In the markets: A sharp late-week rally wasn't enough to reverse U.S.

advertisement

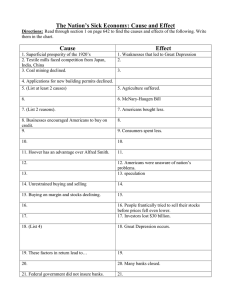

In the markets: A sharp late-week rally wasn’t enough to reverse U.S. market declines for the week as the Dow Jones Industrial Average ended the week down -1.43%, despite a 314 point rally on Friday. Similarly, the S&P 500 LargeCap index declined -0.81%, the S&P 400 MidCap gave up -1.36%, and the SmallCap Russell 2000 lost -1.38%. Dow Transports bucked the trend and gained +1.52% but Dow Utilities, the leading year-to-date sector, ended the week down -2.2%. In international markets, almost all major indices were negative with Japan the biggest loser, plunging 11.1%. In North America, Canada’s TSX declined -3%. European markets also had a difficult week as the Netherlands dropped -5.4%, France’s CAC 40 declined -4.89%, Germany’s DAX pulled back -3.43%, and the United Kingdom’s FTSE declined -2.4%. In commodities, precious metals shone brightly as Gold gained +$64.40 an ounce to end the week at $1,238.50, up +5.49%. Silver added +$0.76 to $15.79, up 5.06%. Crude oil ended the week at $29.02, down -6.39%, despite a huge +10.7% rally on Friday. In U.S. economic news, initial claims for jobless benefits fell 16,000 last week to 269,000, a bigger decline than expected and the lowest reading this year. Jobless claims have now remained below 300,000 for almost a year. Despite financial markets seemingly signaling trouble ahead for the U.S. economy, the labor market remains resilient. Continuing jobless claims remain near long-term lows of 2.239 million. The Labor Department’s “Job Openings and Labor Turnover Survey” (JOLTS) report showed openings rose to 5.6 million in December, up 250,000 from November. Hires climbed to 5.36 million from November’s 5.26 million, the highest reading since the fall of 2004. The number of people quitting their jobs hit a 10-year high of 3.06 million, up 200,000 from the previous month, indicating a higher level of worker confidence in their ability to find better jobs. U.S. retail sales rose a better-than-expected +0.2% in January, according to the Commerce Department. Core sales (ex-autos, restaurants, and building supplies) rose +0.6%. Non-store retailers such as Amazon outperformed all retail segments with a +1.6% gain, up +8.7% annually. Import prices continue to fall, down -1.1% last month, matching the decline seen in December. Expectations had been for a greater drop. Year-over-year, import prices declined -6.2%. Export prices also fell, down -0.8% on the month and down -5.7% from a year ago. Despite all predictions to the contrary, mortgage rates fell below 4% again and mortgage applications surged +9.3% last week. Purchase applications were little changed, but refinancing demand hit a oneyear high, up +15.8%. Small business sentiment fell to its lowest level in nearly 2 years, said the National Federation of Independent Business (NFIB). NFIB’s small business optimism index fell -1.3 points to 93.9, continuing a downtrend for over a year and the lowest since February of 2014. In the NFIB report, 21% of small business owners see economic conditions worsening—the lowest business conditions outlook since late 2013. Despite weaker readings in credit conditions, earnings trends, and sales a net 27% of companies raised compensation—the highest reading since 2007. A large part of the rise in compensation was due to the minimum wage hikes that took effect in 14 states on January 1st, pushing up labor costs. The broader labor issue remains that small businesses continue to have difficulty finding qualified candidates. A full 29% of businesses report having job openings and 45% reported few or no qualified candidates. New York Federal Reserve President William Dudley said key sectors of the U.S. economy are in good shape and more resilient. He stated that the financial system is stronger with banks better capitalized and that household balance sheets are in much better shape. He reiterated Fed Chair Janet Yellen’s statement that economic expansions don’t die of “old age”. In Canada, the Bank of Canada is selling off most of its remaining gold reserves, mainly by selling gold coins. The country held just US$19 million worth of gold as of last Monday. For most of last year, the country’s gold reserves stood at more than US$100 million. In the Eurozone, the economy grew 0.3% in the 4th quarter—matching forecasters’ views. Among the larger countries, Spain gained +0.8%, its 2nd significant quarterly gain. Germany and France rose +0.3%, and Italy managed a +0.1% gain. In Germany, industrial production declined, widely missing analyst expectations of a +0.5% gain. German production fell -2.3%, the worst since October 2012. Capital goods production declined -2.6%, consumer goods fell -1.4%, and energy-related production decreased by -3%. Around the world, Central Banks have been using the tools at their disposal to spur economic growth in their respective zones. The Bank of Japan surprised markets two weeks ago by adopting a negative interest rate on bank funds deposited with the central bank—the idea being that it would get the banks to stop hoarding reserves and force them to put that money to work. Instead, banks appear to have used the money to purchase Japanese government bonds which remain in such high demand that the 10-year bond yield went negative for the first time this week. Since then, Japanese bank stocks have plunged -25%. European Central Bank President Mario Draghi once more pledged to do “whatever it takes”, and further backed it up with a claim that there are “no limits” to how far the ECB will go to avoid a Eurozone breakup and to spur economic growth. Nonetheless, European bank stocks have plunged 60% over the past year. By contrast, in the United States, the Federal Reserve took a different tack by hiking rates in December and anticipating more hikes in 2016. The intention was to put upward pressure on inflation and hence interest rates, but the opposite appears to have occurred. Investors rushed into Treasuries where the yield on the 10-year has plunged from 2.29% at the time of the hike to 1.73%. Steven Ricchiuto, chief economist at Mizuho Securities USA writes that, “The counterintuitive currency market behavior suggests markets are beginning to recognize that monetary policy can’t solve the deflation problem confronting the global economy.” Finally, with oil selling at less than $30/barrel and the US’ major oil terminal at Cushing OK almost to full capacity, let’s revisit the “Peak Oil” scare of just a couple of decades ago. Peak oil is an event based on geologist M. King Hubbert’s theory that there is a point in time when the maximum rate of extraction of petroleum is reached, and after that point the rate of petroleum extraction begins a terminal decline, ending in the destruction of our oil-based economy. Indeed, petroleum production for the lower 48 states of the United States did reach a peak in early 1970 and then began a multi-decade decline. However, the dramatic increases in production since 2010 have reversed the decline, and pushed total production back to within spitting distance of that 1970 peak. Hydraulic fracturing, the ability of refiners to process oil shale and oil sands, and new advanced drilling techniques that are able to breathe new life into old oil fields have all served to dramatically increase North American oil production and have essentially reversed the phenomenon of “Peak oil”. To remind us of the “Peak Oil” hysteria of the last several decades, here is a collage of magazine and book covers that now can be relegated to the Library of Bad Predictions: (sources: all index return data from Yahoo Finance; Reuters, Barron’s, Wall St Journal, Bloomberg.com, ft.com, guggenheimpartners.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet; Figs 1-5 source W E Sherman & Co, LLC)