Type of Journals

advertisement

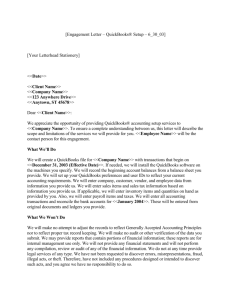

ACCT341, Ch.7, Ref 7a, Questions Read Ch. 7 and answer the following questions: 1. T or F: A ledger is where a transaction is first recorded, which gets posted to a journal. 2. Below are five types of traditional accounting journals. Match which type of journal each of the following transactions should be recorded in. Type of Journals S = Sales journal (all sales on credit) P = Purchases journal (all purchases on credit) R = Cash receipts journal (all incoming cash) D = Cash disbursements journal (all outgoing cash) G = General journal (any transaction that doesn’t fit in one of the other journals) Transactions (1) sales of merchandise on account (2) payment of creditors on account (3) depreciation on buildings (4) collection of a customer’s account (5) sales of merchandise for cash (6) purchase of merchandise on account (7) sale of land for cash 3. T or F: In a computerized system, special journals often take the form of special modules, such as the customer or vendor module (navigator). 4. The answers to these questions may not be in the book but give it a shot anyway. (A) Besides the general ledger (GL), subsidiary ledgers record transaction details without cluttering up the GL. List at least three common examples of subsidiary ledgers. (B) Accounting software can either use batch processing (GL updated once a week or month) or real-time processing (GL updated after every entry). Batch processing is more efficient because it can be done in the evening when the system is not being used, but GL balances are only current after each batch is processed. Under real-time processing, GL balances are always current, but a powerful computer system is needed to make this happen in large businesses with millions of transaction every day. Question: Do you think QuickBooks uses batch or real-time processing? 5. Give an example of a (A) mnemonic code, (B) sequence code, (C) block code 6. (A) T or F: Most chart of accounts use block codes. (B) T or F: Most accounting systems use a numbered chart of accounts. (Not in the book so take a guess). (C) T or F: In QuickBooks, you have the choice whether or not to use a numbered chart of accounts. (D) What are the advantages, if any, of using account numbers? 7. Later in this chapter we will be flowcharting the various documents within an AIS. Before we do that, we want to understand the purpose of each document in the sales/purchase cycles. In your own words, very briefly state the purpose served by each of the following: (A) sales order (B) customer remittance advice (C) shipping notice (D) debit memo (E) credit memo (F) purchase requisition (G) purchase order (H) bill of lading (I) packing slip 8. (A) How can bar codes be used by moving companies? (See Case-in-Point 7.4). (B) How did Piggly Wiggly benefit from using biometric payments? (See Case-in-Point 7.5) (C) What is an RFID tag and how are they used by Boeing and ConocoPhillips? (See Casesin-Point 7.6 and 7.7). Please note: WWU alum Ken Aso is chief executive of Boeing’s parts division!) 9. (A) What is BPO? What are some its advantages and disadvantages? (B) Within the last two decades, WWU sold the college farm, award-winning dairy, printing press, and bookbindery. It also outsourced janitorial, food services, the bookstore, and receipting (although janitorial is now in-house again). Also, Adventist Health (e.g. Walla Walla General Hospital) outsourced its billing, janitorial, IT, and maintenance functions. Why do you think WWU and WWGH did this? Who are the winners and losers? (C) Which business processes (both back and front office) do you think are most commonly outsourced in the U.S.? (D) Overall, do you think offshoring is a good or bad thing? Why? (E) What factors caused DHP to change offshoring to onshoring? (See end of chapter “AIS at Work.”) 10. (A) What is BPM? (B) As indicated in Case-in-Point 7.10, many software add-ons can complement QuickBooks. In fact, thousands of apps exist for QuickBooks in a variety of industries. Go to http://marketplace.intuit.com and record one add-on/app customized for each of the following industries: (1) accounting professionals, (2) hospitality, (3) nonprofits, and (4) shipping/transportation.