PSS and CSS Long Term Cost Report 2014

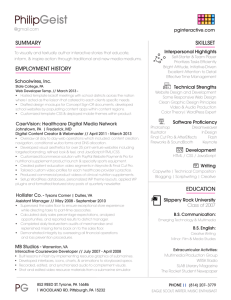

advertisement