HORIZONTAL SCOPE: Diversification at Time Inc.

advertisement

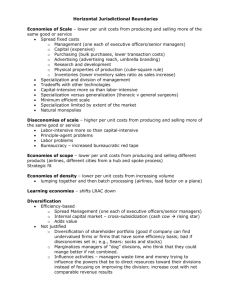

HORIZONTAL SCOPE: Diversification at Time Inc. Business Strategy Marriott School of Management Brigham Young University ©Copyright 1996, 1999, 2001 MOTIVATIONS FOR A MERGER AT TIME INC. Slow growth in magazine division Growth in cable networks Time Inc.’s decision to enter the entertainment industry is being driven primarily by deregulation enabling vertical integration in media. Vertical integration in being motivated by – Increasing risk of holdup in acquiring programming and outlets for Time’s HBO and Cinemax – Reduced risk of losses from growing film production costs due to guaranteed runs in self owned outlets – Multipoint competition TIME’S OFFER FOR WARNER Time shareholders offer a 59% stake in the merged firm to acquire Warner (through a stock swap) – MVT = $109.125 * 57M shares = $6,220,125 M – MVW = $45.875 * 178.5M shares = $8,188.6875 M – Assumes share prices at the data of the announcement Completion of the acquisition requires shareholder approval; combined T-W value = $14.4B EVALUATING THE WARNER OFFER Is Warner worth giving up 59% of Time Warner? Market value of T-W is $14.4B Time pays 0.59 x 14.4B = $8.496B for Warner For Time shareholders to be indifferent between holding Time and holding 41% of T-W must have a value of $15.17B. $6.22B x 100% = Value T-W x 41%; Value T-W = $15.17B Time-Warner must create an additional $771M in synergies beyond their cumulative market values. This requires about $75M in additional annual cash flows. Assuming a perpetuity with a 10% discount rate. EVALUATING THE PARAMOUNT OFFER Is Warner worth giving up the Paramount Offer? With Paramount’s offer, Times value increases to $9.975B $175 x 57M shares = $9.98B For Time shareholders to be indifferent between holding Time (cash from Paramount) and 41% of TimeWarner, T-W must have a value of $24.3 B. $9.98B x 100% = VALUE (T-W) x 41%; VALUE (T-W) = $24.3B Time-Warner must create an additional $9.929B in synergies for shareholders to justify spurning Paramount’s offer. This requires almost $1B in additional annual cash flows. Assuming a perpetuity with a 10% discount rate. ANALYTICAL ISSUES Which stakeholder interests should be served? Which interests are being served? (agency problems) How do we value the options? Where do we find the potential synergies? TIME’S DECISION Time dropped its stock offer for Warner and paid a higher price ($13.1B; $72/share) for Warner with cash. This avoided the need for shareholder approval of the merger that surely would have failed given the Paramount offer. Paramount boosted its offer to $200 per share and indicated a willingness to go higher. Paramount sued based on the business judgment rule and lost. CORPORATE-LEVEL STRATEGY The Scope of the Firm Corporate-Level Strategy is action taken to gain a competitive advantage through the selection and management of a mix of business competing in several industries or product markets. Vertical Integration Diversification 1. Choose business areas to participate in 2. Choose strategies to enter/exit business areas CREATING VALUE THROUGH DIVERSIFICATION Diversification is a strategy attempting to improve long-run profitability by acquiring and managing new business lines. Related diversification – value chain commonalities Unrelated diversification – totally new business activities EVALUATING DIVERSIFICATION How can diversification create value? Acquiring and restructuring Transferring competencies Economies of scale Economies of scope How can diversification dissipate value? Bureaucratic Costs – Information overload – Coordination limitations Pooling Risk Managerial Opportunism (Agency Problems) CREATING VALUES THROUGH ECONOMIES OF SCALE Eliminate operational redundancies – Reduce costs in common activities Eliminate a competitor – Reduce competition and rivalry; increase prices through increased market power CREATING VALUE THROUGH ECONOMIES OF SCOPE Operational Economies of Scope – Shared activities – Core competencies Financial Economies of Scope – Internal capital allocation – Risk reduction – Tax advantages Anticompetitive Economies of Scope – Multipoint competition – Exploiting market power