Use the following information to respond to the

advertisement

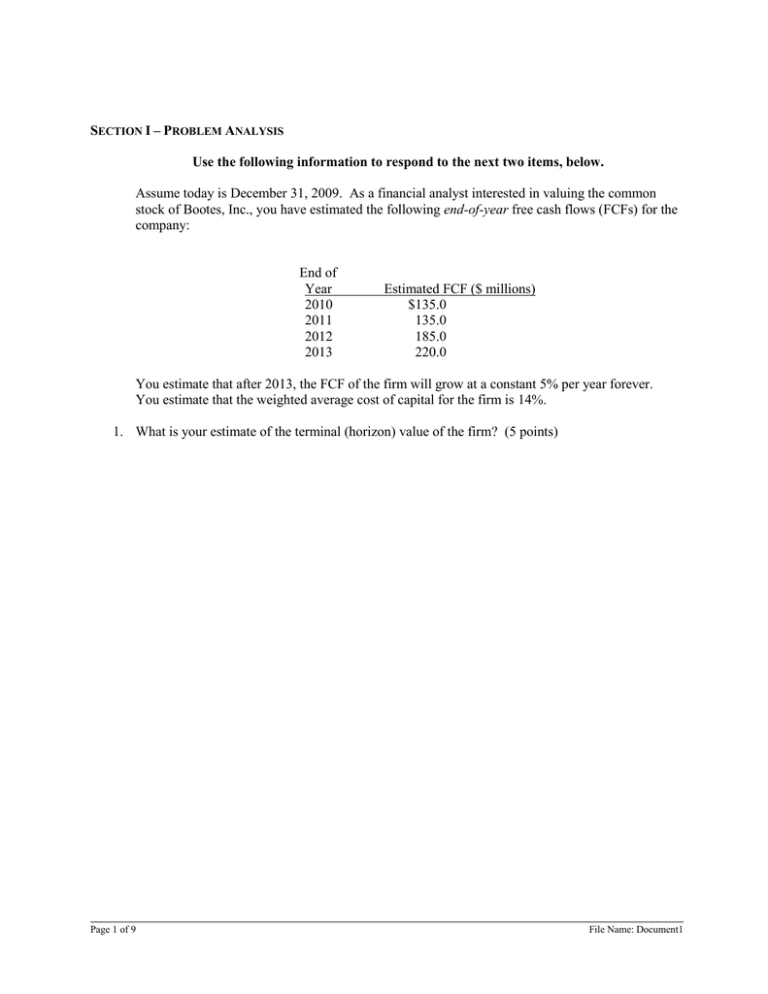

SECTION I – PROBLEM ANALYSIS Use the following information to respond to the next two items, below. Assume today is December 31, 2009. As a financial analyst interested in valuing the common stock of Bootes, Inc., you have estimated the following end-of-year free cash flows (FCFs) for the company: End of Year 2010 2011 2012 2013 Estimated FCF ($ millions) $135.0 135.0 185.0 220.0 You estimate that after 2013, the FCF of the firm will grow at a constant 5% per year forever. You estimate that the weighted average cost of capital for the firm is 14%. 1. What is your estimate of the terminal (horizon) value of the firm? (5 points) Page 1 of 9 File Name: Document1 2. What is your estimate of the value of the entire firm in today’s dollars? (5 points) Use the following information to respond to the next four items, below. You have collected the following information on two mutually exclusive investment proposals: Estimated After-tax Cash Flows End of Year 0 1 2 3 Project J -$100,000 20,000 45,000 80,000 Project K -$100,000 45,000 45,000 45,000 You estimate the cost of capital applicable to each project is 12% and have computed the following measures for Project K: NPV = $8,082.41 IRR = 16.65% MIRR = 14.94% 3. Compute the net present value for Project J. (5 points) Page 2 of 9 File Name: Document1 4. Compute the internal rate of return for Project J. (5 points) 5. Compute the modified internal rate of return for Project J. (10 points) 6. Given your calculations above, which project (if any) do you prefer? Why? (5 points) Page 3 of 9 File Name: Document1 Use the following information to respond to the next five (5) items. Redstone Corporation is considering a leasing arrangement to finance some special manufacturing tools that it needs for production during the next three years. A planned change in the firm's production technology will make the tools obsolete after 3 years. The firm will depreciate the cost of the tools on a straight-line basis over three years (i.e. depreciation expense is 1/3 of the purchase price at the end of each year for three years). Thus, the book value and the salvage value at the end of the third year will be zero. The firm can borrow $4,800,000, the purchase price, at a pre-tax cost of 10 percent to buy the tools, or it can make three equal beginning-of-year lease payments of $2,100,000 that include maintenance. The firm's tax rate is 40 percent. Annual maintenance costs associated with purchasing the equipment are estimated at $240,000 per year and are paid at the beginning of each year. 7. Compute the after-tax lease payments and enter in the table, below. Note: You do not necessarily need to use all the cells in the table. (5 points) Lease Alternative End of year: 0 1 2 3 8. Compute the present value of the lease alternative. (5 points) Page 4 of 9 File Name: Document1 9. Compute the operating cash flows for years t = 0 through t = 3 and place them in the table, below. Note: You do not necessarily need to use all the cells in the table. (10 points) Purchase Alternative End of year: 0 1 2 3 10. Compute the present value of the purchasing alternative. (5 points) 11. Should Redstone purchase or lease the equipment? To answer this question, compute the net advantage to leasing (NAL) and interpret the results. (5 points) Page 5 of 9 File Name: Document1 12. Jackson Co. has the following balance sheet as of December 31, 2009: Assets Current assets Fixed assets Liabilities & Equity $600,000 400,000 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total equity Total Assets $1,000,000 Total Liabilities & Equity $100,000 100,000 100,000 $300,000 300,000 400,000 $1,000,000 In 2009, the company reported sales of $5 million, net income of $100,000, and dividends of $60,000. The company anticipates its sales will increase 20 percent in 2010 and its dividend payout will remain at 60 percent. Assume the company is at full capacity, so its assets and spontaneous liabilities will increase proportionately with the increase in sales. Assume the company uses the AFN formula and all additional funds needed (AFN) will come from issuing new long-term debt. Given its forecast, how much long-term debt will the company have to issue in 2010? (10 points) Page 6 of 9 File Name: Document1 Use the following information to respond to the next 3 items, below. You have been asked by the president of your company to evaluate the proposed acquisition of the new MLM Model 53 spectrometer for your firm’s R&D department. The equipment’s invoice price is $100,000, and it would cost another $10,000 to modify it for special use by your firm. The spectrometer, which falls into the MACRS 3-year class, would be sold after 3 years for $12,700. Use of the equipment would require an increase in net working capital (spare parts inventory) of $3,000 which is expected to be fully recovered at the end of the project. The spectrometer is expected to increase revenues by $60,000 per year, but would also increase operating costs by $20,000 per year. Last year, the firm spent $10,000 to assess the various spectrometers in the marketplace before deciding that the MLM Model 53 was the best choice among the available models. The firm’s marginal federal-plus-state tax rate is 40%. 13. What is the net cost of the spectrometer, i.e. what is the time 0 net cash flow? (5 points) 14. What is the non-operating (terminal) cash flow at the end of year 3? (5 points) Page 7 of 9 File Name: Document1 15. What are the net operating cash flows in years 1, 2 and 3? Do not include the termination cash flows that you computed in the previous item. Note: You do not necessarily need to use all of the spaces provided below. (10 points) Item End of Year 1 End of Year 2 End of Year 3 Net After-Tax Cash Flow Page 8 of 9 File Name: Document1 SECTION II – SHORT ESSAY QUESTION 16. As the Chief Financial Officer (CFO) for Canes Venatici Company, Inc., one of your staff financial analysts has presented you with a capital budgeting proposal. He has estimated that the internal rate of return for the proposed project is 26% and goes on to state, “I think we should undertake the project. After all, a 26% return on our investment is great in the current economic environment.” (Assume that the net present value of the project is positive and the project meets all other corporate-wide capital budgeting guidelines.) How do you respond to your staff analyst’s claim? (5 points) Page 9 of 9 File Name: Document1