Paper by Dorab E Mistry

advertisement

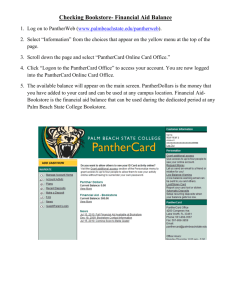

Global Veg Oil Price Outlook 2015-16 Paper by Dorab E Mistry, Director, Godrej International Limited At GLOBOIL INDIA 2015 Hosted by TEFLA’s & Solvent Extractors Association of India In MUMBAI at Renaissance Hotel On 28 September 2015 Ladies and Gentlemen I am delighted to be speaking at Globoil India again this year. India surpassed all expectations in the past year in terms of veg oil imports. This was a windfall for farmers and plantations all over the world but a most depressing development for India’s poor and long suffering oilseed farmers. Let me pay tribute to our Solvent Extractors Association which has been in the forefront of efforts to obtain remunerative prices for our oilseed farmers. Whatever we have done so far has not been enough and we must re-double our efforts. It is the duty of each one of us to support SEA and influence government policy for the betterment of our agriculture and our farmers. Background Earlier in February 2015 many of us believed the assurances coming from Indonesia about their so-called Mandate for use of palm bio diesel. That is why most of us analysts at the Price Outlook Conference in Kuala Lumpur in March 2015 gave relatively bullish price forecasts. We soon realised that the Indonesian government was not in a position to fulfil the mandate, at least until September and so we revised our price forecasts downwards. I forecast on 4 May 2015 in 1 Singapore that CPO futures would decline to 1900 Ringgits and that RBD Olein would decline to US$ 540 FOB with the Malaysian ringgit at 3.75 to the USD. What actually happened? As you all know, crude oil prices declined dramatically after June and for various reasons the Ringgit weakened far more than I had expected, to almost 4.35. As a result, while the Ringgit price reached just below 1900, the price in US Dollars declined much more and bottomed at just below US$ 490 FOB. The reasons for the bearish move were several: A general downturn in commodities as well as in world economic growth; weak growth in China; extremely weak energy prices and the lack of any discernible impact of the EL Nino. Had it not been for the insatiable appetite of India, prices of veg oils would have declined even lower. Indian consumption has been on a sharply rising curve spurred on by lower prices. The months ahead Before I discuss Price Outlook scenario for the months ahead, let me discuss each major oil in detail PALM In my last paper in Manila on 25 August I estimated 2015 Malaysian production at 20.1 million tonnes and Indonesian production at 32 million tonnes. Overall I said I expected world palm oil production to be higher by 2.5 mln mt as compared to the previous calendar year. At present I see no reason to adjust this forecast. The big question in front of every trader is What effect will the current El Nino have on palm oil production? We shall be able to form some opinion after we see October production. Whilst it has been drier than usual, we have seen rains come on each occasion just in the nick of time. As the moisture deficits begin to bite, we shall also proceed into the biological low season from January onwards. Therefore it is possible that we shall see some tangible signs of declining production in the 1 st and 2nd quarters of 2016. I may point out that my estimate of growth in world palm oil production in 15-16 of 2.5 mln mt already takes into account some damage as a result of the current El 2 Nino. We all know that the El Nino story has been around for almost one whole year. In recent days the market is behaving as if this is a brand new story! I would like to point out that the biggest price making factors are likely to be Demand and Macros and not production. I have heard recently that the maximum tonnage of CPO likely to be lost as a result of the current EL Nino is about 1 million tonnes between Indonesia, Malaysia, Thailand and PNG. That is not a big deal. If crude oil prices stay in the range of US$ 35 to 50 per barrel, then the loss of bio diesel demand will be very difficult to make up and will cast a long shadow over veg oil prices. We keep hearing loud noises about palm bio diesel consumption in Indonesia. It is true that they have finally established a Fund to collect Export Taxes on CPO and on Palm products and that some of those funds will be used to subsidise the purchase and blending of palm bio diesel into transport fuel by the state oil company Pertamina.It is far too early to say confidently if these optimistic projections of almost 4 million tonnes of palm bio diesel will actually happen. Indonesia does not have a good reliable track record of implementing new policy initiatives. Also the Blend Rate of 15% appears to be too high and against the advice of every motor manufacturer. So let us wait and see. In the period after 31st August, BMD futures have rallied by over 300 Ringgits whilst soya oil prices have remained stable. The spread between RBD Olein FOB Malaysia and Crude degummed soya oil FOB Argentina for the new crop position of May-June-July 2016 has declined to just around US$ 30. This does not augur well for palm oil demand from price sensitive markets like India. SOYA oil: The September USDA Report confirmed that we are going to harvest a very big soybean crop. The ability of USA to get a big share of bean export demand has been hampered by the weakness of the Brazilian Real and Argentine Peso. After elections on 19 October, we may see Argentina become even more competitive if the winning candidate decides to reduce export taxes and to devalue the Peso. So in the medium term we can at best expect soybean prices to move sideways even from the current sub-US$ 9 level. Demand for soya oil is steady mainly due to India. This Indian demand is likely to get stronger. As I have always said, the flip side of an EL Nino is good rainfall in South America. So we must brace ourselves for an expansion in planted area and big crops once again in South America, to be harvested in March-May 2016. 3 I must also point out that I regard soya oil as the most competitive and Must Own oil today. Soya oil will this year win market share from all other oils. Rapeseed / Canola:In 2015 we face a lower crop of Rape/Canola by almost 5 million tonnes. Apart from a smaller crop in India, we face smaller crops in the EU as well as in Canada. Most of this has already been factored into Rapeseed and Rapeoil prices. On the flip side, demand for rape oil in Europe for bio diesel is soft. There is not that enthusiasm to produce and blend rape bio diesel beyond the statutory minimum. Also cheaper palm oil is forcing its way into formulations. Rape oil prices will continue to receive limited support from Indian demand. However, we must remember that sky high domestic prices of mustard oil will encourage Indian farmers to expand the area under rape/mustard seed and if we have good winter rain, India’s production can be 1 to 1.5 million tonnes higher in 2016. Sunflower oil: We must keep our fingers crossed that Ukraine and Russia will again produce big sunseed crops in 2016. Currently it appears that the 2015 crops just harvested may not have come up to expectation and that has led to an inverse in sun oil prices. If we find sun oil prices remaining at a stiff premium over soya oil, it will simply lead to countries like India importing more soya oil. Sun oil is likely to lose some market share in India anyway. Lauric oils: There has been some recovery in rainfall in Philippines and Coconut oil production is also recovering. Palm kernel oil production is also higher this year as compared with the previous year. I have been very bearish on lauric oil prices since the bulk of demand is industrial. I have been right so far as CPKO prices declined to below US$ 650 CIF Rotterdam. They should continue to trade around US$ 650 – 750 for the medium term. Coconut oil prices at a level of US$ 1100 CIF Rotterdam are still too high and will eventually lose demand. INDIA: The deficit in the monsoon rainfall this year is a big problem for Indian agriculture. It was very interesting to read that the new government in India was planning to boost palm oil production in India to bridge the veg oil deficit. Oil palm cultivation must be encouraged and expanded but it can never be undertaken on such a big scale. The solution to India’s oilseed deficit lies in 3 factors – Better planting material, ability to lease land for contract farming and above all, switch from Wheat to Rapeseed in the granary belt of Punjab and Haryana. The switch must be enabled by making Rapeseed cultivation remunerative and attractive – if necessary by import duties and even cash transfers. To my mind that is the easiest way to reduce India’s oilseed deficit. 4 I am not going into detailed figures on Indian oilseed and oil production and consumption because this has been covered by my distinguished friendGovindbhai Patel of GGN Research. He continues to be the Oil World of India! Take a look at India’s imports in recent years and you will be amazed by how much market share palm oil has lost. Palm oil bulls should remember this table and think ten times before bidding up or ramping up CPO futures on the BMD. 000 Soya oil Palm oil Sun oil Laurics Others Total 2015-16 3,550 9,600 1,400 300 250 15,100 2014-15 3,010 8,710 1,510 250 300 14,100 2013-14 1,951 7,960 1,510 220 200 11,818 2011-12 1,080 7,670 1,140 200 100 10,200 What is at once noticeable from this table is that India’s imports have soared by almost 50% in the last 5 years. Palm tonnages have increased by only 25% in these 5 years while soya oil has recorded an increase of over 300%. Soya oil imports will take market share from every other oil because soya is so attractively priced. As I have said previously, Soya Oil is the Must Own oil of 2016. This is the danger signal that palm bulls have ignored because they have found it easy to talk up the palm bio diesel story. My warning to Indonesian palm bulls is that you can fool the market two years in a row but be careful if you are trying to fool the market a third time as well. This time you better be right! Import duties:It is only a matter of time before Import duties on crude and refined oils in India are revised upward. As I have said recently, inflation is no longer a problem in India. What India needs is a softer currency and more rapid growth. India’s export industries need a dose of competitiveness because other developing countries and even the EU have allowed their currencies to depreciate. A lower rupee and a stronger economy can be achieved by lowering domestic interest rates and that is what India needs to do aggressively. CHINA: It looks as if China will continue to prefer to import oilseeds rather than oil. There are also indications that China is finally releasing small tonnages of its massive 6 million tonne Reserve Stock of rape oil. However, to my mind, the most 5 important story regarding China in 2015 is the lack of growth in consumption of veg oils as well as in animal numbers. After decades of rapid growth, China is rebalancing her economy and one of the key developments for palm and soya oil is the absolute war on wastage and on conspicuous consumption. This is a good development and presents a win-win situation for China. So China is in a state of Waste Not, Want Not and in a de-stocking phase. I do not have to tell you what effect this has on prices of her imports. On a more general note, I remain a bull on China and believe their economy will emerge stronger, more vibrant and more diversified as a result of the present restructuring. Every re-structuring causes some pain and disruption and China is no different. My faith in the recovery and growth of China remains unshakeable – as unshakeable as my belief in my own country India. These are the two economic super-powers of the future. Energy Demand: The US EPA is likely to announce its proposals by the end of November. The other big factor will be Indonesia. As I have said, Indonesia has not been able to consume the massive tonnages of palm bio diesel in the past 2 years that it promised. This year they appear to be better organised. However, we must rely on the Mantra:Seeing is Believing. So let us not get swayed by the ambitious and optimistic targets that Indonesian industry players keep presenting. On that basis I am estimating that world energy demand will expand in 15-16 by just 1 million tonnes. World Demand Low prices have given us a robust increase in food demand by 4 million tonnes in 14-15. Growth in 15-16 is likely to temper to 3.5 million tonnes. Discretionary blending demand for bio diesel has collapsed and is unlikely to surface for a long time. Throughout 2014-15, Indonesia under-performed and proved what I had said at the GAPKI conference in November last year – that its so-called Mandate is a Toothless Mandate. World demand for bio diesel in 2014-15 SHRANK by about 1.5 million tonnes. From that low base, we hope to see a modest recovery and therefore I am expecting 15-16 bio fuel demand to expand by 1 million tonnes at best.So with that here aremy projections of Incremental World S&Ds for 15-16 6 000 Soya oil Rape oil Sun oil Gn&Ctn oil Palm oil Lauric oils Oct 13-Sep 14 + 1,800 + 400 + 1,600 + 3,400 + 300 Oct 14-Sep 15 + 2,700 - 300 - 600 + 1,600 + 200 Oct 15 – Sep 16 + 3,500 - 1,500 - 300 + 2,500 + 400 Supply Increase + 7,500 + 3,600 + 4,600 Demand Increase + 5,200 + 2,500 + 4,500 What we see is that in 2015-16 the shortfall in Rapeseed production of almost 5 million tonnes has a profound effect on the S&Ds. The other big influence will be the impact on Palm oil production of the current El Nino. Overall, after 2 years of comfortable surplus, the world faces a situation where Incremental Supply and Demand are in balance. Such a situation can alter very quickly if we have a production problem in some part of the world or Indonesia suddenly performs to expectation on bio diesel. Therefore I expect a gradual price recovery to begin from now and to take world veg oil prices higher. Prices will rise moderately in local currency terms but will rise very modestly in US Dollar terms Sustainability We have several NGOs present at this conference. I share and admire what they have been saying and doing for the environment. They now face a challenge in how they are going to respond to the recent case of rampant and deliberate cheating on pollution by a well- known western motor manufacturer. Let us not beat about the bush. The culprit will be pursued by the US EPA but what will be the attitude of western NGOs to this company? Will they call for a moratorium on its production of motor vehicles? Will they call for a universal boycott of its products? Will they approach institutional investors and ask them to divest their shares? Will they go to the company’s AGM and speak out or lobby those attending? The palm oil industry will be watching the attitude and reaction of these well-meaning NGOs to this case of a Western company that has been caught polluting the environment relentlessly and serially for at least 20 years. 7 On the brighter side, the palm oil industry is moving strongly in the right direction with ISPO and MSPO complementing the work of the Roundtable. PRICE OUTLOOK – Assumptions I am assuming Brent crude oil to trade in a range US$ 45 to 60 per barrel. I am expecting the FED to increase interest rates very gradually from December 2015 and release dovish statements at the same time. I expect the Malaysian Ringgit, the Indonesian Rupiah, the Brazilian Real and the Argentinian Peso to remain under pressure and lose value against the US Dollar. I expect the Rupee to be allowed to weaken by about 5 percent and I also expect import duties in India to rise. PRICE OUTLOOK I believe Palm oil futures bottomed out around 1900 Ringgits and we are not likely to see 2000 Ringgits again. As you know I had forecast a trading range of 2100 to 2300 Ringgits for BMD futures. I believe CPO futures will trade at the upper end of this range due to the weakness of the Ringgit. If the Ringgit falls further and crosses 4.50, this trading range will have to be expanded to 2400. It is possible to go to 2500 Ringgits just for a short time but I believe such a level is not sustainable unless mineral oil prices rise significantly. Soya oil: Soya oil prices are in an inverse and should have been higher but for the weakness of the Brazilian Real and the Argentinian Peso. These currencies are likely to remain weak and thereforeI expect soya oil prices in US Dollar terms to remain sideaways. If the US EPA comes in with an enhanced mandate for bio diesel, we may see soya oil futures on the CBOT climb to 32 cents but otherwise they are likely to be range bound at current levels of 26 to 28 cents. I expect soybean prices to remain below 900 cents per bushel. Sun oil prices have run up and opened a significant premium to soya oil prices. That premium will cut demand for sun oil and therefore on the new crop positions of November and beyond, I expect stable to sideways prices. The most bullish outlook is for Rapeseed oil due to the shortfall in production and Rape oil will be the premium oil of 2016. I expect Palm Kernel oil to trade in a range of $650 to 750 cif Rotterdam. Lauric oils are dependent on industrial demand and I am surprised at their price recovery. 8 Coconut oil is over-priced and will eventually have to decline to a premium of only US$ 200 over CPKO. Plantation Equities: I remain optimistic on veg oil prices on a three year view. New plantings in the palm belt of Malaysia and Indonesia have declined severely. World demand is growing at between 4 and 5 million tonnes annually. Without expansion of palm, there is no way we shall find those additional supplies. We are currently not planting or re-planting enough. Therefore, for patient investors, palm plantation and processing companies are a very rewarding investment. You all know which palm oil processing company I admire most. Today I am confident to say I like the sector as a whole and I would like to see some mergers take place. We have far too many small listed plantation companies. Conclusion Our industry is passing through very difficult times. As they say, Night is darkest just before Dawn. I believe prices for veg oils have bottomed out. Food demand is robust and we can look forward to better times. Here in India, we are better placed than most. I congratulate Kailash Singh and his TeflasGloboil teamon this uniquely Indian success story and to Dr Mehta and all office bearers of our Association. To everyone in our industry, I shall say – India continues to be a beacon in an otherwise dull scenario. Good Luck and God Bless. Conference Proceedings: Partnered by – Reshamwala Shipbrokers 9