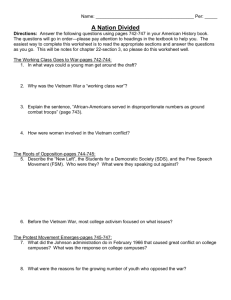

VIETNAM

advertisement

VIETNAM MIS648 - Country IT Profile and Analysis Geoff Duff Todd Herman Joe Hench Christina Scantland Vietnam: Demographics Population Health Literacy 83.5M 70 yrs. 90.3% POPULATION (PEOPLE) VIETNAM POPULATION 66% 60000000 50000000 40000000 30000000 28% Female Male 20000000 6% 10000000 0 0-14 15-64 AGE (YEARS) 65+ Avg. Age: 25.5 Vietnam: Socio-Culture Language Vietnamese (official) English (increasingly favored as a second language), Ethnicity Kinh (Viet) 86.2%, Religion NONE 80.8% Buddhist 9.3%, Catholic 6.7%, Hoa Hao, Cao Dai, Protestant, Muslim Vietnam: Socio-Culture Education High Respect for Learning Politics Communist legal theory French civil law system Government IT Commitment Vietnam: Economics GDP $227.2 billion, 7% annual increase Gini 36.1 Primary Industries Agriculture 21.8% Industry 40.1% Services 38.1% Labor Force 43 million Unemployment 1.9% 1 USD = ~15,000 Vietnam Dong (VND) Vietnam: Economics Trade EXPORTS $23.7 billion US 19.8%, Japan 13.7%, China 8.4% IMPORTS $26.3 billion China 13.6%, Japan 11.5%, US 4.1% Debt 66% of GDP Vietnam: Physical Geography Vietnam: Physical Geography Vietnam: Physical Geography Vietnam: Physical Weather 4-10’ annual rainfall Topography 40% mountains 40% hills 75% forests Transportation Highways, Railways, Waterways Natural Resources phosphates, coal, manganese, bauxite, chromate, offshore oil and gas deposits, forests, hydropower Vietnam IT Industry 9 phones per 100 people 15-18 phones per 100 people by 2010 Focus on mobile phone technologies 3.5 million (4.3% of population) internet users 200% annual growth in internet users IT revenues = US$685 million in 2004 33% increase compared to global increase of 5% Education and Training spend: $45.8 million 02-05’ GLOBAL INTERNET STATISTICS, DECEMBER OF 2003 Country Population Internet users Percentage % ASEAN Singapore 4,225,000 2,100,000 49.70% Malaysia 24,000,000 8,629,000 35.95% Thailand 63,300,000 6,031,000 9.53% Vietnam 81,000,000 3,500,000 4.32% Indonesia 231,340,000 8,000,000 3.46% ASEAN 555,772,000 31,868,000 5.73% 1,287,000,000 79,500,000 6.18% 292,300,000 200,500,000 68.59% Other countries China US Continents and the World Asia 3,808,790,000 243,406,000 6.39% World 6,315,820,000 715,350,400 11.33% Vietnam IT Industry Strengths • Export Software, $60m 2004 • Government IT Blueprint (ASEAN, VPTC, Education) Weaknesses • Global skills, language capabilities • Rural population and IT affordability • IT centers, software parks (Saigon Software Park) Opportunities • Japan Partnership, 40% of exports • Government regulation changes enable foreign (Private) investment Threats • Asia-Pac region competition (China, Singapore, Malaysia) Vietnam vs. China Regional similarities Long-Term orientation and Masculinity differ Rigorous foreign investment in China Behind China in embracing capitalism Vietnam IT Industry Ministry of Post and Telecommunications (VPTC) oversees IT strategy Blueprint to invest US$4 billion from 2002-2010 Telecom infrastructure, HR, IT access and usage Forecast IT revenues of US$6-7 billion by 2010 www.mpt.gov.vn Association of Southeast Asian Nations e-ASEAN: regional initiative to promote electronic government Vietnam IT Industry 6 State owned Telecom providers Government initiative to open 40-50% to non-state ownership by 2010 Drives international investment, competition and growth Result of 2001, Bilateral Trade Agreement (USA) Vietnam IT Industry Local IT resource limitations 72 percent are inexperienced 46 percent lack knowledge of the IT industry 42 percent are unable to work in groups and are bad at foreign languages 41 percent have limited skills and are bad at presentations 28 percent are unconfident in their work. Government focus on Education, Training, HR Vietnam Economy & IT IT industry producer characteristics Of the US$685 million in 2004, hardware expanded 32.9 percent, and software increased 33.3 percent, the highest since 2001. Software Prior to 2004, Singapore led importers of Vietnamese IT products. In 2004, Japan purchased 40% of total and became a strategic IT development partner in Vietnam. IT software companies lack skilled and foreign language-speaking workers. Vietnam Economy & IT PC manufacturing Viettronics Tan Binh Electronics Corporation (VTB) a member of Vietnam Electronics and Information Technology Corporation (VIEC), Hanel and Vietronic Thu duc As of 2003, 20 companies assembling Vietnamese brand computers; 25-30% of market of 350,000 units. 612 Domestic companies and 117 Foreign-invested firm engaging in computer assembling and production. As of 2003, domestic market share was 75-80% of market. Vietnam Economy & IT Internet Service Providers (ISPs) Currently 12 ISPs with 3 Internet exchange providers (IXPs) Vietnam Data Communications Company (VDC), Saigon Postel, Vietel, ETC, and Hanoi Telecom. www.saigonpostel.com.vn/ Tariffs on Internet and telecom services have been gradually decreasing in will continue. Vietnam Economy & IT IT industry consumer characteristics Retail Computer Sales Previous years only 40% of sales targets were met within first 6 months. In 2005, 60% sales targets were met within same time frame, approximately 260,000 desktops sold. Vietnam Economy & IT Business Climate of Vietnam 1986, Central planned to Market based economy. Total number of fixed and mobile subscribers in 2005 is approximately 13.5 million. In 2002, 150 of 5600 remaining state owned enterprises (SOEs) were reformed. The government plans to reduce the number of SOEs to about 2000 by 2005. Non-state Telecom sector increase market share 2530% by 2005. 40-50% by 2010. Corporate monopoly is expected to be removed by 2006 due to Bi-Lateral Trade Agreement between Vietnam and USA. Vietnam Economy & IT Key factors to emerging IT market Investment in IT development by Ministry of Post and Telecommunications. Government is concentrating on upgrading IT networks in government and private sectors. Government is committed to opening the Internet sector to private sector. Government gives strong support by building up numerous hi-tech and software parks. Saigon Software Park www.ssp.com.vn Vietnam Economy & IT Main deterrents to trade and investment are: the lack of a comprehensive and transparent legal system restricted land usage rights complex foreign investment laws continued corruption in infrastructure projects the poor state of the financial system Current Free Trade Trends External Factors U.S.-Vietnam Bilateral Trade Agreement (BTA) ASEAN Free Trade Area (AFTA) WTO Negotiations & Compliance Plan Internal Factors “Doi Moi” Policy-1986 Decree 55 – Internet Policy 2001 Creating a New Market Environment Trade/Investment Risks • Heavy State Control in Business – Minimal Privatization (though improving) – State Control of Telecommunications (DGPT) • Intellectual Property Rights • Access & Understanding of Vietnamese Law • Lower Quantity and Skill Level of IT Personnel Investment Opportunities Outsourcing of Software & Hardware – Low Risk Currently Japan & Singapore are Heavy Importers of IT Products Japan has become a Development Partner Low Level of IT Skilled People in Vietnam – Means Lower Level of Complexity in Product Investment Opportunities Telecommunications Infrastructure – High Risk Government Control is Loosening Initiatives/Goals are in Place to Increase Access Consumer Demand is High & Growing Risk of Government Interference and Corruption are Still High Project management & IT Education – Low Risk • Local Teams Lack Professional Skills to Implement Significant IT Systems • Application Opportunities and Training Initiatives Investment Opportunities Logistics & Import / Export Services – Medium Risk • High Volume of Import and Exports…growing • Good Opportunity for IT Enabled Logistics for Improved Efficiency Call Centers – Medium Risk Inexpensive Business Venture Number of Literate English Speaking Employees Increasing Call Center Ad - Link Recommendations While investment opportunities do exist it is recommended to selectively choose a specific area where the risk is minimal. 1. In Terms of Supply & Value Chain, Biggest Market is Currently Simple Software and Basic Electronic Components 2. Vietnam’s Commitment to IT Diffusion will also Create High Demand for Project Management and Education. 3. In Short Term would be Cautious of Heavy Investment into Infrastructure or Facilities in Vietnam Due to Government Control Website Examples Vietnamese Websites • http://www.vietnamstamp.com.vn/ • http://www.petrolimex.com.vn/ • http://vietnamnet.vn/ • http://english.vietnamnet.vn/ - English.

![vietnam[1].](http://s2.studylib.net/store/data/005329784_1-42b2e9fc4f7c73463c31fd4de82c4fa3-300x300.png)