Pensions (SFAS 87) and Post retirement Benefits (SFAS 106)

advertisement

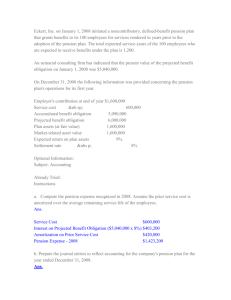

Pensions (FAS 87); Post Retirement Benefits (FAS 106); Post Employment Benefits (FAS 112); Disclosure about Pensions, etc. (FAS 132 [R]) – amendment of FAS 87,88,106 Dr. Heidemarie Lundblad 1 •Pension: Regular payments made to employees after retirement. Covered under ERISA (Employee retirement income security act, 1974) Protected by PBGC (Pension benefit guarantee corporation) 2 Type of Pension Plans: Defined Benefit Plan Defined Contribution Plan Cash Balance Plan 3 Defined Contribution Plan Amount of contribution is predetermined (may be adjusted periodically). Amount of future benefit varies, depends on variety of factors. Employees bear risk.. 4 Defined Benefit Plan Amount of future benefit predetermined on the basis of some type of actuarial model. Contribution depends (may vary) on a variety of factors. Company bears risk. 5 Cash Balance Plan A controversial hybrid between defined contribution and defined benefit plan. “Portable” but lower benefits for older employees Employer bears risk. For accounting purposes is treated like defined benefit plan 6 Type of Benefit Obligation Projected Benefit Obligation PV of pensions earned by employees in previous periods, vested or non vested (based on expected future salary levels) 7 Type of Benefit Obligation Vested Benefit Obligation Only vested obligations, based on current salary levels (amount payable to employees if plan is terminated now) 8 Type of Benefit Obligation Accumulated Benefit Obligation Vested or non-vested obligations, based on current salary levels (amount payable to employee if s/he quits now) To vest requires five years of service under ERISA 9 Type of Benefit Obligation Unfunded Accumulated Benefit Obligation Minimum Liability to be disclosed 10 Type of Service Cost Current Service cost Accumulated prior service costs 11 Type of Service Cost Current Service cost PV of pensions earned by employees in the current period 12 Type of Service Cost Accumulated Prior Service cost PV of pensions awarded to employees for work in periods prior to adoption of pension plan or as a result of retroactive changes in the plan. (Amount not yet taken into income) NOTE: Companies are not required to immediately recognize the expense. Since employees are still working, this cost may be amortized over the remaining service life. 13 Elements of Plan Assets, Pension Expense and Liability Service Cost (current and prior) Plan Assets Interest cost Pension Expense Firm’s Total Obligation Unfunded (Accrued) Pension Liability or Prepaid Pension Cost Amortization of Prior Service Costs Minimum Pension Liability 14 Elements of Plan Assets, Pension Expense and Liability Plan Assets Σ of prior contributions +/- Σ of income (loss) in prior periods +/- income (loss) in current period - Σ payments made to retirees + current contribution 15 Elements of Plan Assets, Pension Expense and Liability Interest cost Beginning projected benefit obligation X discount rate 16 Elements of Plan Assets, Pension Expense and Liability Pension Expense Current service cost + interest cost - expected return on plan assets + amortization of unfunded prior service cost +/- loss (gain) due to difference between expected and actual return on plan assets +/- loss (gain) due to difference between expected and actual value of plan assets Recognized to the extent that gain (loss) exceeds 10% of the greater of obligations or fair value of 17 plan assets Elements of Plan Assets, Pension Expense and Liability Firms total Obligation Projected Benefit obligation + Accumulated prior service costs + accrued interest =/- changes in plan adopted retroactively + Current service cost - payments made to retirees 18 Elements of Plan Assets, Pension Expense and Liability Unfunded (Accrued) Pension Liability or Prepaid Pension Cost Difference between Pension Expense and Funding 19 Elements of Plan Assets, Pension Expense and Liability Amortization of Prior Service Costs 1. Straight line method: Cost / Average remaining service life of employees 2. Years of future service method: Cost X # of employees working / Σ of expected years of future service 20 Elements of Plan Assets, Pension Expense and Liability Pension Liability Fair Value of Plan Assets minus Projected Benefit Obligation 1. If unfunded pension liability < pension liability --> recognize difference in current period and 2. debit Accumulated other comprehensive income (AOCI) 21