2008 CHECKLIST of Information Needed to Complete FEDERAL

advertisement

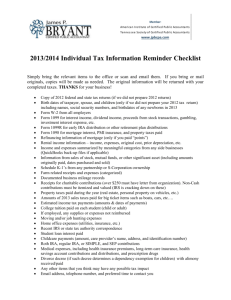

North Jersey Accountants and Consultants/ACnj 973-584-1232 acnj.njcpa@verizon.net www.practicalCPA.com Client Name_____________________________________ Email Address______________________________________________________ 2013ty CHECKLIST of Information Needed to Complete FEDERAL & STATE Income Tax Returns …provide all the information applicable to your returns--not all items apply to everyone & this is not an all-inclusive list… NEW CLIENTS: provide copies of the last tax returns that you filed (both federal and state returns). Review all home & business check registers for deductions. Sales Receipts for all NEW Vehicles/Boats purchased in 2013 W-2 Forms from all 2013 employers for whom you worked. Statements for interest & dividends (1099-INT & 1099-DIV) received in 2013 (including all descriptive capital gain statements/schedules that may be separate from the 1099 statements) 1099-B Statements - sales of stock, bonds, property, etc. (also provide the original cost & date of purchase for each sale). Complete Year-end Statements for all investments - mutual funds, IRAs, banks, bonds (taxable & tax-free), brokerage houses, etc. If statements do not show gains/losses for security sales, provide original purchase confirmation slips obtained at the time of purchase for each 2013 sale. NJ Rebates received: HOMESTEAD… $_____________ SENIOR PROPERTY Tax FREEZE… $_____________ If you had IRA withdrawals – provide the value of each IRA account at the beginning and end of the year. Details of all IRA and/or Keogh contributions made in 2013 for both you and your spouse. TOTAL tip income received $____________ Tip income not reported to employers $____________ Tax-exempt income, e.g., Municipal Bonds Interest. State tax refunds & Unemployment compensation (1099-G) W-2G Forms – certain gambling winnings. Gambling winnings not on form W-2G, plus Gambling Losses. SELF-EMPLOYMENT income and expenses for each business. 1099-R Forms - pension & IRA distributions. RENTAL income & expenses (interest, taxes, repairs, utilities, maintenance, capital improvements, etc.) for each property. Total ROYALTIES (1099-MISC) received & related expenses. K-1 Statements from Partnerships, S-Corporations, Estates, and Trusts, (including any supplementary capital gain statements). SSA-1099 Statements - Social Security received. 1098-T Tuition Payments Statement and 1098-E Student Loan Interest Statement(s). Details of COLLEGE expenses paid, by student, paid in 2013. Miscellaneous income, e.g., jury duty pay, bartering income, debt cancellation, prizes, income from personal property rented, etc. Alimony received and/or Alimony paid (including recipient’s name and Social Security Number). Medical/drug expenses, and Health & Long-term care insurance premiums paid. Medical travel (incl. auto mileage/tolls/parking) … NET of amounts received from health insurance & Medicare for medical expenses, i.e., reimbursements. Amounts and dates of Federal, State, and Local (if applicable) ESTIMATED TAX payments made in 2013. Real Estate taxes paid during 2013 (home, 2nd home, land). Interest paid on primary residence and second homes, land, etc., to financial institutions (Form 1098) or individuals (provide their Social Security Number), includes second mortgages, equity loans, equity lines, etc. Mortgage Insurance Premiums paid in 2013 for insurance contracts entered into after 2006 $__________________ Social Security Numbers of divorced or separated spouses. Contributions of cash to US and Canadian charities are deductible. Maintain a record of the contribution (bank record, such as a cancelled check and written record from charity). Miles driven for Charitable purposes ____________miles, and related out-of-pocket expenses $____________. Contributions of personal items that are new or in good used condition (clothing, furniture, etc.) to recognized charities are deductible. (Provide name, address, and receipts if items total over $500 in value). Appraisals may be required if the value is over $5,000. Miles driven to make the donations _________mi. HOME – sale or purchase or refinanced: HUD-1 closing document and list of capital improvements & costs. Moving expenses (related to start of new job) - transportation & storage of house goods, travel, & lodging for day of move. Employee business expenses, if not reimbursed and not reported as income on your W-2, including: mileage, supplies, union dues, travel expenses, seminar fees, subscriptions, hotel, telephone, books, tools, temporary assignment expenses, job related education, etc. Provide miles driven for business purposes, commuting, and total miles driven for the year. Fees paid for tax preparation, financial planning, investmentbroker fees, safe deposit box, IRA custodial fees, etc. Childcare expenses incurred while working (include fees of nursery schools, camps, etc., and each facility’s tax ID number, phone number, and address). DEPENDENTS-Social Security Numbers, birth dates, and 2013 income received by children and all other dependents. Rent expense paid in 2013 $_________ Address of apartment: ___________________________________________________ Adoption expenses paid (provide complete details). Details of gifts of more than $14,000 (cash or property) to one or more people (directly or in trust)—for Gift Tax returns. Details of amounts spent in 2013 for energy efficient improvements to your main home (e.g., insulation, exterior windows/doors, roof that exceeds Energy Star program requirements, heating/cooling systems, solar energy, solar water heating, fuel cell, small wind energy, or a geothermal heat pump). NJ Residents Only -- Total cost (excluding sales tax) of all items purchased in Pennsylvania in 2013 that were subject to PA sales tax AND were brought back to and used in New Jersey (use educated guess, if necessary) $______________ USE TAX… Details of all items purchased in a state other than your home state in 2013 and on which NO sales tax was paid (but which would have been subject to the NJ sales tax if purchased in NJ), e.g., purchases made over the internet on which no sales tax was paid. NJ Residents – Does every dependent have HEALTH INSURANCE COVERAGE on the projected date your NJ return will be filed? If NO, please explain ________________ For DIRECT DEPOSIT of refunds into bank account - provide Bank Name, Bank Routing Number, & Bank Account Number. Other / comments / questions ___________________________ ______________________________________________________ ______________________________________________________ ______________________________________________________ ______________________________________________________ Document1