Chapter 13

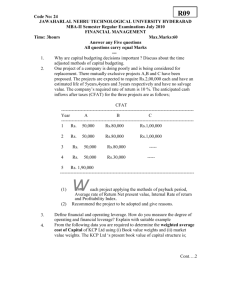

advertisement

Chapter 13 Share capital and reserves Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–1 Learning objectives • Understand that the owners’ equity of an organisation can consist of several different accounts • Understand that within owners’ equity there can be various classes of shares, each providing different rights to holders • Be able to provide the journal entries to recognise the issue of both fully paid and partly paid shares by a company Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–2 Learning objectives (cont.) • Be able to provide the journal entries necessary when preference shares are to be redeemed • Be able to provide the necessary journal entries when shares are forfeited by their owners • Understand what constitutes a share split and a bonus issue of shares • Know the disclosure requirements of AASB 101 ‘Presentation of Financial Statements’ in relation to share capital and reserves Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–3 Status of newly converged accounting standards • AASB 101 ‘Presentation of Financial Statements’ replaces: AASB 1001 ‘Accounting Policies’ – AASB 1018 ‘Statement of Financial Performance’ – AASB 1034 ‘Financial Report Presentation and Disclosures’ – AASB 1040 ‘Statement of Financial Position’ – • AASB 132 ‘Financial Instruments: Presentation and Disclosure’ replaces: – AASB 1033 ‘Presentation and Disclosure of Financial Instruments’ Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–4 Status of newly converged accounting standards (cont.) • The AASB’s ‘Framework for the Preparation and Presentation of Financial Statements’ replaces: – Statement of Accounting Concept No. 3 and No. 4 Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–5 Owners’ equity as a residual claim on net assets • Owners’ equity – Owners’ share of the business calculated by subtracting the entity’s liabilities from its assets • Shareholders’ funds – In a company this represents the difference between total assets and total liabilities • The AASB Framework defines equity as: – the residual interest in the assets of the entity after deducting all of its liabilities Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–6 Owners’ equity as a residual claim on net assets (cont.) • The definition and recognition of equity are directly a function of the definition and recognition of assets and liabilities • Total owners’ equity is made up of a number of accounts: – share capital relating to one or several classes of shares – reserves (e.g. revaluation reserve, general reserve, forfeited share reserve) – retained profits (or accumulated losses) Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–7 Accounting for the issue of share capital • Share capital – Balance of owners’ equity within a company comprising the capital contributions made by owners • Par value – The face value of a security • Share premium – The difference between the issue price of a share and its par value • Under section 254C of the Corporations Act 2001 shares of a company have no par value • Shares no longer issued at a premium or a discount Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–8 Accounting for the issue of share capital (cont.) • To recognise receipt of application monies: Debit Credit Bank trust Application • To recognise the issue of shares and to close application account: Debit Credit Application Share capital Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–9 Accounting for the issue of share capital (cont.) • To transfer cash from trust account to general operating bank account: Debit Credit Cash at bank Bank trust • Refer to Worked Examples 13.1 and 13.2 Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–10 Oversubscription of shares • • When more shares are applied for than the number to be issued, e.g. Telstra and Commonwealth Bank Two approaches to manage oversubscription include: satisfy full demand of a certain number of subscribers and refund the funds advanced by others 2. issue shares to all subscribers on a pro rata basis 1. ▪ • excess monies on application can either be refunded or used to reduce further monies owing on allotment Refer to Worked Example 13.3 Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–11 Oversubscription of shares (cont.) • Accounting for oversubscription of shares partly paid: – Recognise aggregate applications for shares: Debit Credit Bank trust Application • To allot shares as partly paid: Debit Credit Application Share capital Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–12 Oversubscription of shares (cont.) • To recognise amount due on allotment: Debit Credit Allotment Share capital • To offset excess amounts paid on application against amount due on allotment: Debit Credit Application Allotment Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–13 Oversubscription of shares (cont.) • To transfer funds to operating bank account: Debit Credit Cash at bank Bank trust • To recognise receipt of amounts due on allotment: Debit Credit Cash at bank Allotment Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–14 Oversubscription of shares (cont.) • Accounting for call made on shares subsequent to allotment: • To record call: Debit Credit Call Share capital • To record receipt of amounts due on call: Debit Credit Cash at bank Call Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–15 Different classes of shares • Ordinary shares: – – – – – provide a claim against the entity that ranks behind the claims of creditors and some preference shareholders confer voting rights on shareholders entitle their owners to distribution of profits in the form of dividends entail, however, no guarantee of dividends if dividends not paid in one year, do not accrue the right to dividends until dividends are paid Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–16 Different classes of shares (cont.) • Preference shares – – – – – Subject to preferential treatment, often with receipt of dividends or order of ranking for asset distributions Some have voting rights Some have voting rights if dividends unpaid Others have no voting rights If participating, holders may, after receiving preference dividend at fixed rate, participate with ordinary shareholders in further profits distributed Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–17 Different classes of shares (cont.) • Preference shares (cont.) – If convertible, have a right of conversion to ordinary shares – If redeemable, have the ability to redeem shares for cash at later date – Some have the characteristics of equity and others have the characteristics of debt Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–18 Redemption of preference shares • Under sections 254 (J) and (K) of the Corporations Act shares are to be redeemed: – out of profits that would otherwise be available for dividends; or – out of proceeds of a fresh issue of shares made for the purposes of the redemption • Refer to Worked Example 13.4 Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–19 Redemption of preference shares (cont.) • To recognise issue of preference shares: Debit Credit Cash at bank Share capital—preference shares • To eliminate preference shares and create ‘capital redemption reserve’: Debit Credit Share capital—preference shares Capital redemption reserve Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–20 Redemption of preference shares (cont.) • To redeem shares out of profits: Debit Credit Retained profits Cash • Further entry required pursuant to amendments to the Corporations Law: Debit Credit Capital redemption reserve Share capital Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–21 Forfeited shares • Shares can be forfeited if: – shares are issued as partly paid and shareholders do not subsequently pay the amounts due on allotment or on calls – a shareholder ceases to be a member of the company at that time • Shareholders who have forfeited shares might be entitled to a full or partial refund of monies paid before forfeiture Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–22 Forfeited shares (cont.) • Various outcomes – If company is listed on the ASX or if company’s operating rules allow it, a refund is paid to the investor less costs incurred in reissuing shares ▪ amounts paid are recorded in a forfeited shares account (liability) until refunded Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–23 Forfeited shares (cont.) – If company is not listed on the ASX and constitution says nothing about refunds, company can retain the amounts paid less costs of reissuing shares ▪ amounts paid are held in a forfeited shares reserve (part of shareholders’ funds) • Refer to Worked Example 13.5 Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–24 Forfeited shares (cont.) • To record the call: • Debit Call Credit Share capital • To record receipt of call monies: • Debit Cash at bank Credit Call Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–25 Forfeited shares (cont.) • To record forfeiture of shares: Debit Credit Credit Share capital Call Forfeited shares account • To recognise amount received on sale of forfeited shares: Debit Debit Credit Cash at bank Forfeited shares account Share capital Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–26 Forfeited shares (cont.) • To recognise payment of costs relating to sale of shares: Debit Credit Forfeited shares account Cash at bank • To recognise return of remaining monies to original shareholders: Debit Forfeited shares account Credit Cash at bank Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–27 Share splits and bonus issues • Share splits – – – – – Subdivision of the company’s shares into shares of smaller value Result in no change to owners’ equity Companies may undertake share splits because they feel that lower priced shares will be more marketable No journal entries required Company must amend share register Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–28 Share splits and bonus issues (cont.) • Bonus shares – Existing shareholders receive additional shares, at no cost, in proportion to their shareholding at the date of the bonus issue – Journal entry: Debit Retained profits Credit Share capital—ordinary shares – Bonus shares from retained profits often referred to as a bonus share dividend Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–29 Required disclosures for share capital AASB 101 requires disclosure of the following: • For each class of share capital: – number of shares authorised – number of shares issued and fully paid, and issued but not fully paid – par value per share, or that shares have no par value – reconciliation of number of shares outstanding at beginning and end of period – rights, preferences and restrictions of the class Continues/ … Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–30 Required disclosures for share capital (cont.) – shares reserved for issue under options and contracts for sale of shares – shares in the entity held by the entity or by subsidiaries or associates • Description of nature and purpose of each reserve within equity Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–31 Reserves • Include: – revaluation reserve – general reserve: may be used as a means of transferring profits out of retained profits for future expansion plans • Required to disclose (AASB 101): – reconciliation between carrying amount of each reserve at the beginning and end of the period, separately disclosing each change Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–32 Summary • The chapter addresses various issues associated • • • • with share capital and reserves Owners’ equity is the residual interest in the assets of an entity after deduction of its liabilities When shares are issued to the public, funds must be placed in trust prior to allotment of shares Preference shares should be disclosed as debt or equity depending on the conditions of issue Forfeiture of shares, share splits and bonus issues were also discussed Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–33 Summary of main changes to accounting standards • A number of new accounting standards have superseded former ones • But only minor changes to requirements have resulted: – AASB 139 ‘Financial Instruments: Recognition and Measurement’ imposes new requirements for measurement of equity and liability component of preference shares Copyright 2005 McGraw-Hill Australia Pty Ltd PPTs t/a Australian Financial Accounting 4e by Craig Deegan 13–34