Internal Controls

advertisement

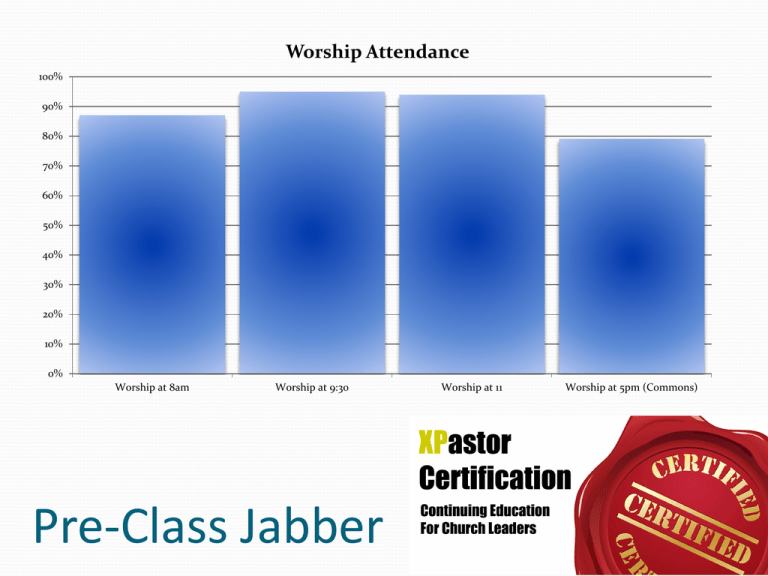

Worship Attendance 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Worship at 8am Worship at 9:30 Pre-Class Jabber Worship at 11 Worship at 5pm (Commons) Operations 103 Finances: Class 1 Level 1: Certificate in Operations Operations 101—Staffing Operations 102—Communications Operations 103—Finances Operations 104—Finances Operations 105—Facilities Operations 103—Finances 1. 2. 3. 4. 5. Cash & Fungible Assets Income Expenses Budgets Reporting 6. Audits & Financial 7. 8. 9. 10. Reviews Financial Health Tax & Legal Insurance for Employees Insurance for the church Tech Issues Do not “un-mute” yourself by clicking the red microphone If you are called on to speak, David will un-mute your mic. The recording will be posted shortly after class. Today’s Topic This topic sounds simple until you begin to define it. Churches need great cash flow management. They often handle a significant amount of cash on Sundays and during the week. There must be adequate procedures in counting the offering, as well as security of offerings and offering boxes. Churches must handle cash advances and cash for youth trips. Today’s Topic, cont. There are often cash surpluses and cash reserves. If stock is given, the church must decide to sell or hold it. This class will define cash and fungible assets, giving policy and practices on cash management. Along the way, we will examine the cash practices of a large church. Chris Gunnare Chris is the Chief Operations Officer at the Lutheran Church of Hope in West Des Moines, Iowa. The church has 9,500 in worship and Chris has come out of the business community to his present position. Through this leadership role in the church, he provides guidance to the following ministries: worship, production, fellowship, administration, finance, hospitality, facilities, communications and Café Hope. Chris Gunnare Chief Operating Officer Lutheran Church of Hope West Des Moines, Iowa Internal Controls What are they? The American Institute of Certified Public Accountants defines it as all the coordinate methods and measures adopted within an organization to safeguard its assets… Internal controls are a set of policies and procedures to prevent deliberate or misguided use of funds for unauthorized purposes. Internal Controls Why Do We Need Them? "abstain from all appearance of evil“ (I Thessalonians 5:22). "he must have a good report of them which are without, lest he fall into reproach and the snare of the devil“ (I Timothy 3:7) "Let all things be done decently and in order.“ (I Corinthians 14:40) Internal Controls Why Do We Need Them? Internal controls help to provide reliable data by ensuring that information is recorded in a consistent way that will allow for useful financial reports They also help prevent fraud and loss by safeguarding assets and essential records. Internal controls promote operational efficiency by reducing unnecessary duplication of effort and guarding against misallocation of resources. They encourage adherence to management policies and funding source requirements. Internal Control Audit Best way to get independent, outside appraisal of your internal controls Fall of 2011, we had our first Internal Control Audit. We plan to schedule another control audit in 2014-2015 We received 26 recommendations. Internal Control Audit (cont) Don’t have to agree with all; Recommendation N Post revenue and expenses separate versus net We (CFO & council) choose to keep it as is Priest stole $1.3 million in church money The former St. Matthew Parish secretary who embezzled more than $200,000 from the church has been sentenced to prison Aug. 24, 2012 - PHILADELPHIA — A former executive of the Philadelphia archdiocese is due in court Friday to be sentenced for stealing more than $900,000 from the church. A pastor of a Lakeland church is accused of stealing more than $5,000 from the church, according to an investigation by the State Attorney's Office in Bartow. CLEVELAND, Ohio -- A longtime priest at St. Helena Church on Cleveland's West Side has pleaded guilty to stealing $176,000 from the Romanian Catholic institution, a prosecutor said. The former bookkeeper of a South Jersey parish has been charged with stealing more than $245,000 from his employer. Handling Cash Weekly Offering Collection Secure Counters Deposit Post Multi-Site Mid-Week Offering Class Fees Fellowship/Coffee $ Bookstore Coffee Shop Weekly Offering - Collection We use 24 ushers with 32 baskets for our worship center, 4 ushers with 8 baskets for our chapel Volunteer Hospitality Captain oversees collection All baskets brought to hospitality room Uniformed police office outside/inside room All cash/checks is sorted, bagged and brought to safe by 3 ushers and uniformed officer Weekly Offering - Secure Safe has a ‘rolling bin’ where the usher and office can drop offering in safe Digital safe keeps log of whose access code opens the safe Safe is professionally bolted to concrete floor in locked room, in a remote location (not visible) Weekly Offering - Counters We have twelve teams of four Team is by invitation only Volunteers have background & credit report checked on bi-annual basis. No family members on same team. Teams are rotated every two years We have our finance assistant there for support They enter all gifts on member contribution report They count all cash, fill out deposit ticket and place in sealed cash bag from bag and sign seal. Counters Bag is dropped in safe Checks are placed in batches of 100 checks and totaled Entire team signs of on report which reports totals for weekend Deposit Monday morning the finance coordinator records the cash bag number in her log book as well as the amount of deposit (cash & change) Copy of deposit ticket stapled to the counter report (to be filed). Note – the third copy remains in deposit book in teller safe (for CFO / Treasurer review) Monday morning check are remote deposited by finance secretary, batch report attached to counter report SHELBY TOWNSHIP, Mich. (WJBK) - St. Therese of Lisieux Catholic Church in Shelby Township was robbed of tens of thousands of dollars after Easter Sunday services. They drilled through the safe and got away with almost $50,000. Safe, money stolen from church in Dixfield, Maine Authorities are searching for the person took a safe from a Concord church. GULFPORT, MS (WLOX) - Burglars broke into a Gulfport church and went away with a safe and hundreds of dollars in cash. JOHNSON CITY, Tenn. - According to police, the person or persons got into the church by kicking in an air vent in the back of the building and then went on a destructive spree, looking for valuables along the way. Johnson City Police say all locked doors inside were kicked in and the rooms ransacked. A safe was ripped off the floor and the offering box was torn off the wall. Post Our giving module is interfaced with our GL (Item K from internal audit) Finance coordinator posts the balancing entry each week to the GL from ‘audited’ counter report. Finance coordinator confirms deposit amount and post cash over/short to GL Multi-Site We have three locations (all schools) Each have 4 teams of Ushers (similar to main site) Ushers complete mini-teller sheet Checks, teller sheet, cash place in numbered sealed bag (number on teller sheet). All ushers sign over the seal Bag is brought to main site and dropped in safe for processing by main site counter team Mid-Week Deposit Processed by volunteers on Wednesday Mid-Week report is filled out containing the total deposit (checks & cash) amount Mid-Week report also provides the GL detail (account numbers and amount for each) All Mid-Week sources have separate internal controls Coffee offering Fellowship offering Café Hope deposit Cash Over-View Safety in numbers (two good, four better) Get amount counted & verified Get to bank AUDIT your controls Volunteer Audit Team = 8 accounting folks Groups of 2 will audit each unit several times per year Report of findings to CFO, Treasurer Review trends May 13, 2013 – Stillwater Okla. - Dana Sue Eckhart 43 years of age, has been arrested and charged with embezzling more than $141,000 from the UMC Stillwater, since 2009. According to authorities, UMC Stillwater informed police that Eckhart had written unauthorized checks to herself, her husband and others from 2009 through 2012. The church also questions hundreds of purchases by Eckhart utilizing churchissued credit card. Dana Eckhart pleaded not guilty and is free on $50,000 bond and due in court for preliminary hearing sometime in June 2013. VIOLET, La. —A church secretary in St. Bernard Parish was arrested for what authorities said was systematic embezzlement of more than $100,000 from her church. JANESVILLE — The former secretary of a Janesville church wrote nearly $90,000 in forged checks to herself over 10 months last year… An accountant uncovered 70 checks forged for herself from First Congregational United Church of Christ between January and October of 2012. A Granger woman pleaded guilty Tuesday to using the postal service to help embezzle $119,000 from a South Bend church she worked at for eight years. Loprest worked as a secretary at Hilltop Lutheran Church from 2001-2009. When the church’s bank contacted leaders about an overdraft fee in 2009, they found out they were nearly bankrupt. For several years, Loprest had been transferring money out of the bank’s investment account. She would have the checks delivered to the church, then deposit them into their spend account and use the money for personal expenses. Check Writing Segregation of duties (from internal audit B) Authorization to execute transaction Recording of the transaction Custody of assets involved in transaction Signing of check Opening of bank statement Reconcile Checking Account Credit Cards Send employee the statement at end of month Employee have receipts for ALL charges Each expense must be budgeted / approved prior to purchase Employee states details on receipt and proper GL code Unauthorized expenses or mission receipts must be paid back within 10 days Other Controls Electronic Wire Our process (Audit F) ACH Payments Always ensure following internal controls – similar to a writing a check Stock Gifts We use a broker who receives all stock We sell all securities upon receipt Cash Flow Management Since cash flow describes how and when money comes into the church and is spent, cash-flow management involves projecting income and expenses with the goal of paying bills on time and creating a surplus for growth. Cash Flow Management Project revenue each June for following fiscal year Use historical data to project future giving Cash Flow Management Project expenses each July for following fiscal year Payroll should be 50% of general fund giving 10% of general fund goes to external mission partners & projects Operational budget is set using historical data (utilities, interest, phone, internet, etc) Program budget set based on strategic objectives, allowing us to move resources based on what we are focusing on Cash Reserves / Surpluses Liquidity simply means available funds. The goal of liquidity management is to have enough funds available for current expenses and new ministry opportunities. Managing liquidity is tougher than it seems because income doesn’t always come in when expenses need to be paid. And we always have unexpected expenses. Cash Flow Fluctuation + Unplanned Events + Potential Opportunities = Operating Liquidity Balance Target Cash Reserves / Surpluses How much cash do you have in reserve? Is it enough? 60 to 90 days of expenses is ‘average’ Does your senior pastor know? Does your council know? Do you have/need a sweep account? How much interest is your reserve earning? What interest rate are you paying on loan(s)? Work with experts in your area you trust Work with ECCU (link on xpastor.org) Excellent white papers on many subjects we covered today Send Questions via Chat to Tami From Chapter 1: “The New Testament Greek word for steward is oikonomos … “manager.” Read the passages that deal with this word (page 23) From Chapter 2: Where does your church teach about money? Sermons, adult classes, small groups, fund-raising drives? Some or all of these? (page 31) Malphurs, Aubrey & Steve Stroope. Money Matters in Church: A Practical Guide for Leaders. Grand Rapids: Baker Books, 2007. Read Chapters 1 & 2: “Developing and Communicating Your Theology of Financial Stewardship” & “Developing Donors.”