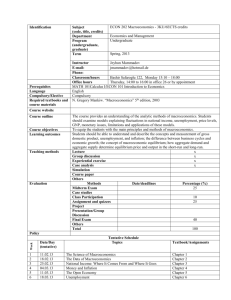

Economics211Exam3

advertisement

Economics 211 Macroeconomic Principles Exam #3 12 or 14 December 2011 Name ___________________________________ Instructor: Brian B. Young The value of this exam is 100 points plus 10 points for the Bonus Question plus 5 points for the Supplemental Question. Please show your work where appropriate! If you need additional space, please use the back of the page or extra sheets of paper. Formulas and Definitions 5 points each ● State and define, at least, one of the formulas defining interest rate parity and offer, at least, one explanation of why interest rate parity holds more closely than does purchasing power parity. ● What is the “gold standard?” not be a good idea today. List a couple of reasons why the gold standard may ● List two differences in the policy recommendations of the neo-classical monetarist school and the Keynesian activist school. ● What is the World Trade Organization and what are its main goals, aims, and functions? ● List the steps in the transmission of monetary policy. Page 1 of 7 Multiple Choice 3 points each 1. President George W. Bush and Congress cut taxes and raised government expenditures in 2003. According to the aggregate supply and aggregate demand model a. both the tax cut and the increase in government expenditures would tend to increase output. b. only the tax cut would tend to increase output. c. only the increase in government expenditures would tend to increase output. d. neither the tax cut nor the increase in government expenditures would tend to increase output. 2. Which of the following Fed actions would both increase the money supply? a. buy bonds and raise the interest rate paid on bank reserves b. buy bonds and lower the interest rate paid on bank reserves c. sell bonds and raise the reserve requirement d. sell bonds and lower the reserve requirement 3. If the world price of textiles is higher than Vietnam’s domestic price of textiles without trade, then Vietnam a. should import textiles. b. has a comparative advantage in textiles. c. should produce just enough textiles to meet its domestic demand. d. should refrain altogether from producing textiles 4. “Crowding out” occurs when investment declines because a. a budget deficit makes interest rates rise. b. a budget deficit makes interest rates fall. c. a budget surplus makes interest rates rise. d. a budget surplus makes interest rates fall. 5. Some economists believe that crowding out is not a problem for the U.S. economy right now because a. some economists suffer from an acute mental illness called economania. b. foreigners prefer to invest in United States Treasury securities. c. the liquidity trap allows the government to finance a substantial deficit without raising interest rates. d. the U.S. dollar is the preferred currency for international trade. Page 2 of 7 6. A balanced budget would require that when real GDP is contracting rapidly, a. the government raise taxes or cut expenditures. This would increase magnitude of economic fluctuations. b. the government raise taxes or cut expenditures. This would decrease magnitude of economic fluctuations. c. the government cut taxes or raise expenditures. This would increase magnitude of economic fluctuations. d. the government cut taxes or raise expenditures. This would decrease magnitude of economic fluctuations the the the the 7. A monetarist is an economist who believes that a. changes in the money supply have no effect on the economy. b. monetary policy should be run using feedback rules. c. fluctuations in the money stock are the main source of economic fluctuations. d. monetary policy should be run by discretionary policy. 8. A Keynesian activist is an economist who believes that fluctuations in a. the money stock are the main source of economic fluctuations. b. aggregate demand combined with sticky wages are the main source of economic fluctuations. c. aggregate supply combined with sticky prices are the main source of economic fluctuations. d. aggregate demand and aggregate supply with flexible prices are the main source of economic fluctuations 9. With international trade, a country a. cannot consume at a point outside of its PPF. b. can consume at a point outside its PPF. c. cannot consume at a point on its PPF. d. None of the above answers is correct. 10. Suppose aggregate demand suddenly falls. In order to stabilize the economy, the government might a. increase the money supply. b. increase government expenditures. c. decrease taxes. d. All of the above are correct Page 3 of 7 11. “Ceteris paribus, fluctuations in exchange rates create a situation in which a given amount of money buys the same basket of goods and services in different currencies.” The previous statement describes a. interest rate parity b. purchasing power parity c. the law of demand for foreign exchange. d. comparative advantage 12. Ceteris paribus, in the foreign exchange market which of the following increases the demand for U.S. dollars? a. The Japanese interest rate rises. b. The expected future exchange rate falls. c. The U.S. interest rate rises. d. None of the above answers will increase the demand for U.S. dollars. 13. The Federal Reserve is charged with the dual goals of full employment and price stability whereas the European Central Bank concerns itself with only the single goal of keeping the rate of inflation at or slightly below 2%. The ECB does not address unemployment because a. Europeans don’t mind being unemployed since the benefits are so generous. b. the ECB believes that unemployment is best addressed by the fiscal policies of the individual Eurozone member states. c. unemployment has never been much of a problem in Europe. d. the ECB is a relatively new central bank and is going take on one policy initiative at a time. 14. The factors that determine the power of monetary and fiscal policy are a. unemployment and inflation. b. aggregate demand and aggregate supply. c. investment demand and the demand for money. d. the demand for and supply of money. 15. When the world price of oil rises rapidly, it causes the a. AD curve to shift rightward. b. AS curve to shift leftward. c. AS curve to shift rightward. d. AD curve to shift leftward. Page 4 of 7 Short Answer 7½ points each (only 4 will be included in your score!) #1 The short-term interest rate on Country A’s alpha currency is 0% while the shortterm interest rate on Country B’s beta currency is 10%. In the spot market, one alpha buys two betas. If interest rate parity holds, how many betas can we expect to buy with one alpha one year hence? The 12-month futures contract for alphas is trading at US$1.05; the same contract on betas is trading at US$0.50. If you cover a currency carry trade position with futures, is there an opportunity to profit? If so, exclusive of leverage and transactions costs, what is your annual rate of return? #2 For the normal fluctuations in the economy (the business cycle), which is the better stabilization tool: discretionary monetary policy or discretionary fiscal policy? Explain your choice. #3 If policy makers wish to take an action which will both increase aggregate demand (i.e., shift the AD curve rightward) and promote long-run economic growth (i.e., shift the LRAS curve rightward), what type of policy action would you recommend? Page 5 of 7 #4 If policy makers wish to take an action which will increase aggregate demand (i.e., shift the AD curve rightward) quickly and provide the greatest boost to real output for the least quantity of government expenditures, what type of policy action would you recommend? #5 Show with graphs and text how a tariff affects the domestic price of the import, the domestic consumption, the domestic production, and the quantity imported? Given that either a quota or a tariff will lead to price and output distortions in the economy, which would you say is preferable? #6 Suppose that Iran announces that it has mined the Strait of Hormuz. This causes the price of crude oil to jump by 50% to $150 per barrel. Show this situation on an AS-AD graph. Also, explain how we could return to a full-employment equilibrium under what the text calls a fixed-rule policy and under what the text calls a feedback-rule policy Page 6 of 7 Bonus Question 10 points You are given the following information about an economy: 1) at full employment, the unemployment rate is 5% and real output is $600 billion; and 2) the following table applies: State: Inflation rate: Unemployment rate: Real output: 1 7% 3% $700 billion 2 3% 5% $600 billion 3 1% 7% $550 billion Assuming the price level in Period 0 was 100, graphically show the economy’s long-run and short-run Phillips Curve and corresponding long-run and short-run aggregate supply curves in Period 1. If the economy is in State 3 and, in addition, short-term interest rates are at or near 0%, which would be more powerful in bringing the economy back to State 2, fiscal stimulus or monetary easing? Phillips Curves Aggregate Supply Page 7 of 7