TOPIC: State Rental Space OFFICE: Department of Administrative

advertisement

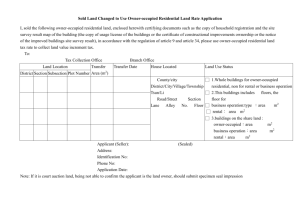

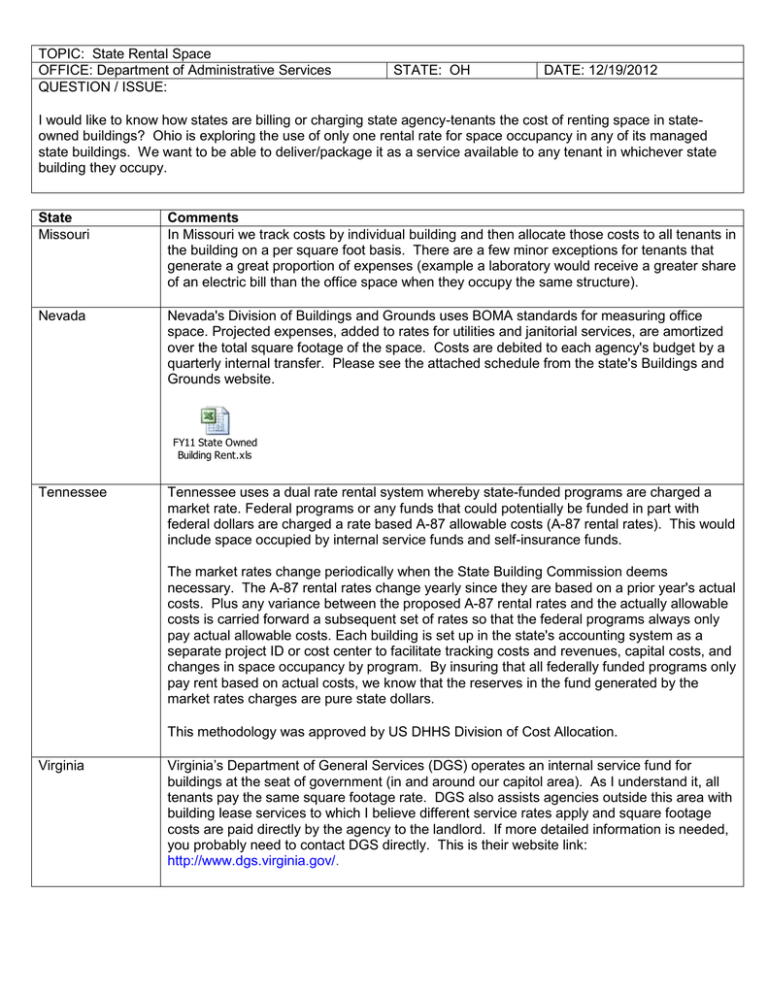

TOPIC: State Rental Space OFFICE: Department of Administrative Services QUESTION / ISSUE: STATE: OH DATE: 12/19/2012 I would like to know how states are billing or charging state agency-tenants the cost of renting space in stateowned buildings? Ohio is exploring the use of only one rental rate for space occupancy in any of its managed state buildings. We want to be able to deliver/package it as a service available to any tenant in whichever state building they occupy. State Missouri Comments In Missouri we track costs by individual building and then allocate those costs to all tenants in the building on a per square foot basis. There are a few minor exceptions for tenants that generate a great proportion of expenses (example a laboratory would receive a greater share of an electric bill than the office space when they occupy the same structure). Nevada Nevada's Division of Buildings and Grounds uses BOMA standards for measuring office space. Projected expenses, added to rates for utilities and janitorial services, are amortized over the total square footage of the space. Costs are debited to each agency's budget by a quarterly internal transfer. Please see the attached schedule from the state's Buildings and Grounds website. FY11 State Owned Building Rent.xls Tennessee Tennessee uses a dual rate rental system whereby state-funded programs are charged a market rate. Federal programs or any funds that could potentially be funded in part with federal dollars are charged a rate based A-87 allowable costs (A-87 rental rates). This would include space occupied by internal service funds and self-insurance funds. The market rates change periodically when the State Building Commission deems necessary. The A-87 rental rates change yearly since they are based on a prior year's actual costs. Plus any variance between the proposed A-87 rental rates and the actually allowable costs is carried forward a subsequent set of rates so that the federal programs always only pay actual allowable costs. Each building is set up in the state's accounting system as a separate project ID or cost center to facilitate tracking costs and revenues, capital costs, and changes in space occupancy by program. By insuring that all federally funded programs only pay rent based on actual costs, we know that the reserves in the fund generated by the market rates charges are pure state dollars. This methodology was approved by US DHHS Division of Cost Allocation. Virginia Virginia’s Department of General Services (DGS) operates an internal service fund for buildings at the seat of government (in and around our capitol area). As I understand it, all tenants pay the same square footage rate. DGS also assists agencies outside this area with building lease services to which I believe different service rates apply and square footage costs are paid directly by the agency to the landlord. If more detailed information is needed, you probably need to contact DGS directly. This is their website link: http://www.dgs.virginia.gov/. State West Virginia Comments For some time we have been charging agency-tenants one rate in state-owned buildings on the Capitol Complex. Off the Capitol Complex the rent for state-owned buildings varies due, in part, to the cost of financing the original purchase amount. However, in 2011 a great deal of effort was made to change this approach and, with the help of a 3rd party consultant, the cost of operating each building on campus was quantified and now serves as the basis for rent calculations. So we are migrating from a single rate for all agency-tenants to various rates based upon what it costs to operate each building. Sounds like we are going in opposite directions. This change in methodology is not without its challenges, as you might suspect.