Slides - ACEFINMOD.com

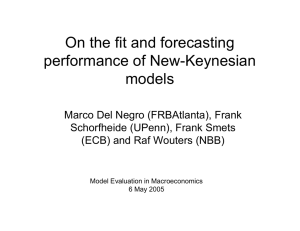

advertisement

Economics Department 24-25 Feb 2014 ESRC Diversity in Macroeconomics Conference Program Committee Paul De Grauwe (London School of Economics) Cars Hommes (University of Amsterdam) Sujit Kapadia (Bank of England) Sheri Markose Chair (University of Essex) Paul Sanderson (Economic and Social Research Council) Introduction: From the pragmatic to the esoteric Setting the scene • Jean-Claude Trichet’s plaintive cry that nothing in macro models that came from top academics from MIT/Harvard/Chicago (note I do not include the great British institutions Ox-Bridge/LSE as much of their work is derived from across the Atlantic) was of little use when 2007 crisis hit the buffers • ESRC concerned about the dearth of operational relevance (prompted by complaints from policy makers) and the derivative nature of British academic economics despite of £millions being pumped in: Have we been reduced to scribes and penpushers ? • In the 25 years I have been in the profession, we only had more of the same: optimization and econometrics What is missing ?: Fundamental Radical Uncertainty Coming from Novelty Based Structure Changing Behaviour • The main problem with policy design: limited incorporation of strategic behaviour in terms of concrete institutional innovations. • In Linear Quadratic Guassian Models where we maximize a quadratic objective function the only thing that stands in the way of the policy maker achieving his target is white noisenot uber intelligent regulatees gaming the system • Goodhart Keynes Lecture :One of the central problems is that uncertainty is far more insidious and pervasive than represented by additive error terms in standard models” • I counted 6 different exogenous shocks in the Smets et al ECB paper (productivity shocks, output gap…) ; environments that can be learnt by linear least squares error minimizing ! David Jones (2000), member of Board of Governors of the Fed Or What Gary Gorton calls the lack of incentives to study the $14 Trillion worth of leverage in shadow banking that upended Western Economies • Jones on why little study done on regulatory capital arbitrage entailed in securitization and other financial innovations: “absent measures to reduce incentives or opportunities for regulatory capital arbitrage over time such developments could undermine the usefulness of formal capital requirement as prudential policy tools”. Jones (2000) concluded that it was a lack of data for econometric modelling that prevented academic or regulators from keeping track of activities that undermined stated policy objectives in Basel II. Are there no other ways of finding out how structures are changing ? • In a complex adaptive system no party has the luxury of withdrawing from the coevolutionary game and precommit like Kydland-Prescott macro-policy doctrines say to a fixed rule to the exclusion of all else: Robert Axelrod (2003) System Failure occurs because coevolution is overlooked • Simplify policy- monitor and enforce meticulously Haldane/Kapadia et al Macroeconometrics External Data Driven but runs into Lucas Critique type problems ; DSGE Calibration of a single representative agents (minimal external data driven constraints) What else is out there ? • • • • Agent Based Macro/Macro Prudential Agents are computer programs and can interact with one another; Dynamics not prespecified by equations ICT data base driven multi-agent networks: glorified data visualizations: Haldane/Buchanan Star Trek Vision Vintage Santa Fe Institute Artificial Stock Market Model : Self-Reflexivity of Prices and Contrarian Payoff Structure in stock market game leading to impossibility of homogeneity and of homogenous Rational Expectations Brian Arthur’s genius intuition on why it is rational to be contrarian and anti-herd creating endogenous boom and bust – the source of heterogeneity not understood by most Agent based modellers Behavioural Macro/Finance • • • • • Cognitive Biases Bounded Rational Behaviours Business Cycle mixed up with problems of asymmetric information and solutions such as least squares learning Hayek(1947), Lucas Island Model Akerlof/Lemons. One behaviour missing : Protean, innovative : hyperintelligence Complexity Sciences and Complexity Economics • • • • Self-organization, emergence, Scottish Enlightenment ‘spontaneous order’ Ceaseless Innovation Novelty – new technologies not previously there: creative destruction Brick-bats are thrown at DSGE and micro/game theory is held to be ok : Not so as there is no game in which there is strategic innovation and existential incompleteness Here is one I made before: Banks and Non Bank Financial Intermediaries- The hard realization that mutual funds and insurance companies and not banks are the net liquidity providers In a nutshell Other (s) How to move beyond asymmetric information models to those on radical uncertainty with endogenous novelty production ? Known Known Unknown Col1 Col 2 (Known,Known) (Known, Unknown) Private Information Common Knowledge Self Unknown (Unknown,Known) Private ignorance Asymmetric Information (Unknown, Unknown) Radical Uncertainty With novelty production when we step outside listable sets of actions