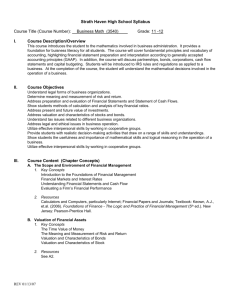

Human Resources Department 360 Degree Review Process Overview

advertisement

Business Valuation: Where Should I start and what should I know Brian A. Reed, CPA, CVA Partner, Transaction Advisory Services Weaver Overview • Identify the events and reasons when an independent business valuation may be needed • Understand the key factors involved in the valuation of a privately held business • Describe a typical valuation engagement, process and report • Discuss discounts and premiums • Court case updates Reasons to perform a business valuation analysis • Gift and estate tax purposes • Marital disputes • Minority shareholder disputes • Buy-sell agreements • Employee stock ownership plans (ESOPs) • Management buyouts • • • • • Lost profit analyses Mergers and acquisitions Purchase price allocations Goodwill impairment analysis Stock option valuation Standards and Premise of value • Standards of value – Fair market value – Fair value – Investment value • Premise of value – Going concern value – Orderly liquidation value – Forced liquidation Standards of value • Revenue ruling 59-60 defines fair market value as: – “ … in effect, it is the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.” • ASC Topic 820, Fair Value Measurements and Disclosures (ASC 820) (formerly FASB Statement No. 157, Fair Value Measurements) defines fair value as: – “[T]he price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date." Standards of value • Revenue ruling 59-60 outlines approaches, methods and factors to consider in valuing shares of closely held corporations – It was meant to apply to valuations for estate and gift tax purposes – Has been accepted in the valuation community as a basis for all valuations of interests in closely held businesses without a public market – Establishes the factors that should be considered as part of a valuation analysis • Nature of the business and the history of the Company Standards of value • Industry outlook • Book value of the stock and the financial condition of the Company • Earnings capacity of the Company • Dividend paying capacity • Assessment of whether the Company has goodwill or other intangible value • Sales of the stock and the size of the block of stock to be valued • Market price of stocks of corporations engaged in the same or similar line of business Standards of value • Fair value as defined by ASC 820 includes the following components: – Exit price – Market participants – Orderly transaction – Principal or most advantageous market – Highest and best use Standards of value Valuation Purpose Gift and estate tax ESOPs Financial acquisitions Dissenting stockholders actions Applicable standard of value FMV FMV FMV Legal fair value (in most states) Minority oppression statutes Legal fair value (in most states) Strategic acquisitions Buy-sell agreements Marital dissolution Investment value Anything parties agree on No standard of value specified in most states – court specific Accounting fair value as defined by ASC 820 Financial reporting value Valuation Methodologies Valuation methodologies Publicly traded comparable companies Comparable transactions analysis • “Public market valuation” • “Private market valuation” • Value based on market trading multiples of comparable companies • Value based on multiples paid for comparable companies in sale transactions • Applied using historical and prospective multiples • Generally includes a control premium • Does not include a control premium Income approach Other • Present value of projected free cash flows • Adjusted book value (Cost approach) • Incorporates shortterm and long-term expected performance • Dividend discount model • Risk in cash flows and capital structure captured in discount rate • Liquidation analysis • Break-up analysis Valuation Methodologies • Publicly traded comparable companies or guideline publicly traded company analysis – Revenue Ruling 59-60 indicates that the market approach should at least be considered – There are rarely, if ever, companies that are exactly like the subject company – The common issues surrounding the use of comparable company information includes the following: • Are the public companies selected by the valuation analyst sufficiently "comparable" to the subject company? • What specific factors make two companies similar? • What adjustments are appropriate, if any, to the chosen market multiple? • Which market multiple is most appropriate? Valuation Methodologies • Publicly traded comparable companies or guideline publicly traded company analysis – Steps to be considered under the guideline company method: • Step 1 – Obtain financial statements for the subject company • Step 2 – Analyze and adjust financial statements of the subject company as needed • Step 3 – Adjust tax expense accordingly, given the other adjustments that were made • Step 4 – Perform a search for and select publicly traded guideline companies Valuation Methodologies • Step 5 – Obtain appropriate financial information for a representative period of time for the guideline public companies • Step 6 – Consider adjusting or normalizing guideline public company financial data for the following • Step 7 – Analyze the differences between the public companies and the subject company including the following: – Business description – Company operations – Financial condition – Other qualitative and quantitative considerations Valuation Methodologies • Step 8 – Select appropriate valuation multiple for guideline public companies • Step 9 – Calculation of valuation multiples • Step 10 – Selection of valuation multiple • Step 11 – Application of selected multiple to subject company • Step 12 – Consider whether any discounts or premiums should be applied to the conclusion of value Valuation Methodologies Guideline publicly traded company analysis example Average BEV / Rev Average BEV / EBITDA Median BEV / Rev Median BEV / EBITDA Lower quartile BEV / Rev Lower quartile BEV / EBITDA Currency: $US actual TTM revenue TTM EBITDA Selected multiple BEV/Rev BEV/EBITDA Indicated BEV BEV/Rev BEV/EBITDA BEV, non-controlling, marketable basis Control premium BEV, on a controlling, marketable basis Marketability discount BEV, on a controlling, non-marketable basis Industry Comps 1.1x 10.0x 0.7x 8.0x 0.5x 6.8x ` ABC Company 27,564,712 1,173,016 0.7x 8.0x 18,305,725 9,426,061 Cash 1,726,820 1,726,820 BEV 20,032,545 11,152,881 Weighting 50% 50% Weighted BEV 10,016,273 5,576,440 15,592,713 15.0% 17,931,620 10.0% 16,138,458 Valuation Methodologies Guideline publicly traded company analysis example Currency: $US in thousands, except per share amounts Operating Performance Total revenue Average days sales outstanding (DSO) Average days payables outstanding (DPO) Cost of revenue Gross margin EBITDA margin Current ratio Effective tax rate Return on assets Return on equity CapEx as % of revenue Working capital (3) Net working capital (4) Working capital as % of revenue Net working capital as % of revenue Depreciation exp as % of revenue Average Median Lower quartile Upper quartile $3,348,403 53.90 40.51 84.22% 15.78% 9.52% 2.04 76.49% 4.28% 6.64% 3.90% $449,501 $210,573 15.93% 10.15% 4.09% $2,417,042 48.15 30.54 84.39% 15.61% 7.64% 1.95 32.84% 3.79% 9.54% 2.94% $300,384 $96,850 15.48% 9.03% 3.16% $701,799 38.20 22.19 88.23% 11.77% 5.28% 1.63 24.37% 1.45% 3.34% 0.87% $111,312 $35,555 11.01% 4.55% 0.94% $4,994,000 58.50 64.71 80.17% 19.83% 13.82% 2.24 36.41% 6.53% 18.42% 5.79% $691,000 $380,981 19.54% 14.35% 6.44% ABC Company $27,565 66.85 22.87 86.58% 13.42% 4.26% 1.87 0.00% 10.18% 18.48% 0.18% $4,115 $4,485 14.93% 16.27% 0.28% Valuation Methodologies • Comparable transaction analysis – The theory behind this method is that prices paid in the acquisition of entire companies that are similar to the subject business that have sold in the marketplace can provide a reasonable approximation of the value of the subject company. – The value generally obtained under the direct market data method is a control value. – Adjustments could be necessary if the value to be calculated is that of a minority interest. Valuation Methodologies • Comparable transaction analysis – Common transaction multiples include price or MVIC to the following: • Revenues • EBIT • EBITDA – Sources include • BIZCOMPS® • Business Brokers • Pratt's Stats™ • Thomson Financial Securities • Institute of Business Appraisers Market Database Valuation Methodologies Comparable transaction analysis example Target SIC code 1541 1542 1541 1542 1542 1752 1731 1542 1541 1521 1796 1541 1542 Country Denmark England Greece Greece Hong Kong Canada United States Greece Malaysia United States Japan Canada Malaysia Lower quartile Median Mean Upper quartile Effective Date 11/30/2000 12/27/2000 8/26/2002 9/9/2002 12/27/2002 5/13/2005 8/30/2007 9/12/2007 10/31/2007 9/1/2009 10/1/2009 7/13/2010 8/18/2011 Mergerstat Control Premium 117.4% 74.6% -39.1% -41.2% 42.9% 82.5% 27.1% -2.9% 52.2% 23.3% 45.9% 17.8% 15.6% Implied Minority Discount 54.00% 42.7% -64.3% -69.9% 30.0% 45.2% 21.3% -3.0% 34.30% 18.9% 31.5% 15.1% 13.5% 15.6% 27.1% 32.0% 52.2% 13.5% 21.3% 13.0% 34.3% Net Sales $ 224.6 $ 733.8 $ 21.7 $ 20.9 $ 685.2 $ 5.9 $ 992.3 $ 204.9 $ 155.4 $ 135.0 $ 283.4 $ 564.5 $ 686.5 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 135.0 224.6 362.6 685.2 EBITDA 8.1 53.8 1.5 1.9 31.4 0.6 77.4 11.5 15.5 7.3 7.7 39.2 55.1 7.3 11.5 23.9 39.2 $ $ $ $ $ $ $ $ $ $ $ $ $ EBIT 4.8 47.1 1.5 1.9 21.0 0.5 50.8 1.7 15.3 5.3 6.5 34.6 55.1 $ $ $ $ $ $ $ $ $ $ $ $ $ MVIC (BEV) 36.7 135.9 10.1 16.3 386.0 2.6 191.4 119.8 40.7 52.8 47.2 99.5 256.9 EBIT Margin 2.12% 6.41% 6.72% 9.06% 3.06% 8.01% 5.12% 0.83% 9.82% 3.93% 2.29% 6.13% 8.03% Net Income Margin 1.30% 4.09% 1.24% 2.64% 1.45% 5.75% 2.77% 0.31% 7.16% 3.74% 0.95% 4.19% 4.93% $ $ $ $ 1.9 6.5 18.9 34.6 $ 36.7 $ 52.8 $ 107.4 $ 135.9 3.06% 6.13% 5.50% 8.01% 1.30% 2.77% 3.12% 4.19% EBITDA MVIC/ MVIC/ MVIC/ Margin Sales EBITDA EBIT 3.58% 0.16 4.56 7.69 7.34% 0.19 2.52 2.89 6.72% 0.47 6.94 6.94 9.06% 0.78 8.62 8.62 4.58% 0.56 12.30 18.41 10.17% 0.45 4.39 5.57 7.80% 0.19 2.47 3.77 5.62% 0.58 10.39 70.01 10.00% 0.26 2.62 2.67 5.44% 0.39 7.19 9.94 2.73% 0.17 6.10 7.29 6.95% 0.18 2.54 2.88 8.03% 0.37 4.66 4.66 5.44% 6.95% 6.77% 8.03% 0.19 0.37 0.37 0.47 2.62 4.66 5.79 7.19 3.77 6.94 11.64 8.62 Valuation Methodologies Comparable transaction analysis example ABC Company TTM revenue (in $US actual) TTM Adjusted EBITDA (in $US actual) Selected multiple BEV/Rev BEV/EBITDA Indicated BEV BEV/Rev BEV/EBITDA BEV on a controlling, non-marketable basis (in $US actual) Discount for lack of control BEV on a non-controlling, non-marketable basis 27,564,712 1,173,016 0.5x 7.2x Weighting 12,850,002 50.0% 8,434,623 50.0% 6,425,001 4,217,311 10,642,312 13.5% 9,205,600 Valuation Methodologies • Income approach – There are two methods that can be used to value direct equity or invested capital: • Discounted cash flow (DCF) – Multi-period – Present value of expected future cash flows – Erratic or unstable net cash flows – Discount by use of a discount rate • Cost of equity capital • WACC Valuation Methodologies – Utilizes residual period after stabilization of cash flow • Capitalization of future net cash flows • CF0(1 + g) / (Discount rate - g) • Capitalization cash flow method – Single period – Stable net cash flows – Shortcut of DCF method – Discount using capitalization rate Valuation Methodologies • Income approach – There are two primary models to determine the appropriate cash flow: • Direct equity – Direct valuation of common equity – Often used when valuing minority interests because a minority interest holder has no ability to influence the capital structure – PV = [NCFe(1))/(1 + ke)] + [NCFe(2))/(1 + ke)2] + ... + [NCFe(n))/(1 + ke)n] Valuation Methodologies • Invested capital – Enterprise valuation – Often used when the capital structure is expected to change and/or control value, especially when the enterprise has little to no debt or too much debt, and an optimal amount of debt would enhance entity value – Based on net cash flow to invested capital – PV = [NCF(1))/(1 + WACC)] + [NCF(2))/(1 + WACC)2] + ... + [NCF(n)/(1 + WACC)n] Valuation Methodologies Income approach: Net cash flow to equity: Net income after tax Plus: Non-cash charges (typically depreciation, amortization and deferred taxes) Less: Incremental working capital to support growth Less: Anticipated capital expenditures (typically property, plant and equipment) Plus: New debt principal in (borrowings) Less: Debt principal out (repayments) Equals: Net cash flow to equity Valuation Methodologies Income approach: Net cash flow to invested capital: Net income after tax Plus: Interest expense (tax-effected) Less: Non-cash charges (typically depreciation, amortization, and deferred taxes) Less: Incremental working capital (excluding interest bearing debt obligations) to support growth Plus: Anticipated capital expenditures (typically property, plant, and equipment) Equals: Net cash flow to invested capital Valuation Methodologies • Income approach – Cost of capital • The expected rate of return that the market requires to attract funds to a particular investment • Referred to as the discount rate • Should represent the perceived risk of the investment • “Forward looking" expected rate of return (or required rate of return) Valuation Methodologies – Cost of capital (continued) • Commonly used approaches for calculating the return on common equity – Capital asset pricing model (CAPM) • CAPM = Rf + (Rp x β) – Modified CAPM • CAPM = Rf + (Rp x β) + Size risk + Specific company risk – Build-up method • Ke = Rf + Rp + Size risk + Specific company risk Valuation Methodologies Income approach Currency: $US in millions – Cost of capital example Assumptions Tax Rate Risk-Free Rate of Return (Rf)(1) Market Risk Premium (Rm - Rf) Size Premium Company Specific Risk Premium Industry D/(D+P+E) Industry D/E Industry P/E Industry Cost of Debt (Rd) Industry Cost of Preferred (Rp) Industry Tax Rate 30.0% 3.34% 6.0% 4.1% 3.0% 22.0% 28.5% 1.1% 5.3% 0.0% 30.0% Valuation Methodologies Income approach – Cost of capital example Market Risk Premium (Rm - Rf) Multiplied by: Industry Levered Beta Adjusted Market Risk Premium Add: Risk-Free Rate of Return (Rf) Add: Size Premium Add: Company Specific Risk Premium Cost of Equity Multiplied by: Industry E/(D+P+E) Cost of Equity Portion Industry Cost of Debt (Rd) Industry Tax Rate After-Tax Cost of Debt Multiplied by: Industry D/(D+P+E) Cost of Debt Portion I ndustry Cost of Preferred (Rp) Multiplied by: Industry P/(D+P+E) Cost of Preferred Portion W ACC 9.45% 1.26 11.88% 3.3% 3.9% 3.0% 22.1% 76.6% 16.93% 5.3% 0.0% 5.3% 23.4% 1.24% 0.0% 0.0% 0.0% 18.2% Valuation Methodologies Income approach – Discounted cash flow example Currency: $US actual Net income Add: interest expense (income) Add: depreciation and amortization Less: capital expenditures Add/Less: incremental working capital Net Cash Flow Discount period (years) Present value (PV) factor: PV of cash flow Residual growth rate Multiple Residual net cash flow Future value of residual Discount period (years) Discount factor PV of residual value 18.2% Sum of PV of cash flow PV residual value Business enterprise value on a controlling, marketable basis Discount for lack of control Business enterprise value on a non-controlling, marketable basis Less: discount for lack of marketability Business enterprise value on non-controlling, non-marketable basis 2012F (6) 2,684,263 31,580 126,318 (157,898) (1,831,383) 852,880 0.38 0.9390 800,883 2013F 4,008,093 47,154 188,616 (235,770) (864,491) 3,143,602 1.25 0.8112 2,549,941 2014F 4,408,902 51,869 207,478 (259,347) (778,042) 3,630,861 2.25 0.6864 2,492,257 2015F 3,423,383 57,056 228,226 (285,282) (855,846) 2,567,537 3.25 0.5808 1,491,354 2016F 3,594,552 59,909 239,637 (299,546) (470,715) 3,123,837 4.25 0.4915 1,535,440 2017F 3,774,280 62,905 251,619 (314,523) (494,251) 3,280,029 5.25 0.4159 1,364,278 Residual 3,962,994 66,050 264,200 (330,249) (518,963) 3,444,030 5.0% 7.59 3,444,030 26,144,047 5.75 0.3826 10,003,188 10,234,152 10,003,188 20,237,339 13.5% 17,505,299 25.0% 13,128,974 Types of Reports • Detailed report – Only for valuation engagements • Summary report – Cannot restrict valuation approaches that are applicable – No difference in relation to economic and industry background research between a summary and a detailed report – No changes in the due diligence measures taken with a summary report versus a detailed report • Calculation report – Requires fewer procedures than a detailed report Discounts and premiums • Discount for Lack of Control – A controlling interest • Is an interest in a business enterprise where the necessary elements of control are active and tied to the interest – A minority interest lacks potentially valuable rights that a controlling shareholder or group enjoys. – Necessary to evaluate the facts and circumstances surrounding the situation to determine whether effective control exists. Discounts and premiums • Discount for Lack of Marketability – The principal economic factor causing a lack of marketability (“LOM”) discount is the increase in risk caused by the inability to quickly and efficiently return the investment to a cash position – There are two types of empirical studies used to quantify valuation adjustments associated with the lack of marketability of noncontrolling ownership interests in closely held businesses: • Restricted Stock Studies – Studies that measure the difference between the private price of a restricted and the publicly traded stock price of the security the same company • Pre-IPO Studies – Studies based on the difference between the initial pubic offering (IPO) price of a company and transactions in the same company’s stock prior to the IPO. Discounts and premiums Discount for Lack of Marketability Study SEC Institutional Investor Study (for NYSE companies) SEC Institutional Investor Study (for non-reporting entities) Gelman Study Moroney Study Maher Study (unadjusted) Trout Study Pittock/Stryker (Standard Research Consultants) Study Willamette Management Associates, Inc. Study Silber Study Hall/Polacek (FMV Opinions) Study Management Planning, Inc. Study John Emory Study (1997-2000) John Emory Study (1995-1997) John Emory Study (1994-1995) John Emory Study (1992-1993) John Emory Study (1990-1992) John Emory Study (1989-1990) John Emory Study (1987-1989) John Emory Study (1985-1986) John Emory Study (1980-1981) Minimum 25th percentile Average Median 75th percentile Maximum Type of study Restricted stock Restricted stock Restricted stock Restricted stock Restricted stock Restricted stock Restricted stock Restricted stock Restricted stock Restricted stock Restricted stock Pre-IPO Pre-IPO Pre-IPO Pre-IPO Pre-IPO Pre-IPO Pre-IPO Pre-IPO Pre-IPO Mean 25.8% 32.6% 33.0% 35.6% 35.4% 33.5% Median 33.0% 32.8% 45.0% 31.2% 33.8% 25.2% 27.7% 50.0% 43.0% 45.0% 45.0% 42.0% 45.0% 45.0% 43.0% 60.0% 25.2% 33.1% 38.9% 38.8% 45.0% 60.0% 22.1% 28.9% 52.0% 42.0% 45.0% 44.0% 40.0% 40.0% 45.0% 43.0% 66.0% 22.1% 32.9% 40.7% 42.0% 45.0% 66.0% Discounts and premiums Discount for Lack of Marketability Inputs Discount for lack of marketability (DLOM) Price of underlying stock (5) S 0 = Strike price (5) K= rf = Risk-free rate (6) $1.00 $1.00 1.24% Ghaidarov method (1) Chaffee method (2) Finnerty method (3) 35.70% 49.17% 61.41% Dividend yield (7) Cumulative yield PV of dividend Adjusted So q = r = PV(Div) = Adj S o = 0.00% 1.24% 0 $1.00 Longstaff method (4) 181.51% T= σ= 60 Months 5.000 65.7% Time in Months Option time in years Volatility (8) Discounts and premiums Discount for Lack of Marketability Case Court Date DLOM Estate of William G. Adams v. Commissioner U.S. Tax Court March 28, 2002 35.0% Jane Z. Astleford v. Commissioner U.S. Tax Court May 5, 2008 21.23% Estate of Dunn v. Commissioner U.S. Tax Court August 1, 2002 22.5% Gross v. Commissioner U.S. Tax Court July 29, 1999 25.0% Kelly v. Commissioner US. Tax Court October 11, 2005 23.0% Court Case Updates • Malik v. Falcon Holdings, LLC, 2012 U.S. App. LEXIS 5336 (March 14, 2012) – Actual transaction is the “gold standard” of valuation – “The value of a thing [asset] is what people will pay.” • Gearreald v. Just Care, Inc., 2012 Del. Ch. LEXIS 91 (April 30, 2012) – Delaware Court accepts supply-side equity risk premium – Court rejects liquidity argument for lesser size premium • Holber v. M&T Bank (In re Scheffler), 2012 Bankr. LEXIS (June 5, 2012) – Cost method inappropriate method to value technology Disclaimer of Liability Weaver provides the information in this presentation for general guidance only, and it does not constitute the provision of legal advice, tax advice, accounting services, investment advice or professional consulting of any kind. The information included herein should not be used as a substitute for consultation with professional tax, accounting, legal or other competent advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation. Tax information is not intended to be used and cannot be used by any taxpayer for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided "as is," with no assurance or guarantee of completeness, accuracy or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability and fitness for a particular purpose. Presenter Biography Brian A. Reed, CPA, CVA Partner, Transaction Advisory Services Brian Reed has more than 12 years of diversified financial advisory experience ranging from acquisition due diligence and valuation services to ligation support and fraud investigations. He has worked with a wide range of clients including both private equity and corporate clients. In addition, he has provided financial support services to attorneys. Brian has participated in acquisition due diligence engagements ranging from $1 million to over $500 million. Additionally, he has performed a significant number of valuation engagements related to purchase price allocations, goodwill impairment analysis, gift and estate taxes and litigation consulting engagements. His experience includes engagements in the manufacturing, retail, software, distribution, professional services and oil and gas industries. He received his Bachelor of Arts degree at the University of Texas at Austin and a Master of Business Administration degree in finance and accounting from Tulane University. Conclusion Questions?