmark • Explains why governments oppose monopolies • Illuminates the “danger” to managers of competitive environments • Importance of product differentiation • Sustainable advantage Profit Maximization for Total Measures Industry D (TR) = Firm D (TR) T is maximized: • Where the slope of T is 0 (TR and TC are parallel or their slopes are equal). dT / dQ = M = 0 2 such points (Q1, Q3) need additional condition: 2. d2T / dQ2 is negative or max TR - TC => Q* = Q3. Profit Maximization for per Unit Measures T is maximized: • At Q where MR = MC. dT dTR dTC M MR MC 0 dQ dQ dQ 2 points, need additional condition • MR < MC for any Q > Q* = Q3 (Q* is one of FONC candidates) or when MC is increasing. T = [(TR – TC)/Q]Q = (AR – AC)Q = (P – AC)Q Max T = area of the rectangle = (AR|Q* - AC|Q*)Q* = (P|Q* - AC|Q*)Q* A Numerical Example • Given estimates of • P = 10 - Q • C(Q) = 6 + 2Q • Optimal output? • MR = 10 - 2Q = 2 = MC • Q = 4 units • Optimal price? • P = 10 - (4) = $6 • Maximum profits? • PQ - C(Q) = 6(4) - (6 + 8) = $10 =0 Shut-Down Point • In the long run all cost must be recovered. • In the short run fixed cost incurred before production begins and do not change regardless of the level of production (even for Q = 0). • Shut down only if: –TFC > T (total) AVC > P (per unit). • TFC = AFC*Q = (SAC – AVC)*Q • Operate with loss if: 0 > T –TFC (total) SAC > P AVC (per unit). • This is the third T maximizing condition. Setting Price $ TR Firm small part of industry: Industry D (TR) > Firm D (TR) Firm’s D small segment of upward slopping Industry D $ Qf(units) $ SM Df = Pf = AR = MR PM DM QM(106) Market Firm Qf(units) Choosing Output • To maximize total profit: T = TR - TC FONC: dT /dQ = M = MR - MC = 0 In general (including monopoly) MR = MC. In perfect competition MR = P = MC. • To maximize profit increase output (Q) until 1) MR = P = MC (at Q*), and 2) for Q > Q* => MC > P (or MC is increasing) => M < 0 => TC < TR • As long as: max T ≥ -TFC or P ≥ AVC A Numerical Example • Given estimates of • P = $10 • C(Q) = 5 + Q2 • Optimal Price? • P = $10 • Optimal Output? • MR = P = $10 = 2Q = MC • Q = 5 units • Maximum Profits? • PQ - C(Q) = 10(5) - (5 + 25) = $20 Profit > Normal Normal Profit • Normal profit is necessary for the firm to produce over the long run and is considered a cost of production • Normal profit is required because investors expect a return on their investment. • Profit < normal leads to exit in the long run. • Profit > normal leads to entry in the long run. • Profit = normal maintains the # of firms in the industry. Shutdown Short-Run Supply Under Perfect Competition Effect of Entry on Market Price & Quantity $ $ S Entry S* Pe Pe* Df Df* D QM Market Firm Qf • Short run profits leads to entry • Entry increases market supply, driving down the market price and increasing the market quantity Effect of Entry on Firms Output & Profit LMC $ LAC Pe Df Pe* Df* QL Qf* • Demand for individual firm’s product and hence its price shifts down • Long run profits are driven to zero Q Perfect Competition in the Long Run • Socially efficient output and price: MR = P = MC (no dead weight loss) • Efficient plant size: P = MC = min AC (all economies of scale exhausted) • Optimal resource allocation: T = Normal = 0 because P = min AC (because of no market power or free entry opportunity cost equals TR ) Price Perfect Competition Consumer surplus S = MC > min AVC PPC Producer surplus 0 Efficient quantity QPC D = P = MR Quantity Price Inefficiency of Monopoly PA Consumer surplus S = MC > min AVC PM Deadweight loss PPC Monopoly’s gain MR 0 QM Producer surplus QPC D=P Quantity Monopoly in the Long Run with Greater than Normal and Normal Profit • Socially inefficient: P > MR = MC (QM<QPC, PM>PPC, dead weight loss) • Scale inefficient: P > MC = min AC (economies of scale still exist) • Misallocated resources: even when T = normal = 0, P is still > min AC (because of market power or barriers to entry opportunity cost < TR) • Encouraged R&D, benefits from natural monopolies, economies of scope and cost complementarity might offset inefficiencies Synthesizing Example C(Q) = 125 + 4Q2 => MC = 8Q is unaffected by market structure. What are profit maximizing output & price, and their implications if • You are a price taker, other firms charge $40 per unit? • You are a monopolist with inverse demand P = 100 – Q? • P = MR = 40 = 8Q = MC • MR = 100 - 2Q = 8Q = MC => Q* = 5 and P* = 40 => Q* = 10 and P* = 100 - Q = 100 - 10 = 90 • Max T = TR - C(Q*) = 40(5) - (125+4(5)2) = 200 - 225 = -$25 • Max T = TR - C(Q*) = 90(10) - (125+4(100)) = 900 - 525 = $375 • Expect exit in the long-run • No entry until barriers eliminated Price (cents per kilowatt-hour) Natural Monopoly Economies of scale exist over the entire LAC curve. One firm distributes 4 million kWh at ¢5 a kWh. 15 This same total output costs ¢10 a kWh with two and ¢15 a kWh with four firms. 10 5 LAC Natural monopoly: one firm meets the market demand at a lower cost than two or more firms. D=P 0 1 Public utility commission ensures that P = LAC (not P 2 3 4 associated with MR = MC), Quantity (millions of kilowatt-hours) eliminating monopoly rent. Break-Even Analysis Approximation in absence of detailed data on revenue & costs. Assume both TR & TC are linear. At the Break-even output: TR = TC = TVC + TFC P*QBE = AVC*QBE + TFC (P – AVC)*QBE = TFC QBE = TFC / (P – AVC) P = $6, AVC = $3.6, TFC = $60K QBE = 60,000 / (6 – 3.6) QBE = $25,000 (P – AVC) unit contribution margin. 1 – P/AVC contribution margin ratio (fraction of P to recover TFC)