Things Needed to Prepare Income Tax - MS Word Document

advertisement

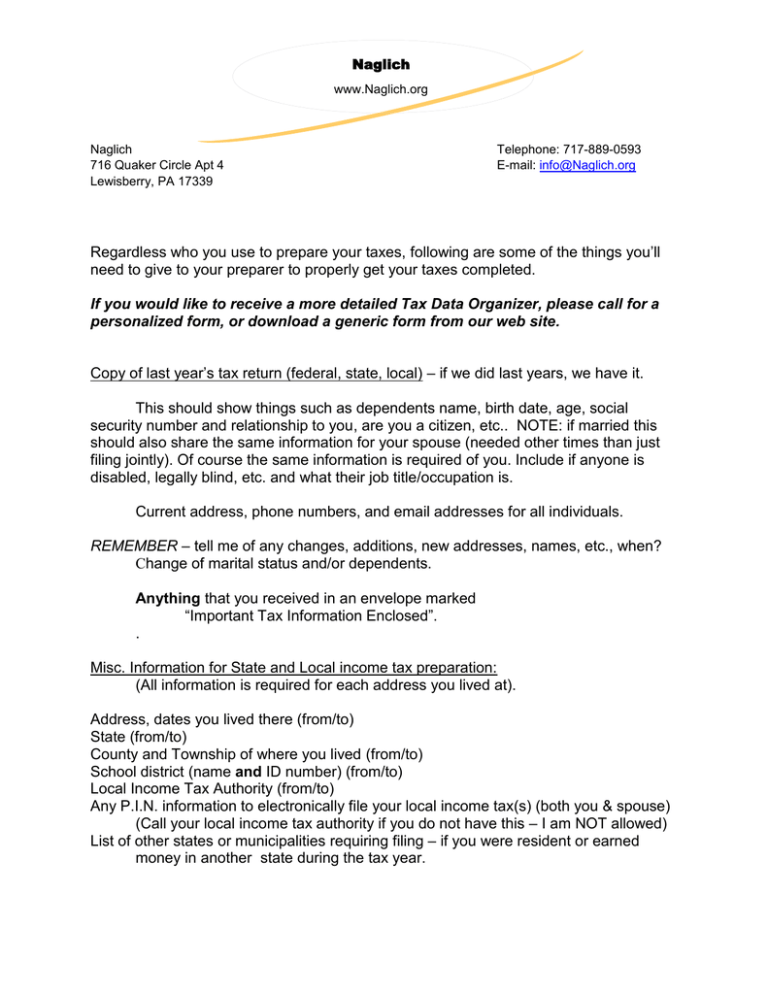

Naglich www.Naglich.org Naglich 716 Quaker Circle Apt 4 Lewisberry, PA 17339 Telephone: 717-889-0593 E-mail: info@Naglich.org Regardless who you use to prepare your taxes, following are some of the things you’ll need to give to your preparer to properly get your taxes completed. If you would like to receive a more detailed Tax Data Organizer, please call for a personalized form, or download a generic form from our web site. Copy of last year’s tax return (federal, state, local) – if we did last years, we have it. This should show things such as dependents name, birth date, age, social security number and relationship to you, are you a citizen, etc.. NOTE: if married this should also share the same information for your spouse (needed other times than just filing jointly). Of course the same information is required of you. Include if anyone is disabled, legally blind, etc. and what their job title/occupation is. Current address, phone numbers, and email addresses for all individuals. REMEMBER – tell me of any changes, additions, new addresses, names, etc., when? Change of marital status and/or dependents. Anything that you received in an envelope marked “Important Tax Information Enclosed”. . Misc. Information for State and Local income tax preparation: (All information is required for each address you lived at). Address, dates you lived there (from/to) State (from/to) County and Township of where you lived (from/to) School district (name and ID number) (from/to) Local Income Tax Authority (from/to) Any P.I.N. information to electronically file your local income tax(s) (both you & spouse) (Call your local income tax authority if you do not have this – I am NOT allowed) List of other states or municipalities requiring filing – if you were resident or earned money in another state during the tax year. Identify yourself and your dependents (new clients but also if any changes or additions) IDs and Social Security cards for yourself and spouse (readable copies). Social Security cards for your dependents (unless I already have them on file). Note: You can contact the SSA at 1-800-772-1213 to update records. Have you talked with your working children living at home or at school to see how much they earned during the tax year? Who will be preparing their return? This could affect if you claim them or that they claim themselves. NOTE: If they file incorrectly, it WILL affect your return filing time. If you can claim a child who doesn’t live with you, try to get the Form 8332 filled out and signed by the custodial parent before you come in to avoid delays. Copy of all income sources: INCOME: Documentation to report all reportable income. If you are not sure whether it is reportable or taxable contact me and/or bring the documentation for review. Include accounts that were closed during the year or that belong to others (children, parents, etc.) with which your SSN is associated. Tax-exempt interest and dividends must still be reported on your return. Include information on foreign accounts; review your statements for reportable totals as well as income earned. W-2’s (wages, salaries, tips, etc.) SSA-1099’s (Social Security benefit statements (this will also have an amount for your part B (doctor, etc.) and part D (RX plan); if not you will need to supply those amounts too for sch. “A” itemization)) 1099’s (any kind) – Send/scan in the entire statements (both sides) Any K-1s from a partnership, S-Corp or fiduciary? Supply all (both sides) Interest, Dividend, Capital Gains/Losses (whether taxable or tax Exempt – showing either ordinary or qualified or both) (Forms 1099-Int, 1099-B, 1099-Div) Note: Interest & dividends must be reported even if you do not receive a 1099. See your January account statement or contact the payer for the amount if you have not received a 1099. (The payer is not required to send out a form for less than $10 interest paid, but you must still report it). Capital gains (or losses) (Form 1099-B, etc.) Other gains (or losses) Business, Rental or Farm, and/or any self-employment income ((income or loss) If you have a business, farm or rental, or other self-employment of any type I will need income and expenses information for them. I don’t need to see the receipts but keep them handy in case I have questions. Also don’t lump expenses into one number. Totals for each separate category such as supplies, repairs, mileage, etc. with possibly a type breakdown. Please list any equipment or major repairs separately, with when you bought/paid for it. Those may be treated differently. Refunds from previous taxes, etc. (state, local taxes, etc.) (Form 1099-G) Alimony received – include payer’s full name and tax ID number Investment statements (stocks, bonds, etc.) If you sold any investment or property in the tax year we are filing for, I will need to have the information on when you bought it and any increases in basis. For investments, that could be dividends that were re-invested. (This might be on the broker statement.). Mutual funds frequently furnish “average cost basis” on the January statement or annual summary. Send/scan in the ENTIRE broker statements (both sides) Property improvements should also be noted, with the date, cost, etc. 1098’s on any property or their equivalent. Retirement plan distributions, etc. (IRA’s Keogh, etc.) (Form 1099-R, etc.) Pensions and/or annuities (Form 1099-R, etc.) Dividends statements () (Form Royalties, partnerships, S corporations, trusts, etc. (sch. K-1’s, etc.) Sale of any property (homes, cars, furniture, etc. that you sold for more than You paid) Sale proceeds (Form 1099-S) and HUD-1 form for purchases or sales of homes. Put or Call Transactions Cancelled debts (Form 1099-C) Interest, Dividends, Gains (or losses) from bank or investment accounts held in foreign countries. May also be reportable as foreign assets. Unemployment compensation (Form 1099-G) Gambling winning and any losses you can support with documentation. (Form W2-G) Any other income of any kind (sell or loss from stocks, bonds, etc. anything, notary fees earned, lottery winnings, any prize winnings, etc.) Do you have any of the following (list amounts and send statements): Health savings account deductions Premium payments to an Archer MSA or HSA. Penalties on early withdrawal of savings Did you move for your job AND the distance of your move is greater than 50 miles: Expenses for moving personal goods, costs of lodging (NOT meals) during the move, and the distance from the old to the new home. All paperwork from your employer pertaining to these items. Self-employed retirement plans (SEP, Simple, qualified plans, etc.) Student loan interest paid Alimony paid – include payee’s full name and tax ID number IRA deduction Self-employed health insurance premiums There are others but they will be based on above income answers Possible credits to tax (list amounts and send statements and/or who, what, when, how much, etc.): Do you have any expenses for child or dependent care? You will need all providers name, complete address, telephone number, employer identification number and/or social security number, dates covered, etc. along with the amount paid to each. In addition, break down of the total amount paid for each child cared for. Residential energy credits (did you put in new windows, water heater, buy a new refrigerator, washer/dryer, do insulation, doors, wind systems, sun panels to offset electric expenses, etc.?) This includes costs of energy-saving equipment installed on your real property - solar, geothermal, fuel cell, etc. Did you have education expense for yourself or dependent? Bring those records in with the 1098T and any statement the school provides. (Tuition and REQUIRED fees for education (for taxpayer, spouse & dependents). Did you contribute to a retirement account for you or your spouse? (Traditional, SEP/SIMPLE, or Roth) Did you have conversions to/from Traditional to Roth IRA with basis information? Was there an adoption? Bring in your documents for that. Did you or do you have? Any household employees (you may need to pay employment taxes) Early withdrawals of retirement plans Penalties you paid on early withdrawal of savings. Pay self-employment tax Have any unreported Medicare or social security tax due from things like tips (reported or unreported), as an independent contractor, etc. Owe the government any first-time homeowner buyers repayments ANY Information on funds held in foreign accounts – bank, brokerage, pension. Name and address of financial institution, account numbers, balance at end of year and highest balance during year. Include information on who has signing authority and why they have this authority, for each account and person. Direct Deposit If you want your refund directly deposited, bring in your bank info. I’ll need the bank’s routing number and your account number. I may have the numbers from last year but did you change banks or want to use another account, I’ll need those numbers. I like to confirm what numbers I have – just to be sure for this year. To itemize (sch. A): Medical and Dental expenses (note – the deduction is ONLY if in excess of your adjusted income for taxpayer, spouse and dependents based on a 10% floor except for people 65 or over by the end of 2013 – their medical floor remains at 7.5% through 2016). Health care costs and insurance premiums must be paid with after-tax dollars to be included in this total. List totals of each item, not necessarily each service (ie: general practitioner doctor can be combined with a heart specialist under Doctor payments; breathing machine can be combined with bandages, etc. under medical equipment, etc.). Be advised that if audited, YOU will need to have receipts for each service, visit, RX, etc. not just something showing the “Total” as requested here to be able to file taxes. Fees for Doctors, Dentists, nursing or “other” care Fees for hospitals, clinics, therapy, etc. RX’s Labs and X-rays Medical aids (such as eyeglasses, hearing aids, contact lenses, braces, crutches, wheelchairs, etc.) Medical equipment and supplies (bandages, breathing machines, ointments, etc.) Medical mileage driven (to & from Dr’s, hospitals, therapy, dentists, etc. anything medical)) Parking fees, tolls, local transportation charges for medical purposes Lodging (overnight up to $50.00 night) for medical purposes – how many nights? Insurance premiums Health insurance premiums Medicare Medigap (supplemental) or Medicare Advantage premiums Medicare part B premiums Drug plans (Medicare part D premiums) Long Term Care insurance premiums (limited) Durable Medical equipment Expenses to stop smoking Any co-pays or deductibles separate totals listed by specific’s (Dr., dentists, hospital, RX, clinics, etc.) Any other medical expense not listed should be shown separately and we will discuss. REMEMBER: These amounts are only what YOU ACTUALLY PAID – if any amounts were reimburse by insurance or any other way, you did not pay it, so it is not deductible to you. Health care costs and insurance premiums must be paid with after-tax dollars to be included in this total. Taxes you paid State and local income taxes (usually shown on W-2’s, etc. but if you paid additional, I need to know what for, when, how much and to who. Real estate taxes (usually several) and I will need copies (2) of each readable PAID receipt as these may be used for property rebate forms also (if applicable). Personal property taxes Property tax paid on real estate or other sales or excise taxes on personal property (cars, boats, airplanes, etc.). Any other tax paid (note what for, when paid, to who and how much) Have you paid any estimated tax payments (federal, state or local)? List who, amount, dates paid, reason. Interest you paid Home mortgage interest (Form 1098) ). If paid to the seller of the property, bring the name address and Taxpayer ID# of the payee/seller. If you refinanced your mortgage, bring the closing escrow statements for both the new loan and the old loan(s). If you purchased your home this year bring the HUD settlement statement from the closing. Home mortgage points Qualified Mortgage Insurance Premiums Investment interest (i.e., business real property, margin interest). Job expenses & certain Misc. (list what, when, where, who, how much, reason) Expenses you incurred related to your job – only deductible portion is total in excess of 2% of adjusted income. For example, union dues, tools and supplies you purchased, uniforms (uniforms only, not “required” clothing, whether or not you would ever choose it yourself), safety equipment, continuing professional education and business meals/entertainment. If you used your own vehicle for your job (commuting to & from your principal workplace is NOT deductible) bring total vehicle mileage and business mileage for the year. If you use a computer, cell phone or other item with a useful life expectancy greater than one year AND you use it primarily for the job, bring date and cost of purchase. If you received reimbursement for job related expense, bring the amount received. Unreimbursed employee expenses Job, travel, union dues, education, etc. Gifts to Charity Gifts to Charity (Cash or Check) Churches, Heart Assoc., Save the animal societies, etc. anything in cash (date, amount, fund, check number, etc.) Gifts to Charity (Goods other than cash or check) Good Will, Salvation Army, Volunteers of America, paintings, collectibles, etc. Bring your list of what you gave and any documentation and, if necessary, the appraisals you had made. Include mileage driven but not the value of your time. NOTE: Any single donation (cash, check, stocks, bonds or property, etc.) over $249.00 REQUIRES a letter from the receiver of the donation acknowledging receipt of the gift date the gift was received, amount of the gift and the way the gift was received (check, cash, property, etc.). Over $500.00 requires more information. If the total value of non-cash gifts exceeds $500, for each gift list the item given, its value (and how you determined the value), how you acquired it, the date given, and the name & address of the recipient. The Salvation Army has an on-line valuation list at https://satruck.org/Home/DonationValueGuide Only goods in good or better condition are deductible, no deduction for very small-dollar items, photos for record are advised. For car donations you will only be able to deduct the amount the charity received for your car as reported to you on Form 1099-C. Also, send/scan all church or other statements showing a history of what was contributed or given for the tax year. Casualty and Theft losses The date of the loss, type of loss, the fair market value before and after the loss and the amount of insurance proceeds received. Other Misc. Deductions Tax preparation fees Safe deposit box fees Investment fees (list type and amount) Any other expenses related to the production of income. Repayments of prior year Social Security or unemployment insurance benefits, or refunded college tuition. Gambling winnings and expenses Various others due to specific circumstances (we’ll discuss these if applicable) Affordable Care Act (ACA) ALL information requirements are for you, your spouse (if any) and all dependents. Questions should be answered separately, both individually and as a family. Did you have “Minimum Essential Coverage” for all or any part of the calendar tax year being filed? If not, list covered months Did you qualify for - Health insurance you purchase through the Health Insurance Marketplace? Were you eligible for the premium tax credit? Did you choose to “get the credit now” or “take it later”? How much was the credit? What months did you “receive the credit”? Did you have and/or report any changes during the tax year? Did/do you qualify for any exemptions to the “Minimum Essential Coverage”? What is the exemption type and exemption certificate number issued by the “Market Place” for each individual? Provide those forms. Did you receive a 1095-A, 1095-B or 1095-C? individual and from all vendors/suppliers, etc. EITC Supply form(s) to us for each (Earned Income Tax Credit) If you meet the IRS requirements and substantiation, you may be eligible for this credit. We will discuss and ALL documentation listed here IS REQUIRED. All requirements MUST be met as pertains to you, your spouse (if any) and any qualifying children for the filing calendar tax year Your “Adjusted Gross Income” and “Total Income” must be at least a dollar but below a certain threshold depending on how many (if any) qualifying children you have. You, your spouse and qualifying children must each have a valid SSN You or your spouse (if any) were NOT a nonresident alien for any part of the tax year or are filing a “married filing jointly” return “Filing” status must be an allowed status Certain IRS forms cannot be being filed Investment income must be below a certain threshold You, your spouse or qualifying children cannot be a “qualifying child” of someone else Your child must meet the relationship, age, residency, and joint return tests for a qualifying child for ONLY you and your spouse (if any) – with exception under the tie-breaker rules If the qualifying child is not your or your spouses (if any) son or daughter; why is the parent not claiming the child? You or your spouse (if any) must be at least age 25 but under age 65 by the end of the calendar tax year you are filing for You or your spouse (if any) cannot be claimed as a dependent on anyone else’s tax return or you are filing a “joint return” Your main home and your spouses (if any) main home (if filing a joint return) was in the United States for more than half the calendar tax year being filed. You are NOT required to file a form 8862 – exceptions are possible Following are “EITC” questions you WILL BE required to answer and document: Child’s name with copy of birth certificate Child’s Social Security number and copy of social security card Is the child the taxpayer’s son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them? Was the child unmarried at the end of the tax filing calendar year? If the child was married at the end of the tax filing calendar year Did the child live with the taxpayer in the United States for over half of that year? You will need to supply a copy of school registration, etc. showing the address as yours and the qualifying child’s Was the child (at the end of the tax filing calendar year) — • Under age 19 and younger than the taxpayer (or the taxpayer’s spouse, if the taxpayer files jointly), • Under age 24, a full-time student, and younger than the taxpayer (or the taxpayer’s spouse, if the taxpayer files jointly), or • Any age and permanently and totally disabled? Doctor, health care provider, Social services/program agency statement affirming status Do you or the taxpayer know of another person who could answer “Yes” to the above questions for the child? If yes, enter the child’s relationship to the other person(s) Does the qualifying child have an SSN that allows him or her to work or is valid for EIC purposes? Was the taxpayer’s main home, and the main home of the taxpayer’s spouse if filing jointly, in the United States for more than half the year? (Military personnel on extended active duty outside the United States are considered to be living in the United States during that duty period. Was the taxpayer, or the taxpayer’s spouse if filing jointly, at least age 25 but under age 65 at the end of the tax filing calendar year? Is the taxpayer eligible to be claimed as a dependent on anyone else’s federal income tax return for the tax year? Have something you are not sure about – e-mail me, call me or send/scan it in. 717-889-0593 info@Naglich.org Ed.Naglich@Naglich.org Or send/transfer it in your “cubby” and let me know it’s there.