PowerPoint

Capital Resources

Capital resources are understood to include assets that are utilized in the process of producing goods or services as part of a business operation.

While the range of assets that can be included in this category is very broad, it is important to note that not all assets are capital resources.

There are a few basic qualifications that govern what assets can properly be referred to by this term.

Capital Resources

One of the basic criteria for an asset to be considered a capital resource relates to the long-term use of the asset in the production of goods and services.

In general, it will be anticipated to aid in the creation of products for an extended period of time.

Manufacturing machinery is an excellent example, as is the support equipment that is used to keep the machinery in good working order.

In fact, the building that houses the machinery will also qualify as a capital resource.

This type of resource can also be defined as something that aids in the storage of the finished goods, pending their sale and shipment to customers.

For this reason, a warehouse will be considered a capital resource, especially if the manufacturer owns the space.

Support structures that aid in the force or power needed to drive the machines used in production may also be included.

Dams that help to generate power for the factory operation also meet the basic criteria.

Capital Resources

One important asset that is usually not considered a capital resource is cold hard cash. Money, in just about any form, cannot be considered part of this category.

This is because currency is the medium that allows for the acquisition of a capital resource, rather than being the resource proper.

While money is necessary to the function of any business, currency does not directly result in production of goods and services.

In addition, money cannot be used to provide force or power to the machinery that actually produces the finished products.

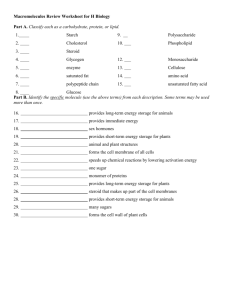

Considerations in Selecting Capital

Resources

return on investment

cost—initial

repair, and replacement—payback period

quality

vendor reputation/relationship

vendor accessibility

space requirements/availability

installation requirements

customer reviews/feedback

Demonstrate Procedures For

Identifying Capital Resource Needs.

Equity. If your business is in its first year of operation and has not yet become profitable, then you might have to rely on equity funds for short-term working capital needs.

These funds might be injected from your own personal resources or from a family member, a friend or a third-party investor.

Trade creditors. If you have a particularly good relationship established with your trade creditors, you might be able to solicit their help in providing short-term working capital.

If you have paid on time in the past, a trade creditor may be willing to extend terms to enable you to meet a big order.

For instance, if you receive a big order that you can fulfill, ship out and collect in 60 days, you could obtain 60-day terms from your supplier if 30-day terms are normally given. The trade creditor will want proof of the order and may want to file a lien on it as security, but if it enables you to proceed, that should not be a problem.

Factoring. Factoring is another resource for short-term working capital financing. Once you have filled an order, a factoring company buys your account receivable and then handles the collection.

This type of financing is more expensive than conventional bank financing but is often used by new businesses.

Demonstrate Procedures For

Identifying Capital Resource Needs

Line of credit. Lines of credit are not often given by banks to new businesses.

However, if your new business is well-capitalized by equity and you have good collateral, your business might qualify for one.

A line of credit allows you to borrow funds for short-term needs when they arise. The funds are repaid once you collect the accounts receivable that resulted from the short-term sales peak.

Lines of credit typically are made for one year at a time and are expected to be paid off for 30 to 60 consecutive days sometime during the year to ensure that the funds are used for short-term needs only.

Short-term loan. While your new business may not qualify for a line of credit from a bank, you might have success in obtaining a one-time short-term loan (less than a year) to finance your temporary working capital needs.

If you have established a good banking relationship with a banker, he or she might be willing to provide a short-term note for one order or for a seasonal inventory and/or accounts receivable buildup.

In addition to analyzing the average number of days it takes to make a product (inventory days) and collect on an account (accounts receivable days) vs. the number of days financed by accounts payable, the operating cycle analysis provides one other important analysis.

You can see that working capital has a direct impact on cash flow in a business. Since cash flow is the name of the game for all business owners, a good understanding of working capital is imperative to making any venture successful.

Read more: http://www.entrepreneur.com/article/225658#ixzz2mL0vroE7

Capital Equipment

large items a company installs in its facilities for operating purposes.

The different categories for these items include furnishings, machines, apparatus, or supplies used for business purposes.

Accounting departments are often responsible for handling the purchase, receipt, and setup of these items in a company. Proper accounting for capital equipment is necessary in order to report the use of cash or debt and acquisition of assets. These assets appear on the balance sheet and alter a company’s net worth.

Furnishings as capital equipment are any large purchase of items used in a normal office environment.

Included in this category are desks, cubicles, chairs, couches, or similar items a company would use on an almost daily basis. Other items may be in this group depending on how a company defines furnishings.

The amount for purchasing these items is also dependent on the company.

For example, office furnishings over a certain dollar level are assets, while those purchases below the level are immediate expenses.

Capital Equipment

Machines typically have two groups that they can fall under in terms of capital equipment purchases.

The first group includes computer hardware used in production or office settings. These items can be large groups of inexpensive items or single software packages worth thousands of dollars.

The other types of machines are large-scale production equipment.

Companies use these items to transform raw materials into usable intermediate or final goods for businesses or consumers.

Apparatus capital equipment includes any other types of equipment that may not fit into the other two preceding categories.

These items may be additions or supplements to other equipment already owned. In accounting, the company may need to add the cost for these items into an already existing capital equipment account.

National accounting rules typically dictate the recording for these purchases. Companies may also be able to decide whether to record these items as an asset or an expense.

sources to contact for information about equipment needs.

There’s a variety of resources you can tap into to understand specific costs associated with your chosen dream startup business. Start with the StartupNation Community , where you can search for other people in your industry, and post a message on the boards asking for help from fellow entrepreneurs.

Industry’s Trade Association - It should have an active group of members who are going through or have successfully navigated the startup process, and they typically will be happy to share tips with you.

You might even get access to sample business plans and checklists for your market niche, but most importantly, you’ll find out which hidden costs to be wary of in your industry.

Network with Business Owners in your Industry- whether it’s online or in person.

They will have the best understanding of how the costs of a typical business in your industry balance out across those six categories. With that knowledge, you’ll be able to create a reasonable cost estimate for starting a business of your own.

Impact That The Type Of Business

Has On Equipment Needs

Running a small business successfully often depends on whether you have got the basics right, and among those basics, we would rank the purchase of office supplies and equipment very highly.

It all adds up, you see. It is not enough for you to find a fantastic office space and a talented workforce. Without proper office equipment, your workforce will be demoralized and unproductive, and you will end up paying through your nose in maintenance and repair costs.

So the success of your small business depends as much on whether you have found the right customers as on the reliability of your software vendor and whether the coffee machine is placed at the right - See more at: http://www.fastupfront.com/business-articles/equiment-forsmall-business.html#sthash.ElOs3P4I.dpuf

Impact That The Type Of Business

Has On Equipment Needs

The ideal solution is to compile a list of supplies that the company needs every day or fairly regularly.

So that whenever an item on the list seems out of stock, you can order fresh supplies.

In any case, every two weeks or so, you should check to see which items need replenishing. “Every month, you should review your office supply costs,” says Aaron. “You should target one or two areas where you can cut costs and get someone to look around a bit for better prices on certain items.

If you prefer a particular supplier, ask him for a better price based on what the competition is offering.” It is best for you to put one person in place to handle the purchasing of all office supplies and equipment.

That way, there is no confusion about who should have checked up on dwindling stock, and why a certain item was not re-stocked. A dedicated purchase manager will also make it his business to find out the best rates on offer and take a call on which vendors to patronize.

However, the scope for scams clearly exists within such a set up. As Aaron says, “It would be fairly easy for an unscrupulous vendor to take your purchase person into confidence and persuade him to order that vendor’s products.

In such cases, it is difficult to spot the scam unless you are personally involved in purchasing office supplies.”

Nevertheless, office supplies and equipment are essential, so you have to make sure that your employees have what they need to get their work done.

In the end, placing a single trusted person in the position of purchase manager will work out to be more feasible than letting each employee order supplies for his or herself. - See more at: http://www.fastupfront.com/business-articles/equiment-for-small-business.html#sthash.ElOs3P4I.dpuf

Use Of A Cost-benefit Analysis In

Identifying Equipment Needs

Cost-benefit analysis is a relatively straightforward tool for deciding whether to pursue a project.

To use the tool, first list all the anticipated costs associated with the project, and then estimate the benefits that you'll receive from it.

Where benefits are received over time, work out the time it will take for the benefits to repay the costs.

You can carry out a Cost-Benefit Analysis using only financial costs and benefits.

However, you may decide to include intangible items within the analysis. As you must estimate a value for these items, this inevitably brings more subjectivity into the process. - See more at: http://www.mindtools.com/pages/article/newTED_08.htm#sthash.

YEBbNPrh.dpuf

Use Of A Cost-benefit Analysis In

Identifying Equipment Needs

Step One: Brainstorm Costs and Benefits

First, take time to brainstorm all of the costs associated with the project, and make a list of these. Then, do the same for all of the benefits of the project. Can you think of any unexpected costs? And are there benefits that you may not initially have anticipated?

When you come up with the costs and benefits, think about the lifetime of the project. What are the costs and benefits likely to be over time?

Step Two: Assign a Monetary Value to the Costs

Costs include the costs of physical resources needed, as well as the cost of the human effort involved in all phases of a project. Costs are often relatively easy to estimate (compared with revenues).

It's important that you think about as many related costs as you can.

For example, what will any training cost? Will there be a decrease in productivity while people are learning a new system or technology, and how much will this cost?

Remember to think about costs that will continue to be incurred once the project is finished.

For example, consider whether you will need additional staff, if your team will need ongoing training, or if you'll have increased overheads.

Use Of A Cost-benefit Analysis In

Identifying Equipment Needs

Step Three: Assign a Monetary Value to the Benefits

This step is less straightforward than step two! Firstly, it's often very difficult to predict revenues accurately, especially for new products.

Secondly, along with the financial benefits that you anticipate, there are often intangible, or soft, benefits that are important outcomes of the project.

For instance, what is the impact on the environment, employee satisfaction, or health and safety? What is the monetary value of that impact?

As an example, is preserving an ancient monument worth $500,000, or is it worth $5,000,000 because of its historical importance? Or, what is the value of stress-free travel to work in the morning? Here, it's important to consult with other stakeholders and decide how you'll value these intangible items.

Step Four: Compare Costs and Benefits

Finally, compare the value of your costs to the value of your benefits, and use this analysis to decide your course of action.

To do this, calculate your total costs and your total benefits, and compare the two values to determine whether your benefits outweigh your costs. At this stage it's important to consider the payback time, to find out how long it will take for you to reach the break even point – the point in time at which the benefits have just repaid the costs.

For simple examples, where the same benefits are received each period, you can calculate the payback period by dividing the projected total cost of the project by the projected total revenues:

Total cost / total revenue (or benefits) = length of time (payback period).

Activity 3.07

Conduct primary and secondary research to identify capital resources that businesses similar to your business.

Develop a list of the capital resources that you will need for his/her own start-up venture.

After developing this list, you should create a digital or hard-copy poster containing drawings, photos, or videos of these specific capital resources.

Add their lists to their VIP portfolios.