Securitization

advertisement

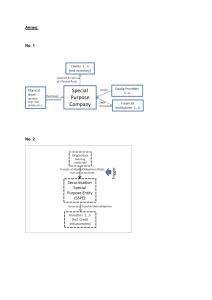

The Expanding Frontiers of Asset Securitization Group I : Institute of Statistics 914007 Chen, Yu-Huei 914008 Liu, Fang-Yi Outline What is Securitization? What is Asset-Backed Securitization? The Collateral Types of ABS The Development of the ABS Market The Advantages of Securitization The Process of Securitization Taiwan’s Difficulties Reference What is Securitization? Securitization A company raises money from capital market by issuing securities that are backed by specific assets. In most cases, the underlying assets are loans, such as mortgage loans or auto loans. The cash flow from the underlying assets usually is the source of funds for the borrower/issuer to make payments on the securities. Securitization products generally are viewed as including the following: asset-backed securities, mortgage-backed securities,corporate bond, commercial papers, etc. Securitization Financial Asset Securitization General Securitization Securitization Corporate Securitization Estate Securitization Corporate Bond Stock MBS Auto Loan Credit Card What is Asset-Backed Securitization? Asset-Backed Securitization Asset-backed Securities (ABS) are essentially securities entitled to the cash flows from a specific pool of assets These assets can be a variety of loans or receivables, such as: Credit Card receivables Auto loans Mortgages In an ABS deal, the issuer, or loan originator: transfers assets into a SPV; the SPV issues securities and sells these securities to investors. investors are entitled to the cash flow from the assets. ABS Typical Legal Structure Loan Originator True Sale The seller transfers assets (receivables/loans) to a specialpurpose vehicle (SPV). The SPV transfers the assets to Bankruptcy Remote SPV investors. The assets of the SPV will not be consolidated with the issuer’s in case of a bankruptcy. The SPV then issues securities to investors Investors Investors are entitled to the cash flows from the assets. True Sale An actual sale, as distinct from a secured borrowing, which means that assets transferred to an SPV are not expected to be consolidated with those of the sponsor in the event of the sponsor’s bankruptcy. Rating agencies usually require what is called a . truesale opinion from a law firm before the securities can receive a rating higher than that of the sponsor. Example Original Flow American Cardholders Monthly Principal & Interest Express Cardholders pay monthly principal and interest to American Express for their monthly credit card payments, including principal, interests, annual charges and other penalty charges. Example Flow After Structuring Cardholders Monthly Principal & Interest SPV Investors Monthly Principal & Interest In an ABS deal, American Express transfers its rights to a specified pool of receivables into a SPV. Proceeds from the specified pool of American Express cardholders will go to the SPV. The SPV in turn pays the investors. American Express is no longer entitled to the receivables. The Collateral Types of ABS Assets Types & ABS Issuers - I Credit Cards: Receivables from monthly payments by credit card holders. Issuers include: – Banks which issue VISA or MasterCard – American Express and Discover – Saks, Neiman Marcus, Circuit City and similar retailers which issue retail cards Auto Loans and Leases: Auto loans for car purchases or leases Issuers include: – Financial Subsidiaries of GM, Ford, Honda, Nissan, Daimler Chrysler – Banks such as Banc One, Chase – Independent finance companies such as Arcardia, Union Acceptance Corporation. Asset types & ABS Issuers - II Home Equity Loans Liens on homes Issuers include independent finance companies: Residential Funding Corp (RASC), Option One Mortgage Corp, Long Beach Mortgage Co, Country-Wide Home Loans. Manufactured Housing Loans Loans on Manufactured Housing Mainly issued by Ginnie Mae, a US-Government Sponsored Enterprise Student Loans Loans to university and graduate students to finish degree Main issuer is the Student Loan Marketing Association (Sallie Mae) Asset types & ABS Issuers - III Equipment Loans and Leases Loans and leases to finance medium/heavy equipment. Issuers include AT&T, Caterpillar, Case, John Deere. Aircraft leases Leases on commercial aircraft. Mainly issued by GPA. Insurance Premium Receivables Loans to commercial borrowers to finance insurance premiums. Main issuer is A.I.Credit. The Development of The ABS Market Development of Asset Securitization Began from the Mortgage-Backed Securitization 1930s FNMA was launched for estate market. 1970s First Mortgage-Pass Through (MPT) security was issued. 1980s First Collateralized Mortgage Obligation (CMO) was issued by FHLMC. Applied this technology to other assets 1985 A computer lease-backed transaction was issued by Sperry. First public auto loan-backed security was issued. 1987 First public credit card-backed security was issued. 1989 First public home equity loan-backed security was issued. 1993 First student loan-backed securitization. 1994 First insurance premium-backed transaction. Highly Liquid Market Amounts in millions 275,000 $259,600 250,000 $221,243 225,000 $197,294 $189,084 $184,589 200,000 175,000 $149,560 150,000 125,000 $112,041 100,000 $75,356 75,000 $50,341 $42,347 50,000 25,000 $10,041 $9,763 $59,673 $50,758 $24,707 $15,456 $1,237 0 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1985 Through 2001 1997 1998 1999 2000 2001 Year American Bond Market AssetBacked Securities 7% MortgageBacked Securities 27% Agency Debentures 15% U.S Treasuries 33% Corporate Bonds 18% Development of ABS Outside the U.S. The U.K. is the leading country for securitization in Europe. The first MBS has been issuing since 1987. Favorable legal and regulatory environment France is the second largest issuer of ABSs in Europe. Other European countries that have issued ABSs include Spain, Sweden, and Italy. Asset securitization in Canada has grown rapidly from 1992. Securitization in Japan continues to move at a glacial pace. “Divided receivables” cannot be traded in the secondary market The reluctance of many non-bank finance companies Securitization Outside the U.S. Australia 10% Asia 6% Other 5% Europe 79% Diverse Universe of Collaterals Amounts in millions 275,000 CC Auto HEL MH Equip Student Other $259,600 250,000 $221,242 225,000 $197,294 200,000 $184,589 $189,084 175,000 $149,560 150,000 $112,041 125,000 100,000 $75,356 75,000 $50,758 $59,673 50,000 25,000 0 1992 1993 1994 1995 1996 1997 Year ABS Supply By Sector 1998 1999 2000 2001 Expansion of Collateral Types Home Equity Loans 22% Auto Loans 25% Credit Cards 20% Others 33% Student Loans Manufactured Housing Equipment Insurance Premium Re. Marine Loans CBO / CLO ABS Senior Classes (by Weighted Average Life) 7 to 10 Years 7% 10 Plus Years 3% Zero to 1 Year 13% 5 to 7 Years 15% 1 to 3 Years 35% 3 to 5 Years 27% The Advantages of Securitization Advantages of Securitization For Issuer Capital Efficiency Funding Diversification Asset-Liability Gain Management on Sale Off-Balance-Sheet Advantages of Securitization For Investor Attractive Risk Nominal Yield Protection Generally Low Prepayment risk relative to MBS Excellent Liquidity Advantages of Securitization For Supervisor Distribute Manage Lower More Capital Efficiency Risk Efficiency the Management Cost Stable Financial system Advantages of Securitization For Macro-Economic Informational Allocational Pricing Efficiency and Operational Efficiency Efficiency Top 10 Issuers 2001 Auto Sector 1 2 3 4 5 6 7 8 9 10 Ford $16,963.40 AmeriCredit 7,576.80 DaimlerChrysler 6,200.00 Honda 4,881.80 Nissan 4,511.40 MMCA 3,853.30 WFS Financial 3,570.00 Toyota 3,294.00 Capital Auto 2,700.50 Chase 2,499.10 Credit Card Sector 1 2 3 4 5 6 7 8 9 10 Citibank $11,400.00 Capital One 8,237.80 MBNA 8,168.90 Chase 6,038.10 American Express 4,669.00 Discover 4,052.60 First USA 3,479.20 Household 2,526.10 Metris 2,434.90 Fleet 2,359.80 Buyers of ABS Others 3% Money Managers 35% Insurance 10% Corporates 11% Banks 30% Government 11% The process of securitization The Mechanics of Securitization debtor Principals and interests Cash flows Special purpose trust originators investors Cash flows Credit enhancement Credit rating institutions Investment bank ABS Cash Flow Diagram Excess Loan Interest Defaults Servicing Fee ABS Coupon Loan Loan Principal Principal Assets ABS Investment ABS Investor Asset Manager Loss Coverage Credit Enhancement or Returned to Seller MPT – Mortgage Pass Throughs Pass Through is the simplest principal repayment structure. Amortization and prepayment cashflows from the collateral are transferred directly to the security holders. Outstanding Balance, $MM . 500 450 Interest 400 Principal 350 300 250 200 150 100 50 0 1 3 5 7 9 11 13 15 17 19 21 23 Time 25 27 29 31 33 35 37 39 41 43 45 CMO ( Collaterized Mortgage Obligations) In a sequential, principal cashflows from the underlying collateral are allocated to one tranche at a time. When one tranche is paid off, the next tranche receives all the principal and so on. In other words, the tranches are sequentially allocated principal payments. Advantages of CMO(contrast to MPT) The portfolio of CMO is bigger that has more stable statistical properties. Stable investment period. Consistency to investor’s demand. PAC(Planned Amortization Class) Provide the bonds with highly stable cashflows. 0-1 bond 0-3 bond 0-4 bond (CS) (Companion Securities) (CS) principal 0-2 bond(PAC) repayment time Advantages of PAC Stable cash-flows High credit qualities High yield Floating-rate CMO(FRCMO) Attract the Euro dollars and floating-rate bonds investors Generally issue with Reverse Floaters. Caps and floors. Example Floater Reverse Coupon rate LIBOR+0.0065 0.424-4*LIBOR Value $40m $10m The average weighted interest always equal: 40/50(LIBOR+0.0065)+10/50(0.424-4*LIBOR) Advantages of FRCMO The price volatility is smaller than fixed interest rate bond. Balance the assets and liabilities. Stripped MBS Objectives:hedge and speculation Example: A1(principal):coupon rate=5%,below par A2(interest):coupon rate=605%,over par Cost of funding=5%*0.99+605%*0.01=11% PO(principal only) IO(interest only) The influence of interest on PO & IO Market rate prepayment Bond price Discount rate Bond price prepayment Bond price Discount rate Bond price prepayment Bond price Discount rate Bond price Prepayment Bond price Discount rate Bond price Net effect PO Market rate Market rate Net effect Net effect IO Market rate Net effect Concerns raised by securitization Adverse selection Securitize lower risk loans to reduce credit enhancement costs and lower due diligence expenses. Risk shifting Sell only the weakest assets through securitized structure. Moral hazard “Window Dressing” of financial statements Legal uncertainties Taiwan’s Difficulties Problems of securitization in Taiwan Lack of motivations to sell CMO. Lack of sufficient data and analysis. Lack of sound and economic scale bond market. Lack of standard and suitable laws. References - I Books 1. 陳文達、李阿乙、廖咸興,「資產證券化理論與實務」 ,智勝出版社,2002 年8月 2. 李儀坤,「金融證券化之可行性研究」 ,台北銀行經濟研究室,1995年6月 3. Mason、Merton、Perol、Tufano, 「 Cases in Financial Engineering」,Prentice Hall,1995 Journals & Reports 1. 廖咸興、李阿乙,「推動抵押債權證券與金融機構流動性」,新世紀智庫論壇 第15期,2001年9月 2. 儲蓉,「金融資產證券化之探討(上)(下)」 ,台灣金融財務季刊第二輯第三、 四期 References - II 3. 吳家昌、游迺文,「金融資產證券化及其對金融業影響之探討」 ,金融財務 第4期 4. 「資產證券化」,國泰人壽綜合企劃室,1997年2月 5. 李阿乙,「資產證券化專題研討」 ,台北金融研究發展基金會教育訓練中心 ,2001年3月 6. 「投資資產抵押債券(ABS)」,Deutsche Bank,2002年11月 7. 「Asset-Backed Securities: Introduction to the Market and its Structures」, Goldman Sachs ABS Research,May 1998 8. 「The U.S. Asset-Backed Securities Market」, Banc of America Securities LLC, 2002 THE END ^__^