Marketing economies

advertisement

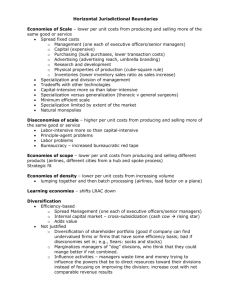

1.7 Growth and Evolution Economies of Scale ◦ Purchasing economies “bulk buying” – discounts for large orders ◦ Technical economies Production lines – produce products at a reduced cost because of efficiency Computer systems – afforded by large firms that can absorb greater fixed costs ◦ Financial economies Banks show preference to large corporations Large firms can “go public” with their stock ◦ Marketing economies Advertising costs for large companies can be spread over a large product line ◦ Managerial Economies Large firms can higher specialists Diseconomies of Scale ◦ Communication Problems ◦ Alienation of Workforce ◦ Poor Coordination and slow decision making ◦ Large Scale production costs Growth Internal Growth Companies expand by creating new offices, opening new stores, growing existing business External Growth Merging with other firms, or acquiring other firms through purchase Types of External Growth Merger When companies agree to combine and operate under one board of directors with shareholders in both businesses owning the newly merged company. Takeover When a company buys over 50% of the shares of stock to gain controlling interest Integration Options Horizontal – Forward Vertical – Backward Vertical – Conglomerate – same industry and same stage of production United Airlines & Continental Airlines same industry but a customer of the existing business. Manufacturer owns distribution company and retailers. Comcast Cable owns NBC Television same industry but a supplier of the existing business. Manufacturer owns suppliers; helps control and stabilize the supply chain. Car manufacturer owns tire, glass, and metal fabricator. merger or takeover of a business in a different industry GE owns finance, energy, technology, and consumer companies Small Business VS Large Business Can be managed and controlled Can afford to employ by owners professional managers Can adapt quickly to customer needs Cost reductions due to largescale production Personal service Can set prices that other firms follow Can know your staff Access to financing Average lower costs due to low overhead and diseconomies of scale Risks can be spread over diversification of markets and/or products Easy to communicate with workers and customers Likely to afford research to develop new products/processes Recommending Size of Business 1. 2. 3. 4. 5. Owners Objectives Capital Available Size of Market Number of Competitors Scope for scale economies Either Diseconomies or Economies Types of Businesses Franchise A business that uses the name, logo, and marketing methods of the franchiser. Example: McDonald’s, Dairy Queen, Wendy’s, Subway NOT: Walmart, Target, Harris Teeter Joint Venture Two or more businesses agree to work closely together to further a common interest. Costs are shared Different companies have different strengths Different market shares that could be combined Examples of Joint Ventures DowCorning Dow Chemical with Corning Glass Works Dow Chemical combined their chemical technology with Corning Glass Works glass products. Products: Solar Panels, “teflon” coatings Sony Ericisson Sony – A Japanese electronics firm partnered with Ericsson a Swiss telecommunication company. Products: mobile phones MillerCoors SabMiller and Molson Coors Brewing Co. partnered to better compete with Anheuser-Busch InBev – a Dutch company- 7/2008 Ice Cream Partners USA Nestle – experience in specialty foods partnered with Haagen-Dazs an ice cream company to expand their markets and growth opportunity Strategic Alliance Agreements between firms to commit resources to achieve an agreed set of objectives University research – NC State has Engineering campus with many companies represented. Supplier – design new materials for the manufacturer. Soho Natural Soda worked with Anheuser-Busch for distribution. Competitor – reduce risks entering a market that neither currently operate. Motorola And InFocus created high performance video displays. Ansoff’s Matrix A model used to show risk with the four growth strategies Market Penetration – higher market shares in existing market with existing products Market Development – selling existing products in new markets Product Development – sales of new or improved products in existing markets Diversification – selling different or unrelated products in new markets Southwest Airlines expands their service from the Texas. Southwest Airlines now operates in 37 states…mainly in the northeast, midwest, and southwest regions of the country. Market Penetration Developing new products for a market you already serve. Coke created new products: Diet Coke Coke Zero Coke Cherry Coke Product Development Selling existing products into NEW markets Burger King expanding into foreign markets. Expecting 80% of new growth to be overseas. High expectations for the Asian market Market Development Selling different and unrelated goods or services in new markets. GE (General Electric) Generation, transmission and distribution of electricity (e.g. nuclear, gas and solar), industrial automation, medical imaging equipment, motors, railway locomotives, aircraft jet engines, and aviation services. It co-owns NBCUniversal. Through GE Commercial Finance, GE Consumer Finance, GE Equipment Services, and GE Insurance it offers a range of financial services as well. Diversification